Diving into the world of the stock market can feel like navigating a complex maze. You hear about incredible opportunities, but also about the risks involved. What if there was a powerful, intuitive platform designed to simplify this journey, helping you make informed decisions for smarter investing? Welcome to the realm of IQ Option, where trading stocks becomes accessible to everyone, from curious beginners to seasoned financial market enthusiasts.

This guide empowers you to unlock the potential of online trading with IQ Option. We strip away the jargon and present a clear path to understanding how you can build and manage your investment portfolio directly from the platform. Imagine having the tools and knowledge to spot growth opportunities and act on them with confidence.

Here’s what this ultimate guide will help you discover:

- How to effectively navigate the IQ Option platform for stock trading.

- Key strategies to identify promising stocks and diversify your portfolio.

- Understanding the essential features and tools IQ Option offers for analysis.

- Tips for managing risk and making more confident investment choices.

- Leveraging IQ Option to enhance your financial growth and investment journey.

Prepare to transform your approach to the financial markets. IQ Option offers a dynamic environment for trading stocks, and with this guide, you gain the insights needed to make every investment decision a step towards smarter, more strategic wealth building.

- What is IQ Option and How it Works for Stock Trading

- How IQ Option Facilitates Your Stock Trading Journey:

- Understanding Stock CFDs on IQ Option

- Key Aspects of Stock CFD Trading on IQ Option:

- Getting Started: Opening an Account and Trading Stocks on IQ Option

- Your First Step: Opening an IQ Option Account

- Exploring the IQ Option Platform: Your Trading Hub

- Ready to Trade Stocks? Here’s How

- Why Choose IQ Option for Stock Trading?

- Verification and First Deposit Steps

- Key Features and Benefits for IQ Option Stock Traders

- Unparalleled Accessibility and User Experience

- Diversified Portfolio Opportunities

- Advanced Trading Tools and Analytics

- Empowering Educational Resources

- Seamless Mobile Trading Experience

- Key Benefits for IQ Option Stock Traders:

- Essential Tools for Analyzing Stocks on IQ Option

- Unveiling Market Insights with Technical Indicators

- Integrating Fundamental Analysis Considerations

- Essential Risk Management Tools and Techniques

- Leveraging IQ Option’s Platform Features

- Your Path to Confident Trading

- Charting, Indicators, and Market News Features

- Dynamic Charting Capabilities

- Powerful Technical Indicators Beyond raw price action, technical indicators provide invaluable insights, helping you interpret market data and forecast future price movements. We integrate a wide array of built-in indicators, from the simplest to the most advanced. These tools streamline your technical analysis, making it easier to identify patterns and confirm your trading hypotheses. Here are just a few examples of the powerful indicators at your disposal: Moving Averages: Smooth out price data to identify trend direction and potential support/resistance levels. Relative Strength Index (RSI): Gauge the momentum of price changes to determine overbought or oversold conditions. Bollinger Bands: Measure market volatility and identify potential price reversals. MACD (Moving Average Convergence Divergence): Reveals changes in the strength, direction, momentum, and duration of a trend. Each indicator serves a unique purpose, and learning to combine them can significantly enhance your ability to spot profitable opportunities and refine your trading strategies. Real-time Market News and Analysis The forex market reacts instantly to global events, economic data releases, and political developments. Our market news features ensure you are always ahead of the curve, providing real-time data and critical insights that influence currency values. This is where fundamental analysis comes alive. Key Market News Features Include: Feature Benefit to Traders Economic Calendar Track upcoming high-impact economic events and data releases (e.g., interest rate decisions, CPI reports, employment figures) that often cause significant market volatility. Breaking News Feeds Receive instant updates on geopolitical events, central bank statements, and other critical news as it happens, allowing for timely reactions. Market Sentiment Indicators Understand the prevailing mood of the market, helping you gauge potential shifts in investor behavior. Expert Analysis Articles Access insights and commentary from seasoned forex experts, offering deeper understanding of market movements and potential future trends. Staying informed with real-time data and expert analysis is crucial for making confident, informed decisions, especially when navigating fast-moving markets. These features are not just add-ons; they are essential components of a robust trading toolkit, enabling you to integrate both technical and fundamental perspectives into your trading approach. Join us and unlock the full potential of these powerful trading features! Open Account in IQ Option Effective Strategies for IQ Option Stock Trading Navigating the world of IQ Option stock trading requires more than just intuition; it demands a solid approach. Successful traders always follow well-defined trading strategies. They understand that the market is dynamic and preparation is key to spotting profitable opportunities and managing potential downsides. Whether you are new to stocks or looking to refine your method, a systematic strategy gives you a clear roadmap. Here are the fundamental pillars that underpin effective IQ Option stock trading: Mastering Analysis: Learn to read the market using both technical and fundamental insights. Robust Risk Management: Protect your capital by understanding how to limit losses. Disciplined Execution: Stick to your plan and avoid emotional trading decisions. Continuous Learning: The market constantly evolves, and so should your knowledge. Technical analysis is a powerful tool for IQ Option stock trading. It involves studying historical price charts and volume data to predict future price movements. Traders often look for recurring chart patterns, like head and shoulders or double bottoms, and use various technical indicators. Moving averages, Relative Strength Index (RSI), and MACD are popular choices that help identify potential entry and exit points. By understanding these tools, you gain a visual perspective of market trends and momentum, which is crucial for making timely decisions. When considering different analytical approaches for IQ Option stock trading, a clear distinction emerges between technical and fundamental analysis: Feature Technical Analysis Fundamental Analysis Focus Price charts, volume, indicators Company financials, news, industry trends Goal Predict short-term price movements Assess intrinsic value, long-term potential Time Horizon Short to medium-term Medium to long-term Key Tools Chart patterns, Oscillators, Moving Averages Earnings reports, Economic data, News releases Both methods offer unique insights, and many successful traders combine elements of each for a comprehensive view of the market.As a seasoned trader once wisely put it: “The biggest obstacle to successful trading isn’t the market itself, but often the mind of the trader. Discipline and emotional control are paramount.” Maintaining a calm and rational mindset during IQ Option stock trading prevents impulsive decisions that can quickly erode your capital. Stick to your trading strategies even when faced with minor setbacks. Before you commit real funds to IQ Option stock trading, make extensive use of the demo account. It’s a risk-free environment where you can test different trading strategies, familiarize yourself with the platform, and build confidence. Consider it your personal training ground. The market is always evolving, so commit to continuous learning. Read financial news, follow market trends, and refine your approach constantly. This proactive attitude will significantly enhance your chances of long-term success in the dynamic world of stock trading. Risk Management Techniques for Stock Positions Navigating the stock market requires more than just picking winning companies; it demands a robust approach to managing potential losses. Effective risk management strategies are the bedrock of sustainable success in stock trading, ensuring you protect your hard-earned capital and stay in the game for the long haul. Without them, even a few bad trades can significantly erode your portfolio. Essential Strategies for Protecting Your Capital Let’s dive into some fundamental techniques every serious trader and investor should master: Stop-Loss Orders: This is perhaps the most fundamental tool for limiting downside. A stop-loss order tells your broker to sell a security when it reaches a certain price. It acts as an automatic safety net, preventing minor pullbacks from turning into catastrophic losses. You can set a fixed percentage below your entry price or use technical indicators to determine your stop level. Position Sizing: Never put all your eggs in one basket, and never bet too much on a single trade. Position sizing involves determining the appropriate number of shares to buy based on your overall portfolio size and your acceptable risk per trade. A common rule suggests risking no more than 1-2% of your total trading capital on any single position. This practice directly supports capital preservation, even if several trades go against you. Diversification: Spreading your investments across various sectors, industries, and asset classes helps mitigate specific company or industry-related risks. While not a guarantee against market downturns, diversification can smooth out your portfolio’s performance and reduce exposure to individual company woes. It’s a proactive way to manage `market risk`. Profit Taking: While not strictly a loss prevention technique, knowing when to take profits is crucial for locking in gains and reducing your exposure to potential reversals. Setting target prices alongside your stop-losses ensures you don’t let winning trades turn into losing ones. This strategy is vital for effective `volatility management` as market conditions can change rapidly. Comparing Stop-Loss Approaches Understanding different types of stop-loss orders can enhance your stock trading strategies: Technique Description Benefit Fixed Stop-Loss A predetermined price point below your entry where you exit the trade. Provides clear exit strategy, limits maximum loss. Trailing Stop-Loss Adjusts the stop price as the stock’s price moves in your favor, maintaining a fixed distance. Protects profits while allowing for further gains, adapts to upward momentum. “Effective risk management is not about avoiding risk entirely; it’s about understanding, measuring, and controlling the risks you take. It allows you to participate in market opportunities without jeopardizing your entire financial future.” Implementing these techniques requires discipline and a clear understanding of your personal risk tolerance. The market is unpredictable, but your response to its movements doesn’t have to be. By consistently applying these principles, you build resilience into your stock trading activities and set yourself up for long-term success. Open Account in IQ Option Navigating the IQ Option Platform for Stock Trading Are you ready to dive into the exciting world of stock trading? The IQ Option platform offers a streamlined and intuitive gateway to global financial markets. Whether you are a seasoned investor or just starting your journey, understanding how to navigate this powerful online trading tool is your first step towards success. Let’s explore the platform together and unlock its full potential for stock trading. Getting Started with Your Trading Journey

No discussion of effective IQ Option stock trading is complete without emphasizing risk management. This is your first line of defense against market volatility. Always determine your maximum acceptable loss per trade before you even enter the market. Implementing stop-loss orders is non-negotiable; they automatically close your position if the price moves against you beyond a certain point. Conversely, setting clear profit targets helps you lock in gains. Never risk more than a small percentage of your total capital on a single trade. This disciplined approach safeguards your trading account and allows you to stay in the game longer.

