Welcome, aspiring traders! Are you ready to dive into the dynamic world of forex trading and uncover its immense potential? If so, you’ve come to the right place. This comprehensive guide will illuminate the path to successful currency exchange using the popular IQ Option platform. Forget complex jargon and overwhelming charts; we’re here to simplify the journey and equip you with the knowledge to make informed decisions.

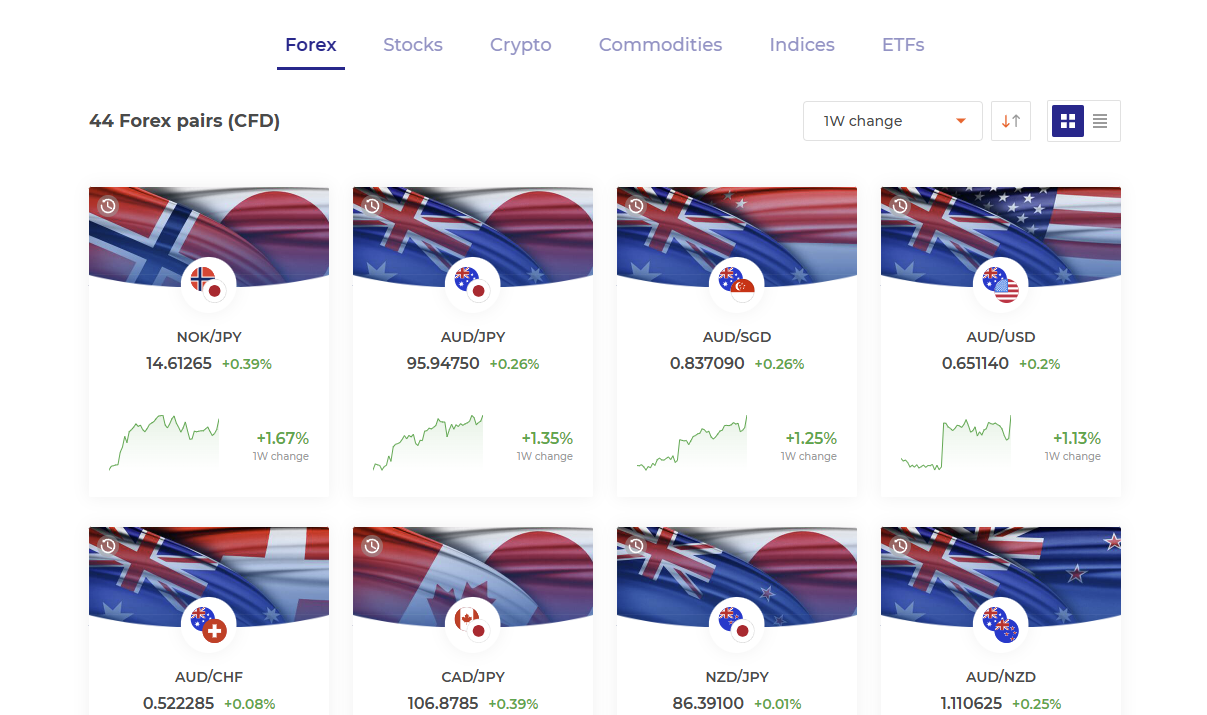

Forex, or foreign exchange, is the largest financial market globally, offering unparalleled opportunities for those who understand its mechanics. Imagine the power to trade currencies like EUR/USD, GBP/JPY, and countless others, capitalizing on global economic shifts. With IQ Option, accessing this exciting market is more straightforward than ever before, combining advanced tools with user-friendly design.

- Why Choose IQ Option for Your Forex Trading Journey?

- What is IQ Option and Why Choose it for Forex Trading?

- Understanding Forex Trading Fundamentals on IQ Option

- What is Forex, Anyway?

- Essential Concepts for IQ Option Traders

- Currency Pairs: The Heart of Forex

- Pips: Measuring Movement

- Leverage: Amplifying Potential (and Risk)

- Why Start Your Forex Journey on IQ Option?

- Key Terms: Pips, Lots, Bid, Ask, and Spread

- Let’s Unpack These Core Concepts:

- Major, Minor, and Exotic Currency Pairs on IQ Option

- Major Currency Pairs: The Market Giants

- Minor Currency Pairs (Crosses): Beyond the Dollar

- Exotic Currency Pairs: High Risk, High Reward

- Getting Started with IQ Option Forex: Account Setup and Verification

- Your First Steps: IQ Option Account Registration

- Securing Your Trading Experience: Account Verification

- Navigating the IQ Option Forex Trading Platform

- Getting Started: Your First Steps on IQ Option

- Unveiling the User Interface and Key Trading Tools

- Mastering Risk and Trading on the Go

- Leverage and Margin in IQ Option Forex Trading Explained

- Essential Technical Analysis Tools for IQ Option Forex

- Utilizing Indicators: Moving Averages, RSI, MACD

- Moving Averages: Your Trend Detectives

- RSI: Gauging Market Momentum

- MACD: The Trend-Following and Momentum Powerhouse

- Chart Patterns and Support/Resistance Levels

- Common Chart Patterns You Need to Know:

- Fundamental Analysis: How News Events Impact IQ Option Forex

- Developing an Effective IQ Option Forex Trading Strategy

- Key Components of a Winning Strategy

- The Strategy Development Process

- Advantages of a Solid IQ Option Trading Strategy

- Risk Management Techniques for IQ Option Forex Traders

- Key Pillars of Forex Risk Management

- The Human Element: Taming Emotional Trading

- Setting Stop-Loss and Take-Profit Orders on IQ Option

- Why Smart Traders Use SL and TP:

- How to Set Them on the IQ Option Platform:

- Key Considerations for Setting Levels:

