- Understanding IQ Option and Cryptocurrency Basics

- What is IQ Option?

- The Rise of Cryptocurrency

- IQ Option and Cryptocurrency: A Powerful Combination

- Why IQ Option for Trading Crypto? Key Advantages

- Getting Started: Setting Up Your IQ Option Account

- Your Easy Path to Registration:

- The Power of the IQ Option Demo Account

- Transitioning to a Real Account

- Demo vs. Real Account: Key Differences

- Registration and Verification Steps

- Getting Your Account Setup: The Registration Process

- Securing Your Account: The Verification Process (KYC)

- Depositing Funds for Crypto Trading

- Navigating the IQ Option Trading Platform

- Getting Started: Your First Steps

- Exploring the User-Friendly Interface

- Key Interface Elements You’ll Encounter:

- Unlocking Trading Potential with Integrated Tools

- Interface Overview and Tools for Crypto Trading

- Key Elements of a Crypto Trading Interface

- Essential Trading Tools for Crypto Enthusiasts

- How to Trade Crypto on IQ Option: Step-by-Step Guide

- Your Path to Crypto Trading on IQ Option

- Essential Tips for Successful Crypto Trading on IQ Option

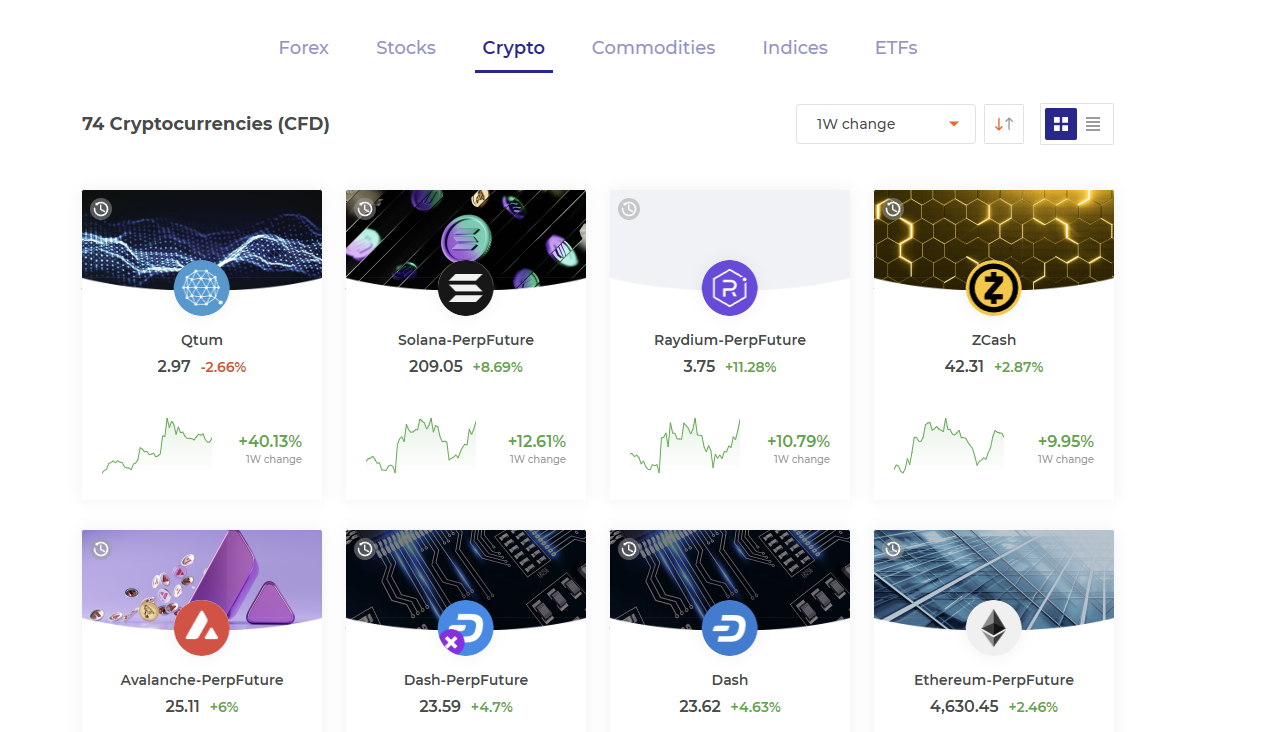

- Available Cryptocurrencies and Trading Instruments on IQ Option

- Unlocking the Crypto Market

- A Spectrum of Traditional and Modern Trading Instruments

- Forex Trading: The World’s Largest Market

- Stocks, Commodities, and ETFs via CFDs

- Digital Options: High Potential, Defined Risk

- Effective Strategies for IQ Option Crypto Trading

- The Pillars of Profitable Crypto Trading

- Essential Tools for Market Analysis

- The Golden Rule: Risk Management

- Mindset and Continuous Learning

- Technical and Fundamental Approaches for Crypto

- Understanding Technical Analysis in Crypto

- Exploring Fundamental Analysis in Crypto

- Combining Both Approaches for Optimal Strategy

- Risk Management Essentials in Crypto Trading

- Key Pillars of Crypto Risk Management

- The Human Element: Managing Emotions

- Implementing Stop-Loss and Take-Profit on IQ Option

- Setting Your Orders: A Quick Guide

- Why These Tools Are Your Best Friends

- Understanding Fees, Spreads, and Rollovers on IQ Option

- Withdrawing Your Profits from IQ Option

- Your Withdrawal Journey: A Simple Path

- Key Considerations for a Smooth Withdrawal

- Popular IQ Option Withdrawal Methods

- Withdrawal Method Comparison

- Tips for a Seamless IQ Option Withdrawal Experience

- Security, Regulation, and Customer Support

- Your Funds, Your Protection: Top-Tier Security

- The Regulator’s Watch: A Mark of Trust

- Always There for You: Exceptional Customer Support

- Pros and Cons of IQ Option Trading Crypto

- Advantages of Trading Crypto on IQ Option

- Disadvantages of Trading Crypto on IQ Option

- Tips for Maximizing Success in IQ Option Crypto Trading

- Develop and Refine Your Crypto Trading Strategies

- Master Robust Risk Management

- Harness the Power of Technical Analysis on IQ Option

- Understand Market Sentiment and News

- Practice Smart Diversification Crypto Strategies

- Keep a Detailed Trading Journal

- Utilize Demo Account Practice Extensively

- Stay Updated with Crypto News and Trends

- Cultivate Emotional Discipline

- Frequently Asked Questions

Understanding IQ Option and Cryptocurrency Basics

Diving into the world of online trading can feel like exploring a vast, dynamic ocean. But with the right tools and knowledge, you can navigate these waters with confidence and uncover incredible opportunities. Today, we’re going to demystify two powerful forces in the financial landscape: IQ Option and the exciting realm of cryptocurrencies. Together, they create a compelling pathway for traders looking to explore modern financial instruments.

What is IQ Option?

Imagine a sophisticated, user-friendly platform designed to put global financial markets at your fingertips. That’s IQ Option. It’s an acclaimed online trading platform that allows you to engage with a diverse range of assets, from traditional forex pairs and stocks to commodities and, crucially, digital assets like cryptocurrencies. IQ Option is built to be intuitive, offering powerful analytical tools and a straightforward interface that appeals to both seasoned traders and newcomers alike. It’s about empowering you to make informed decisions and act on market movements efficiently.

The Rise of Cryptocurrency

Cryptocurrency has transformed the financial conversation, emerging as a groundbreaking form of digital currency built on an innovative technology called blockchain. Unlike traditional money issued by governments, cryptocurrencies like Bitcoin and Ethereum are decentralized, secure, and operate globally 24/7. Their rapid growth and volatility have captured the attention of investors worldwide, offering unique profit potential. Trading these digital assets means engaging with a market driven by technology, global sentiment, and real-world adoption.

Here’s why many traders find cryptocurrency trading particularly appealing:

- Unprecedented Volatility: While it carries risk, significant price swings can lead to substantial gains.

- Global Accessibility: The crypto market never sleeps, allowing trading at any time, from anywhere.

- Diversification: Adding digital assets to your portfolio can offer a fresh way to diversify beyond traditional markets.