Understanding the IQ Option Interface The heart of the IQ Option platform is its incredibly user-friendly interface. You’ll immediately notice the large, dynamic chart dominating the screen, displaying real-time data for your chosen asset. To the left, a convenient asset selection panel allows you to easily switch between various stocks, forex pairs, commodities, and even cryptocurrencies. The right side hosts your crucial trade panel, where you execute your orders. Below, you can always see your open positions and review your comprehensive trade history. Key Features for Savvy Stock Traders IQ Option equips you with an impressive arsenal of trading tools designed to enhance your stock trading experience. Here are some essentials that every trader appreciates: Comprehensive Charting: Visualize price movements with various chart types like Japanese candlesticks, bars, and lines, offering deep insights. Technical Analysis Indicators: Apply a wide range of popular indicators such as Moving Averages, RSI, and Bollinger Bands to help predict future price actions. Graphical Tools: Draw trend lines, identify support/resistance levels, and plot Fibonacci retracements directly on your chart for advanced analysis. Economic Calendar & News Feed: Stay informed about market-moving events and important company announcements that can directly impact your chosen stocks. Educational Resources: Access a wealth of tutorials and guides right within the platform to continuously sharpen your investment knowledge and skills. Placing and Managing Your Stock Trades Executing a stock trade on IQ Option is designed for efficiency. After selecting your desired stock, specify the investment amount. You also have the option to utilize a multiplier, which can amplify both potential returns and, importantly, potential risks. Crucially, always implement robust risk management strategies by setting Stop Loss and Take Profit levels. These automatic triggers help protect your capital from excessive losses and secure your profits when the market moves in your favor. Once your trade is open, monitor its performance in the ‘Open Trades’ section and close it manually when you see fit, or simply let your predefined levels take over. Tips for Effective Platform Navigation Mastering the IQ Option platform comes with consistent practice. We strongly encourage you to take full advantage of the demo account to experiment without any financial risk. Explore every button, every feature, and every setting. Customize your workspace to perfectly fit your individual trading style and preferences. Remember, continuous learning, disciplined execution, and smart navigation are key to achieving success in online trading. Open Account in IQ Option Deposits and Withdrawals: Funding Your Stock Trading Account Ready to jump into the exciting world of stock trading? Before you can seize market opportunities, you need to ensure your trading account is properly funded. Understanding the ins and outs of deposits and withdrawals is crucial for a smooth and efficient trading journey. It’s not just about putting money in; it’s about doing it securely, affordably, and accessing your profits without hassle. Think of your trading account as your financial engine. Just as a car needs fuel, your account needs capital to execute trades. We will explore the common ways you can fund your stock trading account and retrieve your earnings, making sure you keep control of your money every step of the way. Common Deposit Methods for Your Trading Capital Getting money into your stock trading account is straightforward with most reputable brokers offering a variety of options. Choose the method that best suits your needs for speed, convenience, and cost. Bank Transfers (Wire Transfers/ACH): These are a popular choice for larger sums. Wire transfers are generally faster but may incur fees. ACH transfers are often free for US accounts but can take a few business days to clear. Debit/Credit Cards: Instant funding is often available with major debit and credit cards. This is convenient for smaller, quick deposits. Be mindful of potential fees from your card issuer or broker. E-Wallets (e.g., PayPal, Skrill, Neteller): Digital wallets provide a fast and secure way to deposit funds without directly sharing your bank details with the broker. They bridge the gap between your bank and your trading account efficiently. Online Payment Processors: Some brokers integrate with local or specialized online payment services, offering region-specific solutions that can be very convenient. Accessing Your Earnings: Withdrawal Options Making profits is thrilling, and getting them into your bank account should be just as easy! Most brokers prioritize secure and efficient withdrawal processes. Here are the typical ways you can withdraw funds from your stock trading account: Bank Transfer: Usually the default for larger withdrawals. Funds are sent directly to your linked bank account. This method is generally secure but can take a few days to process. Debit Card Reimbursement: If you deposited via debit card, some brokers allow withdrawals back to the same card, up to the deposited amount. E-Wallet Transfer: If you used an e-wallet for deposits, you can often withdraw your profits back to the same e-wallet, providing a quick way to access your funds. Cheque (Less Common): While less frequent today, some brokers still offer cheque withdrawals, though this is typically the slowest option. Key Considerations for Secure Deposits and Fast Withdrawals When selecting your funding method, look beyond just convenience. Factors like fees, processing times, and security protocols play a significant role in your overall trading experience. Consideration Why it Matters Processing Time You want your funds available for trading quickly, and you want to access your profits without undue delay. Instant deposits are great, but understand withdrawal timelines. Transaction Fees Both deposits and withdrawals can sometimes incur fees from the broker, your bank, or the payment processor. These can eat into your trading capital or profits. Always check the fee schedule. Security Measures Ensure your broker uses robust encryption and security protocols for all financial transactions. Two-factor authentication (2FA) for your account adds another layer of protection. Verification Requirements Reputable brokers require identity verification (KYC) before you can deposit or withdraw. This protects both you and the broker from fraud. Be prepared to provide necessary documents. Pro Tip: Always review your broker’s specific deposit and withdrawal policies before you commit. Look for transparency on fees, minimums, maximums, and processing times. A well-informed decision saves you time and potential frustration down the line. Funding your stock trading account and managing your withdrawals effectively are fundamental aspects of successful trading. By understanding your options and keeping key factors in mind, you empower yourself to manage your trading capital efficiently, allowing you to focus on what truly matters: making informed trading decisions and growing your portfolio. Open Account in IQ Option Understanding Leverage and Spreads in IQ Option Stock Trading Embarking on the exciting journey of IQ Option stock trading means equipping yourself with essential knowledge. Among the most critical concepts for any trader are leverage and spreads. These aren’t just technical terms; they are fundamental tools and costs that directly impact your potential for magnifying profits and your overall trading strategy. Mastering them is key to making smart trading decisions on any online trading platform. The Power and Peril of Leverage in Trading Imagine you have a small amount of capital, but you spot a significant opportunity in the market. This is where leverage in trading comes into play. Leverage allows you to control a much larger position in the market than your initial capital would typically permit. It’s like using a financial loan from your broker, IQ Option, to amplify your potential returns. Magnified Potential: Even small price movements can translate into substantial gains on a larger position. Capital Efficiency: You don’t need to tie up a lot of your own capital to open a significant trade. Enhanced Market Access: Participate in markets that might otherwise be out of reach with limited funds.Accessing your trading adventure on IQ Option is incredibly straightforward. First, you’ll create or log into your account. Many traders wisely begin with a demo account. This fantastic, risk-free environment allows you to practice strategies, familiarize yourself with the platform’s features, and gain confidence without financial pressure. Once you feel comfortable and ready, transitioning to a live account opens the door to real market opportunities and the potential for significant returns.