- Position Sizing and Capital Preservation Strategies

- Deposits and Withdrawals for IQ Option Forex Trading

- Funding Your IQ Option Account: Deposit Methods

- Accessing Your Profits: The Withdrawal Process

- Key Considerations for Managing Your Funds

- Common Mistakes to Avoid When Trading Forex with IQ Option

- The Lure of Overleveraging and Poor Risk Management

- Emotional Trading: The Enemy Within

- Ignoring a Trading Plan and Market Analysis

- Key Mistakes to Actively Avoid: No Demo Account Practice: Jumping straight into live trading without honing your skills on a demo account is a fast track to financial setbacks. Use the demo account to test strategies and get comfortable with IQ Option’s features without any real risk. Overtrading: The belief that more trades equal more profit is a common misconception. Overtrading often leads to exhaustion, poor decision-making, and increased transaction costs. Focus on quality over quantity. Neglecting Stop-Loss Orders: Many traders fail to set stop-loss orders, hoping that a losing trade will eventually turn around. This is a dangerous gamble. A stop-loss is your crucial safety net, limiting potential losses. Chasing News Events: While news drives market movement, trying to trade during highly volatile news releases without a clear, robust strategy is incredibly risky. Price action can be erratic and unpredictable. Lack of Continuous Learning: The forex market is dynamic. What worked yesterday might not work today. Complacency is a killer. Always stay updated with market trends, new strategies, and global economic developments. By being mindful of these common mistakes, you empower yourself to trade smarter, not harder. IQ Option provides excellent tools and resources; it’s up to you to use them wisely and cultivate a disciplined, analytical approach to your trading. Open Account in IQ Option Advanced Tips for Maximizing Profits on IQ Option Forex Ready to move beyond the basics and truly elevate your trading game on IQ Option Forex? Maximizing profits isn’t just about making more trades; it’s about making smarter, more strategic moves. As an experienced trader, you understand that the forex market demands a blend of analytical skill, disciplined execution, and continuous learning. This section dives deep into sophisticated strategies and insights designed to help you push your profit potential further. Mastering Advanced IQ Option Trading Strategies To truly unlock significant returns, you need to look beyond simple indicators. Advanced IQ Option trading strategies involve a more nuanced understanding of market dynamics and predictive analysis. Consider integrating multi-timeframe analysis into your routine. This approach allows you to confirm trends on longer timeframes while pinpointing precise entry and exit points on shorter ones, significantly improving the accuracy of your forex profit maximization efforts. Advanced Strategy Spotlight: Correlation Trading One powerful yet often underutilized technique is correlation trading. This involves understanding how different currency pairs move in relation to each other. For example, EUR/USD and GBP/USD often exhibit a strong positive correlation, while USD/CHF typically shows a negative correlation with EUR/USD. By identifying these relationships, you can: Diversify risk: If two pairs are highly correlated, opening positions in both might increase your exposure rather than diversify it. Confirm trends: A strong move in one correlated pair can signal an impending move in another. Identify hedging opportunities: Trade pairs with negative correlation to balance out potential losses. This insight into currency pair analysis provides an edge, helping you make more informed decisions about your trades on the IQ Option platform. Refining Your Risk Management on IQ Option Even the most advanced strategies are futile without robust risk management on IQ Option. While basic stop-loss and take-profit orders are essential, advanced traders implement dynamic risk-sizing and portfolio-level risk assessment. Never risk more than 1-2% of your total trading capital on a single trade. For profitable forex trading, consider adjusting your position size based on market volatility – smaller positions during high volatility, larger during calmer periods, assuming your strategy accounts for it. Key Components of Advanced Risk Management Component Description Benefit to Forex Profit Maximization Dynamic Position Sizing Adjusting trade size based on current market conditions and account equity, not just a fixed percentage. Optimizes risk exposure for varying market environments, protecting capital during drawdowns. Correlation Hedging Opening offsetting positions in negatively correlated assets to mitigate overall portfolio risk. Reduces overall portfolio volatility and limits potential losses from unexpected market moves. Breakeven Stop-Loss Adjustment Moving your stop-loss to your entry price once a trade moves significantly into profit. Secures capital, ensuring that profitable trades cannot turn into losing ones. Regular Portfolio Review Periodically assessing the overall risk exposure and performance of all open trades. Identifies concentrated risks and ensures alignment with your overarching trading goals. The Psychology of Profitable Forex Trading Beyond charts and indicators, your mindset is a critical factor in achieving consistent forex profit maximization. Trading psychology forex is not merely about staying calm; it’s about cultivating resilience, objectivity, and patience. Avoid revenge trading after a loss. Do not chase the market if you miss an entry. Stick to your trading plan, even when emotions run high. Developing self-awareness about your emotional triggers can be just as important as mastering technical analysis IQ Option. As a seasoned professional, I’ve seen countless traders fail, not due to lack of knowledge, but due to lack of discipline. As the legendary trader Jesse Livermore once said, “The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the man of less than average emotional balance, nor for the adventurer who has the mentality of a gambler.” His words resonate deeply, emphasizing that successful trading is a test of character as much as intellect. Leveraging Fundamental Analysis for Long-Term Gains While technical analysis helps pinpoint entries and exits, fundamental analysis forex provides the broader context. Understanding global economic events, interest rate decisions, geopolitical shifts, and central bank policies can give you a significant advantage in predicting longer-term currency movements. Don’t just react to news; anticipate it. Regularly review economic calendars and interpret how upcoming data releases might impact your chosen currency pairs. This deeper dive into market drivers is crucial for those seeking sustained profitable forex trading. By integrating these advanced techniques – sophisticated strategies, refined risk management, strong trading psychology, and thorough fundamental analysis – you are well on your way to maximizing your profits on IQ Option Forex. Remember, continuous learning and adaptation are key in the ever-evolving forex market. Open Account in IQ Option Is IQ Option Forex Trading Regulated and Safe? When you venture into the dynamic world of forex trading, one of the first and most critical questions you should ask about any broker is its regulatory status and overall safety. Your capital and personal data deserve the highest level of protection. So, let’s dive into whether IQ Option, a prominent name in the online trading space, meets these essential criteria for its forex offerings. Understanding the regulatory environment is key to a secure trading experience. A regulated trading platform provides a layer of oversight, ensuring fair practices and a certain degree of investor protection. Unregulated brokers, on the other hand, carry significant risks, as there’s no governing body to hold them accountable. This is why traders actively seek out a trusted broker with robust financial compliance. IQ Option’s Regulatory Framework IQ Option has established itself by obtaining licenses from various financial authorities in different jurisdictions. These licenses are not just pieces of paper; they signify that the broker adheres to strict operational standards designed to protect client interests. For example, their operations in Europe fall under the Cyprus Securities and Exchange Commission (CySEC), a well-respected regulatory body within the European Union. This specific IQ Option regulation ensures they comply with MiFID II (Markets in Financial Instruments Directive) requirements, which are fundamental for secure forex trading. It’s important to note that the specific regulatory body overseeing your account can depend on your country of residence. IQ Option strategically structures its services to comply with local laws, often operating under different entities to meet regional regulatory demands. This commitment to financial compliance is a strong indicator of their dedication to forex broker safety. Measures for Trader Safety and Fund Protection Beyond external regulation, IQ Option implements several internal measures to enhance the safety and security of its users. These protocols are crucial for safeguarding your funds and personal information: Segregated Accounts: Client funds are kept in separate bank accounts, distinct from the company’s operational funds. This means that even if the company faced financial difficulties, your capital would remain protected and inaccessible to creditors. This is a cornerstone of investor protection. Data Encryption: All transactions and personal data are protected using advanced SSL encryption technology. This ensures that sensitive information transmitted between you and the platform remains confidential and secure from unauthorized access. Risk Management Tools: The platform offers various tools such as stop-loss and take-profit orders, which help you manage your exposure and mitigate potential losses, contributing to overall trading safety. Negative Balance Protection: For certain jurisdictions and account types, IQ Option provides negative balance protection, ensuring your account balance cannot fall below zero, thus protecting you from incurring debt beyond your deposited funds. Why Choose a Regulated Broker? Opting for a regulated broker like IQ Option brings several advantages, making your trading journey more reliable: Aspect of Safety Benefit to Trader Transparency Clearer pricing, terms, and conditions. Accountability Broker is answerable to regulatory bodies for their actions. Dispute Resolution Access to official channels if issues arise. Financial Stability Checks Regulators ensure the broker meets capital requirements. In conclusion, while no financial activity is entirely risk-free, IQ Option’s commitment to obtaining and maintaining regulation in key markets, coupled with its internal security measures, strongly positions it as a platform focused on forex broker safety and investor protection. Their efforts towards financial compliance make them a considered choice for many looking for a regulated trading platform. Open Account in IQ Option IQ Option Trading Forex vs. Other Instruments Embarking on the journey of online trading often brings a crucial decision: which financial instrument best suits your style and goals? IQ Option offers a diverse ecosystem, presenting traders with a vibrant selection from currency pairs to company shares. While the allure of forex trading is undeniable, understanding how it stacks up against other popular instruments like stocks, commodities, or cryptocurrencies can sharpen your focus and refine your trading strategy. Forex, short for foreign exchange, is the global market for exchanging national currencies. On IQ Option, it allows you to speculate on the price movements of currency pairs such as EUR/USD or GBP/JPY. This market boasts unparalleled liquidity, meaning you can often enter and exit positions quickly, even with substantial trading volumes. Its 24/5 operating hours offer immense flexibility, catering to various time zones and personal schedules. Traders are often drawn to its volatility, which, when managed correctly, can present numerous profit opportunities throughout the day. Beyond the dynamic world of currency, IQ Option also provides access to a rich array of other assets. You can delve into stocks of major companies, aiming to profit from their growth or daily price swings. Commodities like gold and oil offer exposure to global economic trends. Cryptocurrencies such as Bitcoin and Ethereum present a newer, highly volatile frontier for those seeking high-risk, high-reward scenarios. Each instrument carries unique characteristics, from market hours to typical price drivers, influencing how and when you might choose to trade them. To help you navigate these choices, here’s a comparative look at forex trading against other instruments on IQ Option: Feature Forex Trading Stocks Commodities Cryptocurrencies Market Hours 24/5 (Sunday evening to Friday evening) Specific exchange hours (e.g., 9:30 AM – 4:00 PM EST) Nearly 24/5 (dependent on market) 24/7 (most exchanges) Liquidity Extremely High High (for major stocks) to Moderate Moderate to High Moderate to High (can vary widely by coin) Volatility High (influenced by economic news) Moderate to High (company-specific news, industry trends) Moderate to High (global events, supply/demand) Very High (rapid price swings common) Key Drivers Interest rates, inflation, political events, economic data Company earnings, industry news, economic outlook Supply and demand, geopolitical events, weather Technological developments, adoption rates, regulatory news Typical Leverage Often higher Moderate Moderate Varies, often lower for safety Choosing to focus on forex trading on IQ Option often comes down to its compelling combination of accessibility, deep liquidity, and round-the-clock action. The ability to react quickly to global economic shifts and employ diverse trading strategies makes it a favorite for many. While other instruments offer exciting avenues for diversification and specialized market exposure, the sheer volume and constant movement in the currency markets make forex a dynamic starting point or a solid core component of any serious trader’s portfolio. Remember, effective risk management is crucial regardless of the instrument you choose. Open Account in IQ Option The Future of Forex Trading on IQ Option The landscape of financial markets is constantly evolving, and forex trading stands at the forefront of this transformation. As a leading online trading platform, IQ Option is not just keeping pace with these changes; it’s actively shaping the future. We’re witnessing a dynamic shift powered by technological innovation, greater accessibility, and a deeper understanding of market dynamics, all converging to create an exciting environment for traders worldwide. The trajectory of forex on IQ Option points towards an even more sophisticated and user-friendly experience. Here’s a glimpse into what’s on the horizon: Advanced Technological Integration Technology is the engine driving the future of online trading. On IQ Option, expect to see further integration of cutting-edge tools that empower traders: Artificial Intelligence (AI) and Machine Learning: These powerful technologies are set to revolutionize market analysis. AI algorithms can process vast amounts of data, identify complex patterns, and predict potential price movements with greater accuracy than ever before. This doesn’t replace human intuition but significantly augments it, helping you make more informed decisions in your trading strategies. Enhanced Algorithmic Trading: While fully automated trading needs careful consideration, IQ Option is exploring ways to offer more advanced analytical tools that can help traders develop and test their own rules-based systems, refining their approach to the financial markets. Superior Mobile Trading Experience: The IQ Option mobile app is already a market leader, but the future promises even more seamless integration, real-time alerts, and comprehensive functionality, ensuring you have constant global access to your trades no matter where you are. Greater Accessibility and Education The future of forex is inclusive. IQ Option is committed to breaking down barriers, making trading accessible to a broader audience. This involves: Simplified User Interfaces: While the underlying mechanics of forex can be complex, platforms like IQ Option are constantly refining their interface to be intuitive for newcomers while retaining depth for experienced traders. Comprehensive Educational Resources: The importance of knowledge cannot be overstated. IQ Option will continue to expand its suite of educational tools, offering more webinars, tutorials, and articles to equip traders with the understanding they need for effective risk management and successful trading. Democratic Access to Information: Expect even more robust economic calendars, news feeds, and analytical insights directly within the platform, ensuring traders have all the necessary information at their fingertips to react to market events. Evolving Regulatory Landscape and Security The commitment to security and fair play remains paramount. As the future of trading unfolds, regulatory frameworks will also adapt to protect traders and ensure platform integrity. IQ Option continues to prioritize regulatory compliance, employing state-of-the-art encryption and security protocols to safeguard your funds and personal information. You can trade with confidence, knowing your interests are protected by robust systems designed for transparency and reliability. The Power of Community Trading doesn’t have to be a solitary endeavor. The future of forex on platforms like IQ Option will likely see an increased emphasis on community features. Imagine being able to share insights, discuss trading strategies, and learn from a diverse global trader community right within the platform. This collaborative environment fosters learning and allows traders to benchmark their performance against others, creating a richer, more interactive experience. The future of forex trading on IQ Option is bright, promising a blend of cutting-edge technology, user-centric design, and unwavering commitment to trader success. Get ready to embrace an era where precision, accessibility, and community redefine your trading journey. Frequently Asked Questions What is IQ Option and why should I choose it for forex trading? IQ Option is a leading online trading platform offering CFDs on various assets, including forex. It’s known for its user-friendly interface, accessibility, free demo account, diverse currency pairs, educational resources, and mobile trading capabilities, making it suitable for both beginners and experienced traders. How do leverage and margin work in IQ Option forex trading? Leverage allows traders to control larger positions with a smaller amount of capital, amplifying potential profits but also losses. Margin is the security deposit required by IQ Option to keep leveraged positions open, acting as a guarantee to cover potential losses. Understanding both is crucial for risk management. What essential technical analysis tools does IQ Option offer for forex? IQ Option provides interactive charts, candlestick patterns, trend lines, support/resistance levels, and a rich library of technical indicators like Moving Averages (MA), Relative Strength Index (RSI), and MACD. These tools aid in identifying trends, momentum, and potential entry/exit points. What are the key risk management techniques for IQ Option forex traders? Essential risk management involves implementing stop-loss orders to limit potential losses, using take-profit orders to secure gains, mastering position sizing (e.g., risking 1-2% of capital per trade), and understanding leverage. Avoiding emotional trading and using a demo account are also crucial. Is IQ Option forex trading regulated and safe? Yes, IQ Option is regulated by various financial authorities, such as CySEC in Europe, ensuring compliance with strict operational standards. They use segregated accounts for client funds, advanced data encryption, and provide risk management tools like negative balance protection, making it a secure platform.