- Technological Innovation: Investing in crypto also means being part of a movement that’s reshaping how we think about money and transactions.

IQ Option and Cryptocurrency: A Powerful Combination

Bringing IQ Option and cryptocurrency together creates a seamless experience for those eager to participate in this cutting-edge market. The platform simplifies access to major cryptocurrencies, allowing you to execute crypto trading strategies with ease. You can analyze market trends, apply various indicators, and manage your positions all within a single, integrated environment. This synergy means you don’t need a separate crypto exchange; you can start trading digital assets directly through your IQ Option account.

Consider the benefits:

| Feature | Benefit to Crypto Traders |

|---|---|

| Integrated Platform | Trade crypto alongside other assets without switching interfaces. |

| User-Friendly Interface | Easy for beginners to grasp, yet powerful for advanced analysis. |

| Advanced Tools | Access to charts, indicators, and market analysis tools for better decision-making. |

| Quick Execution | Swift order placement to capitalize on fast-moving crypto markets. |

As renowned financial analyst Michael Saylor once noted, “Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, an unstoppable, exponentially expanding, intelligent asset.” This highlights the disruptive and intelligent nature of these digital assets, and platforms like IQ Option provide the gateway to participate in this revolution. Understanding these basics is your first step towards potentially unlocking new avenues for growth in your trading journey.

Why IQ Option for Trading Crypto? Key Advantages

Are you ready to explore the dynamic world of trading crypto? Choosing the right platform is your first critical step. Many enthusiastic traders discover IQ Option offers an exceptional environment for engaging with digital assets. It provides a blend of accessibility, powerful tools, and a user-friendly experience that truly stands out.

IQ Option features an incredibly low minimum deposit, making it accessible to virtually anyone. You can begin exploring market opportunities without needing a substantial initial investment, and a free demo account allows you to experiment with strategies without any financial risk.

Here are some compelling reasons why IQ Option could be your go-to crypto trading platform:

- Unmatched Accessibility: Starting your journey into the world of cryptocurrency has never been easier. IQ Option features an incredibly low minimum deposit, making it accessible to virtually anyone. You can begin exploring market opportunities without needing a substantial initial investment.

- Intuitive User-Friendly Interface: Whether you are a seasoned trader or just starting out, you will appreciate IQ Option’s highly user-friendly interface. Its clean design and straightforward navigation ensure a smooth trading experience. Focus on your strategy, not on figuring out the platform.

- Diverse Cryptocurrency Selection: Gain access to a diverse cryptocurrency portfolio. IQ Option allows you to trade a wide range of popular coins, from Bitcoin and Ethereum to many other trending digital assets. This variety empowers you to diversify your portfolio and seize different market opportunities.

- Advanced Trading Tools at Your Fingertips: Equip yourself with powerful resources. The platform offers a comprehensive suite of advanced trading tools, including technical indicators, customizable charts, and analytical features. These tools are designed to help you make informed decisions when you are trading crypto.

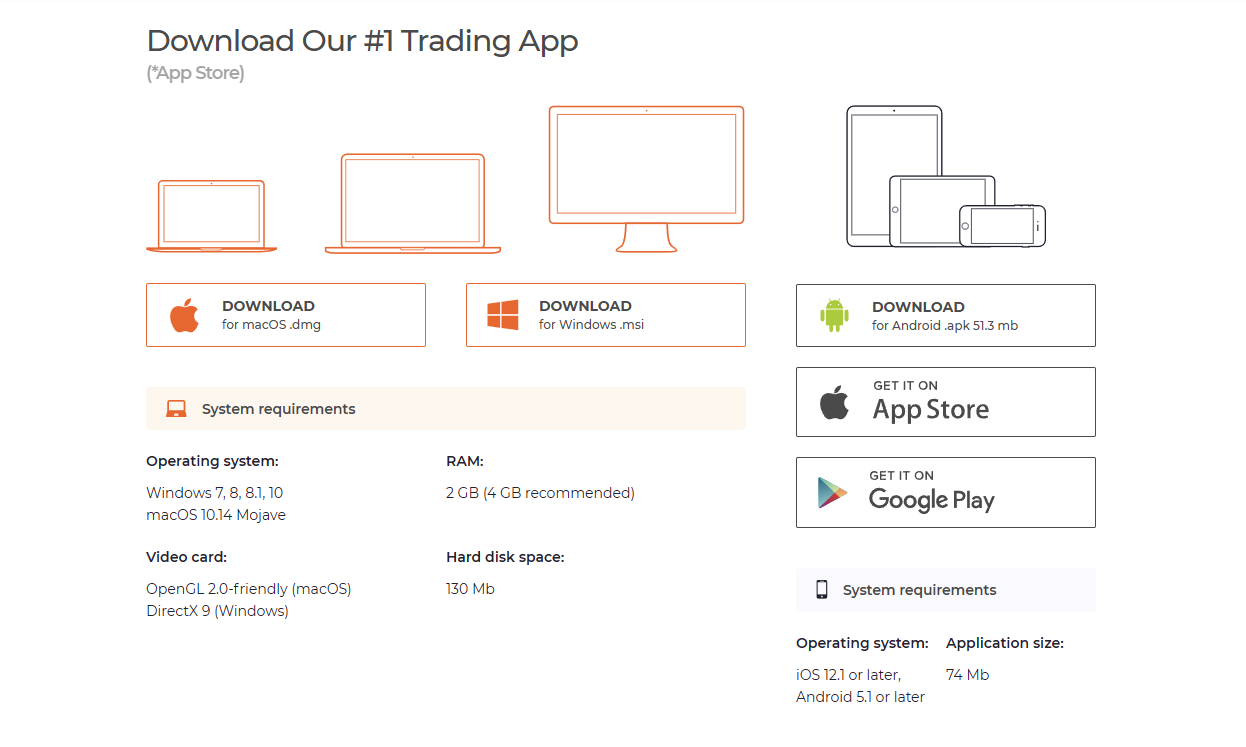

- Seamless Mobile Trading Experience: Never miss a beat. With the dedicated IQ Option mobile app, you can manage your trades and monitor the markets from anywhere. Enjoy a full-featured trading experience directly from your smartphone or tablet, ensuring flexibility and convenience.

- Risk-Free Learning with a Demo Account: Practice makes perfect, especially in trading. IQ Option provides a free demo account pre-loaded with virtual funds. This allows you to experiment with strategies, understand market dynamics, and get comfortable with the platform’s features without any financial risk before you commit real capital to trading crypto.

- Fast Execution and Robust Risk Management: Experience lightning-fast execution of your trades, a critical factor in the volatile crypto markets. Furthermore, IQ Option integrates essential risk management tools to help you protect your capital and control potential losses. Trade with greater confidence knowing these features support you.

Getting Started: Setting Up Your IQ Option Account

Embarking on your trading journey is an exciting step, and setting up your IQ Option account is your first port of call. This popular trading platform is known for its intuitive design and diverse range of financial instruments. Whether you’re a seasoned trader or just starting out, getting registered is a straightforward process that opens the door to a world of market opportunities. Let’s walk through it together and get you ready to explore the financial markets with confidence.

Your Easy Path to Registration:

Signing up for an IQ Option account is designed to be quick and hassle-free, allowing you to dive into trading without unnecessary delays. Follow these simple steps to get your account operational:

- Visit the IQ Option Website: Navigate to the official IQ Option homepage. Look for the “Sign Up” or “Register” button, usually prominently displayed on the main page.

- Enter Your Details: You’ll be prompted to provide basic information such as your email address and a strong password. You might also have the option to register using your social media accounts for even faster access.

- Agree to Terms: Read and accept the Terms and Conditions and the Privacy Policy. It’s crucial to understand the platform’s rules and your responsibilities as a user.

- Email Verification: After submitting your details, check your inbox for a verification email from IQ Option. Click the link inside to confirm your email address and activate your account. This step is vital for security.

- Complete Profile Information: Once verified, log in and complete your profile. This often includes providing personal details like your full name, date of birth, and country of residence. This information is required for regulatory compliance and ensures the security of your funds.