Spreads Explained: Your Trading Costs Every time you open a trade, there’s a small cost associated with it, and this cost often comes in the form of a spread. So, what exactly are spreads explained? In simple terms, the spread is the difference between the bid price (the price at which you can sell an asset) and the ask price (the price at which you can buy an asset). It’s how your broker, like IQ Option, earns a profit for facilitating your trades. Think of it as a transaction fee built into the price. Understanding spreads is crucial because it directly affects your entry and exit points and, consequently, your profitability. A wider spread means a higher immediate trading cost for you, making it harder to profit from small price movements. Conversely, a tighter spread means lower costs, which is generally more favorable for traders. Factors Influencing Spreads: Factor Impact on Spreads Market Volatility Higher volatility often leads to wider spreads as market makers adjust for increased risk. Asset Liquidity Less popular or less traded stocks typically have wider spreads than highly liquid assets. Trading Session Spreads can vary during different market hours, often tightening during peak trading times. By keeping an eye on these factors, you can develop a better understanding of market dynamics and how they influence your potential returns. Always check the current spread for an asset on IQ Option before placing your trade. In essence, mastering leverage and understanding spreads are fundamental pillars for anyone serious about IQ Option stock trading. They are not merely numbers; they are powerful concepts that shape your financial outcomes. Embrace them wisely, and you’re well on your way to navigating the markets like a seasoned professional. Open Account in IQ Option Mobile Trading: Accessing Stocks on the IQ Option App Imagine having the global stock market right in your pocket. With the IQ Option app, this isn’t just a dream – it’s your everyday reality. Mobile trading has revolutionized how we interact with financial markets, offering unparalleled convenience and speed. The IQ Option app puts powerful tools at your fingertips, allowing you to access and trade stocks from companies worldwide, anytime, anywhere. You no longer need to be chained to your desktop to seize market opportunities. Your smartphone or tablet becomes your personal trading terminal, empowering you to react instantly to market movements.However, with great power comes great responsibility. Leverage is a double-edged sword. While it can accelerate your gains, it can just as quickly amplify your losses. This is why disciplined risk management is not just recommended, but absolutely essential when trading with leverage. Always understand the maximum exposure you are comfortable with before opening a position.

Advantages of Stock Trading on the IQ Option App: Unmatched Convenience: Trade stocks from any location with an internet connection. Your mobile device becomes your command center for accessing global stocks. Real-time Market Data: Get instant access to live stock prices, charts, and news, helping you make informed decisions quickly. Intuitive Interface: The app is designed for ease of use, making navigation and trade execution straightforward, even for those new to mobile trading. Advanced Analytical Tools: Utilize a variety of technical indicators and charting tools directly on your mobile device to perform thorough market analysis. Portfolio Management: Monitor your open positions, track your profit and loss, and manage your entire portfolio with just a few taps. Secure and Reliable: IQ Option prioritizes the security of your account and transactions, providing a safe environment for your stock market activities. Getting started is simple. Download the IQ Option app from your device’s app store, create an account, or log in with your existing credentials. You’ll quickly discover a world of stock trading opportunities awaiting you. Dive into the diverse range of financial assets available and start building your trading journey today. The power to trade stocks and manage your investments is truly in the palm of your hand. Open Account in IQ Option Risks Involved in IQ Option Stock TradingThe IQ Option mobile app stands out for its user-friendly interface and robust features designed for both beginners and experienced traders. It’s not just about viewing charts; it’s about executing trades, managing your portfolio, and staying informed with real-time data. Whether you’re commuting, waiting for an appointment, or simply relaxing at home, the app ensures you are always connected to the pulse of the stock market. This level of accessibility means you never miss a beat, giving you the edge in fast-moving environments.

Here are some of the primary risks you should be aware of when engaging in stock trading: Market Volatility: Stock prices move constantly, influenced by news, economic data, and investor sentiment. Sudden, unpredictable swings can quickly erode your capital, sometimes in a matter of minutes. What looks promising one moment can turn sour the next. Leverage and Margin: IQ Option often provides leverage, allowing you to control a larger position with a smaller amount of capital. While this amplifies potential gains, it also dramatically magnifies potential losses. A small market move against your position can lead to significant financial loss, even exceeding your initial investment. You must understand how margin calls work and their implications. Capital Loss: This is perhaps the most fundamental risk. You can lose some or all of your invested capital. There’s no guarantee of returns, and if your trades don’t go as planned, your investment will decrease in value. Never invest money you cannot afford to lose. Emotional Trading: Fear and greed are powerful forces in the markets. Making impulsive decisions based on emotions rather than a well-thought-out strategy often leads to poor outcomes. Chasing quick profits or panicking during a downturn can be detrimental to your portfolio. Lack of Knowledge and Experience: Entering stock trading without a solid grasp of market fundamentals, technical analysis, or risk management strategies is akin to navigating an ocean without a map. Understanding how to analyze stocks, interpret charts, and set stop-loss orders is vital for long-term success. Understanding these risks is the first step toward becoming a more resilient and effective trader. It’s not about avoiding risk entirely, but about knowing how to measure it, mitigate it, and make informed decisions that align with your financial goals and risk tolerance. Open Account in IQ Option Is IQ Option Trading Stocks Beginner-Friendly? Embarking on the journey of stock trading can feel overwhelming, especially for newcomers. Many aspiring traders wonder if platforms like IQ Option truly cater to those just starting out. The short answer is a resounding yes! IQ Option has specifically designed its platform with new users in mind, making IQ Option trading stocks remarkably accessible even if you have no prior experience. Think of it this way: a good trading platform should be like a friendly guide, not a complex maze. IQ Option excels in simplifying the often-intimidating world of financial markets. Its intuitive design means you spend less time figuring out how to use the platform and more time learning about the markets themselves. What Makes IQ Option So Welcoming for New Traders? User-Friendly Interface: The platform boasts a clean, uncluttered layout. You can easily find essential tools like charts, asset lists, and order execution buttons without getting lost. This streamlined experience is a huge plus for those new to online trading. Free Demo Account: This is perhaps the biggest draw for anyone starting out. With a free, reloadable demo account, you can practice trading stocks with virtual money. It’s an invaluable tool to understand market dynamics and test your strategies without any financial risk. You can experiment, make mistakes, and learn at your own pace. Low Minimum Deposit: Getting started with real money doesn’t require a large capital outlay. IQ Option allows you to begin with a very modest initial deposit, which helps reduce the barrier to entry and allows you to transition from demo to live trading with minimal financial commitment. Educational Resources: IQ Option understands that knowledge is power. They provide a wealth of educational materials, including video tutorials, webinars, and articles. These resources cover everything from basic trading concepts to advanced strategies, helping you build a solid foundation as you learn to trade stocks. Customer Support: Having reliable support is crucial. IQ Option offers responsive customer service to assist with any questions or issues you might encounter, ensuring a smoother learning curve for beginners.Diving into the world of stock trading on platforms like IQ Option offers exciting opportunities, but it’s crucial to approach it with a clear understanding of the risks involved. While the potential for profit is a strong draw, every trade carries a degree of uncertainty. Smart traders don’t ignore these risks; they learn to manage them.