- Advanced Tips for Maximizing Profits on IQ Option Forex

- Mastering Advanced IQ Option Trading Strategies

- Advanced Strategy Spotlight: Correlation Trading

- Refining Your Risk Management on IQ Option

- Key Components of Advanced Risk Management

- The Psychology of Profitable Forex Trading

- Leveraging Fundamental Analysis for Long-Term Gains

- Is IQ Option Forex Trading Regulated and Safe?

- IQ Option’s Regulatory Framework

- Measures for Trader Safety and Fund Protection

- Why Choose a Regulated Broker?

- IQ Option Trading Forex vs. Other Instruments

- The Future of Forex Trading on IQ Option

- Advanced Technological Integration

- Greater Accessibility and Education

- Evolving Regulatory Landscape and Security

- The Power of Community

- Frequently Asked Questions

Why Choose IQ Option for Your Forex Trading Journey?

IQ Option stands out as a preferred online trading platform for many reasons. It provides a robust environment where both new and experienced traders can pursue profitable currency exchange. We believe in empowering our community, offering resources that enhance your understanding and strategy.

Here are just a few advantages of trading forex with IQ Option:

- Accessibility: Start trading with a minimal deposit, making forex accessible to a broader audience.

- Intuitive Platform: Navigate financial markets with ease thanks to a clean, well-designed interface.

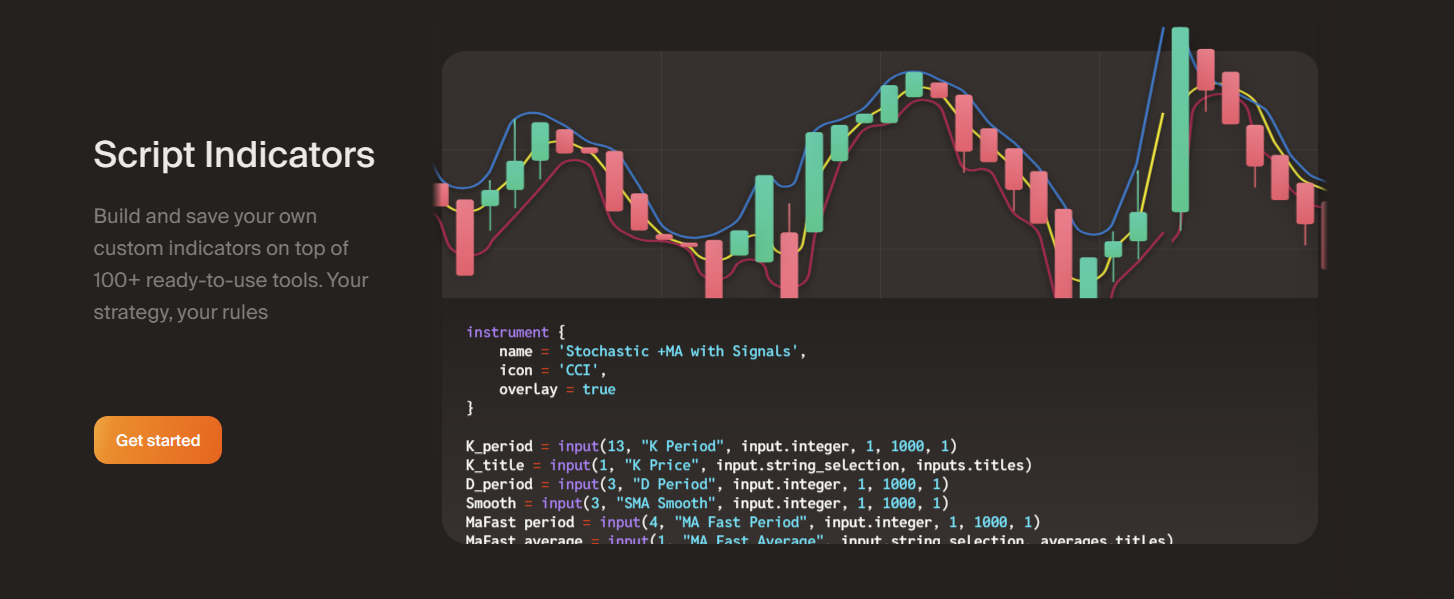

- Analytical Tools: Access a suite of technical indicators and charting tools to analyze currency pairs effectively.