The Power of the IQ Option Demo Account

One of the best features of the IQ Option platform is the free demo account. This is an invaluable tool for new traders and a great way to familiarize yourself with the platform’s functionality and various trading strategies without any financial risk. You receive virtual funds, typically $10,000, which you can use to practice trading. It’s the perfect environment to learn how to place trades, understand market movements, and experiment with different assets before you commit any real capital.

Here’s why starting with a demo account is highly recommended:

- Risk-Free Learning: Practice with virtual money and make mistakes without losing actual funds.

- Platform Familiarity: Get comfortable with the user-friendly interface, charting tools, and order types.

- Strategy Testing: Experiment with various trading strategies and see how they perform in real-time market conditions.

- Access to Assets: Explore different financial instruments like forex, stocks, crypto, and commodities.

Transitioning to a Real Account

Once you feel confident and have developed a basic understanding of how the platform works, you can easily switch to a real account. This involves making your first deposit, which can be done using various secure payment methods available on the platform. Remember, only deposit funds you can afford to lose, as trading always involves risk.

Demo vs. Real Account: Key Differences

| Feature | Demo Account | Real Account |

|---|---|---|

| Funds | Virtual, replenishable | Real, deposited funds |

| Risk | None | Financial risk involved |

| Psychology | Low emotional impact | High emotional impact |

| Withdrawals | Not applicable | Available (after verification) |

| Learning | Primary focus | Application of learning |

Pro Tip from an Expert: “Take your time with the demo account. It’s not a race to start trading with real money. Master the platform, understand your chosen assets, and develop a solid strategy before making your first real investment. Patience and practice are your best friends in the financial markets.”

With your IQ Option account set up and the power of the demo account at your fingertips, you are now well-equipped to begin your trading adventure. The world of online trading offers incredible opportunities, and IQ Option aims to make it accessible to everyone. So, go ahead, complete your registration, explore the platform, and get ready to start trading!

Registration and Verification Steps

Embarking on your journey into the exciting world of forex trading begins with a few straightforward steps: registering your account and completing the essential verification process. We’ve streamlined everything to get you trading quickly and securely. Think of it as your express pass to the global financial markets!

Getting Your Account Setup: The Registration Process

Setting up your account is surprisingly simple. We designed it to be intuitive, allowing you to focus on what matters most: exploring trading opportunities. Here’s how you do it:

- Visit Our Platform: Navigate to our website and locate the “Register” or “Sign Up” button. It’s usually prominent and easy to find.

- Fill Out the Form: Provide some basic information. We typically ask for your full name, a valid email address, and a secure password. Choose a strong password to protect your future trading activities!

- Agree to Terms: Read through our Terms and Conditions and Privacy Policy. It’s important to understand how we operate and protect your data. Check the box to confirm you agree.

- Submit Your Details: Click the “Register” button. You might receive an email asking you to confirm your email address – just click the link in that email to proceed.

That’s it! Your account is now created. You’re one step closer to making your first trade.

Securing Your Account: The Verification Process (KYC)

Once you’ve registered, the next crucial step is verification. This process, often known as “Know Your Customer” (KYC), is a standard industry practice. It ensures the safety of your funds, complies with international financial regulations, and prevents fraud. It also gives us confidence that you are who you say you are, fostering a trusted trading environment for everyone.

To complete your verification, you will need to provide a couple of documents. Don’t worry, the process is digital and usually takes just a few minutes to upload. We aim for quick processing so you can start trading without unnecessary delays.

Here are the common documents required for verification:

- Proof of Identity: A clear, color copy of a valid government-issued photo ID. This could be your national ID card, passport, or driver’s license. Ensure all four corners of the document are visible, and the text is legible.

- Proof of Address: A recent utility bill (electricity, water, gas, internet), bank statement, or credit card statement. This document should be dated within the last three to six months and clearly show your name and residential address. Screenshots or photos of online bills are usually acceptable, provided they are complete and unaltered.

Benefits of Completing Verification:

| Benefit | Description |

|---|---|

| Enhanced Security | Protects your account from unauthorized access and potential fraud. |

| Full Account Access | Unlocks all platform features, including deposit and withdrawal functionalities. |

| Regulatory Compliance | Ensures we adhere to global anti-money laundering (AML) and counter-terrorism financing (CTF) laws. |

| Trusted Environment | Contributes to a safe and reliable trading ecosystem for all participants. |

Our team reviews submitted documents efficiently. Once approved, you receive a confirmation, and your account will be fully activated. You are then ready to explore the exciting possibilities of the forex market!

Depositing Funds for Crypto Trading

Ready to dive into the electrifying world of crypto trading? Exciting! But before you can make your first move in the market, there’s one vital step: getting your funds onto a crypto exchange. Think of it as fueling up your rocket ship before launch. This process is straightforward, designed to be as smooth as possible, allowing you to quickly transition from observer to active participant. Understanding how to securely deposit funds is your first key to unlocking the vast opportunities that cryptocurrencies present.

Getting money into your trading account is easier than you might think, with various secure deposit methods tailored for different preferences. Whether you’re dealing with traditional fiat currency or already have some digital assets, there’s a path for you to fund your journey.

Popular Ways to Fuel Your Crypto Trading Account

Crypto exchanges offer several flexible options to add funds. Here are the most common approaches:

- Bank Transfer (Wire Transfer/ACH): Often preferred for larger sums due to lower transaction fees. While it might take a day or two for funds to clear, it’s a reliable method. Many traders appreciate the security and cost-effectiveness of a direct bank transfer.

- Credit/Debit Card: This is arguably the quickest way to get started. You can use your credit card or debit card for instant deposits, making it ideal for those eager to jump into the market right away. Be aware that these transactions usually come with higher fees compared to bank transfers.

- E-Wallets (e.g., PayPal, Skrill, Neteller): Some crypto exchanges integrate with popular e-wallets, offering another convenient and often fast way to deposit funds. Check if your preferred exchange supports this option.

- Cryptocurrency Deposits: If you already own crypto in an external cryptocurrency wallet, you can transfer it directly to your exchange account. This involves selecting the specific crypto, generating a deposit address, and sending your assets over the blockchain network. This method is usually fast, depending on network congestion.

What to Consider Before You Deposit

Before you commit, it’s smart to look at a few details. These will help you choose the best method for your needs and ensure a smooth experience:

| Consideration | Why it Matters |

|---|---|

| Transaction Fees | Fees can vary significantly between deposit methods. A credit card deposit might be instant but pricier, while a bank transfer could be cheaper but take longer. Always check the fees clearly displayed by your chosen crypto exchange. |

| Deposit Limits | Exchanges often impose minimum and maximum deposit limits. These can vary based on your account verification level and the chosen method. Make sure your desired deposit amount falls within these ranges. |

| Processing Time | How quickly do you need your funds available? Bank transfers can take hours or days, while credit card or crypto deposits are often instant or near-instant. Understanding this helps manage your trading expectations. |

| Security and Compliance | Always use a reputable crypto exchange that prioritizes fund security. Ensure your account verification is complete, as this often unlocks higher limits and ensures compliance with financial regulations. Look for features like two-factor authentication. |

Your Simple Deposit Journey

The general steps for depositing funds are quite universal across most platforms:

- Log In: Access your account on your chosen crypto exchange.

- Navigate to Deposits: Look for a “Deposit” or “Add Funds” section, usually found in your wallet or account dashboard.

- Select Method: Choose your preferred deposit method (e.g., bank transfer, credit card, crypto).

- Enter Details: Provide the necessary information (e.g., bank account details, card number, crypto address).

- Confirm & Fund: Review all details and confirm the transaction. Your funds will then be processed.

Once your funds are deposited, you’re officially ready to begin your crypto trading adventure! The market is dynamic, exciting, and full of possibilities. By understanding these initial steps, you set yourself up for a confident start. Happy trading!

Navigating the IQ Option Trading Platform

Embarking on your trading journey requires a reliable and intuitive platform. The IQ Option trading platform stands out as a popular choice for many, offering a gateway to various financial markets. Whether you’re interested in forex trading, digital options, or CFDs, understanding how to navigate this powerful tool is your first step towards informed decision-making. We’ll explore its features, layout, and how you can make the most of its capabilities, ensuring a smooth and engaging experience for both new and experienced traders.