Open Account in IQ Option Expert Tips for Successful IQ Option Stock Trading Embarking on the journey of IQ Option stock trading can be an incredibly rewarding experience, offering unique opportunities to grow your capital. However, success doesn’t happen by chance. It requires a strategic approach, disciplined execution, and a deep understanding of market dynamics. This guide provides you with essential insights to navigate the exciting world of stock trading on IQ Option and boost your profit potential. Master Your Trading Strategy Developing a robust trading strategy is your compass in the volatile financial markets. Don’t jump in without a clear plan. Successful traders often combine various analytical methods to make informed decisions. Key Elements of a Winning Strategy: Thorough Market Analysis: Before you place a trade, delve into the company’s performance, industry trends, and global economic factors. Understanding what drives stock prices is fundamental. Look beyond the headlines and dig into financial reports. Risk Management: This is arguably the most critical aspect of sustained trading. Define how much capital you are willing to risk on a single trade and stick to it. Many experts recommend risking no more than 1-2% of your total trading capital per trade. Clear Entry and Exit Points: Know exactly why you are entering a trade and, more importantly, when you will exit. Use stop-loss orders to limit potential losses and take-profit orders to secure gains automatically. Adaptability: Markets constantly evolve. A strategy that worked yesterday might not work today. Be prepared to adapt your approach based on new information and changing market conditions. Leverage Technical and Fundamental Analysis These two pillars form the backbone of sound stock trading decisions. Combining them gives you a comprehensive view of a stock’s potential. Technical Analysis vs. Fundamental Analysis Aspect Technical Analysis Fundamental Analysis Focus Price charts, patterns, indicators (moving averages, RSI, MACD) Company financials, industry health, economic data, news Goal Predict future price movements based on historical data Determine the intrinsic value of a stock Tools Charting software, various indicators Financial statements, economic reports, news feeds When to Use Identifying short-term entry/exit points, market sentiment Long-term investment decisions, understanding underlying value While technical analysis helps you spot ideal entry and exit times by studying price action, fundamental analysis tells you why a company’s stock might be a good buy or sell. Using both gives you a powerful edge in your IQ Option trading activities. Cultivate a Disciplined Trading Mindset Trading is as much about psychology as it is about strategy. Emotions can be your biggest enemy if not managed properly. “The market is a device for transferring money from the impatient to the patient.” – This timeless wisdom resonates deeply with successful stock trading. Patience, discipline, and emotional control are paramount. Avoid chasing quick profits or making impulsive decisions based on fear or greed. Stick to your pre-defined plan. If a trade doesn’t meet your criteria, simply don’t take it. Review your trades regularly, both wins and losses, to learn and refine your approach. A consistent, calm mindset is a powerful asset. Practice with a Demo Account IQ Option offers an excellent demo account feature, which is an invaluable resource, especially for new traders. Treat it as your personal laboratory for honing your stock trading strategies without any financial risk. Advantages of Using the IQ Option Demo Account: Risk-Free Learning: Experiment with different strategies and asset classes without fear of losing real money. Platform Familiarity: Get comfortable with the IQ Option interface, charting tools, and order execution. Strategy Testing: Validate your trading ideas and see how they perform under simulated market conditions. Building Confidence: Gain experience and confidence before transitioning to live trading. Only move to a live account once you consistently demonstrate profitability and confidence on the demo platform. Remember, every expert trader started as a beginner, and practice is the key to mastering any skill. Open Account in IQ Option Common Questions About IQ Option Stock Trading Venturing into the world of online trading can feel like stepping into a bustling financial marketplace. If you are considering IQ Option for your stock trading endeavors, it’s natural to have a few questions. As a seasoned professional, I understand the importance of clarity before you commit your time and capital. Let’s tackle some of the most frequently asked questions about IQ Option stock trading to help you navigate this exciting platform with confidence. Is IQ Option a good platform for stock trading? Many aspiring traders wonder if IQ Option is a suitable environment for diving into the stock market. Absolutely! IQ Option has gained significant traction as an accessible and robust online trading platform. It offers a diverse range of assets, including numerous stocks from global companies. The platform is designed with a user-friendly interface, making it an attractive option for both beginner traders and those with more experience. You can execute trades, analyze market data, and manage your portfolio all within a single intuitive application, making the entire IQ Option stock trading experience streamlined and efficient. How do I start stock trading on IQ Option? Getting started with IQ Option is straightforward. The platform prides itself on making the entry barrier low for anyone interested in the stock market. Here’s a simple breakdown: Sign Up: Create an account using your email or social media. Verify Your Identity: Complete the necessary verification steps to ensure security and compliance. Fund Your Account: Make a minimum deposit using various convenient payment methods. Explore the Demo Account: Practice your trading strategies without financial risk using the free demo account. This is crucial for understanding how the platform works and testing your approach to the stock market. Choose Your Stocks: Navigate to the stock section, select the companies you want to invest in, and begin live trading! Remember, starting small and gradually increasing your investment as you gain experience is a wise approach to risk management. What is the minimum deposit required for IQ Option stock trading? One of the most appealing aspects for new traders is the low entry point. IQ Option typically requires a very modest minimum deposit, often as low as $10. This makes it incredibly accessible for individuals who want to explore stock trading or forex trading without committing a substantial amount of capital upfront. This low threshold allows you to test the waters, understand the platform, and get comfortable with your trading strategies before scaling up your investment. Can I practice stock trading on IQ Option without risking real money? Yes, absolutely! IQ Option provides a fantastic demo account feature. This practice account comes pre-loaded with virtual funds, allowing you to engage in simulated IQ Option stock trading, test various trading strategies, and familiarize yourself with the platform’s features – all without risking any real money. It’s an invaluable tool for beginner traders to gain confidence and hone their skills before transitioning to live online trading. Think of it as your personal sandbox for mastering the nuances of the stock market. How does the withdrawal process work on IQ Option? Once you’ve made some profitable trades, you’ll naturally want to access your earnings. The withdrawal process on IQ Option is designed to be user-friendly and secure. You can typically withdraw funds using the same method you used for your deposit, or other verified options. The platform aims to process requests efficiently, though exact times can vary depending on the payment method and any necessary verification checks. Always ensure your account is fully verified to facilitate smooth and quick withdrawals, enhancing your overall experience with the stock trading platform. Is IQ Option a regulated broker? The question of regulation is critical for any serious trader. IQ Option operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). This regulation means the platform adheres to strict financial standards and client protection protocols, providing an added layer of security and trust for users. Knowing you are trading with a regulated broker should give you greater peace of mind as you engage in online trading and explore various investment opportunities. What about risk management in IQ Option stock trading? Risk management is paramount in any form of investment, especially when dealing with the dynamic stock market. IQ Option provides various tools and features to help you manage your risk effectively. These include stop-loss orders, which automatically close a position if the market moves against you by a certain amount, and take-profit orders, which secure your gains. Educating yourself on market analysis and understanding the potential volatility of different stocks are also crucial steps in protecting your capital. Always remember that trading involves risk, and it’s possible to lose your invested capital. Does IQ Option offer customer support for stock traders? Excellent customer support is a hallmark of a reliable trading platform. IQ Option provides multi-lingual customer support available 24/7 through various channels, including live chat, email, and phone. Whether you have a technical query, need assistance with your account, or require clarification on a trading strategy, their dedicated team is ready to help. This robust support system ensures that you receive timely assistance whenever you need it, making your IQ Option stock trading journey smoother and more confident. Frequently Asked Questions What is IQ Option’s primary approach to stock trading? IQ Option primarily facilitates stock trading through Contracts for Difference (CFDs). This means traders speculate on stock price movements without owning the underlying asset, allowing potential profits from both rising and falling markets. Can beginners trade stocks on IQ Option? Yes, IQ Option is designed to be beginner-friendly. It offers an intuitive interface, a free demo account with virtual funds for practice, low minimum deposit requirements, and extensive educational resources to help new traders learn and build confidence. What analytical tools does IQ Option provide for stock trading? IQ Option equips traders with a wide range of essential tools, including comprehensive charting capabilities (candlesticks, bars, lines), various technical indicators (Moving Averages, RSI, MACD, Bollinger Bands), graphical tools for drawing trend lines, and an economic calendar with news feeds. How important is risk management when trading stocks on IQ Option? Risk management is paramount. IQ Option provides critical features like Stop-Loss and Take-Profit orders to help traders limit potential losses and secure gains. It’s essential to define your risk tolerance, practice position sizing, and never invest more than you can afford to lose. Can I trade stocks on IQ Option from my mobile device? Absolutely. IQ Option offers a powerful and user-friendly mobile app for both iOS and Android devices. This allows traders to access real-time market data, execute trades, manage their portfolios, and utilize analytical tools conveniently from anywhere, at any time.While IQ Option provides an excellent environment for learning and practicing, remember that becoming proficient in stock trading still requires dedication and continuous learning. Use the platform’s features to your advantage, especially the demo account, to build confidence and develop your skills. Your journey to understanding the stock market can be an exciting one, and IQ Option offers a solid starting point for those eager to dive in.

- Real-time Market News and Analysis

- Effective Strategies for IQ Option Stock Trading

- Risk Management Techniques for Stock Positions

- Essential Strategies for Protecting Your Capital

- Comparing Stop-Loss Approaches

- Navigating the IQ Option Platform for Stock Trading

- Getting Started with Your Trading Journey

- Understanding the IQ Option Interface

- Key Features for Savvy Stock Traders

- Placing and Managing Your Stock Trades

- Tips for Effective Platform Navigation

- Deposits and Withdrawals: Funding Your Stock Trading Account

- Understanding Leverage and Spreads in IQ Option Stock Trading

- The Power and Peril of Leverage in Trading

- Spreads Explained: Your Trading Costs

- Factors Influencing Spreads:

- Mobile Trading: Accessing Stocks on the IQ Option App

- Advantages of Stock Trading on the IQ Option App:

- Risks Involved in IQ Option Stock Trading

- Is IQ Option Trading Stocks Beginner-Friendly?

- What Makes IQ Option So Welcoming for New Traders?

- Expert Tips for Successful IQ Option Stock Trading

- Master Your Trading Strategy

- Key Elements of a Winning Strategy:

- Leverage Technical and Fundamental Analysis

- Technical Analysis vs. Fundamental Analysis

- Cultivate a Disciplined Trading Mindset

- Practice with a Demo Account

- Advantages of Using the IQ Option Demo Account:

- Common Questions About IQ Option Stock Trading

- Is IQ Option a good platform for stock trading?

- How do I start stock trading on IQ Option?

- What is the minimum deposit required for IQ Option stock trading?

- Can I practice stock trading on IQ Option without risking real money?

- How does the withdrawal process work on IQ Option?

- Is IQ Option a regulated broker?

- What about risk management in IQ Option stock trading?

- Does IQ Option offer customer support for stock traders?

- Frequently Asked Questions

What is IQ Option and How it Works for Stock Trading

Ever wondered how to step into the dynamic world of financial markets without needing a hefty initial investment or complex traditional brokerage accounts? Enter IQ Option, an innovative online trading platform that has made a significant impact by simplifying access to various assets, including stocks. It’s a popular choice for traders globally, providing a robust yet user-friendly interface that caters to both beginners and seasoned investors.