- Educational Resources: Benefit from tutorials, webinars, and articles designed to sharpen your trading skills.

- Leverage Options: Amplify your potential returns with flexible leverage, though always remember to manage risk wisely.

Whether you dream of supplementing your income or pursuing trading as a full-time endeavor, IQ Option offers the gateway. We’ll explore everything from basic concepts to advanced trading strategies, ensuring you grasp the nuances of currency trading. Get ready to transform your understanding of global finance and discover how you can actively participate in the world’s most liquid market.

Embark on this exciting adventure with us. Your ultimate guide to profitable currency exchange starts right here, right now.

What is IQ Option and Why Choose it for Forex Trading?

IQ Option stands out as a leading online trading platform, renowned for its user-friendly interface and a diverse range of financial instruments. It began as an innovative broker but has expanded significantly, now offering contracts for difference (CFDs) on various assets, including forex, stocks, cryptocurrencies, and commodities. For many, it’s the gateway to the financial markets, simplifying complex trading concepts into an accessible format. It’s built for both newcomers taking their first steps and experienced traders looking for a robust platform.

When it comes to forex trading, IQ Option offers a compelling package. Here’s why many traders worldwide gravitate towards it:

- Intuitive Platform Design: Navigating the forex market can feel daunting, but IQ Option’s platform is designed for clarity. Its clean, modern interface makes it incredibly easy to find currency pairs, analyze charts, and execute trades, even if you are just starting your trading journey. This online platform prioritizes user experience.

- Access to Popular Currency Pairs: You gain entry to a wide array of major, minor, and exotic currency pairs. This variety allows you to explore different market opportunities and diversify your trading strategies, giving you plenty of options for your forex trading.

- Free Demo Account: Before committing real capital, you can practice with a free, reloadable demo account. This is invaluable for learning the ropes of forex trading, testing strategies, and getting comfortable with the platform’s features without any financial risk. It’s a perfect environment for new traders.

- Flexible Trading Conditions: IQ Option provides competitive trading conditions, including transparent spreads and the option to use leverage, which can amplify potential gains. However, remember that leverage also amplifies potential losses, so managing risk is crucial.

- Comprehensive Educational Resources: The platform offers a wealth of educational materials, including video tutorials and articles. These resources are perfect for understanding market dynamics, technical analysis, and developing a solid forex trading strategy. They make the platform very beginner-friendly.

- Advanced Trading Tools: Despite its simplicity, IQ Option doesn’t skimp on powerful tools. You’ll find a range of technical indicators, charting tools, and analytical features that assist in making informed trading decisions. These are excellent for those seeking advanced tools.

- Mobile Trading Capability: Stay connected to the markets no matter where you are. IQ Option’s robust mobile app for iOS and Android devices ensures you can monitor your trades, analyze charts, and open or close positions on the go, giving you ultimate flexibility in your forex trading.

Choosing IQ Option means opting for a platform that balances ease of use with powerful functionalities, making it a strong contender for your forex trading endeavors.

Choosing IQ Option means opting for a platform that balances ease of use with powerful functionalities, making it a strong contender for your forex trading endeavors.

Understanding Forex Trading Fundamentals on IQ Option

Embarking on the journey of forex trading can feel like stepping into a vast, dynamic ocean. But don’t worry, with the right guidance and a clear understanding of the basics, you’ll navigate these waters with confidence. On the IQ Option platform, grasping the fundamentals of forex trading is your first and most crucial step towards potential success in the financial markets.

What is Forex, Anyway?

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It’s the largest and most liquid market in the world, with trillions of dollars changing hands daily. Imagine the global economy as a massive machine; forex is the oil that keeps it running, facilitating everything from international trade to tourism. When you engage in online trading, you are essentially speculating on the future value of one currency against another.

Here’s a quick breakdown of why forex captures so much attention:

- 24/5 Market: It never sleeps, operating around the clock from Monday to Friday. This flexibility allows traders worldwide to participate at their convenience.

- High Liquidity: With such massive trading volumes, you can usually enter and exit trades with ease, ensuring fair pricing.

- Potential for Profit: Traders aim to profit from the fluctuating exchange rates between different currencies.

Essential Concepts for IQ Option Traders

Before you dive into placing your first trade on IQ Option, it’s vital to familiarize yourself with some core terminology. These aren’t just jargon; they are the building blocks of every trading decision you’ll make.

Currency Pairs: The Heart of Forex

Unlike stock trading where you buy shares in a single company, forex trading involves currency pairs. You’re always buying one currency while simultaneously selling another. The first currency in the pair is the ‘base currency’, and the second is the ‘quote currency’. For example, in EUR/USD, you are trading the Euro against the US Dollar. If you believe the Euro will strengthen against the Dollar, you buy EUR/USD.

“Understanding currency pairs is fundamental. It’s not just about the numbers; it’s about the economic stories behind each currency that drive their value against one another.” – A seasoned forex trader.

Pips: Measuring Movement

A “pip” (percentage in point) is the smallest unit of price movement in a currency pair. For most pairs, a pip is the fourth decimal place (e.g., 0.0001). For example, if EUR/USD moves from 1.1200 to 1.1201, that’s a one-pip movement. Understanding pips helps you calculate your potential profit or loss and assess the volatility of the market.

Leverage: Amplifying Potential (and Risk)

IQ Option, like many brokers, offers leverage. Leverage allows you to control a larger position with a smaller amount of capital. For instance, 1:100 leverage means for every $1 of your capital, you can control $100 in the market. While this can magnify your profits, it’s crucial to remember it can also amplify your losses. Effective risk management is non-negotiable when using leverage.

| Fundamental Concept | Why It Matters for IQ Option Traders |

|---|---|

| Currency Pairs | Choose the right pair based on your analysis and market insights. |

| Pips | Quantify your trade’s performance and set realistic profit targets. |

| Leverage | Optimize your capital utilization while managing exposure. |

| Market Analysis | Develop informed trading strategies based on economic data and chart patterns. |

Why Start Your Forex Journey on IQ Option?

IQ Option offers an accessible and intuitive environment to learn and practice these fundamentals. Their platform is designed to be user-friendly, even for beginners. You can start with a demo account to hone your skills, test different trading strategies, and get comfortable with market analysis without risking real capital. Understanding these basic concepts is not just about memorizing definitions; it’s about building a solid foundation that empowers you to make smarter, more confident trading decisions.

Ready to unlock the potential of the global currency markets? Join the community on IQ Option and start building your expertise today!

Key Terms: Pips, Lots, Bid, Ask, and Spread

Diving into the world of foreign exchange means getting familiar with some essential vocabulary. These aren’t just fancy words; they are the building blocks of every trade you make and every strategy you develop. Understanding them clearly will sharpen your trading decisions and help you navigate the currency markets with confidence.

Let’s Unpack These Core Concepts:

- Pips (Percentage in Point): Think of a pip as the smallest unit of price movement in a currency pair. For most pairs, a pip is the fourth decimal place (e.g., 0.0001). For JPY pairs, it’s typically the second decimal place (0.01). Every pip movement translates directly into your profit or loss, making them critical for calculating trade outcomes.

- Lots: This term refers to the standardized unit size of a transaction in forex. You don’t trade single dollars; you trade in “lots.” Here’s a quick breakdown:

- Standard Lot: 100,000 units of the base currency.

- Mini Lot: 10,000 units of the base currency.

- Micro Lot: 1,000 units of the base currency.

- Nano Lot: 100 units of the base currency (less common).

Your choice of lot size directly impacts your exposure and potential profit or loss on each trade, aligning with your risk management strategy.

- Bid: This is the price at which your broker is willing to buy the base currency from you in exchange for the quote currency. Essentially, it’s the price you can sell at. You see the bid price on the left side of a currency quote.

- Ask (or Offer): The ask price is what your broker charges you to sell the base currency to you. It’s the price at which you can buy. The ask price always sits on the right side of a currency quote and is typically higher than the bid price.

