Ever dreamed of tapping into the pulse of the global financial world? Imagine having the power to trade major currencies, explore company stocks, delve into cryptocurrencies, and much more, all from one intuitive platform. Welcome to IQ Option, a leading online trading broker designed to make financial markets accessible to everyone, from seasoned traders to absolute beginners.

IQ Option isn’t just another trading platform; it’s your personal portal to a universe of financial opportunities. We believe that understanding and participating in the global markets shouldn’t be complicated or exclusive. Our mission is to simplify the complex, offering a streamlined experience that empowers you to make informed decisions and act on them swiftly.

Here’s what makes IQ Option stand out as your ideal trading partner:

- Broad Asset Selection: Gain access to a wide array of financial instruments, including forex currency pairs, various company stocks, popular cryptocurrencies, and commodities. This diversity allows you to explore different strategies and diversify your portfolio.

- User-Friendly Interface: Our platform is engineered for simplicity and efficiency. Whether you’re on your desktop or mobile device, you’ll find navigation effortless and execution lightning-fast.

- Accessible Entry: Start your trading journey with a low minimum deposit, making online trading a real possibility without significant upfront investment. We’re all about making global markets accessible.

- Risk Management Tools: We provide tools designed to help you manage potential risks effectively, giving you greater control over your trading activities.

- Educational Resources: Sharpen your trading skills with our comprehensive educational materials, including tutorials, video lessons, and market analysis. Learning never stops, and neither do we in supporting your growth.

Joining IQ Option means stepping into a vibrant trading community ready to embrace the dynamic nature of financial assets. It’s an opportunity to engage with market trends, learn new strategies, and potentially grow your capital. Discover why millions globally choose IQ Option as their preferred platform for navigating the exciting world of online trading.

- Understanding the IQ Option Platform and Its Features

- What Makes IQ Option Stand Out?

- IQ Option’s Commitment to Traders

- Exploring Core IQ Option Trading Instruments

- Your Trading Toolkit on IQ Option:

- Forex Trading on IQ Option: Currency Exchange Simplified

- Why Trade Forex on IQ Option?

- Major, Minor, and Exotic Currency Pairs Available

- Understanding Spreads, Swaps, and Leverage in Forex

- Stock CFDs with IQ Option: Accessing Global Equities

- Trading Top Companies as Contract for Difference

- Dividends and Corporate Actions Affecting Stock CFDs

- Cryptocurrency CFDs: Trading Digital Assets on IQ Option

- Popular Cryptocurrencies and Their Volatility

- Understanding Crypto Trading Hours and Market Dynamics

- Commodity CFDs: Harnessing Natural Resources with IQ Option

- Popular Commodities to Consider with IQ Option:

- ETF Trading via IQ Option: Diversification Made Easy

- Index CFDs: Betting on Overall Market Performance

- Digital Options on IQ Option: A Unique Trading Opportunity

- What Makes Digital Options on IQ Option Stand Out?

- Binary Options on IQ Option (Where Available): High-Paced Trading

- What Makes Binary Options on IQ Option So Engaging?

- Maximizing Your Strategy with IQ Option Trading Instruments

- Essential Risk Management Techniques

- Utilizing Technical Analysis Tools and Indicators

- Key Technical Indicators Every Trader Should Know

- How to Effectively Apply Them

- Choosing the Right IQ Option Trading Instruments for Your Portfolio

- Understanding Your Options on IQ Option

- Factors Guiding Your Instrument Selection

- Comparing Popular IQ Option Instruments

- Conclusion: Diversifying Your Investment with IQ Option Trading Instruments

- Why Diversifying with IQ Option Makes Sense:

- Frequently Asked Questions

Understanding the IQ Option Platform and Its Features

Diving into the world of online trading requires a reliable and feature-rich platform, and IQ Option stands out as a strong contender. It’s a popular choice for traders globally, known for its innovative approach to financial markets. When you join IQ Option, you gain access to a dynamic environment designed to make trading accessible and potentially rewarding for everyone, from beginners to seasoned pros. The platform’s commitment to continuous improvement ensures a cutting-edge experience that keeps pace with market demands.

What Makes IQ Option Stand Out?

The IQ Option platform isn’t just another trading interface; it’s a comprehensive ecosystem built with the trader in mind. Its core strengths lie in its intuitive design and the breadth of tools it offers. Here’s a closer look at the features that define the IQ Option experience:

- Intuitive User-Friendly Interface: Navigating the IQ Option platform is remarkably straightforward. Its clean, modern design ensures you can quickly find what you need, place trades, and analyze market movements without feeling overwhelmed. This focus on usability makes it an excellent starting point for new traders looking to understand financial markets.

- Diverse Asset Selection: IQ Option offers a wide array of instruments to trade. You can explore various markets, including forex trading with major currency pairs, stock trading from leading companies, cryptocurrency trading with popular digital assets, and even commodities. This diversity allows you to diversify your portfolio and explore different trading strategies.

- Advanced Trading Tools and Indicators: Success in trading often hinges on smart analysis. IQ Option provides a robust suite of trading tools, including a variety of technical indicators like moving averages, Bollinger Bands, and MACD. Customizable charts with multiple timeframes empower you to conduct thorough market analysis and make informed decisions.

- Free Demo Account: Perhaps one of the most valuable features for anyone starting their trading journey is the demo account. This risk-free environment comes pre-loaded with virtual funds, allowing you to practice strategies, familiarize yourself with the platform, and build confidence without risking real capital. It’s an indispensable tool for learning and honing your skills.

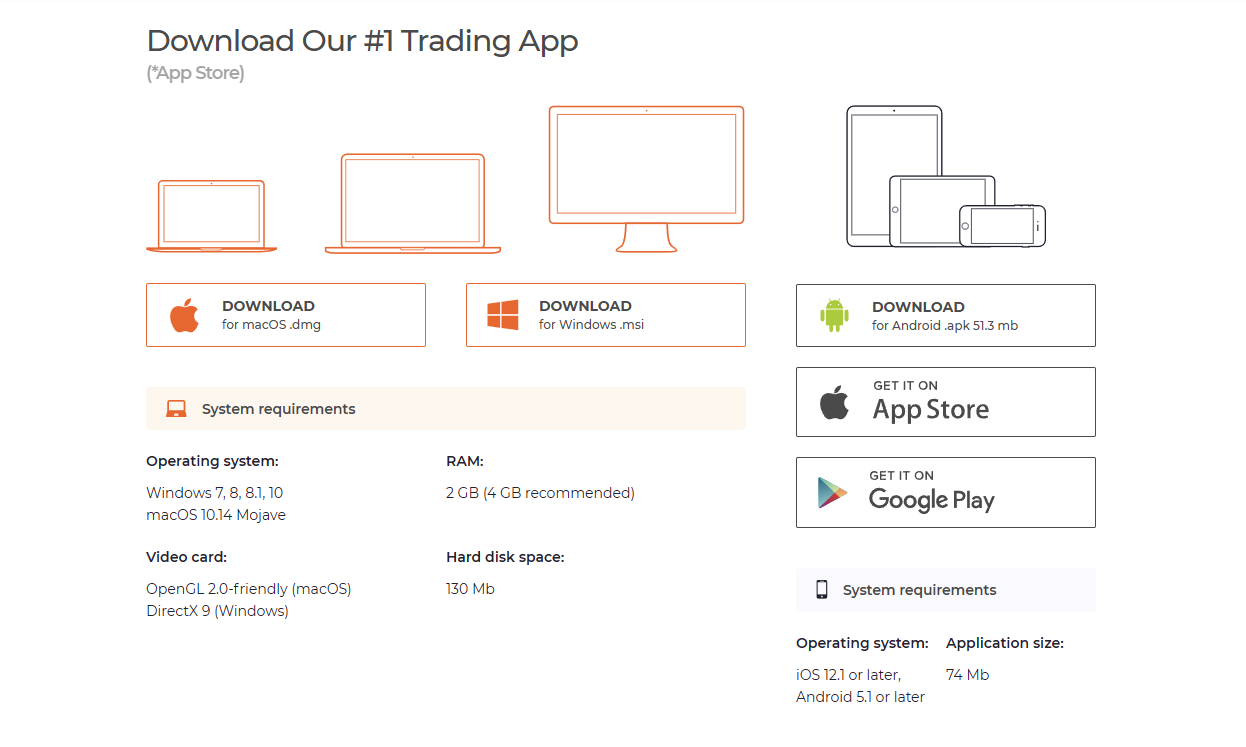

- Seamless Mobile Trading App: The world moves fast, and so do the markets. The IQ Option mobile app ensures you never miss an opportunity. Available on both iOS and Android, it offers full functionality, allowing you to monitor trades, analyze charts, and execute orders directly from your smartphone or tablet, anytime, anywhere.