At its core, IQ Option allows you to engage in stock trading primarily through Contracts for Difference (CFDs). This means you don’t actually own the underlying stock shares. Instead, you speculate on their price movements. If you believe a stock’s price will rise, you “buy” (go long); if you anticipate a fall, you “sell” (go short). This offers incredible flexibility, letting you potentially profit from both upward and downward market trends. The IQ Option platform brings the excitement of the market right to your fingertips, enabling quick decisions based on real-time data.

How IQ Option Facilitates Your Stock Trading Journey:

- Account Setup: Your journey begins with a straightforward registration process. You can start with a free demo account, which comes pre-loaded with virtual funds, allowing you to practice strategies and explore the platform without any financial risk. This is an invaluable tool for understanding how stock trading works.

- Funding Your Account: Once you feel confident, funding your live trading account is simple, with various deposit methods available. This readiness ensures you can capitalize on investment opportunities as they arise.

- Selecting Your Stocks: The platform offers a diverse range of CFDs on stocks from major global companies. You can easily navigate through categories or use the search function to find the stocks you are interested in. The comprehensive list gives you ample choice.

- Analyzing the Market: IQ Option equips you with an array of analytical tools. Access charts, technical indicators, and economic calendars directly on the platform. These resources help you make informed decisions, predicting potential price movements with greater accuracy.

- Placing a Trade: When you’ve identified a trading opportunity, executing a trade is intuitive. You select the asset, choose your investment amount, set your desired leverage (which amplifies your potential returns and risks), and decide whether to buy or sell. The execution speed on the IQ Option platform is a distinct advantage, crucial in fast-moving markets.

- Managing Your Position: Effective risk management is key. IQ Option allows you to set stop-loss orders to limit potential losses and take-profit orders to secure gains automatically. You monitor your open positions directly from your dashboard, adjusting as market conditions evolve.

IQ Option demystifies stock trading, making it accessible and engaging. It provides the tools, the education, and the environment for you to explore the vast potential of the financial markets. The platform’s design focuses on ease of use, ensuring that even those new to online trading can quickly grasp the mechanics and begin their journey towards mastering the art of market speculation.

Understanding Stock CFDs on IQ Option

Ever wondered how to capitalize on the movements of global company stocks without actually owning them? Welcome to the exciting world of Stock CFDs on IQ Option! A Contract for Difference (CFD) on stocks allows you to speculate on the price direction of a company’s shares. Whether the market goes up or down, you have the potential to profit by accurately predicting the next big shift. It’s an accessible way to engage with some of the biggest names in the stock market, from tech giants to established blue-chip companies, all from the convenience of your preferred device.

IQ Option provides a user-friendly platform that simplifies the process of trading stock CFDs. Instead of purchasing shares outright, you enter into a contract with the broker to exchange the difference in the price of a stock between the time the contract is opened and closed. This means you can react quickly to market news and economic indicators, taking advantage of short-term volatility. The beauty of this approach lies in its flexibility; you can go long (buy) if you expect a price increase, or go short (sell) if you anticipate a decline. This offers a broad range of opportunities for smart traders looking to diversify their portfolio and explore different market dynamics.

Key Aspects of Stock CFD Trading on IQ Option:

- Leverage: Amplify your trading power. Leverage allows you to control a larger position with a relatively smaller capital outlay, potentially magnifying your gains. However, remember it also amplifies potential losses.

- Accessibility: Gain exposure to a wide array of global stocks without the complexities of traditional stock ownership. IQ Option brings markets directly to you.

- Flexibility: Trade both rising and falling markets. Profit from bullish trends by buying or bearish trends by selling.

- No Physical Ownership: You don’t own the underlying asset, which simplifies the trading process by avoiding share certificates, voting rights, or dividend payments. Your focus remains purely on price movements.

- Real-time Data: Access live price feeds and essential market information directly on the IQ Option platform, enabling informed decision-making.

Successful engagement with stock CFDs requires a strategic approach and robust risk management. Before diving into live trading, many find the IQ Option demo account an invaluable tool. It allows you to practice your strategies with virtual funds, getting a feel for market movements and the platform’s features without any financial risk. Understanding how to set stop-loss and take-profit orders is crucial for protecting your capital and locking in gains. By mastering these tools, you enhance your chances of long-term success in this dynamic trading environment. Engage with stock CFDs on IQ Option to open up a world of speculative potential in the global financial markets.

Getting Started: Opening an Account and Trading Stocks on IQ Option

Are you ready to dive into the exciting world of financial markets? IQ Option offers a streamlined, user-friendly gateway for anyone looking to begin their investment journey, especially when it comes to stock trading. Whether you are a complete novice or an experienced trader seeking a new platform, opening an account here is a straightforward process designed to get you trading quickly and confidently.

Your First Step: Opening an IQ Option Account

Creating your IQ Option account is surprisingly simple. Just follow these quick steps:

- Visit the IQ Option Website: Head over to the official IQ Option website. Look for the “Sign Up” or “Open Account” button, usually prominently displayed.

- Provide Your Details: You will need to enter your email address and create a strong password. You might also have the option to register using your social media accounts for even faster setup.

- Agree to Terms: Read and accept the Terms and Conditions and Privacy Policy. It’s always wise to understand the rules before you play the game.

- Verify Your Email: IQ Option sends a verification link to your registered email. Click this link to activate your account. This crucial step confirms your identity and secures your account.

- Complete Your Profile: For full access and to comply with regulatory requirements, you will need to provide additional personal information. This often includes your name, date of birth, and country of residence.

- Fund Your Account: Once your profile is complete, you can deposit funds into your real trading account. IQ Option supports various payment methods, including credit/debit cards, e-wallets, and bank transfers. Choose the one most convenient for you.

And just like that, you are ready to explore the platform!

Exploring the IQ Option Platform: Your Trading Hub

Once you successfully open your trading account and log in, you will discover a sleek, intuitive interface. IQ Option’s online trading platform is designed for ease of use, making market analysis and trade execution accessible even for beginners. You will find interactive charts, a wide range of analytical tools, and a clear overview of available assets. Before you jump into trading stocks with real money, take some time to familiarize yourself with the platform’s layout and features.

Ready to Trade Stocks? Here’s How

Trading stocks on IQ Option means you are participating in the dynamic movements of some of the world’s largest companies. Here’s a basic overview of how you can get started:

- Select Your Asset: On the platform, navigate to the asset selection menu. You will see various categories, including “Stocks.” Browse the list of available companies. You can trade popular stocks from global exchanges.

- Analyze the Market: Use the built-in technical indicators and charting tools to understand price trends. Pay attention to fundamental news that might impact a company’s stock value. Good market analysis is key to informed decisions.

- Choose Your Investment Amount: Decide how much capital you want to allocate to a particular stock trade. Remember to start small, especially when you are just beginning.

- Set Your Parameters: For better risk management, consider using features like Stop Loss and Take Profit. A Stop Loss helps limit potential losses, while a Take Profit secures your gains when the price reaches a desired level.

- Execute Your Trade: Once you are confident in your analysis and settings, click “Buy” if you expect the stock price to rise, or “Sell” if you anticipate it will fall.

Your trade is now active! You can monitor its performance directly from your trading dashboard.

Why Choose IQ Option for Stock Trading?

Many traders find IQ Option an attractive choice for their stock trading activities due to several compelling reasons:

- User-Friendly Interface: The platform is easy to navigate, making it ideal for new traders.

- Diverse Stock Selection: Access to a broad range of popular company stocks from various industries and regions.

- Free Demo Account: Practice trading stocks with virtual money before risking real capital. This is an invaluable tool for learning and strategy testing.

- Educational Resources: IQ Option often provides tutorials, webinars, and articles to help you improve your trading knowledge.

- Competitive Conditions: Enjoy competitive spreads and transparent fee structures.

- Mobile Trading: Trade on the go with their powerful mobile app, available for both iOS and Android devices.

While the prospect of trading stocks is exciting, always remember that investment carries risk. Never invest money you cannot afford to lose. The free demo account is your best friend when you are learning the ropes. Use it extensively to build confidence, test strategies, and understand market dynamics without any financial pressure. Once you feel prepared, transition to a real account with a clear understanding of market volatility and sound risk management practices. Your successful investment journey starts with preparation and smart decisions.

Verification and First Deposit Steps

Embarking on your journey into the world of foreign exchange requires a couple of crucial, yet straightforward, initial steps: verifying your identity and making your first deposit. These processes are not mere formalities; they are fundamental to ensuring a secure forex platform for all participants and complying with international financial regulations. A reputable online forex broker prioritizes these steps to protect your funds and personal information, laying the groundwork for your successful trading experience.