Getting Started: Your First Steps

Joining the IQ Option community is straightforward. The platform prioritizes ease of access, allowing you to set up an account quickly. Once registered, you gain immediate access to a free demo account, a crucial tool for learning without financial risk. This practice environment perfectly mirrors the live trading conditions, giving you ample opportunity to explore the interface, test strategies, and familiarize yourself with different asset classes before committing real capital.

- Account Registration: Simple sign-up process, typically requiring an email and password.

- Verification: A standard procedure for security and compliance, ensuring your funds and data are safe.

- Demo Account Access: Instantly available with virtual funds, ideal for skill development and strategy testing.

- Fund Your Account: Various secure deposit methods are available when you’re ready for live trading.

Exploring the User-Friendly Interface

The core strength of the IQ Option platform lies in its clean and highly functional layout. From the moment you log in, you’ll notice a well-organized workspace designed to put all essential trading tools at your fingertips. The central area features a customizable chart, your primary window into market movements. To the right, the trade panel allows for quick order placement, while the top bar provides easy access to asset selection, account balances, and various platform settings.

Key Interface Elements You’ll Encounter:

| Element | Function |

|---|---|

| Trading Chart | Visualize price movements with various chart types (candlestick, bar, line, Heikin-Ashi) and timeframes. |

| Asset Selection | Choose from a wide range of assets including currency pairs, cryptocurrencies, stocks, and commodities. |

| Trade Panel | Set investment amount, expiry time (for options), leverage, and execute buy/sell orders. |

| Technical Analysis Tools | Access a suite of indicators (moving averages, Bollinger Bands, RSI) and graphical tools (trend lines, Fibonacci retracements). |

Unlocking Trading Potential with Integrated Tools

Beyond its simple appearance, the IQ Option platform is packed with powerful features designed to enhance your online trading experience. The integrated technical analysis tools allow you to spot trends, identify potential entry and exit points, and refine your strategies directly within the platform. You can customize your charts, apply multiple indicators, and draw various analytical objects, all contributing to a more comprehensive market understanding. This rich set of trading tools empowers you to make data-driven decisions.

One of the significant advantages is the seamless transition between different markets. You can easily switch from analyzing a major currency pair to reviewing a popular cryptocurrency, all within the same intuitive environment. This flexibility, combined with robust charting capabilities, makes IQ Option a versatile choice for traders looking to diversify their portfolios.

As you become more comfortable, remember that effective risk management is paramount. The platform provides features like stop-loss and take-profit orders for CFDs, helping you define your risk exposure and lock in profits automatically. Always approach trading with a clear strategy and a disciplined mindset to navigate the markets successfully.

Interface Overview and Tools for Crypto Trading

Diving into the world of crypto trading means getting familiar with your command center: the trading platform interface. Think of it as your cockpit – an intuitive, feature-rich design is crucial for making quick, informed decisions in a fast-moving market. A well-designed crypto trading platform helps you navigate volatility with confidence, putting all the essential information and trading tools right at your fingertips.

When you first log in, you will notice a standard layout designed to provide market insights and execution capabilities. While each platform has its unique flair, the core components of a user interface are usually consistent, ensuring you can quickly adapt as you explore different exchanges.

Key Elements of a Crypto Trading Interface

- Price Chart: This is your visual representation of a cryptocurrency’s historical price movements. It’s where you conduct most of your technical analysis, spotting trends and patterns.

- Order Book: Here you see the real-time supply and demand for an asset. It displays pending buy orders (bids) and sell orders (asks) at various price levels, giving you a sense of market depth.

- Order Entry Panel: This is where you place your trades. You specify the type of order (market, limit, stop-limit), the quantity, and the price.

- Wallet Management: An integrated section for viewing your balances, depositing funds, and withdrawing assets. Effective wallet management is critical for securing your capital.

- Trade History/Open Orders: You can track your past trades and monitor any active orders waiting to be filled.

- News Feed/Market Data: Many interfaces provide a stream of market news, announcements, and real-time data to help you stay informed.

Beyond the layout, the true power lies in the advanced trading tools available. These are designed to empower your market analysis and execution strategies. Mastering these tools elevates your trading from speculative guesses to strategic moves.

Essential Trading Tools for Crypto Enthusiasts

Traders rely heavily on various features to predict market movements and manage their positions. Here are some of the most powerful tools you will encounter:

| Tool Category | Description | Key Benefit |

|---|---|---|

| Charting Tools | Advanced graphs with customizable timeframes and display types (candlestick, line, bar). | Visualizing price action and identifying trends. |

| Technical Indicators | Mathematical calculations based on price, volume, or open interest (e.g., RSI, MACD, Moving Averages). | Signaling potential entry/exit points and confirming trends. |

| Drawing Tools | Ability to add trend lines, Fibonacci retracements, support/resistance levels directly on charts. | Enhancing market analysis and marking key levels. |

| Risk Management Features | Stop-loss and take-profit orders, margin calls, and portfolio trackers. | Protecting capital and locking in gains automatically. |

| Alerts & Notifications | Customizable price alerts and news notifications. | Staying informed without constant monitoring. |

Successful crypto trading hinges on your ability to utilize these tools for thorough market analysis. From understanding the nuances of the order book to interpreting the signals from technical indicators, every feature serves a purpose in your strategy. Always remember that real-time data is your best friend; it helps you react swiftly to market changes and implement your risk management plan effectively.

Choosing a platform with an interface that resonates with your trading style and provides access to robust trading tools makes a significant difference. Spend time exploring, practicing, and familiarizing yourself with every component. Your journey in crypto begins with a solid understanding of your trading environment.

How to Trade Crypto on IQ Option: Step-by-Step Guide

Are you ready to dive into the electrifying world of digital currencies? Trading crypto on IQ Option opens up a universe of possibilities for both new and experienced traders. This comprehensive guide will walk you through every essential step, helping you navigate the platform and begin your cryptocurrency trading journey with confidence. IQ Option offers a dynamic environment for accessing popular digital assets through Contract for Differences (CFDs), letting you speculate on price movements without owning the underlying asset.

Your Path to Crypto Trading on IQ Option

Embarking on your digital asset trading adventure is simpler than you might think. Follow these clear steps to set up your account, fund it, and place your first trade.

- Create Your Account: Your journey begins here. Visit the IQ Option website and click on the “Sign Up” button. You’ll need to provide basic information like your email and choose a strong password. This initial step is quick and straightforward, getting you ready to explore the platform in minutes.

- Verify Your Profile: After signing up, IQ Option requires you to verify your identity. This is a crucial security measure and a standard practice for regulated online trading platforms. You’ll typically need to upload a photo of your ID (like a passport or driving license) and proof of residence (utility bill or bank statement). Completing this ensures the safety of your funds and allows for smooth withdrawals later on.

- Deposit Funds: Once your account is set up and verified, it’s time to fund your trading account. IQ Option supports a variety of deposit methods, including bank cards, e-wallets, and bank transfers. Choose the option that best suits you and decide on your initial investment amount. Remember, you can start with a relatively small sum, which is great for new traders looking to manage risk.

- Select Your Crypto Asset: With funds in your account, head to the trading interface. Look for the “Trade” button or the asset selection menu. You’ll find a wide array of cryptocurrencies available for trading, such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many more. Choose the digital asset you wish to trade.

- Analyze the Market: Before placing a trade, take some time for market analysis. IQ Option provides excellent tools, including various indicators (like Moving Averages, RSI, MACD) and charting options. Pay attention to current news and market sentiment surrounding your chosen cryptocurrency. Understanding market trends is key to making informed decisions and effective cryptocurrency trading.

- Place Your Trade: Ready to act? Decide whether you believe the price of the crypto asset will rise or fall.

- Buy (Call/Up): Choose this if you expect the price to increase.

- Sell (Put/Down): Select this if you anticipate a price decrease.

“Effective risk management is not just a suggestion; it’s the bedrock of sustained success in online trading.”

Set a Stop-Loss to automatically close your trade if the market moves against you beyond a certain point, limiting potential losses. Also, consider setting a Take-Profit to lock in gains once the price reaches your desired level. - Monitor and Close Your Trade: Once your trade is open, you can monitor its performance in real-time. Keep an eye on market developments and be prepared to adjust your strategy if necessary. You can close your trade manually at any point to secure profits or minimize losses, or let your Stop-Loss or Take-Profit levels trigger automatically.