- Spread: The spread is simply the difference between the ask price and the bid price. It represents the cost of executing a trade, effectively the broker’s commission for facilitating your transaction. A smaller spread means lower trading costs for you, while a wider spread indicates higher costs. The spread can vary based on market volatility, liquidity, and the specific currency pair.

Mastering these fundamental terms empowers you to read quotes accurately, understand your transaction costs, and manage your trades more effectively. They are the backbone of your trading knowledge, paving the way for a more informed and strategic approach to the forex market.

Major, Minor, and Exotic Currency Pairs on IQ Option

Diving into the world of forex trading on IQ Option means exploring a vast universe of currency pairs. Understanding the differences between major, minor, and exotic pairs is crucial for crafting a successful trading strategy and managing your risk effectively. Each category offers unique characteristics regarding liquidity, volatility, and potential profit, making it essential to know what you’re getting into before placing a trade.

Major Currency Pairs: The Market Giants

Major currency pairs are the most frequently traded on IQ Option and across the global forex market. They involve the US Dollar (USD) paired with one of the world’s other leading currencies. Think of them as the bedrock of forex trading. Their popularity stems from several key factors:

- High Liquidity: You can easily buy or sell these pairs without significantly affecting their price. This means tighter spreads and more predictable price movements.

- Lower Volatility (Relative): While still volatile, their price swings are generally less erratic compared to minor or exotic pairs, making them a favorite for both new and experienced traders.

- Abundant Information: Economic data, news, and analyses for these currencies are readily available, helping you make informed decisions.

Common examples you’ll find on IQ Option include:

| Currency Pair | Description |

|---|---|

| EUR/USD | Euro vs. US Dollar – The most traded pair globally. |

| GBP/USD | British Pound vs. US Dollar – Known for its dynamic movements. |

| USD/JPY | US Dollar vs. Japanese Yen – Often reacts strongly to risk sentiment. |

| USD/CHF | US Dollar vs. Swiss Franc – A classic safe-haven pair. |

| AUD/USD | Australian Dollar vs. US Dollar – Influenced by commodity prices. |

| USD/CAD | US Dollar vs. Canadian Dollar – Strongly linked to oil prices. |

Minor Currency Pairs (Crosses): Beyond the Dollar

Minor currency pairs, also known as cross-currency pairs or simply “crosses,” do not include the US Dollar. Instead, they represent trades between other major currencies, offering diversification and unique trading opportunities. While still liquid, they typically have wider spreads and can exhibit more volatility than major pairs.

Trading minor pairs on IQ Option allows you to capitalize on specific economic trends between two non-USD economies. For example, if you foresee a strong performance of the Euro against the British Pound due to differing economic policies, you might trade EUR/GBP. These pairs often provide distinct trading narratives that might not be visible when looking at USD-centric pairs.

Some popular minor pairs you can explore:

- EUR/GBP

- EUR/JPY

- GBP/JPY

- AUD/JPY

- NZD/CAD

Exotic Currency Pairs: High Risk, High Reward

Exotic currency pairs involve a major currency paired with a currency from a smaller, developing, or emerging economy. These pairs are characterized by their significantly lower liquidity, much wider spreads, and higher volatility. Trading exotics on IQ Option requires a higher degree of caution and robust risk management.

Why trade exotics? The potential for substantial profits is the main draw. Their large price swings can, in theory, lead to significant gains if your predictions are accurate. However, the risk of equally significant losses is also much higher. Economic and political events in the smaller nation can cause dramatic and unpredictable price movements.

Consider the following before engaging with exotic pairs:

Expert Insight: “When exploring exotic currency pairs on IQ Option, always prioritize in-depth fundamental analysis over technical signals alone. Geopolitical events, interest rate decisions from central banks in emerging markets, and commodity price fluctuations can have an outsized impact on these pairs. Approach them with smaller position sizes and a clear exit strategy.”

When exploring exotic currency pairs on IQ Option, always prioritize in-depth fundamental analysis over technical signals alone. Geopolitical events, interest rate decisions from central banks in emerging markets, and commodity price fluctuations can have an outsized impact on these pairs. Approach them with smaller position sizes and a clear exit strategy.

Examples of exotic pairs you might find:

- USD/ZAR (US Dollar vs. South African Rand)

- USD/MXN (US Dollar vs. Mexican Peso)

- USD/TRY (US Dollar vs. Turkish Lira)

- EUR/PLN (Euro vs. Polish Zloty)

- GBP/HUF (British Pound vs. Hungarian Forint)

Whether you stick to the predictable majors, diversify with minors, or chase the high-stakes exotics, IQ Option provides a comprehensive platform to access a wide range of currency pairs. Your choice should always align with your personal risk tolerance, trading style, and market knowledge.

Getting Started with IQ Option Forex: Account Setup and Verification

Embarking on your journey into the exciting world of forex trading with IQ Option is a thrilling prospect! Many aspiring traders find themselves eager to dive in, and setting up your account correctly is the first crucial step. We make the process straightforward and secure, ensuring you can quickly move from registration to actively engaging with the markets.

Your First Steps: IQ Option Account Registration

Creating your IQ Option account is designed for simplicity. You will find the process intuitive, allowing you to get started without unnecessary delays. Here’s what you need to do:

- Visit the Official Website: Head directly to the IQ Option website. Look for the “Sign Up” or “Register” button, usually prominently displayed.

- Provide Basic Information: You will be asked for essential details such as your email address and to create a secure password. Make sure to use an email you regularly access.

- Agree to Terms: Read and accept the terms and conditions and the privacy policy. It’s important to understand the operational guidelines before you proceed with forex trading.

- Email Confirmation: Check your inbox for a confirmation email from IQ Option. Click the link inside to verify your email address. This step is vital for securing your account.

Once your email is confirmed, you gain access to the IQ Option trading platform. You can now explore the interface, understand the different currency pairs, and even practice with a free demo account before committing any real funds. This practice environment is an excellent way to familiarize yourself with the platform and develop your trading strategies without risk.

Securing Your Trading Experience: Account Verification

Account verification is not just a formality; it is a critical security measure that protects both you and the platform. It helps prevent fraud, ensures compliance with financial regulations, and ultimately safeguards your funds. Completing this process promptly allows for smoother withdrawals and full access to all platform features.

Here’s what the typical verification process entails:

- Identity Verification (KYC): You will need to provide a clear photo or scan of a government-issued identification document. This could be your passport, national ID card, or driver’s license. The name on your document must match the name registered on your IQ Option account.

- Address Verification: To confirm your residential address, IQ Option usually requests a document like a utility bill (electricity, water, gas), a bank statement, or a tax document. This document should clearly show your name and address and be no older than three months.

- Payment Method Verification: If you plan to deposit funds using a specific method (e.g., a credit card), you might be asked to verify ownership of that method. For credit cards, this often involves submitting a photo of the card, showing only the first six and last four digits, and covering the CVV.

The IQ Option team works efficiently to review your submitted documents. You can typically monitor the status of your verification directly from your account dashboard. Getting your account fully verified sets you up for a seamless IQ Option forex experience, giving you peace of mind as you focus on market analysis and potential trades.

Navigating the IQ Option Forex Trading Platform

Stepping into the world of currency exchange can feel like diving into the deep end, but with the right tools, it becomes an exhilarating journey. The IQ Option platform stands out as a powerful gateway for anyone keen on forex trading. It’s designed with an intuitive approach, making it accessible for beginners while offering advanced functionalities that seasoned traders appreciate. Our goal here is to guide you through its core features, ensuring you feel confident and ready to tackle the markets.

Getting Started: Your First Steps on IQ Option

Your journey begins with a straightforward account setup. IQ Option streamlines this process, allowing you to get up and running in no time. But before you commit real capital, we always recommend exploring the vast potential of the demo account. This invaluable feature offers a risk-free environment where you can practice strategies, understand market dynamics, and familiarize yourself with the platform’s every nook and cranny. Think of it as your personal sandbox for mastering the art of currency speculation.

Once you feel comfortable, transitioning to live trading is simple. The platform ensures a seamless experience, allowing you to focus purely on your trading decisions rather than wrestling with complex menus.

Unveiling the User Interface and Key Trading Tools

The beauty of IQ Option lies in its clean, user-friendly user interface. Everything you need is typically just a click or two away. Here’s a quick overview of what you’ll find essential:

- Interactive Charts: Visualise price movements across various timeframes, from minute-by-minute to daily, using powerful charting options.

- Asset Selection: Easily switch between different currency pairs, knowing their current market rates and trading hours.