Becoming a verified forex trader is a smooth process designed for your security and peace of mind. Here’s what you can expect:

- Account Registration: Begin by signing up with your chosen online forex broker. You will typically provide basic personal information and confirm your email address.

- Identity Verification (KYC): Submit a clear copy of a valid government-issued photo ID, such as a passport or driver’s license. This helps confirm your identity.

- Address Verification: Provide a recent utility bill or bank statement (usually issued within the last three months) that clearly shows your name and current residential address. This document verifies your place of residence.

- Review and Approval: The compliance team at your broker will review your submitted documents. This process is usually quick, often completed within 24-48 hours. You will receive a notification once your forex trading account is fully verified.

Once your account is verified, you are ready to fund it and gain forex market access. Depositing funds is designed to be user-friendly and efficient:

- Access the Deposit Section: Log into your verified forex trading account and navigate to the “Deposit” or “Fund Account” area.

- Choose Your Deposit Method: Select a preferred payment option. Common choices include bank transfers, credit/debit cards, or various e-wallets. A secure forex platform offers multiple reliable options.

- Enter Deposit Amount: Specify how much you wish to deposit. Always check for any minimum deposit requirements set by your online forex broker.

- Confirm Transaction: Follow the on-screen instructions to finalize your deposit. Funds typically reflect in your forex trading account swiftly, allowing you to quickly move towards engaging with the forex market.

Completing these essential verification and deposit steps transforms you from a prospective trader into a fully verified forex trader ready for action. You now have secure forex market access, backed by a trusted online forex broker, and can confidently begin exploring the dynamic opportunities available in the global currency markets.

Key Features and Benefits for IQ Option Stock Traders

Are you ready to dive into the exciting world of stock trading? IQ Option offers a dynamic and user-friendly platform specifically designed to empower both new and experienced stock traders. We understand what it takes to succeed in the market, and our features are tailored to give you an edge. Imagine having cutting-edge tools and a vast array of opportunities right at your fingertips. That’s what you get with IQ Option.

Unparalleled Accessibility and User Experience

Our platform stands out for its incredible ease of use. Whether you’re a seasoned pro or just starting your journey in online trading, you’ll find the interface intuitive and straightforward. Setting up your account is a breeze, and navigating through various markets feels natural. We believe that a great trading experience begins with a platform that simply works for you, not against you.

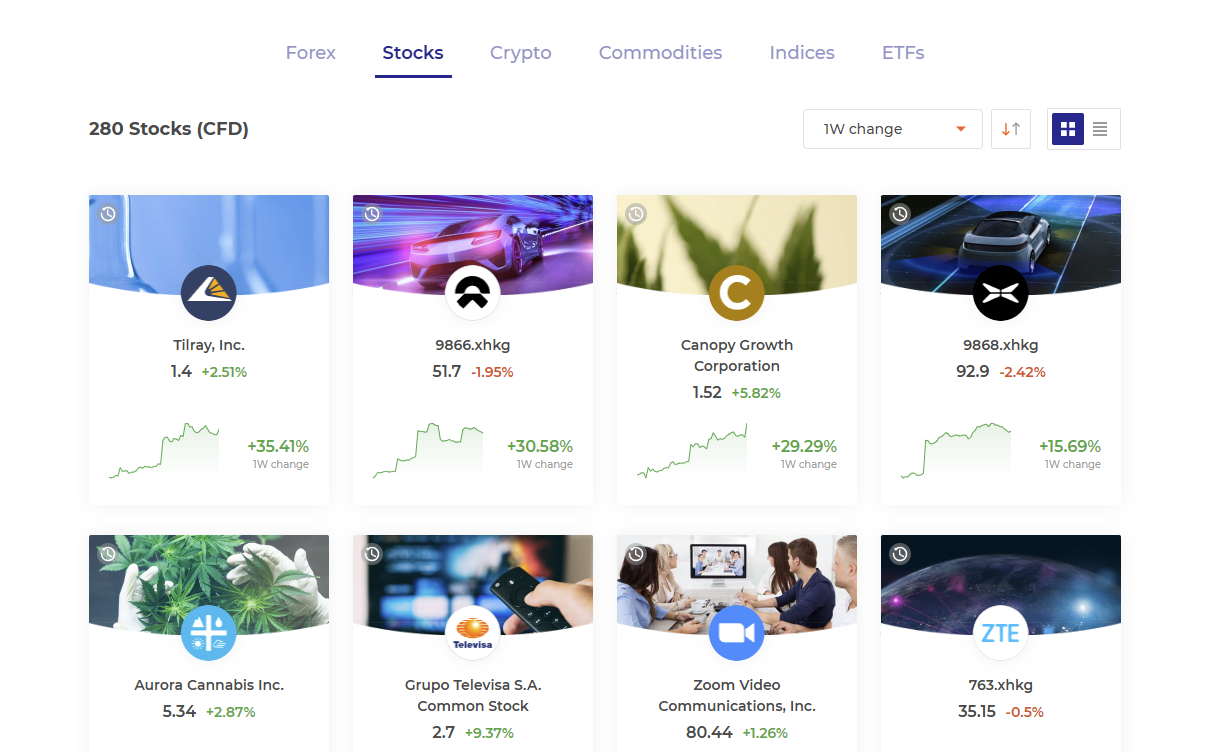

Diversified Portfolio Opportunities

Expand your investment horizons with a rich selection of stocks. IQ Option lets you build a truly diversified portfolio by offering access to leading companies from various industries worldwide. You are not limited; you can explore and choose the stocks that align best with your investment strategy. From tech giants to emerging markets, the world’s most popular companies are within reach.

Advanced Trading Tools and Analytics

Successful trading hinges on smart decisions, and smart decisions come from robust analysis. IQ Option equips you with powerful trading tools, including a variety of charting options, technical indicators, and analytical instruments. Visualize market trends, identify potential entry and exit points, and execute your trades with confidence. These tools are your eyes and ears in the market, helping you spot opportunities and manage your positions effectively.

Empowering Educational Resources

Knowledge is power, especially in the financial markets. We provide comprehensive educational resources to help you sharpen your skills and deepen your understanding of stock trading. Access tutorials, webinars, and articles that cover everything from basic concepts to advanced strategies. Continuously learn and refine your approach to become a more informed and profitable trader.

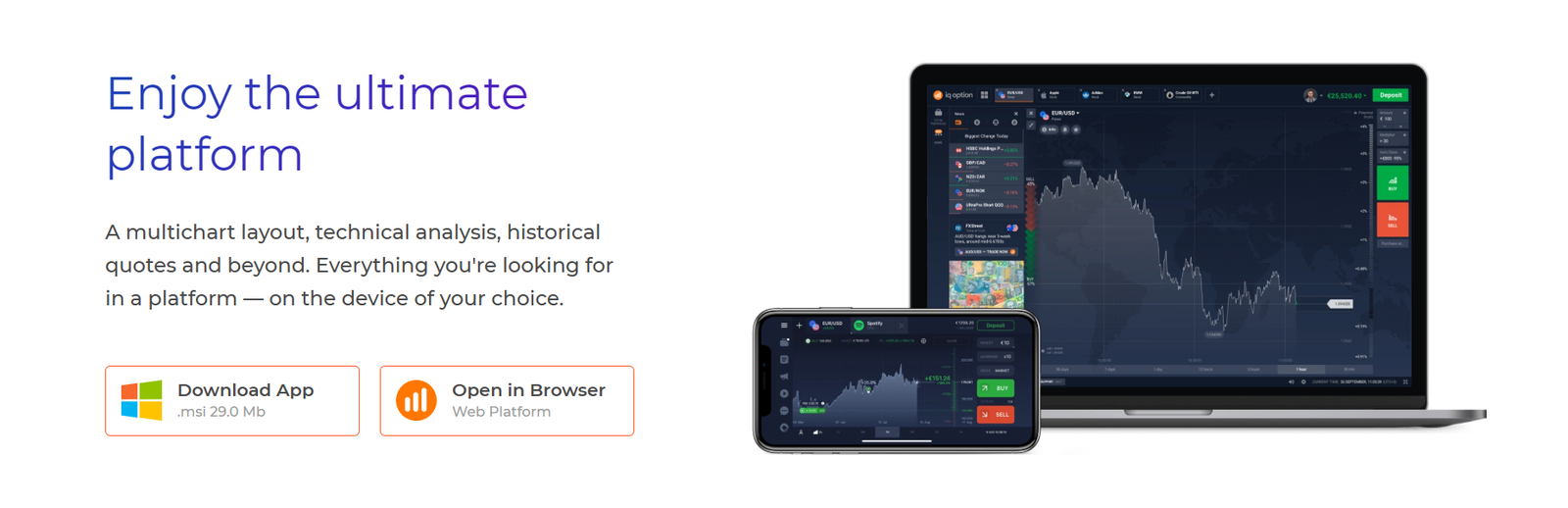

Seamless Mobile Trading Experience

Your trading journey doesn’t have to stop when you leave your desk. Our award-winning mobile app ensures you stay connected to the markets anytime, anywhere. Enjoy full functionality, real-time data, and swift trade execution directly from your smartphone or tablet. Manage your positions, monitor your portfolio, and react to market movements on the go with unparalleled convenience.