IQ Option’s Commitment to Traders

IQ Option is constantly evolving, adding new features and improving existing ones to enhance the trading experience. They focus on providing a secure and transparent environment, giving you peace of mind as you pursue your financial goals. Their dedication to user education and accessible technology is a cornerstone of their appeal, making complex financial trading approachable for a broader audience.

In essence, the IQ Option platform brings sophisticated trading capabilities into a user-friendly package. Its array of assets, powerful analytical tools, and the vital demo account combine to create an inviting space for anyone eager to engage with the financial markets. It’s a platform built not just for trading, but for learning and growth.

Exploring Core IQ Option Trading Instruments

Ready to dive into the dynamic world of online trading? IQ Option opens up a universe of possibilities, offering a diverse array of trading instruments designed to suit various strategies and risk appetites. Understanding these core instruments is not just a recommendation; it’s your first crucial step towards making informed decisions and unlocking your trading potential. Let’s explore the exciting tools available on the platform, each presenting unique avenues for engaging with the global financial markets.

When you start your journey with IQ Option, you gain access to a powerful online trading platform that simplifies complex markets. From speculating on currency movements to capitalizing on stock trends, the choice is yours. Mastering these options is key to building a robust portfolio and navigating the thrilling landscape of financial trading.

Your Trading Toolkit on IQ Option:

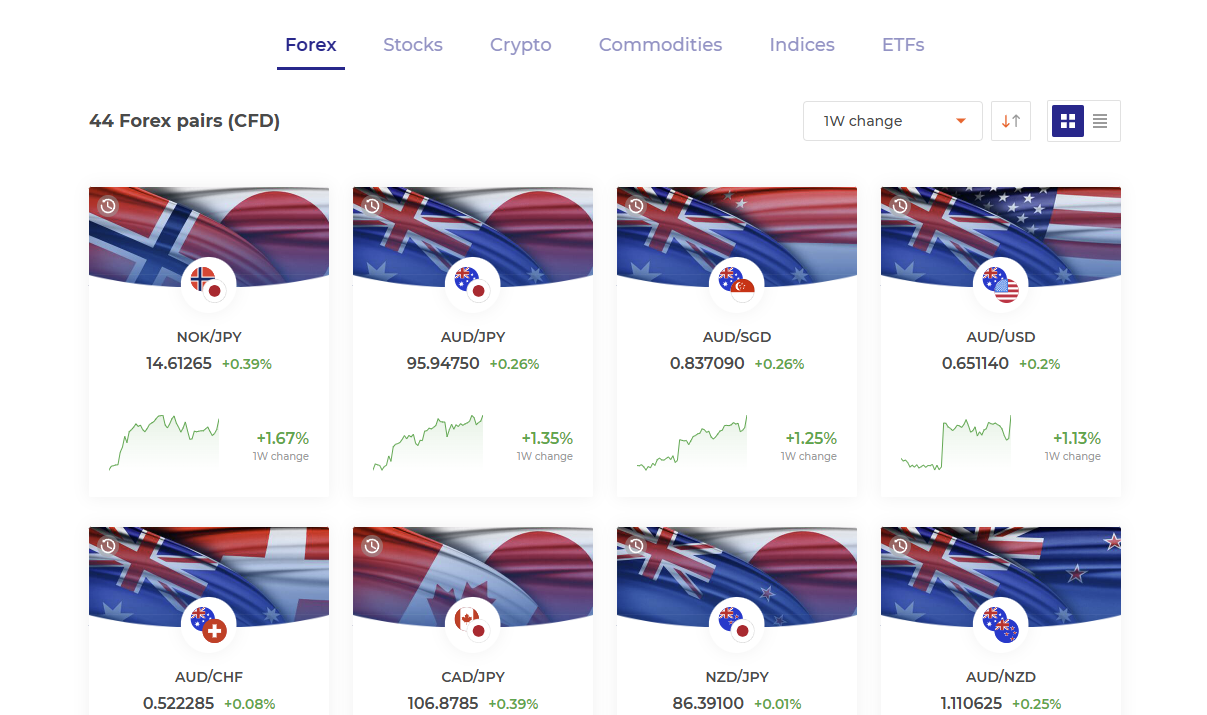

- Forex (Currency Pairs): Engage in the world’s largest financial market. Forex trading involves speculating on the exchange rate fluctuations between different currencies, such as EUR/USD or GBP/JPY. You predict whether one currency will strengthen or weaken against another. This market operates 24/5, offering constant opportunities for those who understand its rhythm.

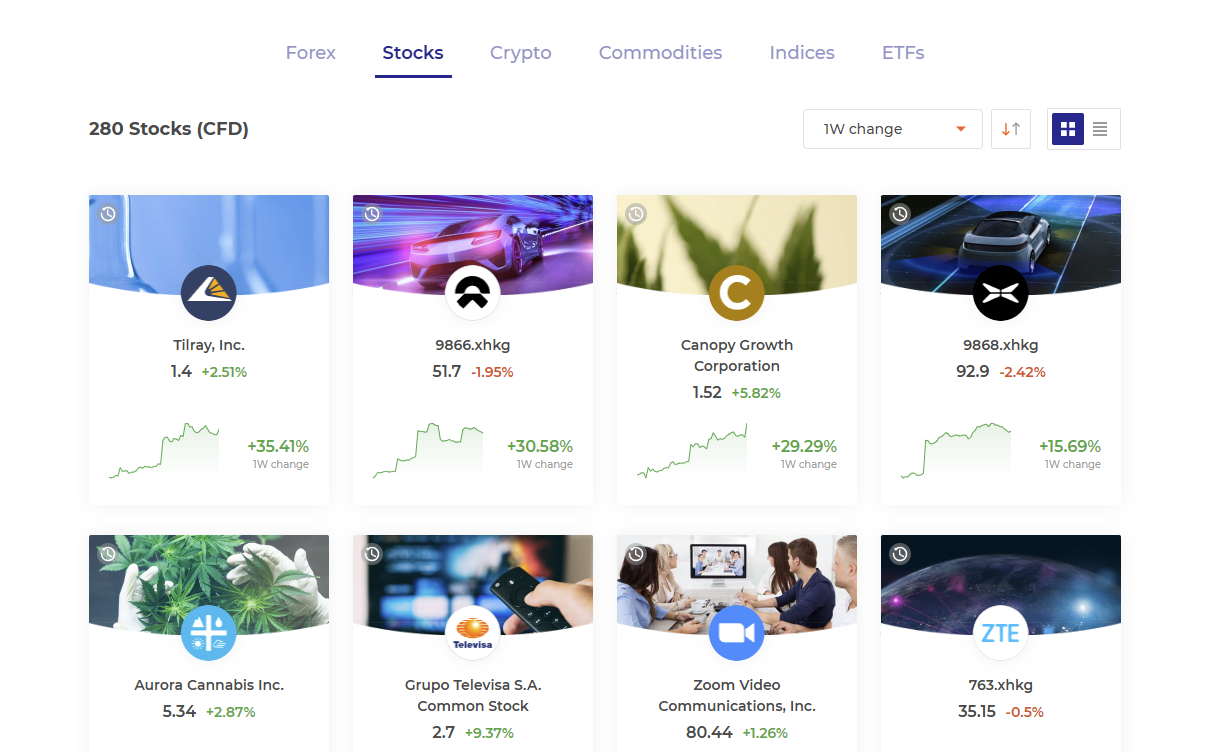

- CFDs on Stocks: Want to trade shares of global companies like Apple or Tesla without owning the actual stock? CFDs (Contracts for Difference) on stocks allow you to do just that. You profit from the price movements of a company’s shares. It’s an excellent way to participate in the equity market, whether you believe prices will rise or fall.