- Order Panel: Place your trades with precision, setting your desired investment amount, stop-loss, and take-profit levels.

- Indicators and Analytical Tools: Access a rich library of technical indicators like Moving Averages, RSI, and MACD to perform in-depth market analysis. These tools are crucial for identifying trends and potential entry/exit points.

These trading tools empower you to make informed decisions, transforming raw market data into actionable insights.

Mastering Risk and Trading on the Go

Effective risk management is paramount in forex, and IQ Option provides features to help you stay in control. You can set stop-loss orders to limit potential losses and take-profit orders to secure gains automatically. These are not just suggestions; they are critical safeguards for protecting your capital in volatile markets.

Furthermore, your trading doesn’t have to be confined to a desktop. With robust mobile applications, IQ Option offers seamless mobile trading. This means you can monitor your positions, open new trades, and react to market news no matter where you are. The mobile app mirrors the desktop experience, providing full functionality right at your fingertips. This flexibility is a game-changer for traders who value agility and constant market access.

Leverage and Margin in IQ Option Forex Trading Explained

Ever wondered how savvy traders manage to open significant positions in the bustling forex market with what seems like a modest amount of initial capital? The answer lies in understanding two fundamental yet powerful concepts: leverage and margin. When you engage in IQ Option forex trading, mastering these tools isn’t just an option—it’s absolutely essential for smart, strategic trading.

Leverage: Your Financial Magnifying Glass

Imagine leverage as a financial tool that allows you to control a much larger trading position than your actual initial deposit would typically permit. IQ Option, like other reputable brokers, offers various leverage ratios, effectively multiplying your purchasing power. For instance, with 1:50 leverage, every $1 of your own trading capital can control $50 worth of currency in the market. This mechanism means that even small market movements can translate into significant potential profits for your account. It’s a powerful way to gain increased exposure to the market without needing to commit vast sums of money upfront.

Here are some clear advantages of using leverage:

- Enhanced Market Exposure: You can open larger positions with a smaller portion of your capital.

- Amplified Potential Profits: Even minor, favorable price changes can lead to substantial gains, making forex trading more appealing.

- Capital Efficiency: You don’t have to tie up all your funds in one trade, freeing up capital for other trading opportunities or diversification.

Margin: Your Security Deposit

While leverage expands your trading potential, margin acts as the security deposit required by IQ Option to keep your leveraged positions open. It’s a specific portion of your account equity set aside by the platform, essentially as a guarantee to cover potential losses from your active trades. It’s crucial to understand that margin isn’t a fee you pay; it’s simply a reserved amount of your funds. Generally, the higher the leverage you use, the smaller the margin percentage required for a given trade size. However, this is where the concept of a margin call becomes vital. If your trade moves significantly against you and your account equity falls below the required margin level, IQ Option may issue a margin call. This means you need to deposit more funds to maintain your open positions, or some of your positions might be automatically closed to prevent further losses. This is precisely why effective risk management strategies are not just recommended, but imperative.

Be aware of the risks associated with leverage and margin:

- Magnified Losses: Just as profits can be amplified, losses are equally magnified. A small unfavorable price movement can quickly deplete your account balance.

- Margin Calls: Failure to meet margin requirements can lead to the forced closure of your positions, often at an unfavorable time, locking in losses.

- Emotional Trading: The high stakes involved with leveraged trading can sometimes lead to impulsive or emotional decisions if you lack a disciplined trading plan.

Leverage vs. Margin: A Clear Comparison

| Feature | Leverage | Margin |

|---|---|---|

| Purpose | Amplifies your trading power; allows control of larger positions with less capital. | Acts as a security deposit or collateral to maintain open leveraged trades. |

| Impact on Capital | Enables you to trade with borrowed capital beyond your initial deposit. | A specific portion of your own capital held by the broker as a guarantee. |

| Key Risk Factor | Significantly increases both potential profits and, more critically, potential losses. | Acts as a trigger point for potential margin calls and forced position closures. |

Strategic Trading with IQ Option’s Leverage and Margin

Using leverage and margin wisely in IQ Option forex trading is paramount for long-term success. It’s not about always chasing the highest leverage possible, but rather selecting the *appropriate* leverage that aligns with your trading strategy, risk tolerance, and account size. We strongly advise starting by thoroughly understanding market dynamics, practicing extensively with a demo account, and consistently implementing robust risk management techniques, such as setting precise stop-loss and take-profit orders. IQ Option provides a user-friendly platform where you can easily monitor your margin levels and manage your open positions effectively. Embrace these powerful tools with caution and an informed approach, and you’ll be well-equipped to navigate the exciting and dynamic world of forex trading.

Essential Technical Analysis Tools for IQ Option Forex

Diving into the fast-paced world of forex trading with IQ Option requires more than just gut feelings. You need a robust approach, and that’s exactly what technical analysis offers. It’s your roadmap to understanding market trends, predicting potential price movements, and crafting winning trading strategies. Forget the noise; focus on the charts. Let’s explore the indispensable tools that will elevate your trading game.

The Foundation: Price Action and Structure

At its heart, technical analysis begins with price action. This means studying how prices have moved in the past to anticipate future movements. No fancy calculations needed here, just pure chart reading. Key concepts within price action include:

- Candlestick Patterns: These visual formations tell stories of buying and selling pressure. Recognizing patterns like Doji, Engulfing, or Hammer can signal reversals or continuations.

- Trend Lines: Drawing lines connecting significant highs or lows helps you identify the prevailing market direction – uptrend, downtrend, or consolidation.

- Chart Patterns: Larger formations such as Head and Shoulders, Triangles, or Double Tops/Bottoms offer powerful insights into future price trajectory.

Pillars of Stability: Support and Resistance

Every seasoned trader knows the importance of support and resistance levels. Think of support as a floor where falling prices tend to bounce back up, and resistance as a ceiling where rising prices often meet selling pressure. These aren’t just arbitrary lines; they represent critical psychological levels where supply and demand are balanced or imbalance shifts. Identifying these zones helps you pinpoint ideal entry and exit points, greatly enhancing your trading strategies on IQ Option.

A smart trader once said: “Support broken becomes resistance, and resistance broken becomes support.” Master this concept, and you’ll unlock a new dimension in your technical analysis.

“Support broken becomes resistance, and resistance broken becomes support.” Master this concept, and you’ll unlock a new dimension in your technical analysis.

Powering Up with Indicators and Oscillators

While price action and support/resistance form the bedrock, indicators and oscillators provide additional confirmation and insights. They are mathematical calculations based on price, volume, or open interest, displayed visually on your charts.

Commonly Used Indicators:

These tools help identify trends, momentum, and volatility. Here are a few must-knows:

- Moving Averages (MA): Smoothens price data to highlight the trend direction. Crossovers of different MAs can signal potential trend changes.

- Bollinger Bands: Consist of a middle band (SMA) and two outer bands (standard deviations). They measure volatility and can indicate overbought or oversold conditions at the extremes.

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. It helps identify overbought (above 70) and oversold (below 30) conditions.

Understanding Oscillators:

Oscillators are particularly useful in ranging markets or for confirming trend strength. They typically fluctuate between set values, providing signals when prices are likely to reverse.

| Oscillator | What It Does | Key Signal |

|---|---|---|

| Stochastic Oscillator | Compares a closing price to a range of prices over time, showing momentum. | Overbought (>80), Oversold (<20), Crossovers. |

| MACD (Moving Average Convergence Divergence) | Shows the relationship between two moving averages of a security’s price. | Crossovers of the MACD line and signal line, divergence. |

| RSI (Relative Strength Index) | Measures the speed and change of price movements. | Overbought (>70), Oversold (<30), Divergence. |

Combining Tools for Powerful Trading Strategies

The real magic happens when you don’t rely on just one tool. Instead, combine multiple forms of technical analysis to build a comprehensive view of market trends. For instance, you might look for a bullish candlestick pattern at a strong support level, confirmed by an oversold signal from an oscillator. This confluence of signals significantly increases the probability of your trade success. Always remember that no single indicator is perfect, but a well-constructed trading strategy using multiple confirmations can give you a significant edge in forex trading on IQ Option.

Crucially, never forget the importance of risk management. Even with the best technical analysis, markets are unpredictable. Define your stop-loss and take-profit levels for every trade, ensuring you protect your capital and stay in the game for the long haul. Master these tools, integrate them wisely, and watch your trading potential soar!