Key Benefits for IQ Option Stock Traders:

- Accessible Platform: A user-friendly interface makes online trading simple for everyone.

- Diversified Stock Selection: Choose from a wide range of global companies to build a robust diversified portfolio.

- Advanced Trading Tools: Utilize powerful charts, indicators, and analytical features for informed decisions.

- Risk Management Features: Implement stop-loss and take-profit orders to protect your investments and optimize returns.

- Educational Support: Gain access to extensive learning materials to enhance your trading knowledge.

- Low Minimum Deposit: Start your trading journey with an accessible entry point, making it easier to begin.

- Free Demo Account: Practice your strategies with virtual funds before committing real capital.

- Fast Execution: Experience rapid order placement and quick trade processing.

- Dedicated Customer Support: Receive prompt and professional assistance whenever you need it.

- Convenient Mobile Trading: Trade effortlessly from your mobile device, keeping you connected to the markets 24/7.

Join IQ Option today and discover a world where powerful features meet exceptional benefits, designed to elevate your stock trading experience.

Essential Tools for Analyzing Stocks on IQ Option

Ready to make your mark in the stock market? Trading stocks on IQ Option offers incredible opportunities, but success hinges on smart decisions. You wouldn’t navigate unknown waters without a compass, right? The same goes for trading. Equipping yourself with the right essential tools for analyzing stocks is not just recommended; it’s crucial. IQ Option empowers you with a range of features designed to give you that analytical edge. Let’s explore how these tools transform raw market data into actionable insights, helping you develop winning trading strategies.

Many aspiring traders wonder where to begin. The good news? IQ Option integrates a suite of features designed to assist you. These tools empower you to dissect market movements, identify trends, and develop solid trading strategies. Let’s explore some of these indispensable aids that will sharpen your analytical edge.

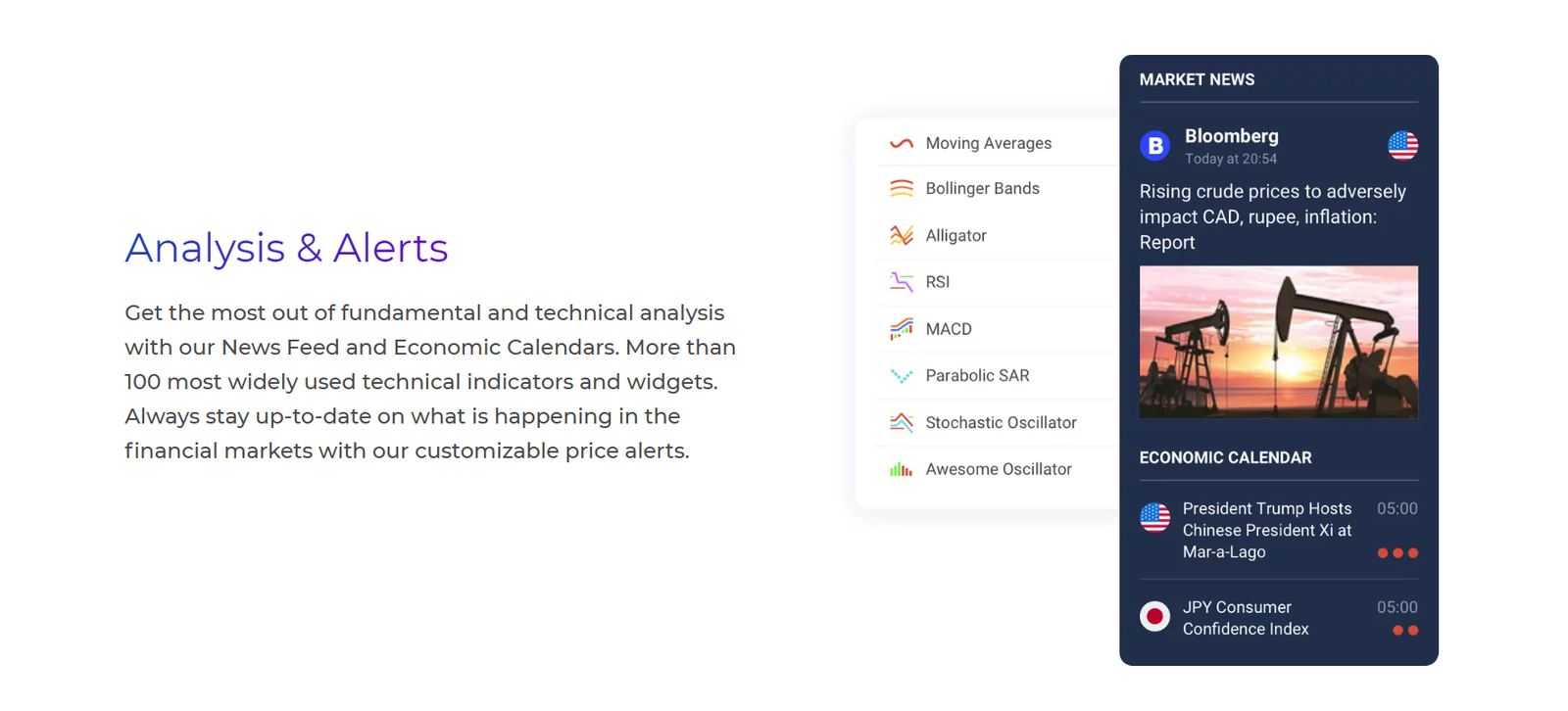

Unveiling Market Insights with Technical Indicators

One of the most powerful sets of instruments at your disposal are technical indicators. These mathematical calculations, based on price, volume, or open interest, visually represent market sentiment and potential future movements directly on your chart. IQ Option provides a rich library of these indicators. Mastering them can significantly enhance your stock analysis:

- Moving Averages (MAs): These smooth out price data to identify trend direction. A simple glance tells you if the stock is generally heading up, down, or consolidating.

- Relative Strength Index (RSI): A momentum oscillator measuring the speed and change of price movements. It helps identify overbought or oversold conditions, signalling potential reversals.

- MACD (Moving Average Convergence Divergence): This trend-following momentum indicator shows the relationship between two moving averages of a security’s price. It’s excellent for spotting new trends or reversals.

- Bollinger Bands: These volatility bands adapt to market conditions. They help determine if prices are high or low on a relative basis and can signal potential price breakouts or consolidations.

Learning how to combine these indicators gives you a comprehensive view of price action and helps you confirm signals, boosting the reliability of your market entries and exits.

Integrating Fundamental Analysis Considerations

While technical tools focus on price action, integrating aspects of fundamental analysis provides a broader perspective. This involves looking at the underlying health of a company or the economy. On IQ Option, while you primarily execute trades based on technical signals, a quick check on major news events, earnings reports, or industry developments for the stocks you are watching can offer valuable context. Understanding the “why” behind significant price moves adds another layer to your analytical process.

Essential Risk Management Tools and Techniques

Even with the best analysis, markets can be unpredictable. This is where robust risk management becomes your co-pilot. IQ Option offers built-in features that are indispensable for protecting your capital:

- Stop-Loss Orders: Automatically closes your position if the price moves against you to a predefined level. It’s your safety net, limiting potential losses.

- Take-Profit Orders: Closes your position once the price reaches a specific profit target. This helps you lock in gains and avoid emotional decisions.

- Position Sizing: While not a direct tool, it’s a strategy you implement. Never risk more than a small percentage of your total trading capital on a single trade. This disciplined approach is a cornerstone of sustainable trading.

Utilizing these features is non-negotiable for serious traders. They allow you to define your risk before entering a trade, helping you maintain control and trade with confidence.

Leveraging IQ Option’s Platform Features

IQ Option itself is designed with traders in mind, integrating many essential analytical features directly into its interface. This means you don’t need to jump between multiple platforms. The charting package is powerful and customizable, allowing you to:

- Choose from various chart types (candlesticks, bars, lines) for different visual perspectives.

- Apply multiple indicators simultaneously to create your unique analytical setup.

- Draw trend lines, support/resistance levels, and Fibonacci retracements directly on the charts.

- Access historical data to backtest your strategies and see how they performed in the past.