Essential Tips for Successful Crypto Trading on IQ Option

Trading digital assets carries inherent risks, but with the right approach, you can enhance your chances of success. Here are some key considerations:

- Start with a Demo Account: IQ Option offers a free demo account with virtual funds. This is an invaluable tool for practicing your strategies, familiarizing yourself with the platform, and understanding how crypto trading works without risking real money.

- Understand Volatility: Cryptocurrencies are known for their high price volatility. This can lead to significant gains but also considerable losses. Approach the market with caution and never invest more than you can afford to lose.

- Stay Informed: The crypto market is heavily influenced by news, technological advancements, regulatory changes, and broader economic events. Keeping up-to-date with relevant information can give you an edge.

- Diversify Your Portfolio: While IQ Option offers numerous digital assets, consider diversifying your trades across different cryptocurrencies to spread risk.

By following this step-by-step guide and applying these practical tips, you can confidently begin your journey to trade crypto on IQ Option. Embrace the opportunities, manage your risks wisely, and enjoy the thrill of the digital currency markets!

Available Cryptocurrencies and Trading Instruments on IQ Option

Diving into the world of online trading means finding a platform that offers the tools and assets you need to succeed. IQ Option stands out for its impressive array of trading instruments, catering to both seasoned professionals and those just starting their journey. This diversity allows you to explore various markets, manage risk, and truly build a comprehensive trading strategy.

Unlocking the Crypto Market

The rise of digital assets has reshaped finance, and IQ Option offers a dynamic gateway to this exciting realm. You can engage in crypto trading directly through CFDs on a variety of popular cryptocurrencies. This means you don’t actually own the underlying asset, but rather speculate on its price movements. It’s an incredibly accessible way to participate in the volatile, yet rewarding, crypto market.

- Bitcoin (BTC): The pioneer, still dominating headlines.

- Ethereum (ETH): Powering the world of decentralized applications.

- Ripple (XRP): Focused on fast, low-cost international payments.

- Litecoin (LTC): Often called the “silver to Bitcoin’s gold.”

- Solana (SOL): Known for its high transaction speeds and scalability.

- And many more emerging altcoins, giving you ample choices for your portfolio.

Trading crypto CFDs on IQ Option offers flexibility, allowing you to react quickly to market shifts without the complexities of managing a crypto wallet.

A Spectrum of Traditional and Modern Trading Instruments

Beyond the digital frontier, IQ Option provides access to a broad range of traditional financial markets. This ensures every trader finds their niche and can apply various strategies.

Forex Trading: The World’s Largest Market

Forex trading remains a cornerstone for many traders, and IQ Option delivers. You can trade major, minor, and exotic currency pairs, speculating on the exchange rate fluctuations between different national currencies. Think of it as predicting how one country’s economy will perform against another. The liquidity and 24/5 nature of the forex market make it incredibly appealing for fast-paced trading.

Stocks, Commodities, and ETFs via CFDs

IQ Option empowers you to participate in other crucial markets through CFDs:

| Instrument Type | What You Trade | Market Example |

|---|---|---|

| Stocks | Price movements of shares from global companies | Apple, Tesla, Google, Amazon |

| Commodities | Fluctuations in raw materials and agricultural products | Gold, Oil, Silver, Natural Gas |

| ETFs | Baskets of assets that track an index, sector, or commodity | S&P 500 ETF, Technology Sector ETF |

Trading these assets as CFDs means you can potentially profit from both rising and falling markets, adding another layer of strategic depth to your trading. It’s an efficient way to gain exposure to different sectors and global economies without direct ownership.

Digital Options: High Potential, Defined Risk

IQ Option became famous for its unique approach to options trading. Digital options allow you to predict whether an asset’s price will be higher or lower than a specific strike price at an expiry time. With a clear potential profit and a defined maximum loss before you even place the trade, they offer a very transparent risk-reward profile. This structure attracts many traders looking for high-return opportunities with managed risk.

The vast selection of trading instruments on IQ Option empowers you to build a diverse portfolio. Whether your interest lies in the fast-paced world of cryptocurrencies, the global influence of forex trading, or the stability of major stocks and commodities, this platform provides the tools to explore and execute your financial ambitions. This variety is key for adapting to different market conditions and truly mastering the art of trading.

Effective Strategies for IQ Option Crypto Trading

Diving into the fast-paced world of cryptocurrency trading on IQ Option offers incredible opportunities for those ready to navigate its unique dynamics. As a leading online trading platform, IQ Option makes accessing digital assets straightforward, but success hinges on employing smart, disciplined strategies. Forget guesswork; we are talking about a systematic approach to unlock the potential of the crypto market.

Mastering IQ Option crypto trading involves more than just picking popular coins. It requires understanding market movements, managing risk effectively, and utilizing the right tools. Let’s explore some proven cryptocurrency trading strategies that can sharpen your edge.

The Pillars of Profitable Crypto Trading

Successful traders on IQ Option often lean on a combination of foundational strategies, adapting them to the volatile nature of digital assets. Here are a few to consider:

- Trend Following: Ride the Wave

This strategy involves identifying the prevailing direction of a cryptocurrency’s price and trading in alignment with it. If Bitcoin is trending upwards, you look for buying opportunities. If Ethereum is heading down, you might consider shorting or avoiding long positions. Use moving averages or trend lines to confirm the direction. The key is to enter early and exit when the trend shows signs of reversal. - Breakout Trading: Seize the Momentum

Cryptocurrencies often consolidate within a specific price range before making a significant move. Breakout trading capitalizes on these moments. Traders look for prices to “break out” above resistance or below support levels, signaling the start of a new trend. Confirm the breakout with increased trading volume for higher probability trades. - Range Trading: Profit from Sideways Markets

Not all markets trend. Sometimes, digital assets move within a defined upper (resistance) and lower (support) boundary. Range traders buy near support and sell near resistance. This strategy demands patience and precise entry/exit points, making it ideal for less volatile periods when clear boundaries are present. - Scalping: Quick Profits, High Frequency

Scalping involves making numerous small trades throughout the day to capitalize on minor price fluctuations. Traders using this approach on IQ Option aim for small profits from each trade, accumulating significant gains over time. It requires intense focus, quick decision-making, and often relies on very short-term technical indicators and candlestick patterns.

Essential Tools for Market Analysis

Your IQ Option platform is equipped with powerful technical indicators that enhance your market analysis. Leverage them to make informed decisions:

| Indicator | Primary Use | How it Helps |

|---|---|---|

| Moving Averages (MA) | Trend identification, support/resistance | Smooths price data to highlight trend direction and potential reversal points. |

| Relative Strength Index (RSI) | Momentum, overbought/oversold conditions | Identifies if an asset is becoming overvalued or undervalued, signaling potential pullbacks. |

| Moving Average Convergence Divergence (MACD) | Trend strength, reversals, momentum | Shows the relationship between two moving averages, helping to spot shifts in momentum. |

| Bollinger Bands | Volatility, price extremes | Illustrates how volatile the market is and where prices might bounce within a range. |

The Golden Rule: Risk Management

No matter how powerful your cryptocurrency trading strategies are, neglecting risk management can quickly derail your efforts. This is paramount, especially when trading highly volatile digital assets.

“Never risk more than you can comfortably afford to lose on any single trade. Use stop-loss orders to limit potential downsides and take-profit orders to secure your gains. Diversify your portfolio and avoid emotional trading. This discipline separates consistent traders from impulsive gamblers.”

Mindset and Continuous Learning

Beyond the technical aspects, a successful mindset is crucial for IQ Option crypto trading. The market moves fast, and emotions like fear and greed can lead to poor decisions. Develop a trading plan, stick to it, and review your performance regularly. The digital asset landscape evolves constantly, so commit to continuous learning. Stay updated on market news, technological advancements, and regulatory changes that could impact your chosen cryptocurrencies. This proactive approach will keep you ahead of the curve and allow you to adapt your strategies for sustained success.