Utilizing Indicators: Moving Averages, RSI, MACD

Diving into the world of forex trading requires more than just guesswork; it demands smart tools and keen insights. That’s where technical indicators come in, acting as your compass and map through volatile markets. Master the art of interpreting Moving Averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD), and you’ll unlock a deeper understanding of market trends, empowering your trading strategies.

Moving Averages: Your Trend Detectives

Imagine cutting through the daily noise of price fluctuations to reveal the true direction of the market. That’s what Moving Averages (MAs) do! They smooth out price data, making it easier to identify market trends. We often use Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). SMAs treat all prices equally, while EMAs give more weight to recent prices, making them more responsive to current shifts.

- Trend Identification: A rising MA signals an uptrend, while a falling MA points to a downtrend.

- Support and Resistance: Prices often bounce off or break through MAs, which act as dynamic support or resistance levels.

- Crossovers: When a shorter-term MA crosses a longer-term MA, it often signals potential entry and exit points for your trades.

RSI: Gauging Market Momentum

The Relative Strength Index (RSI) is your go-to momentum indicator, telling you the speed and change of price movements. It’s like a market speedometer, helping you spot when an asset is potentially overbought or oversold. The RSI oscillates between 0 and 100, providing clear signals:

| RSI Level | Interpretation | Trading Implication |

|---|---|---|

| Above 70 | Overbought | Potential for a price pullback or reversal downwards. |

| Below 30 | Oversold | Potential for a price bounce or reversal upwards. |

Smart traders also look for divergence, where price makes a new high or low, but the RSI doesn’t confirm it, hinting at weakening momentum and a possible trend reversal. Spotting these signals can give you a significant edge in your forex trading.

MACD: The Trend-Following and Momentum Powerhouse

The Moving Average Convergence Divergence (MACD) is a dynamic indicator that elegantly combines trend-following and momentum aspects. It features two lines—the MACD line and the signal line—and a histogram. This powerful combination helps you identify new market trends, momentum shifts, and potential reversal signals. When the MACD line crosses above the signal line, it often indicates a bullish momentum shift, suggesting a potential buy opportunity. Conversely, a cross below signals bearish momentum. The histogram visually displays the distance between these lines, growing taller as momentum strengthens and shrinking as it weakens.

By learning to interpret these three fundamental indicators—Moving Averages, RSI, and MACD—you build a robust foundation for your technical analysis. They offer powerful insights into market trends, potential entry and exit points, and overall market sentiment, making them indispensable tools for successful forex trading strategies.

Chart Patterns and Support/Resistance Levels

Ready to unlock some of the most powerful insights in the world of forex trading? Understanding chart patterns and support/resistance levels is like having a secret map to market movements. These are not just lines on a graph; they are the visual echoes of collective market psychology, giving you a serious edge in your forex trading journey.

Think of chart patterns as the market’s way of telling a story. They reveal the ongoing battle between buyers and sellers, often foreshadowing potential trend reversals or continuations. Spotting these formations is a cornerstone of effective technical analysis, helping you anticipate where prices might go next.

Common Chart Patterns You Need to Know:

- Head and Shoulders: A classic reversal pattern, signaling a potential shift from an uptrend to a downtrend (or inverse for downtrend reversal).

- Double Top/Bottom: Another strong reversal indicator. A “double top” shows two failed attempts to break higher, while a “double bottom” signals two failed attempts to push lower.

- Triangles (Ascending, Descending, Symmetrical): These are continuation or breakout patterns. They show a narrowing price range, indicating an impending strong move once the price breaks out of the triangle.

- Flags and Pennants: Short-term continuation patterns that form after a sharp price move, suggesting a temporary pause before the original trend resumes.

Now, let’s talk about support and resistance levels. These are the invisible, yet incredibly significant, horizontal price levels where the market has historically found “floors” (support) or “ceilings” (resistance). When price reaches a support level, demand often increases, pushing the price back up. Conversely, at a resistance level, supply tends to overwhelm demand, causing the price to fall.

Identifying these critical zones is vital for setting your entry and exit points. These levels act as psychological barriers that traders watch closely, making them excellent locations to plan your trades. A key aspect of their nature is their dynamic role:

“What was once resistance can become support, and what was once support can become resistance. This flip is a powerful confirmation of a new market phase.”

The real magic happens when you combine chart patterns with support and resistance. Imagine seeing a “double top” pattern forming precisely at a major resistance level – that’s a powerful signal for a potential downtrend. Or, a “bullish flag” pattern consolidating right above a strong support level – a clear sign that the uptrend is likely to continue.

By learning to read these signals, you’ll gain a deeper understanding of price action and how to interpret market trends. This foundational knowledge is crucial for developing robust trading strategies and significantly improving your decision-making, helping you navigate the exciting world of forex with greater confidence and precision. Practice spotting these on your charts, and watch your analytical skills soar!

Fundamental Analysis: How News Events Impact IQ Option Forex

Ever wondered what truly drives the dynamic world of forex trading? It’s not just charts and indicators. Behind every significant currency movement lies a story, often sparked by powerful news events. This is where fundamental analysis shines, offering you a profound understanding of why currencies strengthen or weaken. For traders on the IQ Option platform, mastering this art means transforming from a reactive observer to a proactive participant, ready to seize opportunities as the global economy unfolds.

Fundamental analysis is your window into the health of an economy. It’s about evaluating a country’s economic prospects, financial stability, and geopolitical standing to predict future currency movements. Imagine having an edge, not just guessing, but understanding the underlying forces that dictate the value of a currency pair. This deep insight empowers your trading decisions, moving beyond simple price action to a more holistic view of the forex market.

So, what kind of news makes waves in the forex world? Here are some of the heavy hitters that consistently impact currency movements:

- Interest Rate Decisions: Central banks, like the Federal Reserve or the European Central Bank, hold immense power. Their announcements on interest rate decisions directly influence a currency’s attractiveness. Higher rates often draw foreign investment, boosting the currency.

- Employment Reports: Key data such as the Non-Farm Payrolls (NFP) in the US or unemployment rates across major economies reflect economic health. Strong employment data signals growth, which can strengthen the respective currency.

- Gross Domestic Product (GDP): The ultimate scorecard of economic output. Robust GDP reports suggest a growing economy, making its currency more appealing to investors.

- Inflation Figures: Consumer Price Index (CPI) and Producer Price Index (PPI) reveal the pace of price increases. Central banks closely monitor these. High inflation might lead to rate hikes, while low inflation could signal rate cuts, both impacting currency value.

- Geopolitical Events: Wars, political instability, trade disputes, or even elections can introduce massive uncertainty, causing investors to seek safe-haven currencies or abandon riskier ones. These geopolitical tensions create rapid shifts in market sentiment.

- Retail Sales and Consumer Confidence: These indicators provide insight into consumer spending, a significant driver of economic growth. Positive figures usually bode well for a currency.

When these news events hit the wires, the market reacts, often with significant volatility. A surprising jobs report or an unexpected interest rate cut can send a currency soaring or plummeting in minutes. As an IQ Option trader, your task is to stay vigilant. Use the integrated economic calendar and real-time news feeds available on many platforms to track these events. Understanding the potential impact beforehand allows you to prepare your trading strategy, whether you’re looking to capitalize on the surge or protect your existing positions.

Successfully navigating news-driven markets requires more than just knowing when the data is released. It demands quick thinking, disciplined risk management, and the ability to interpret the data in context. Sometimes, the market reaction isn’t what you’d intuitively expect, as it often “prices in” anticipated events. Learning to differentiate between anticipated and unexpected news is a critical skill. Joining the IQ Option community means you’re part of a platform that supports your journey, providing the tools you need to integrate fundamental analysis into your everyday trading, helping you make smarter, more informed choices.

Developing an Effective IQ Option Forex Trading Strategy

Embarking on the exciting journey of IQ Option forex trading demands more than just enthusiasm; it requires a well-thought-out, robust strategy. Many new traders jump in hoping for quick wins, but true profitability and sustainable success come from a disciplined approach. Developing an effective forex trading strategy is your compass in the volatile currency markets, guiding your decisions and protecting your capital. Without one, you are essentially gambling, not trading. Let’s explore how you can build a strategy that works for you.

Key Components of a Winning Strategy

An effective IQ Option forex trading strategy isn’t a single magic indicator. It’s a combination of several critical elements working in harmony. Think of it as building a strong foundation for your trading success. Each component plays a vital role in defining your approach to the markets.

- Clear Trading Goals: What do you aim to achieve? Define realistic profit targets and timeframes.