The platform also offers a news feed and economic calendar. These elements, while not direct trading tools, provide crucial context for your daily stock analysis, keeping you informed about market-moving events.

Your Path to Confident Trading

Mastering these essential tools for analyzing stocks on IQ Option is a journey of continuous learning. Each tool offers a unique lens through which to view the market. Combine them wisely, practice diligently on the demo account, and build a trading methodology that suits your style. The market is full of possibilities, and with these powerful tools at your fingertips, you’re well-equipped to seize them. Ready to elevate your trading game? Start exploring these features on IQ Option today and transform your approach to the stock market!

Charting, Indicators, and Market News Features

Diving into the world of currency trading requires more than just enthusiasm; it demands powerful tools to navigate market complexities. Our comprehensive forex trading platform equips you with an arsenal of features designed to empower your trading decisions. Imagine having the pulse of the market at your fingertips, the ability to predict potential moves, and the foresight to react to global events instantly. This is precisely what our advanced charting, sophisticated indicators, and real-time market news bring to your trading desk.

Successful traders understand that knowledge is power. Combining technical analysis with fundamental analysis gives you a distinct edge. Let’s explore how these integral features elevate your trading experience, helping you craft robust trading strategies and manage risk effectively.

Dynamic Charting Capabilities

Our platform offers interactive and highly customizable charts, giving you a clear visual representation of price movements. These aren’t just pretty pictures; they are your window into market behavior. With a variety of chart types, including the ever-popular candlestick charts, bar charts, and line charts, you can analyze historical data, identify trends, and spot potential entry and exit points with precision. Customization options allow you to tailor the charts to your specific analytical style, adjusting timeframes from tick-by-tick to monthly views. This flexibility ensures you always have the perspective you need to make informed decisions.

Powerful Technical Indicators

Beyond raw price action, technical indicators provide invaluable insights, helping you interpret market data and forecast future price movements. We integrate a wide array of built-in indicators, from the simplest to the most advanced. These tools streamline your technical analysis, making it easier to identify patterns and confirm your trading hypotheses. Here are just a few examples of the powerful indicators at your disposal:

- Moving Averages: Smooth out price data to identify trend direction and potential support/resistance levels.

- Relative Strength Index (RSI): Gauge the momentum of price changes to determine overbought or oversold conditions.

- Bollinger Bands: Measure market volatility and identify potential price reversals.

- MACD (Moving Average Convergence Divergence): Reveals changes in the strength, direction, momentum, and duration of a trend.

Each indicator serves a unique purpose, and learning to combine them can significantly enhance your ability to spot profitable opportunities and refine your trading strategies.

Real-time Market News and Analysis

The forex market reacts instantly to global events, economic data releases, and political developments. Our market news features ensure you are always ahead of the curve, providing real-time data and critical insights that influence currency values. This is where fundamental analysis comes alive.

Key Market News Features Include:

| Feature | Benefit to Traders |

|---|---|

| Economic Calendar | Track upcoming high-impact economic events and data releases (e.g., interest rate decisions, CPI reports, employment figures) that often cause significant market volatility. |

| Breaking News Feeds | Receive instant updates on geopolitical events, central bank statements, and other critical news as it happens, allowing for timely reactions. |

| Market Sentiment Indicators | Understand the prevailing mood of the market, helping you gauge potential shifts in investor behavior. |

| Expert Analysis Articles | Access insights and commentary from seasoned forex experts, offering deeper understanding of market movements and potential future trends. |

Staying informed with real-time data and expert analysis is crucial for making confident, informed decisions, especially when navigating fast-moving markets. These features are not just add-ons; they are essential components of a robust trading toolkit, enabling you to integrate both technical and fundamental perspectives into your trading approach. Join us and unlock the full potential of these powerful trading features!

Effective Strategies for IQ Option Stock Trading

Navigating the world of IQ Option stock trading requires more than just intuition; it demands a solid approach. Successful traders always follow well-defined trading strategies. They understand that the market is dynamic and preparation is key to spotting profitable opportunities and managing potential downsides. Whether you are new to stocks or looking to refine your method, a systematic strategy gives you a clear roadmap.

Here are the fundamental pillars that underpin effective IQ Option stock trading:

- Mastering Analysis: Learn to read the market using both technical and fundamental insights.

- Robust Risk Management: Protect your capital by understanding how to limit losses.

- Disciplined Execution: Stick to your plan and avoid emotional trading decisions.

- Continuous Learning: The market constantly evolves, and so should your knowledge.

Technical analysis is a powerful tool for IQ Option stock trading. It involves studying historical price charts and volume data to predict future price movements. Traders often look for recurring chart patterns, like head and shoulders or double bottoms, and use various technical indicators. Moving averages, Relative Strength Index (RSI), and MACD are popular choices that help identify potential entry and exit points. By understanding these tools, you gain a visual perspective of market trends and momentum, which is crucial for making timely decisions.

When considering different analytical approaches for IQ Option stock trading, a clear distinction emerges between technical and fundamental analysis:

| Feature | Technical Analysis | Fundamental Analysis |

|---|---|---|

| Focus | Price charts, volume, indicators | Company financials, news, industry trends |

| Goal | Predict short-term price movements | Assess intrinsic value, long-term potential |

| Time Horizon | Short to medium-term | Medium to long-term |

| Key Tools | Chart patterns, Oscillators, Moving Averages | Earnings reports, Economic data, News releases |

Both methods offer unique insights, and many successful traders combine elements of each for a comprehensive view of the market.

No discussion of effective IQ Option stock trading is complete without emphasizing risk management. This is your first line of defense against market volatility. Always determine your maximum acceptable loss per trade before you even enter the market. Implementing stop-loss orders is non-negotiable; they automatically close your position if the price moves against you beyond a certain point. Conversely, setting clear profit targets helps you lock in gains. Never risk more than a small percentage of your total capital on a single trade. This disciplined approach safeguards your trading account and allows you to stay in the game longer.

As a seasoned trader once wisely put it:

“The biggest obstacle to successful trading isn’t the market itself, but often the mind of the trader. Discipline and emotional control are paramount.”

Maintaining a calm and rational mindset during IQ Option stock trading prevents impulsive decisions that can quickly erode your capital. Stick to your trading strategies even when faced with minor setbacks.

Before you commit real funds to IQ Option stock trading, make extensive use of the demo account. It’s a risk-free environment where you can test different trading strategies, familiarize yourself with the platform, and build confidence. Consider it your personal training ground. The market is always evolving, so commit to continuous learning. Read financial news, follow market trends, and refine your approach constantly. This proactive attitude will significantly enhance your chances of long-term success in the dynamic world of stock trading.

Risk Management Techniques for Stock Positions

Navigating the stock market requires more than just picking winning companies; it demands a robust approach to managing potential losses. Effective risk management strategies are the bedrock of sustainable success in stock trading, ensuring you protect your hard-earned capital and stay in the game for the long haul. Without them, even a few bad trades can significantly erode your portfolio.

Essential Strategies for Protecting Your Capital

Let’s dive into some fundamental techniques every serious trader and investor should master:

- Stop-Loss Orders: This is perhaps the most fundamental tool for limiting downside. A stop-loss order tells your broker to sell a security when it reaches a certain price. It acts as an automatic safety net, preventing minor pullbacks from turning into catastrophic losses. You can set a fixed percentage below your entry price or use technical indicators to determine your stop level.

- Position Sizing: Never put all your eggs in one basket, and never bet too much on a single trade. Position sizing involves determining the appropriate number of shares to buy based on your overall portfolio size and your acceptable risk per trade. A common rule suggests risking no more than 1-2% of your total trading capital on any single position. This practice directly supports capital preservation, even if several trades go against you.

- Diversification: Spreading your investments across various sectors, industries, and asset classes helps mitigate specific company or industry-related risks. While not a guarantee against market downturns, diversification can smooth out your portfolio’s performance and reduce exposure to individual company woes. It’s a proactive way to manage `market risk`.

- Profit Taking: While not strictly a loss prevention technique, knowing when to take profits is crucial for locking in gains and reducing your exposure to potential reversals. Setting target prices alongside your stop-losses ensures you don’t let winning trades turn into losing ones. This strategy is vital for effective `volatility management` as market conditions can change rapidly.

Comparing Stop-Loss Approaches

Understanding different types of stop-loss orders can enhance your stock trading strategies:

| Technique | Description | Benefit |

|---|---|---|

| Fixed Stop-Loss | A predetermined price point below your entry where you exit the trade. | Provides clear exit strategy, limits maximum loss. |

| Trailing Stop-Loss | Adjusts the stop price as the stock’s price moves in your favor, maintaining a fixed distance. | Protects profits while allowing for further gains, adapts to upward momentum. |