Embrace the challenge, apply these effective strategies, and you can confidently navigate the exciting world of cryptocurrency trading on IQ Option.

Technical and Fundamental Approaches for Crypto

Diving into the fast-paced world of cryptocurrency trading and investment can feel like navigating a stormy sea without a compass. Thankfully, two powerful analytical frameworks, technical analysis and fundamental analysis, offer the guidance you need. Understanding and applying both can significantly sharpen your decision-making, whether you are aiming for short-term gains or long-term portfolio growth.

Understanding Technical Analysis in Crypto

Technical analysis (TA) is all about studying past price action and trading volume to predict future market movements. It operates on the belief that all available information is already reflected in the price. Crypto markets, known for their volatility and 24/7 nature, often present clear patterns and trends that technical analysts can identify.

Key tools and concepts in TA include:

- Chart Patterns: Recognizing recurring shapes on price charts like head and shoulders, double tops/bottoms, and triangles can signal potential reversals or continuations.

- Indicators: Tools like Moving Averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) help gauge momentum, overbought/oversold conditions, and trend strength.

- Support and Resistance: These are price levels where an asset historically struggles to move above (resistance) or below (support). They are crucial for identifying entry and exit points.

- Volume Analysis: High trading volume often confirms the strength of a price move, while low volume can indicate a lack of conviction.

Many traders use TA to time their entries and exits, manage risk, and identify short-term opportunities. It’s a method driven by market psychology and statistical probabilities.

Exploring Fundamental Analysis in Crypto

Fundamental analysis (FA) takes a different approach. Instead of looking at charts, FA focuses on evaluating the intrinsic value of a cryptocurrency project. It involves a deep dive into the underlying technology, team, tokenomics, and real-world utility. For long-term investors, FA is often the cornerstone of their strategy.

When you conduct fundamental analysis on a crypto project, you might consider:

- Project Vision and Whitepaper: Does the project solve a real problem? Is its mission clear and ambitious?

- Blockchain Technology and Innovation: Is the underlying blockchain technology novel, scalable, and secure? Does it offer unique features like advanced smart contracts or a superior consensus mechanism?

- Team and Advisors: Who is behind the project? Do they have relevant experience and a strong track record in software development, finance, or decentralized finance (DeFi)?

- Tokenomics: This refers to the supply, distribution, and utility of the native token. Is the supply capped? How is the token used within the ecosystem (e.g., for fees, governance, staking)?

- Community and Partnerships: A strong, engaged community and strategic partnerships with other blockchain projects or traditional companies can signal robust growth potential.

- Use Cases and Adoption: Is the project gaining real-world adoption? Are developers building on its platform?

FA helps you separate projects with genuine potential from those built on hype. It’s about understanding the “why” behind an investment.

Combining Both Approaches for Optimal Strategy

While technical and fundamental analysis are distinct, the most successful crypto investors and traders often integrate both. Think of FA as choosing the right ship for a long voyage, and TA as navigating that ship through immediate weather conditions.

Consider this perspective:

“Fundamental analysis tells you what to buy, and technical analysis tells you when to buy it. Neglecting either one leaves a significant gap in your investment strategy.”

Using FA, you might identify a promising project with strong blockchain technology, a solid team, and compelling use cases. Then, you turn to TA to pinpoint optimal entry points, perhaps after a market correction or when a strong uptrend is confirmed by key indicators. This holistic approach provides a robust framework for making informed decisions in the exciting, yet challenging, crypto landscape.

Risk Management Essentials in Crypto Trading

Diving into the fast-paced world of crypto trading offers incredible opportunities, but it also comes with unique challenges. The market’s high volatility means prices can swing wildly in a short period. This dynamic environment makes robust risk management not just a good idea, but an absolute necessity for protecting your capital and achieving long-term success. Think of it as your financial seatbelt in a high-speed race – you wouldn’t get on the track without one, right?

Effective risk management isn’t about avoiding all risks; that’s impossible in any market. Instead, it’s about understanding, measuring, and controlling the risks you take. It helps you stay in the game, learn from your experiences, and capitalize on opportunities without wiping out your entire portfolio. Let’s explore the core pillars that will fortify your crypto trading strategy.

Key Pillars of Crypto Risk Management

Successful traders don’t just guess; they plan. These principles form the bedrock of a resilient crypto trading approach:

- Define Your Risk Tolerance: Before you place a single trade, understand how much you’re truly comfortable losing on any given position or in your overall portfolio. This personal threshold guides all your trading decisions.

- Implement Stop-Loss Orders: This is your primary defense. A stop-loss order automatically closes your position if the price drops to a predetermined level, limiting your potential downside. It’s a non-negotiable tool for managing crypto exposure.

- Strategic Position Sizing: Never put all your eggs in one basket, and never bet more than you can afford to lose on a single trade. Determine a small, fixed percentage of your total trading capital (e.g., 1-2%) that you’re willing to risk per trade. This protects your overall capital even if a few trades go against you.

- Diversification Across Digital Assets: While tempting to chase the latest trending coin, spreading your investments across different cryptocurrencies and even different sectors (DeFi, NFTs, Layer 1s) can reduce the impact of a poor performance in any single asset.

- Profit Taking and Rebalancing: Don’t just hold; take profits when your targets are hit. Rebalance your portfolio periodically to maintain your desired asset allocation and secure gains.

The Human Element: Managing Emotions

The biggest risk factor often sits between your ears. Fear of missing out (FOMO) and panic selling are common pitfalls in the crypto market. Here’s how to build emotional discipline:

- Stick to Your Trading Plan: Create a detailed plan outlining your entry and exit points, profit targets, and stop-loss levels. Once you have a plan, execute it without emotional interference.

- Avoid Overtrading: Don’t feel pressured to trade constantly. Sometimes, the best move is to do nothing and wait for clear setups.

- Learn from Every Trade: Win or lose, analyze your trades. What worked? What didn’t? Use a trading journal to track your progress and identify patterns in your behavior and the market.

Remember this golden rule in crypto trading:

Embracing these risk management essentials transforms you from a gambler into a strategic trader. It gives you the confidence to navigate the crypto landscape, ride out the storms, and position yourself for sustainable growth in your digital asset journey.

Implementing Stop-Loss and Take-Profit on IQ Option

Mastering your trading journey means knowing when to step away and secure your gains, and when to limit your potential losses. This is precisely where Stop-Loss and Take-Profit features become indispensable tools on the IQ Option platform. They are your automated sentinels, working tirelessly to protect your capital and lock in profits, even when you are away from your screen. Ignoring these features is like navigating a ship without a compass – you are leaving too much to chance.

When you open a new position on IQ Option, setting these parameters is straightforward and should be a non-negotiable part of your trading routine. These aren’t just advanced features; they are foundational elements of responsible risk management for every trader, regardless of experience level. Embrace them to bring structure and discipline to your trading strategy.

Setting Your Orders: A Quick Guide

Here’s how you typically implement these crucial orders:

- Open a New Trade: First, choose your asset and decide on your investment amount. This is your initial step before market entry.

- Locate S/L and T/P Options: Before clicking “Buy” or “Sell,” look for the “Stop-Loss” and “Take-Profit” fields within the trade settings panel. They are usually clearly represented by symbols or text labels, making them easy to identify.

- Define Your Price Levels: You can often set these by a specific price point, a percentage of your investment, or a specific amount of money you are willing to risk or aim to gain. For example, if you predict a currency pair will rise, you might set your Stop-Loss below your entry point and your Take-Profit above it, anticipating the upward move.

- Confirm Your Trade: Once satisfied with your risk parameters, execute your trade. Your Stop-Loss and Take-Profit orders are now active, ready to trigger when market conditions meet your specified levels.

Why These Tools Are Your Best Friends

Think of Stop-Loss and Take-Profit as your personal trading assistants, bringing discipline and automation to your strategy:

- Automated Risk Management: A Stop-Loss order automatically closes your position if the market moves against you to a predetermined point, preventing excessive losses. This is critical for capital preservation and preventing account depletion.

- Profit Protection: A Take-Profit order ensures that your trade closes automatically when it reaches your desired profit level. It helps you avoid the common pitfall of greed, where you hold a winning trade for too long only to see it reverse.