- CFDs on Commodities: From the glint of gold to the flow of crude oil, commodity CFDs connect you to the raw materials driving the global economy. These instruments let you trade on the price changes of various commodities, often influenced by supply and demand, geopolitical events, and economic data.

- CFDs on Cryptocurrencies: The digital revolution is here! Trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. These volatile assets offer exciting opportunities for those who can navigate their rapid price swings. It’s an electrifying market that never sleeps.

- Digital Options: Experience a unique way to trade with a clear risk-reward profile. With Digital Options, you predict whether the price of an asset will go up or down within a specific timeframe. If your prediction is correct, you earn a fixed percentage profit. This instrument provides transparency regarding potential gains and losses before you even place a trade.

- ETFs (Exchange Traded Funds): Looking for diversification? ETFs offer a way to invest in a basket of assets, like a collection of stocks from a specific industry or region, all within a single instrument. Trading ETFs allows you to spread your risk and gain exposure to broad market trends easily.

Each of these instruments on IQ Option comes with its own set of characteristics and potential. The platform provides intuitive tools, charts, and indicators to help you analyze market conditions for any chosen asset. Whether you prefer the fast pace of cryptocurrency CFDs or the steady flow of forex trading, you’ll find an instrument that aligns with your personal trading style.

“Successful trading isn’t about guessing; it’s about understanding your tools and the markets they interact with. IQ Option empowers you with both, wrapped in a user-friendly experience.”

Take the time to explore each category. Practice with a demo account to get a feel for how these trading instruments behave without risking real capital. The world of online trading is vast and rewarding for those who come prepared and continuously seek to expand their knowledge.

Forex Trading on IQ Option: Currency Exchange Simplified

Have you ever considered diving into the exciting world of currency exchange? With IQ Option, forex trading becomes accessible and straightforward for everyone, from seasoned investors to those just starting their financial journey. Forget the complex jargon and overwhelming charts; our platform is designed to demystify the global financial markets, allowing you to focus on strategic trading. We believe that understanding how to exchange currencies and potentially profit from market movements shouldn’t be a privilege, but a readily available opportunity.

IQ Option brings the dynamic forex market directly to your fingertips. You can trade a wide array of currency pairs, speculating on their price movements. This means you buy one currency while simultaneously selling another, aiming to profit from the fluctuating exchange rates. The beauty of it? You don’t need to own the actual currencies. You trade Contracts for Difference (CFDs), which track the underlying asset’s price. This approach offers flexibility and efficiency, making online trading a smooth experience.

Why Trade Forex on IQ Option?

- User-Friendly Interface: Our platform is intuitively designed, making it easy to navigate and execute trades. You won’t get lost in complicated menus.

- Diverse Currency Pairs: Access major, minor, and exotic currency pairs. This variety gives you more opportunities to explore and find promising trades.

- Powerful Trading Tools: Utilize a suite of technical indicators and analytical tools right on your chart. These features help you make informed decisions based on real-time data.

- Risk Management Features: We provide tools like stop-loss and take-profit orders to help you manage your potential risks and secure your gains.

- Educational Resources: Learn more about forex and market analysis through our extensive library of tutorials and guides. We empower you with knowledge.

- Low Minimum Deposit: Start trading with a very accessible minimum deposit, lowering the barrier to entry for aspiring traders.

Imagine the euro strengthening against the US dollar, or the British pound experiencing a dip. With IQ Option, you can react to these market shifts quickly. Our platform provides real-time data, ensuring you stay updated on global events that influence currency values. We simplify the process of entering and exiting trades, allowing you to focus on your strategy and market analysis. Join thousands of traders who are already experiencing the convenience and potential of forex trading on IQ Option. It’s time to explore currency exchange in a truly simplified way.

Major, Minor, and Exotic Currency Pairs Available

Diving into the world of foreign exchange means understanding the different types of currency pairs you can trade. These classifications aren’t just arbitrary; they reflect liquidity, volatility, and the potential for profit or risk. Knowing the distinction helps you make informed trading decisions, aligning your strategy with the characteristics of each pair.

Here’s a breakdown of the currency pairs you’ll encounter in the forex market:

- Major Currency Pairs: These are the titans of the forex world. They involve the US Dollar (USD) paired with other highly liquid currencies from developed economies.

- Minor Currency Pairs (Cross Pairs): These pairs do not include the US Dollar. They feature two non-USD major currencies trading against each other.

- Exotic Currency Pairs: These pairings include a major currency against a currency from a smaller or emerging economy. They offer unique opportunities but come with distinct challenges.

Understanding the Differences:

| Pair Type | Characteristics | Examples |

|---|---|---|

| Major Pairs | Highest liquidity, tightest spreads, generally lower volatility compared to others. Extremely popular due to their stability and trading volume. | EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD, USD/CAD, NZD/USD |

| Minor Pairs (Crosses) | Good liquidity, but less than majors. Spreads are wider, and they can show higher volatility. They reflect economic dynamics between two non-USD economies. | EUR/GBP, EUR/JPY, GBP/JPY, AUD/NZD, CAD/JPY, CHF/JPY |

| Exotic Pairs | Lower liquidity, widest spreads, and often high volatility. They are sensitive to geopolitical events and specific economic data from the emerging market. Trading these can be more challenging. | USD/MXN, EUR/TRY, GBP/ZAR, USD/SGD, USD/THB |

When you choose a currency pair to trade, consider your risk tolerance, trading style, and market knowledge. Majors offer a smoother ride for beginners, while minors and exotics might appeal to experienced traders seeking higher potential returns and comfortable with greater risk. Each category provides a unique window into global economics and offers distinct opportunities for those ready to explore them.

Understanding Spreads, Swaps, and Leverage in Forex

Diving into the world of forex trading means getting to grips with a few fundamental concepts that directly impact your profitability and risk. Spreads, swaps, and leverage are not just technical terms; they are the gears that drive the currency market and understanding them gives you a powerful edge. Let’s break down these essential elements so you can navigate your trades with confidence and precision.

The Cost of Trading: Spreads

Think of the spread as the primary cost of placing a trade. When you look at any currency pair, you will always see two prices: a ‘bid’ price and an ‘ask’ price. The bid price is what you can sell the base currency for, while the ask price is what you pay to buy it. The difference between these two prices is the spread, typically measured in pips. This small difference is essentially the broker’s commission for facilitating your trade.

- Bid Price: The price at which buyers are willing to purchase a currency pair.

- Ask Price: The price at which sellers are willing to sell a currency pair.

- Spread: The gap between the bid and ask price. A tighter spread usually means better trading conditions and lower transaction costs for you.