- Robust Risk Management: This is paramount. Determine how much capital you are willing to risk per trade and set stop-loss orders diligently. Protecting your capital is always the first priority.

- Market Analysis Approach: Will you use technical analysis, fundamental analysis, or a combination? Identify your preferred indicators and chart patterns. Understanding how to interpret market data is crucial.

- Defined Entry and Exit Rules: Precision is key. Establish clear conditions for entering a trade and equally clear conditions for taking profits or cutting losses.

- Trading Psychology Management: Your mindset impacts every decision. Learn to control emotions like fear and greed to stick to your trading plan.

The Strategy Development Process

Building your personal forex trading strategy is an iterative process that involves research, testing, and refinement. It’s not a one-time task but an ongoing evolution as you gain experience and market conditions change. Start by choosing a trading style that suits your personality and available time, whether it’s scalping, day trading, swing trading, or position trading.

Consider these steps when constructing your strategy:

- Research and Learn: Dive deep into different technical indicators, chart patterns, and fundamental news events. Understand how they impact currency pairs.

- Define Your Parameters: Based on your research, outline specific rules for trade entry, exit, position sizing, and stop-loss placement. Be as detailed as possible.

- Backtesting: Apply your rules to historical data. See how your strategy would have performed in the past. This helps you identify potential flaws and areas for improvement before risking real money.

- Demo Account Trading: Practice your strategy extensively on an IQ Option demo account. This is a crucial step to gain confidence and fine-tune your approach without financial risk. Treat your demo account seriously, as if it were real money.

- Live Trading (Small Scale): Once confident, transition to a live account with a very small portion of your capital. Monitor performance closely and make minor adjustments as needed.

Advantages of a Solid IQ Option Trading Strategy

| Advantage | Description |

|---|---|

| Discipline & Consistency | A strategy removes emotional decision-making, ensuring you follow a set of rules consistently. This builds discipline. |

| Improved Risk Management | Clear risk parameters mean you know your potential loss before entering a trade, preventing impulsive, oversized positions. |

| Performance Measurement | With a strategy, you can track your trades and objectively assess what works and what doesn’t, leading to continuous improvement. |

| Reduced Stress & Anxiety | Knowing your plan reduces uncertainty, which in turn lowers stress levels during live trading. |

Remember, the best forex trading strategy is one that you understand, trust, and can consistently execute. It’s unique to your risk tolerance, time commitment, and trading goals. Invest the time in developing and refining your strategy; it’s the single most important step towards achieving consistent profitability in IQ Option forex trading. Start crafting your roadmap to success today.

Risk Management Techniques for IQ Option Forex Traders

Diving into the dynamic world of forex trading with platforms like IQ Option offers exciting opportunities, but it’s crucial to understand that success isn’t just about predicting market movements. It’s fundamentally about protecting your capital. Effective risk management is not a luxury; it’s the backbone of sustainable trading. Without it, even the most brilliant market insights can lead to significant losses. Think of it as your trading shield, designed to minimize potential downsides and keep you in the game for the long haul.

Many new traders overlook this vital aspect, jumping straight into live trades without a clear strategy for capital protection. This often results in frustration and early exits from the market. But with a disciplined approach, you can navigate the inherent volatility of currency markets with confidence. Let’s explore some essential techniques every IQ Option trader should master.

Key Pillars of Forex Risk Management

Protecting your trading capital starts with a few core principles. Incorporating these into your daily routine can dramatically improve your longevity and profitability.

- Implement Stop Loss Orders: This is arguably your most critical tool. A stop loss order automatically closes your trade when the market moves against you to a predetermined price point. It caps your potential loss on any single trade, preventing small setbacks from becoming catastrophic. Define your maximum acceptable loss before you even open a position.

- Utilize Take Profit Orders: While not strictly a risk management tool in the sense of limiting losses, a take profit order helps lock in gains at a specific price level. It removes emotional decision-making from closing profitable trades, ensuring you don’t watch a winning position turn into a loser because of greed or indecision.

- Master Position Sizing: This technique is about determining the appropriate amount of capital to allocate to each trade. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade. For example, if you have $1,000, you wouldn’t risk more than $10-$20 per trade. This conservative approach ensures that a string of losses doesn’t wipe out your account.

- Understand Leverage and Margin: Leverage can amplify both your profits and your losses. While it allows you to control a larger position with a smaller amount of capital, it also increases your exposure. Always be aware of your margin requirements and the potential for a margin call. Using excessive leverage is a common pitfall for new traders.

The Human Element: Taming Emotional Trading

Even with the best technical strategies, human emotions can derail your efforts. Emotional trading – driven by fear, greed, or impatience – is a significant source of avoidable losses. It leads to impulsive decisions that contradict your well-researched trading strategy.

Consider these points for mental discipline:

- Stick to Your Plan: Develop a robust trading plan and commit to following it. Don’t deviate because of short-term market noise or external pressure.

- Practice on a Demo Account: Demo accounts on platforms like IQ Option are invaluable. They allow you to test strategies, understand market dynamics, and build confidence without risking real money. Use it to solidify your risk management principles before going live.

- Maintain a Trading Journal: Document every trade, including your entry/exit points, reasons for the trade, and the outcome. Crucially, also note your emotional state. This helps you identify patterns in your behavior and refine your approach.

- Never Overtrade: Resist the urge to constantly be in the market. Quality over quantity is key. Wait for high-probability setups that align with your strategy.

By diligently applying these forex risk management techniques, you transform yourself from a hopeful speculator into a strategic investor. Your goal isn’t just to make money, but to sustainably grow your capital protection over time, making every trade a calculated move in your journey with IQ Option.

Setting Stop-Loss and Take-Profit Orders on IQ Option

Every successful trader understands the critical role of robust risk management. Two indispensable tools in your arsenal are Stop-Loss (SL) and Take-Profit (TP) orders. These aren’t just features; they are your automated guardians, designed to protect your hard-earned capital and lock in profits, especially when engaging in dynamic markets like forex trading on the IQ Option platform.

Think of them as pre-set instructions you give to your broker. A Stop-Loss order automatically closes your trade if the market moves against your position to a specific, predefined stop-loss level. Conversely, a Take-Profit order automatically closes your trade when it reaches a certain profitable take-profit level, securing your desired profit target. This dual approach ensures you have a clear exit strategy for every trade from the moment you enter.

Why Smart Traders Use SL and TP:

- Capital Protection: Stop-Loss orders are your first line of defense. They prevent small losses from snowballing into significant damage to your account balance.

- Profit Locking: Take-Profit orders ensure you don’t miss out on gains when the market hits your target, even if you’re away from your screen.

- Emotional Detachment: By pre-setting these levels, you remove the human element of fear and greed, helping you avoid impulsive decisions driven by market fluctuations. This is key to preventing emotional trading.

- Automated Execution: Once set, these orders are handled by the platform, providing peace of mind and freeing you from constant market monitoring. This is true automated execution.

- Clear Trading Strategy: They are an integral part of any disciplined trading strategy, giving structure to your trade management.

How to Set Them on the IQ Option Platform:

Setting your Stop-Loss and Take-Profit levels on IQ Option is straightforward. When you open a new trade:

- Choose your asset and investment amount.

- Look for the ‘Auto-close’ or ‘Stop-Loss/Take-Profit’ section, typically found near the trade entry panel.

- Activate the Stop-Loss option and input your desired percentage, specific price level, or amount of loss you’re willing to accept. The platform will show you the corresponding price.

- Activate the Take-Profit option and input your desired percentage, specific price level, or amount of profit you aim for. The platform will display the corresponding price.

- Confirm your trade. Your SL and TP orders are now active!

“The essence of good trading is not merely to win often, but to keep your losses small and your wins large.” – A seasoned trader’s wisdom. This perfectly encapsulates the power of SL/TP.

“The essence of good trading is not merely to win often, but to keep your losses small and your wins large.” – A seasoned trader’s wisdom. This perfectly encapsulates the power of SL/TP.

Key Considerations for Setting Levels:

| Factor | Impact on SL/TP Settings |

|---|---|

| Market Volatility | Higher volatility might require wider SL/TP to avoid premature exits. |

| Technical Analysis | Use support and resistance levels, trend lines, or indicator signals to define logical entry and exit points. |

| Risk-Reward Ratio | Aim for a favorable ratio (e.g., risking 1 unit to gain 2 or 3 units) to ensure profitability over time. |

| Trading Style | Scalpers might use very tight SL/TP, while swing traders might opt for wider parameters. |