- Emotional Detachment: By pre-setting these levels, you remove the emotional component from closing trades. You make decisions based on analysis and a predefined trading plan, not on fear or hope, which are detrimental to consistent trading.

- Time Efficiency: Once set, you don’t need to constantly monitor the market. Your trades will close when conditions are met, freeing up your valuable time for other activities or further market analysis.

Effective implementation of Stop-Loss and Take-Profit on IQ Option requires a clear understanding of your trading strategy, market volatility, and your personal risk tolerance. Always align these settings with your overall trading plan to maximize their benefits and build a more resilient portfolio. This proactive approach significantly enhances your chances of long-term success in the dynamic world of online trading.

Understanding Fees, Spreads, and Rollovers on IQ Option

Stepping into the world of `IQ Option trading` offers exciting opportunities, but truly successful traders know that understanding the underlying `forex trading costs` is just as crucial as making winning predictions. These aren’t hidden charges; they are standard operational expenses in the financial markets, and knowing them helps you calculate your real profits and refine your strategy. Let’s demystify the fees, spreads, and rollovers you might encounter on IQ Option. First, let’s talk about the more direct `broker fees`. While IQ Option strives to keep things straightforward, some operational costs apply. For instance, you might encounter `withdrawal fees` depending on your chosen payment method or frequency. It’s always wise to check the specifics for your preferred withdrawal option. Another consideration is an `inactivity fee`. If your trading account remains dormant for a certain period, a small charge might be applied to cover administrative costs. Staying active and engaged is one way to easily avoid this particular `forex expense`. Next up are `trading spreads`. This is perhaps the most common cost in `forex trading`, and it’s built right into every trade you make. A spread is simply the difference between the bid (sell) price and the ask (buy) price of a financial instrument. When you open a position, you immediately “pay” this small difference. It’s how brokers like IQ Option make their money on `forex trades`, without charging a direct commission per trade on many assets. The tighter the `forex spreads`, the less it costs you to enter and exit a position, which can significantly impact your short-term `trading platform fees` and overall profitability, especially for high-frequency traders. Spreads are dynamic and can fluctuate based on market volatility and liquidity. Finally, we have `rollover fees`, also widely known as `swap rates`. These come into play when you hold a `forex position` overnight. Essentially, it’s an interest adjustment for maintaining an open trade past the market close (typically 5 PM EST). The fee (or credit) is based on the interest rate differential between the two currencies in your pair, combined with your trade direction (buy or sell). Consider these points about rollovers:- Positive Swap: Sometimes, you might even receive a small credit if the currency you bought has a higher interest rate than the currency you sold. This is rare but possible.

- Negative Swap: More commonly, you’ll pay a small `overnight fee` if the interest rate differential works against your position. This is a common `forex trading cost` for extended trades.

- Triple Swap Day: Wednesdays are often considered “triple swap” days, meaning the rollover charge (or credit) is three times the usual amount to account for the upcoming weekend. Always be aware of this if holding positions mid-week.

Withdrawing Your Profits from IQ Option

The moment you turn your trading strategy into real gains is exhilarating! After successful sessions on IQ Option, the next logical step – and certainly the most rewarding one – is to get those hard-earned profits into your pocket. It’s a simple process, but knowing the ins and outs makes it even smoother and quicker. We understand you’re eager to access your funds, and IQ Option makes it straightforward to withdraw your forex trading profits and gains from other assets.

Your Withdrawal Journey: A Simple Path

Taking your money out of your IQ Option trading account is designed to be user-friendly. Here’s a quick overview of what to expect:

- Log In to Your Account: Access your personal IQ Option dashboard.

- Navigate to the Withdrawal Section: Look for the “Withdraw Funds” or “Cash Out” option, usually found in your personal profile or financial section.

- Choose Your Preferred Method: Select from the available payment methods that suit you best.

- Enter the Amount: Specify how much you want to withdraw. Remember to check for minimum and maximum limits.

- Confirm Your Request: Double-check all details and submit your withdrawal request.

It’s that easy! Your IQ Option withdrawal request then enters the processing queue.

Key Considerations for a Smooth Withdrawal

To ensure your profit withdrawal goes off without a hitch, keep these points in mind:

- Account Verification: This is crucial. Before your first withdrawal, IQ Option requires you to verify your identity. This is a standard security measure to protect your funds and prevent fraud. Complete the verification process proactively to avoid delays later.

- Matching Deposit and Withdrawal Methods: Whenever possible, IQ Option often prefers that you withdraw funds back to the same method you used to deposit them. For example, if you deposited with a specific e-wallet, withdrawing to that same e-wallet is usually the most direct path.

- Processing Times: While IQ Option aims for fast processing, external payment providers also have their own timeframes. We’ll look at these in more detail below.

- Currency Conversion: Be aware of potential currency conversion fees if your trading account currency differs from your bank account or e-wallet currency.

Popular IQ Option Withdrawal Methods

IQ Option offers a variety of payment methods to cater to traders worldwide. Here are some of the most commonly used options:

- E-wallets (Skrill, Neteller, Perfect Money, Advcash, WebMoney): These are often the fastest withdrawal methods. They offer quick processing once IQ Option approves your request, sometimes within minutes to a few hours. This makes them a top choice for traders seeking speed.

- Bank Transfers: A traditional method that allows you to directly transfer funds to your bank account. While reliable, bank transfers typically take longer to process compared to e-wallets, often several business days.

- Debit/Credit Cards (Visa, MasterCard): You can withdraw funds back to your card, especially if you used it for deposits. However, often only the initial deposit amount can be returned to the card, with any additional profits needing to be withdrawn via another method like a bank transfer or e-wallet.

Withdrawal Method Comparison

Here’s a quick look at how different methods stack up:

| Method | Typical Processing by IQ Option | External Processing Time (approx.) | Common Use |

|---|---|---|---|

| E-wallets | Within 24 hours | Instant to a few hours | Fastest access to funds |

| Bank Transfer | Within 24 hours | 3-7 business days | Direct to bank account, larger amounts |

| Debit/Credit Card | Within 24 hours | 3-9 business days | Returns initial deposit amount |

Tips for a Seamless IQ Option Withdrawal Experience

We want you to enjoy your profits without any fuss. Follow these simple tips:

- Complete Verification Early: Don’t wait until you’re ready to withdraw. Get your account verified right after registration.

- Understand Limits: Familiarize yourself with the minimum and maximum withdrawal limits for your chosen method.

- Monitor Your Email: IQ Option often communicates withdrawal status updates or requests for additional information via email. Keep an eye on your inbox.

- Choose Wisely: Select the withdrawal method that balances speed, convenience, and any associated fees for your specific needs.

- Document Everything: Keep records of your withdrawal requests, including transaction IDs and dates, for your own peace of mind.

Cashing out your profits from IQ Option should be a moment of triumph, not a hassle. By understanding the process and keeping these tips in mind, you ensure a smooth transition of your trading success into your real-world funds. Happy trading, and even happier withdrawing!

Security, Regulation, and Customer Support

When you step into the dynamic world of forex trading, your peace of mind is paramount. It’s not just about finding profitable trades; it’s about knowing your investments are safe and you have reliable support. This is where the pillars of security, regulation, and customer support come into play, forming the bedrock of a trustworthy trading experience.

Your Funds, Your Protection: Top-Tier Security

Imagine navigating volatile markets while constantly worrying about the safety of your capital. Not ideal, right? Reputable brokers prioritize your financial security above all else. They implement stringent measures to shield your investments and personal data from any threats.

Here’s how leading platforms ensure your assets remain protected:

- Segregation of Client Funds: Your money is kept in separate bank accounts from the broker’s operational funds. This critical step ensures that even if a broker faces financial difficulties, your capital remains untouched and accessible.

- Advanced Encryption (SSL): All your personal and transaction data gets encrypted using Secure Socket Layer (SSL) technology. Think of it as an unbreakable digital lock, safeguarding your sensitive information during transmission.

- Two-Factor Authentication (2FA): Adding an extra layer of security, 2FA requires a second verification step, usually through your mobile device, before you can access your account. This significantly reduces the risk of unauthorized access.

- Negative Balance Protection: Some brokers offer this vital feature, ensuring your account balance never drops below zero, even during extreme market moves. You cannot lose more money than you deposit.