Market conditions greatly influence spreads. During highly volatile times or when major economic news hits, spreads can widen significantly. For active traders, especially scalpers, even a small change in spread can impact strategy, making it vital to choose a broker known for competitive spreads.

Overnight Holdings: Swaps

Swaps, also known as rollover interest, come into play when you hold a trade open past the daily market close (typically 5 PM EST). When you trade forex, you are effectively borrowing one currency to buy another. Interest rates vary between different currencies, and this difference results in either a credit or a debit to your trading account for holding that position overnight.

Here’s how swaps work:

| Scenario | Effect | Description |

|---|---|---|

| Positive Swap | You earn interest | The interest rate of the currency you buy is higher than the interest rate of the currency you sell. |

| Negative Swap | You pay interest | The interest rate of the currency you buy is lower than the interest rate of the currency you sell. |

For short-term traders, swaps might be negligible. However, if you plan to hold positions for days or weeks, understanding and factoring in swap costs (or benefits!) becomes an essential part of your trade management and overall profitability.

Amplifying Power: Leverage

Leverage is a powerful tool in forex that allows you to control a large position in the market with a relatively small amount of capital. It’s essentially a loan provided by your broker. For example, with 1:100 leverage, you can control $100,000 worth of currency with just $1,000 of your own money (your margin).

The allure of leverage is clear: it significantly amplifies your potential profits from small price movements. A trade that might yield a few dollars with no leverage could turn into hundreds with a high leverage ratio. However, this amplification works both ways:

“Leverage is a double-edged sword. It can multiply your gains, but it can also magnify your losses just as quickly. Always approach it with a clear understanding of the risks involved.”

Leverage is a double-edged sword. It can multiply your gains, but it can also magnify your losses just as quickly. Always approach it with a clear understanding of the risks involved.

While attractive, high leverage also dramatically increases your risk. A small adverse price movement can quickly deplete your initial margin, leading to a margin call or even the automatic closure of your position. Effective risk management, including proper position sizing and stop-loss orders, is paramount when using leverage in forex trading. Never trade with more leverage than you can comfortably manage.

Stock CFDs with IQ Option: Accessing Global Equities

Unlock the dynamic world of financial markets right at your fingertips with stock CFDs on IQ Option. This powerful trading instrument allows you to speculate on the price movements of company shares without actually owning the underlying asset. Imagine the thrill of engaging with top-tier companies, both rising and falling, and potentially capitalizing on their performance.

IQ Option brings the sprawling landscape of global equities directly to your screen. You gain access to a diverse range of companies from major exchanges worldwide, from the tech giants in the US to robust European industrials and emerging Asian innovators. This broad selection empowers you to truly diversify your portfolio and seize opportunities across different sectors and economies, all from a single, intuitive platform.

Why consider trading stock CFDs with IQ Option?

- Leverage Opportunities: Magnify your potential exposure to market movements with less initial capital. Understand leverage, as it amplifies both gains and losses.

- Short-Selling Potential: Profit not only when share prices rise but also when they fall. This flexibility allows you to adapt to various market conditions.

- No Physical Ownership: Bypass the complexities and costs associated with traditional stock ownership, such as stamp duty or physical delivery. You simply speculate on price direction.

- Instant Market Access: Open and close positions rapidly, reacting swiftly to breaking news and market shifts.

- Diverse Selection: Explore a vast catalog of companies, giving you the freedom to choose based on your research and market outlook.

Embark on your journey into the exciting realm of stock CFDs and discover how IQ Option can be your gateway to engaging with the pulse of the world’s most influential businesses. It’s an accessible way to participate in the global economy.

Trading Top Companies as Contract for Difference

Ever thought about engaging with the giants of industry without actually owning their stock? Trading top companies as Contract for Difference (CFD) offers you exactly that opportunity. Imagine having a position on tech titans, consumer staples, or automotive leaders, all through a single, versatile financial instrument. This method allows you to speculate on the price movements of these global brands, whether their value is climbing or dipping.

One of the compelling aspects of CFD trading on these prominent firms is the accessibility it provides. You can gain exposure to diverse sectors and well-established names, often with the added benefit of leverage, which amplifies your potential market interaction. It’s an exciting way to participate in the financial markets, allowing you to react to news, earnings reports, and economic trends that influence the world’s most recognized corporations. This isn’t about long-term investment; it’s about navigating short-to-medium term market dynamics and aiming to capitalize on price shifts in companies you know and follow.

Dividends and Corporate Actions Affecting Stock CFDs

When you trade

stock CFDs

, you’re essentially betting on the price movement of an underlying share without actually owning it. However, this doesn’t mean you’re immune to the real-world events that impact those shares. Quite the opposite! Dividends and a range of

corporate actions

directly influence your CFD positions.

Understanding how these events are handled is crucial for every forex expert and CFD trader. Let’s break it down:

Dividend Payments: The Cash Adjustment

When a company declares a dividend, it’s a direct payment to shareholders. With

stock CFDs

, this is replicated through a cash adjustment:

- If you hold a “long” (buy) CFD position, you will typically receive a cash credit equivalent to the net dividend on the ex-dividend date. This means you get the economic benefit as if you owned the share.

- Conversely, if you hold a “short” (sell) CFD position, you will incur a debit equivalent to the net dividend. Essentially, you pay out what the real shareholder would receive.

This adjustment ensures that the CFD accurately reflects the underlying stock’s value change after the

dividend payments

, maintaining a fair market representation.

Navigating Corporate Actions: Beyond Dividends

Corporate actions are events initiated by a company that affect its securities. These can significantly alter the value and structure of your

stock CFDs

. Here are some common ones:

- Share Splits and Reverse Splits: A standard

share split

increases the number of shares while decreasing their price proportionally, making them more accessible. A reverse split does the opposite. Your CFD contract will be adjusted automatically to reflect the new number of shares and price, ensuring your overall position value remains the same.

- Mergers and Acquisitions (M&A): When two companies combine or one takes over another, your CFD position might be closed out at the prevailing market price, or in some cases, converted into CFDs for the new entity, depending on the broker’s policy and the nature of the deal. These events can create considerable market volatility.

- Rights Issues and Bonus Issues: Companies sometimes issue new shares to existing shareholders. Brokers typically adjust CFD positions to reflect the change in the underlying share’s value due to these issues, preventing any unfair advantage or disadvantage to CFD holders.

Staying informed about these events is a critical part of

risk management

and making sound

trading decisions

. They directly impact your

profit potential

and can require you to adjust your

trading strategy

accordingly. Always check your broker’s specific policy on how they handle dividends and various corporate actions to avoid surprises.

Cryptocurrency CFDs: Trading Digital Assets on IQ Option

The world of digital assets is dynamic, offering exciting opportunities for traders who understand market movements. With Cryptocurrency CFDs (Contracts for Difference) on platforms like IQ Option, you can engage with this thrilling market without actually owning the underlying cryptocurrencies. Imagine speculating on the price shifts of Bitcoin, Ethereum, or other popular digital currencies, aiming to profit from both rising and falling markets. It’s an accessible way to participate in the crypto phenomenon, leveraging your insights into market trends.

Trading crypto CFDs on IQ Option brings several distinct advantages, especially for those familiar with traditional financial markets and the fast pace of forex trading. It’s a way to diversify your trading portfolio and explore new frontiers.

- Accessibility: Gain exposure to the cryptocurrency market with a relatively small initial capital, thanks to leverage.

- Flexibility: Trade on both upward (long) and downward (short) price movements. This means you can potentially profit regardless of the market’s direction, a key feature that distinguishes CFDs.

- No Wallet Needed: You don’t need to set up a digital wallet or worry about the security of holding actual cryptocurrencies. You are simply trading on their price fluctuations.

- Leverage Opportunities: Enhance your potential returns by trading with leverage, which allows you to control a larger position with a smaller amount of capital. However, remember that leverage can also amplify losses.

- User-Friendly Platform: IQ Option provides an intuitive interface, making it easier for both new and experienced traders to analyze charts, place orders, and manage their positions effectively.

Engaging with digital assets through CFDs requires a keen eye for market analysis and a solid understanding of risk management. The cryptocurrency market is known for its volatility, presenting both significant potential and inherent risks. As a seasoned forex expert, I can tell you that the principles of technical analysis and market sentiment remain crucial here. Focus on understanding the factors that drive price changes, from global news to technological advancements in the blockchain space. IQ Option empowers you to test your strategies and predictions in real-time, making it an engaging choice for those ready to navigate the future of finance.

Popular Cryptocurrencies and Their Volatility

The world of cryptocurrencies is incredibly dynamic, with digital currencies offering unique characteristics compared to traditional assets. One of their most talked-about features is their inherent price volatility. This means prices can change dramatically and quickly, creating both significant opportunities and considerable risks for traders and investors alike. Understanding these market movements is crucial for anyone looking to engage with the cryptocurrency market.

Here are some of the leading digital assets that often exhibit notable price swings:

- Bitcoin (BTC): As the original and largest cryptocurrency, Bitcoin often sets the tone for the entire market. Its price movements are closely watched and can influence other digital currencies.

- Ethereum (ETH): Powering the vast ecosystem of decentralized applications, Ethereum is another giant. Its technological advancements and adoption drive much of its value and, subsequently, its price fluctuations.

- Ripple (XRP): Known for its focus on enterprise solutions and cross-border payments, XRP has a unique market position. News related to partnerships and regulatory clarity can significantly impact its price.

- Solana (SOL): A relatively newer player, Solana has gained traction for its high transaction speeds and scalability. Its rapid growth has also come with periods of intense volatility.

- Cardano (ADA): Built on a research-driven philosophy, Cardano aims for security and sustainability. Its development milestones and project updates are key drivers of its market activity.

This characteristic volatility stems from several factors, including the nascent stage of the technology, speculative trading, evolving regulatory landscapes, and rapid shifts in market sentiment. Unlike traditional markets, the blockchain assets space can react more intensely to news and global events, leading to sharper upward and downward trends. For an experienced trader, this dynamic environment provides abundant trading opportunities, but it also underscores the critical need for sound risk management strategies when exploring the immense investment potential these digital currencies offer.

Understanding Crypto Trading Hours and Market Dynamics

Unlike traditional stock markets that operate within specific opening and closing hours, the world of cryptocurrency never sleeps. This fundamental difference shapes the entire trading experience, offering both unique opportunities and challenges for anyone looking to engage with digital assets. When you trade crypto, you are participating in a truly global, 24/7 market that constantly reacts to events unfolding across different time zones.

The continuous nature of crypto trading means that market dynamics can shift rapidly at any moment. There are no “after-hours” sessions; every second is an active trading second. This constant activity contributes significantly to the market’s well-known volatility.

The continuous nature of crypto trading means that market dynamics can shift rapidly at any moment. There are no “after-hours” sessions; every second is an active trading second. This constant activity contributes significantly to the market’s well-known volatility. Prices can move dramatically during what would typically be considered off-hours for traditional markets, driven by news, technological developments, or even shifts in sentiment from a community half a world away.

Several factors play a crucial role in these dynamic movements:

- Global Liquidity: With participants from every continent, liquidity pools are constantly shifting, influencing price stability and execution.

- News and Events: Major announcements, regulatory changes, or even tweets from influential figures can trigger immediate price reactions, regardless of the clock.

- Technological Developments: Updates to blockchain protocols, new project launches, or security breaches can significantly impact market confidence and valuations.

- Market Sentiment: The collective mood of traders, often driven by fear, greed, or general optimism, is a powerful force that can create momentum swings.

- Macroeconomic Factors: While crypto aims for decentralization, it’s not entirely immune to broader economic trends, interest rate changes, or geopolitical events that might push investors towards or away from risk assets.

Embracing this always-on environment means you must adapt your trading strategy. You can’t rely on market close to pause and regroup; instead, constant vigilance and an understanding of global market influences become paramount. This continuous cycle means opportunities arise frequently, but so do risks, making a well-informed approach essential for navigating the exciting, dynamic crypto landscape.

Commodity CFDs: Harnessing Natural Resources with IQ Option

Ever considered tapping into the raw power of the global economy? Commodity CFDs offer a fascinating avenue to do just that. These contracts for difference allow you to speculate on the price movements of underlying natural resources without ever needing to own the physical asset. Think about the bustling energy markets or the enduring allure of precious metals – these are the arenas you can enter with confidence and strategic insight. IQ Option provides a robust and user-friendly online trading platform, making it accessible for traders keen to explore the dynamic world of commodity trading.

When you engage in commodity CFDs, you’re not buying barrels of oil or kilos of gold. Instead, you’re trading on their price fluctuations. This approach offers incredible flexibility and allows you to potentially profit from both rising and falling markets. Our experienced traders often look to natural resources trading as a way to diversify their portfolios and hedge against inflation, making it a compelling option for a well-rounded trading strategy.

Popular Commodities to Consider with IQ Option:

- Crude Oil: A cornerstone of the global economy, oil trading is driven by geopolitical events, supply and demand dynamics, and industrial output. Volatility here can create significant opportunities.

- Gold: Often seen as a safe-haven asset, gold trading attracts investors during periods of economic uncertainty. Its value tends to rise when other markets falter.

- Silver: With both industrial and monetary uses, silver trading offers a unique blend of stability and growth potential, often correlating with gold but with its own distinct movements.

- Natural Gas: Influenced by weather patterns and energy demand, natural gas markets can be highly reactive, presenting distinct chances for those who follow market trends closely.

Trading commodity CFDs with IQ Option means you gain access to these powerful markets with relative ease. The platform offers intuitive tools and real-time data, enabling you to make informed decisions. Whether you’re interested in the speculative thrill of oil trading or the long-term stability often associated with gold, our platform empowers you to harness the potential of natural resources. Join us and discover how you can position yourself within these foundational sectors of the global economy.

ETF Trading via IQ Option: Diversification Made Easy

Exchange Traded Funds, or ETFs, offer a fantastic way to spread your investments across various assets with just one trade. Think of an ETF as a basket holding multiple stocks, bonds, or commodities. Instead of picking individual companies, you can invest in an entire sector, a specific country’s economy, or even a broad market index. This strategy significantly simplifies building a robust investment portfolio without the need for extensive research into countless individual securities.

IQ Option makes accessing the world of ETF trading incredibly straightforward for both new and experienced traders. Their platform provides a user-friendly interface where you can explore a wide range of popular ETFs covering different market sectors and asset classes. With IQ Option, you gain the ability to diversify your holdings with ease, opening up opportunities that might otherwise seem complex or out of reach. It’s about empowering you to make smart investment choices efficiently.

The core benefit of incorporating ETFs into your trading strategy, especially through a platform like IQ Option, is profound diversification. By investing in an ETF, you automatically reduce the specific risk associated with any single company or asset. If one component of the ETF performs poorly, the impact on your overall investment is softened by the performance of the other assets within the fund. This built-in risk management is invaluable for anyone looking to protect their capital while still aiming for growth.

Here’s how ETFs on IQ Option enhance your diversification efforts:

- Broad Market Exposure: Access entire indices or sectors like technology, healthcare, or emerging markets with a single investment.

- Cost-Effectiveness: Often, ETFs come with lower expense ratios compared to actively managed mutual funds, making them an attractive option for long-term growth.

- Liquidity: Trade ETFs throughout the day just like stocks, giving you flexibility to enter or exit positions when you choose.

- Reduced Volatility: The inherent diversification within an ETF can help smooth out the ups and downs of your portfolio during market fluctuations.

Embrace the power of ETFs with IQ Option and take a significant step towards building a more balanced and resilient investment portfolio. It’s a smart move for anyone serious about managing risk and capturing opportunities across diverse markets.

Index CFDs: Betting on Overall Market Performance

Ever wanted to trade an entire stock market without buying individual shares? That’s precisely what index CFDs offer. These powerful financial instruments allow you to speculate on the price movements of a broad market index, like the S&P 500, NASDAQ 100, or FTSE 100. Instead of focusing on single company performance, you place a bet on the collective health and direction of a specific economy or sector, making them a fascinating tool for any serious forex trading enthusiast.

With index CFDs, you don’t actually own the underlying assets. Instead, you enter into a contract with a broker to exchange the difference in the price of an index from the time you open the trade to the time you close it. This means you can profit whether the market performance rises or falls – a significant advantage over traditional stock investing. If you believe a global index is poised for growth, you ‘go long’. If you anticipate a decline, you ‘go short’. It’s that simple.

Consider the compelling reasons traders turn to index CFDs:

- Broad Market Exposure: Gain exposure to an entire economy or industry sector through one single position, rather than having to research and buy multiple individual stocks.

- Diversification: Index CFDs offer instant diversification for your portfolio. Trading a basket of top companies within an index can potentially reduce the impact of poor performance from any single company.

- Leverage Opportunities: Many brokers offer leverage on index CFDs, meaning you can control a large position with a relatively small amount of capital. Remember, while leverage amplifies potential profits, it also magnifies potential losses.

- Flexibility in Trading Strategies: You can apply various trading strategies, including day trading, swing trading, or even longer-term positions based on macroeconomic trends.

- Access to Global Markets: Easily trade on major global indices from around the world, opening up opportunities no matter where you are.

Mastering index CFDs requires a solid understanding of market dynamics and effective risk management. They are dynamic instruments that respond to a wide array of economic data, geopolitical events, and corporate news. By focusing on overall market performance rather than individual stock picks, you adopt a different perspective on the financial world, which can be incredibly rewarding. Ready to explore how you can capture the pulse of entire economies?

Digital Options on IQ Option: A Unique Trading Opportunity

Ever wondered if there’s a trading instrument that blends the predictability of fixed-time trades with the dynamic excitement of traditional options? Look no further than digital options on IQ Option. This innovative offering presents a distinctive avenue for traders looking to capitalize on price movements across a wide array of financial markets, all within a user-friendly and sophisticated platform.

At its core, a digital option requires you to predict whether the price of an asset will be above or below a chosen ‘strike price’ by a specific expiration time. What makes them unique is the flexibility they offer. You define both the strike price and the expiration, giving you remarkable control over your potential reward and risk. This isn’t just another way to trade; it’s a strategic approach to market engagement.

Many traders are drawn to digital options due to their transparent payout structure and defined risk. Before you even place a trade, you know exactly how much you stand to gain if your prediction is correct, and how much you might lose if it isn’t. This clarity is a significant advantage, allowing for more disciplined risk management and a clearer understanding of your trading strategy. It’s an evolution in how traders interact with short-term market dynamics.

What Makes Digital Options on IQ Option Stand Out?

IQ Option has engineered its digital options product with the trader in mind, providing a robust environment for engaging with the financial markets. Here are some key aspects that highlight this unique trading opportunity:

- Flexible Strike Prices: Unlike some other instruments, you can select from a range of strike prices, giving you more granular control over your risk-reward profile for each trade.

- Defined Expiry Times: Choose specific timeframes for your trades, from minutes to hours, allowing you to align with various market conditions and personal trading styles.

- Clear Payouts: Before opening a position, you see the exact potential profit percentage, making it easy to calculate your expected returns.

- Diverse Assets: Access a broad spectrum of assets including forex pairs, commodities, indices, and cryptocurrencies, expanding your trading horizons.

- Intuitive Platform: IQ Option’s award-winning platform makes navigating and executing digital options trades straightforward, even for those new to the concept.

The ability to tailor your trade parameters means you can adapt your strategy to various market conditions, whether you anticipate a strong trend or a period of consolidation. This adaptability is what truly elevates digital options as a compelling choice for online trading. It’s about empowering you to make informed decisions and act swiftly on market insights.

Embracing digital options on IQ Option opens up a world of possibilities for those ready to explore a dynamic and controlled approach to the financial markets. It’s an invitation to refine your analytical skills and potentially unlock new levels of trading success.

Binary Options on IQ Option (Where Available): High-Paced Trading

Step into the exhilarating world of binary options trading on IQ Option, where the markets move at an electrifying pace. This unique financial instrument, available in many regions, captures the attention of traders seeking dynamic opportunities and swift outcomes. For those ready to make quick decisions and navigate a fast-moving landscape, binary options offer a distinct approach to the financial markets.

At its core, binary options trading on IQ Option is about predicting the direction of an asset’s price movement within a set timeframe. Will the price of a currency pair, stock, or commodity go up or down by the expiry time? Your task is to make that call. If your prediction is correct, you receive a predetermined payout. If it’s incorrect, you lose your initial investment. It’s a straightforward, yes-or-no proposition that makes the action clear and immediate.

What Makes Binary Options on IQ Option So Engaging?

The draw of this high-paced trading style comes from several key characteristics:

- Fixed Returns: Before you even place a trade, you know exactly how much you stand to gain if your prediction is right. This transparency helps in planning your potential profits.

- Defined Risk: Similarly, your maximum loss is always limited to the amount you invested in that specific trade. This helps in understanding your exposure and practicing effective risk management.

- Short-Term Contracts: Trades can last from as little as 30 seconds to several minutes, offering countless opportunities throughout the trading day. This suits traders who enjoy constant engagement and rapid results.

- Simplicity: The fundamental ‘up or down’ prediction simplifies the entry barrier, making IQ Option trading accessible to a wide range of individuals interested in financial markets.

- Accessible Platform: IQ Option provides an intuitive and user-friendly platform, making it easy to analyze charts, place trades, and monitor your positions efficiently.

While the allure of quick returns and straightforward mechanics is strong, successful engagement with binary options demands discipline and strategic thinking. It’s not just about speed; it’s about making informed choices. Effective market analysis and understanding underlying trends are crucial. Developing a robust trading strategy, practicing proper risk management, and maintaining emotional control are vital components for anyone looking to thrive in this exciting trading environment.

Many traders are drawn to the immediacy and the potential for rapid gains. However, embracing this style means understanding its inherent challenges. The short timeframes require traders to be agile, making quick decisions based on real-time data and technical indicators. It’s a field where continuous learning and adaptation are your best allies, transforming the fast-paced nature into an opportunity for growth and excitement.

Maximizing Your Strategy with IQ Option Trading Instruments

Unlock the full potential of your trading journey by strategically leveraging the diverse range of IQ Option trading instruments. The platform offers more than just a gateway to the markets; it provides a comprehensive toolkit designed to empower traders, regardless of their experience level. Understanding how each instrument fits into your overall approach is key to refining your methods, managing risk effectively, and ultimately enhancing your profit potential.

When you step onto the IQ Option platform, you gain access to a powerful arsenal of assets. This variety allows for incredible flexibility in developing and executing a robust trading strategy. No two market conditions are alike, and having a diverse selection means you can adapt, seize opportunities, and navigate challenges with greater confidence.

Your Trading Arsenal: A Closer Look

IQ Option brings a world of markets to your fingertips, catering to various trading preferences:

- Forex (Foreign Exchange): Dive into the largest financial market globally with forex trading. Speculate on currency pairs like EUR/USD or GBP/JPY, capitalizing on exchange rate fluctuations. Forex offers high liquidity and round-the-clock trading, perfect for various short-term and long-term strategies.

- CFDs (Contracts for Difference): Explore a broad spectrum of assets through CFDs, which allow you to speculate on price movements without owning the underlying asset. This includes:

- Stock Trading: Access shares of leading global companies. Predict if giants like Apple or Google will rise or fall based on company news or broader market sentiment.

- Commodities: Trade precious metals like gold, energy sources like oil, or agricultural products. These often react to global economic events and supply-demand shifts, offering unique trading opportunities.

- Indices: Bet on the performance of entire market sectors or economies, such as the S&P 500 or the DAX. This allows for broader market exposure.

- Cryptocurrency: Engage in cryptocurrency trading, speculating on popular digital assets like Bitcoin and Ethereum against fiat currencies. The volatility here can present significant profit potential.

- Options Trading: Engage with digital or binary options, where you predict whether an asset’s price will go up or down within a specific timeframe. These instruments offer defined risk and reward, appealing to traders looking for high potential returns over short periods.

Matching Instruments to Your Strategy for Maximum Impact

The true power comes from aligning the right instrument with your specific goals and market outlook. For instance, a day trader might lean into the volatility of forex trading or short-term options trading, seeking quick gains from rapid price shifts. Conversely, a swing trader might use stock trading CFDs to capture larger movements over several days or weeks, while a long-term investor could focus on indices or stable commodities, valuing sustained growth over immediate returns.

Consider the benefits of diversification. Instead of putting all your eggs in one basket, spreading your capital across different asset classes can mitigate risks. If one market segment experiences a downturn, gains in another might help balance your portfolio. This strategic approach to choosing multiple IQ Option trading instruments is a cornerstone of robust risk management, ensuring your trading strategy remains adaptable and resilient.

“The intelligent trader doesn’t just trade; they understand the tools at their disposal and how to wield them for optimal effect.” – A timeless trading principle.

Practical Tips for Optimizing Your Trading with IQ Option

To truly maximize your strategy and take full advantage of the IQ Option platform, here are actionable steps:

- Conduct Thorough Market Analysis: Before placing any trade, perform due diligence. Use market analysis tools provided by IQ Option to understand trends, support, and resistance levels across different instruments. Identify key indicators that signal potential movements.

- Start Small and Learn: Utilize IQ Option’s demo account to practice with various instruments without real financial risk. Experiment with different strategies to see what works best for you and gain confidence before trading with real capital.

- Understand Leverage and Margin: Especially with CFDs, understand how leverage amplifies both potential gains and losses. Manage your margin carefully to avoid unnecessary risks and protect your capital.

- Develop a Trading Plan: Define your entry and exit points, stop-loss levels, and take-profit targets for each instrument you trade. A well-defined trading plan is your roadmap to disciplined and consistent trading.

- Stay Informed: Global news and economic events significantly impact markets. Keep abreast of current affairs that could influence your chosen assets, as market sentiment often drives price action.

By thoughtfully integrating a variety of IQ Option trading instruments into your approach, you move beyond mere speculation. You build a dynamic, resilient trading strategy capable of adapting to market changes and consistently aiming for your financial objectives. The tools are there; it’s up to you to master them and redefine your trading success.

Essential Risk Management Techniques

As a forex trader, protecting your capital is paramount. Ignoring risk management is like driving a car without brakes – sooner or later, you face a major crash. Successful traders understand that consistently managing trading risk defines their longevity and profitability. These essential techniques help you navigate the volatile forex markets with greater confidence and control.

Key Strategies for Managing Forex Trading Risk:

- Implementing Stop-Loss Orders: This is your primary defense. A stop-loss order automatically closes your trade when the market moves against you to a specified price. It caps your potential loss on any single trade, preventing a small dip from becoming a devastating account drawdown. Always place a stop-loss before entering a trade.

- Utilizing Take-Profit Orders: Just as crucial as limiting losses is securing your gains. A take-profit order automatically closes your trade when it reaches a predetermined profit level. It helps you lock in profits and avoids the emotional trap of hoping for more, only to see the market reverse.

- Mastering Position Sizing: This technique involves calculating the appropriate size of your trade based on your account balance and your acceptable risk per trade. For example, many traders risk no more than 1-2% of their total capital on any single trade. Proper position sizing ensures that no single loss, even with a stop-loss, significantly damages your overall equity.

- Defining Your Risk-Reward Ratio: Before every trade, evaluate how much you stand to lose versus how much you aim to gain. A common rule is to seek trades with at least a 1:2 risk-reward ratio, meaning you aim to gain twice as much as you risk. This principle allows you to be profitable even if you only win 50% of your trades.

Understanding Core Risk Management Tools

| Technique | What It Does For You | Why It Matters |

|---|---|---|

| Stop-Loss Orders | Automatically exits a losing trade at a set price. | Limits your maximum loss on a trade, protecting capital. |

| Take-Profit Orders | Automatically exits a winning trade at a set price. | Secures your gains and prevents emotional overtrading. |

| Position Sizing | Determines the optimal trade volume based on risk. | Ensures no single loss wipes out a significant portion of your account. |

| Risk-Reward Ratio | Compares potential profit to potential loss. | Helps you choose high-probability trades and maintain long-term profitability. |

Beyond these technical tools, cultivating strong trading discipline and maintaining a detailed trading journal are also vital. A journal helps you analyze past trades, identify patterns, and continuously refine your approach. Remember, the goal of forex trading is not just to make money, but to keep it and grow it consistently over time. Embrace these techniques, and you build a robust foundation for your trading journey.

Utilizing Technical Analysis Tools and Indicators

Diving into the world of forex trading means understanding the language of charts, and that’s where technical analysis shines. It’s not about crystal balls; it’s about interpreting historical price data to predict future movements. Think of technical analysis tools and indicators as your compass and map in the vast ocean of currency pairs. They help you identify potential entry and exit points, understand market sentiment, and make informed trading decisions.

Successful traders don’t just guess; they analyze. These tools allow you to spot patterns and trends that might otherwise go unnoticed, giving you an edge in a fast-paced market. Mastering them can significantly enhance your trading strategy and improve your chances of profitability.

![]()

Key Technical Indicators Every Trader Should Know

The beauty of technical analysis lies in its diversity. There are hundreds of indicators, but some stand out for their reliability and widespread use. Here are a few essentials:

- Moving Averages (MAs): These smooth out price data over a specified period, helping to identify the direction of a trend. Simple Moving Averages (SMAs) and Exponential Moving Averages (EMAs) are common. When a shorter-term MA crosses above a longer-term MA, it often signals an uptrend, and vice-versa.

- Relative Strength Index (RSI): An oscillator that measures the speed and change of price movements. It helps identify overbought or oversold conditions. An RSI above 70 suggests an asset is overbought, while below 30 suggests it’s oversold.

- MACD (Moving Average Convergence Divergence): This trend-following momentum indicator shows the relationship between two moving averages of a security’s price. It provides clear buy and sell signals when the MACD line crosses its signal line.

- Bollinger Bands: These volatility indicators consist of a central moving average and two outer bands, which are typically two standard deviations away from the MA. Prices tend to stay within these bands, and a squeeze in the bands often foreshadows a significant price move.

- Support and Resistance Levels: While not strictly an “indicator,” these price levels are fundamental to technical analysis. Support is a price level where a downtrend can be expected to pause due to a concentration of demand, while resistance is where an uptrend can pause due to a concentration of selling interest.

How to Effectively Apply Them

Simply knowing about these indicators isn’t enough; you need to know how to use them. Effective application involves more than just looking at one indicator in isolation. The real power comes from combining multiple tools to confirm signals. For instance, you might look for a bullish MACD crossover that is also confirmed by the RSI moving out of an oversold region. This confluence of signals provides stronger evidence for a potential trade.

Another crucial aspect is understanding context. Is the market trending or ranging? Different indicators perform better in different market conditions. Trend lines and moving averages are excellent for trending markets, while oscillators like RSI are more useful in ranging or sideways markets to spot reversals.

Remember, no single indicator is perfect, and false signals can occur. Always integrate sound risk management practices and consider the broader market picture. Practice is key, and with time, you’ll develop an intuitive understanding of how these powerful tools can guide your forex trading journey.

Choosing the Right IQ Option Trading Instruments for Your Portfolio

Navigating the diverse world of online trading can feel overwhelming, especially when you encounter the vast selection of instruments available on platforms like IQ Option. Making the right choices for your portfolio is not just about picking what looks interesting; it is a strategic decision that directly impacts your potential for success. Your unique financial goals, risk tolerance, and market understanding should guide every choice you make.

Understanding Your Options on IQ Option

IQ Option provides a rich array of trading instruments, each with its own characteristics and potential. Knowing these options is the first step toward building a resilient and profitable portfolio.

- Forex (Currency Pairs): Trade major, minor, and exotic currency pairs. The forex market is the largest and most liquid financial market globally, offering opportunities around the clock.

- Binary Options: These are all-or-nothing options where you predict whether an asset’s price will go up or down within a specific timeframe. You either get a fixed payout or lose your initial investment.

- Digital Options: Similar to binary options but with a slightly different structure, allowing you to choose a strike price. Your potential profit depends on how far the price moves beyond your chosen strike.

- Stocks CFDs: Trade contracts for difference on shares of top companies worldwide. You speculate on price movements without owning the actual stock.

- Commodities CFDs: Gain exposure to valuable raw materials like gold, oil, and silver without direct ownership.

- ETFs CFDs: Diversify your portfolio by trading exchange-traded funds, which are collections of assets that track an underlying index.

- Cryptocurrencies CFDs: Participate in the volatile crypto market, speculating on the price movements of popular digital currencies such as Bitcoin, Ethereum, and Ripple.

Factors Guiding Your Instrument Selection

Selecting the ideal instruments for your IQ Option portfolio requires careful consideration of several key factors. Think of it as tailoring a suit – it needs to fit you perfectly.

- Your Trading Style: Are you a fast-paced day trader, a short-term swing trader, or a long-term position holder? Some instruments, like binary options, suit quick entries and exits, while stock CFDs might appeal more to those with a longer outlook.

- Risk Tolerance: Be honest about how much risk you are comfortable taking. Instruments like binary and digital options offer high potential returns but also carry high risk. Forex and CFD trading, especially with leverage, can also expose you to significant risk.

- Market Knowledge: Trade what you know. If you understand the dynamics of the global currency market, forex might be a natural fit. If you follow tech companies closely, stock CFDs could be for you.

- Time Commitment: How much time can you dedicate to market analysis and monitoring? Active trading in volatile instruments demands more attention than a more passive approach.

- Capital Available: Your starting capital influences the instruments you can effectively trade and the position sizes you can manage.

Comparing Popular IQ Option Instruments

To help you decide, let’s look at some key distinctions between commonly traded instruments:

| Instrument Type | Key Characteristic | Potential Advantage | Potential Disadvantage |

|---|---|---|---|

| Forex CFDs | High liquidity, 24/5 market | Consistent trading opportunities, diverse pairs | Requires deep market analysis, leverage amplifies risk |

| Binary/Digital Options | Fixed expiry, defined risk/reward | High potential return on short-term predictions | High risk of losing initial investment, all-or-nothing outcome |

| Stocks/Commodities/ETFs CFDs | Reflects underlying asset price, leverage available | Diversification, access to various sectors | Leverage can magnify losses, market gaps can occur |

| Cryptocurrencies CFDs | High volatility, 24/7 market | Rapid price movements offer profit opportunities | Extreme price swings, unpredictable market sentiment |

As the acclaimed investor Benjamin Graham wisely stated, “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return.” While trading is inherently riskier than traditional investing, the principle of thorough analysis remains paramount. Do your homework before you commit.

Ultimately, the right IQ Option trading instruments for your portfolio are those that align with your personal profile. Do not chase every trend. Instead, focus on understanding a few instruments deeply, manage your risk meticulously, and consistently refine your strategy. This thoughtful approach sets the foundation for a more successful and less stressful trading journey.

Conclusion: Diversifying Your Investment with IQ Option Trading Instruments

As you navigate the dynamic world of online trading, the importance of a diversified investment portfolio cannot be overstated. IQ Option stands out as a robust platform that empowers traders like you to achieve this crucial goal. It offers an extensive array of trading instruments, providing the flexibility and opportunity to spread your capital across various financial markets, ultimately enhancing your potential for growth while managing risk effectively.

Think of your investment journey as building a sturdy house. You wouldn’t rely on just one type of material, would you? Similarly, in trading, relying on a single asset class or market exposes you to unnecessary vulnerabilities. IQ Option’s diverse offerings allow you to weave together different threads – from the volatile excitement of currency pairs in forex trading to the stability of stocks, the tangible value of commodities, and the innovative edge of cryptocurrencies.

Why Diversifying with IQ Option Makes Sense:

- Broad Market Access: Gain entry to global markets with ease, from major stock exchanges to the intricate world of digital assets.

- Flexible Investment Options: Tailor your exposure to fit your risk tolerance and capital availability with varying contract sizes and asset types.

- Enhanced Risk Management: By not putting all your eggs in one basket, a downturn in one market may be offset by gains in another, smoothing out your overall portfolio performance.

- Opportunity for Varied Returns: Different instruments react differently to economic news and market conditions, offering diverse avenues for potential profit generation.

- User-Friendly Experience: The platform is designed for both beginners and experienced traders, making the process of exploring new instruments straightforward.

Embracing a strategy of diversification through IQ Option’s trading instruments is a smart move for any serious investor. It’s about building resilience and opening up new possibilities. Take the reins of your financial future and explore the wealth of options available. Your journey towards a more secure and prosperous investment portfolio starts with making informed, diversified choices today.

Frequently Asked Questions

What is IQ Option and what kind of trading instruments does it offer?

IQ Option is a leading online trading broker providing access to a wide array of financial instruments, including Forex, CFDs on stocks, commodities, cryptocurrencies, ETFs, digital options, and binary options (where available), allowing traders to diversify their portfolios.

Can I practice trading on IQ Option without risking real money?

Yes, IQ Option offers a free demo account pre-loaded with virtual funds. This risk-free environment allows you to practice strategies, familiarize yourself with the platform, and build confidence before trading with real capital.

What are CFDs, and why trade them on IQ Option?

CFDs (Contracts for Difference) allow you to speculate on the price movements of assets like stocks, commodities, or cryptocurrencies without owning them. IQ Option offers CFDs with leverage opportunities, short-selling potential, and no physical ownership complexities, providing flexibility to profit from both rising and falling markets.

How does IQ Option help traders manage risk?

IQ Option provides essential risk management tools such as stop-loss orders to limit potential losses, take-profit orders to secure gains, and encourages proper position sizing and defining risk-reward ratios to protect capital.

What distinguishes Digital Options on IQ Option?

Digital Options on IQ Option are unique as they allow traders to predict whether an asset’s price will be above or below a chosen ‘strike price’ by a specific expiration time. They offer flexible strike prices, defined expiry times, and clear, transparent payouts, making risk and reward predictable before the trade is placed.