The Regulator’s Watch: A Mark of Trust

Regulation isn’t just a fancy term; it’s your ultimate safeguard in the financial markets. Choosing a regulated broker means you are trading under the watchful eye of official bodies designed to protect investors and maintain market integrity. These authorities enforce strict rules and standards, ensuring fair and transparent trading practices.

Consider the benefits of trading with a properly regulated entity:

- Investor Protection Schemes: Many regulatory bodies mandate compensation schemes that can protect your funds up to a certain amount in case a regulated firm goes bankrupt.

- Fair Trading Practices: Regulators ensure brokers offer honest pricing, execute trades fairly, and avoid conflicts of interest.

- Transparency: Regulated brokers must adhere to strict reporting requirements, providing clear information about their services, fees, and risks.

- Dispute Resolution: Should a disagreement arise, you have an official channel for complaint and resolution through the regulatory body.

Always verify a broker’s regulatory status. Top-tier regulators include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC), among others. These bodies demand high capital requirements and rigorous operational standards.

Always There for You: Exceptional Customer Support

Even the most experienced traders need a helping hand sometimes. Whether it’s a technical glitch, a question about a withdrawal, or guidance on platform features, responsive and knowledgeable customer support makes all the difference. A broker’s commitment to its clients shines brightest through its support team.

What to look for in outstanding customer support:

| Support Channel | Benefit to You |

|---|---|

| Live Chat | Instant answers to urgent questions, direct access to a support agent. |

| Email Support | Detailed responses for complex queries, a written record of communication. |

| Phone Support | Personalized assistance, ideal for discussing account-specific issues. |

| Comprehensive FAQs | Self-service solutions for common questions, saving you time. |

Look for brokers offering 24/5 support, matching the forex market’s operating hours. Multilingual support is also a huge plus, ensuring you can communicate effectively in your preferred language. Excellent support elevates your entire trading journey, making it smoother and less stressful.

Pros and Cons of IQ Option Trading Crypto

Embarking on the journey of trading cryptocurrencies can feel like navigating a vibrant, ever-changing digital landscape. For many, IQ Option serves as a gateway to this exciting world, offering a platform where you can speculate on the price movements of various digital assets. As a professional forex expert, I’ve seen countless traders, from novices to seasoned pros, utilize platforms like IQ Option for their online trading needs. It’s crucial to understand both the advantages and disadvantages before diving in, especially when it comes to volatile markets like crypto.

IQ Option provides a streamlined environment for trading, making it particularly appealing for those looking to get started without complex setups. Their proprietary trading platform is known for its accessibility and intuitive design, allowing users to quickly grasp the basics of placing trades. However, like any financial tool, it comes with its own set of considerations that can impact your trading experience and potential profitability.

Advantages of Trading Crypto on IQ Option

- Accessibility for Beginners: IQ Option truly shines for new traders. With a remarkably low minimum deposit, it lowers the barrier to entry, allowing you to start trading with a small capital. The user-friendly interface is straightforward, making it easy to navigate charts, place orders, and manage positions without feeling overwhelmed.

- Diverse Crypto Selection: You’re not limited to just Bitcoin. IQ Option offers a respectable range of popular cryptocurrencies, including Ethereum, Ripple, Litecoin, and many others. This variety allows traders to diversify their portfolio and explore different market opportunities beyond the major players.

- Leverage Trading Opportunities: One of the significant draws is the availability of leverage. This means you can control a larger position with a smaller amount of capital, amplifying potential profits from even slight price movements. For those confident in their market analysis, this can be a powerful tool to maximize returns on their digital assets.

- Free Demo Account: Before risking real money, IQ Option provides a robust, fully functional demo account. This is an invaluable resource for practicing trading strategies, getting familiar with the platform, and understanding market dynamics without any financial pressure. It’s essentially a risk-free training ground for your trading skills.

- Fast Execution: The platform is designed for speed. Trades are typically executed quickly, which is critical in fast-moving crypto markets where prices can change in an instant. This responsiveness helps traders capitalize on short-term opportunities.

Disadvantages of Trading Crypto on IQ Option

While the benefits are clear, it’s equally important to consider the potential drawbacks, especially for those who might prefer more specialized tools or have specific trading requirements.

| Aspect | Description of Disadvantage |

|---|---|

| Regulation Concerns | IQ Option operates under certain regulatory bodies, but its licensing can vary by region. This sometimes leads to restrictions for traders in certain countries, and some more experienced traders might prefer platforms with broader or more stringent regulatory oversight, particularly for significant capital. |

| High Risk with Leverage | While leverage can boost profits, it equally amplifies losses. In the highly volatile crypto market, a sudden price swing can liquidate your position quickly if you don’t employ robust risk management strategies. This makes it a double-edged sword that requires careful handling. |

| Limited Advanced Tools | Compared to dedicated cryptocurrency exchanges or more advanced forex market platforms, IQ Option’s charting and analytical tools can feel somewhat basic. Experienced traders looking for highly specialized indicators, advanced order types, or extensive market depth analysis might find it lacking. |

| Withdrawal Conditions & Fees | While deposits are generally smooth, some users report occasional delays or specific conditions associated with withdrawals. Additionally, certain withdrawal methods might incur fees, which can eat into your profits, especially for smaller trades. |

| Spreads & Overnight Fees | IQ Option, like many CFD brokers, generates revenue through spreads (the difference between buying and selling prices) and overnight fees (swap rates) for positions held open after a certain time. These costs, though seemingly small individually, can accumulate and impact profitability, especially for long-term or swing traders. |

While leverage can boost profits, it equally amplifies losses. In the highly volatile crypto market, a sudden price swing can liquidate your position quickly if you don’t employ robust risk management strategies. This makes it a double-edged sword that requires careful handling.

In conclusion, IQ Option presents a viable and accessible option for many looking to engage in crypto trading. Its ease of use and low entry barrier make it an excellent starting point for a beginner trader. However, for an experienced trader seeking advanced features, deeper market insights, or a more traditional ownership model for their cryptocurrencies, exploring specialized crypto exchanges might be more suitable. Always remember that regardless of the platform, the inherent volatility of digital assets necessitates a disciplined approach and a thorough understanding of the risks involved. Trade wisely and never invest more than you can afford to lose!

Tips for Maximizing Success in IQ Option Crypto Trading

Diving into the fast-paced world of crypto trading on IQ Option offers incredible opportunities, but success isn’t just about luck. It demands a sharp mind, disciplined execution, and a solid plan. To truly thrive, you need more than just identifying a promising asset; you need a strategic approach to navigate the volatile digital currency markets. Let’s explore practical tips to help you elevate your game and achieve consistent profitability.

Develop and Refine Your Crypto Trading Strategies

Never trade without a clear roadmap. Effective crypto trading strategies are your foundation. Whether you prefer scalping, day trading, or swing trading, define your entry and exit points, set profit targets, and understand your indicators. Test your approach rigorously. What works for Bitcoin might not be ideal for altcoins, so be adaptable and always willing to refine your methods based on market conditions.

Master Robust Risk Management

This is non-negotiable for long-term survival. Proper risk management prevents single trades from wiping out your capital. Here’s how to implement it effectively:

- Position Sizing: Never allocate more than 1-2% of your total trading capital to a single trade.

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses on every position.

- Avoid Over-Leverage: While tempting, excessive leverage amplifies both gains and losses. Use it cautiously.

- Capital Protection: Prioritize protecting your existing capital over chasing massive, speculative gains.

Harness the Power of Technical Analysis on IQ Option

Becoming proficient in technical analysis IQ Option tools empowers you to read charts and predict potential price movements. Learn to identify patterns like head and shoulders, double tops/bottoms, and flag formations. Understand key indicators such as Moving Averages, RSI, MACD, and Bollinger Bands. These tools, when used correctly, provide invaluable insights into market dynamics and help you make informed decisions.

“The markets are constantly communicating. Technical analysis is simply learning to understand their language.”

Understand Market Sentiment and News

Cryptocurrency prices often react strongly to news and overall market sentiment. Stay informed about major developments in the crypto space – regulatory news, technological advancements, institutional adoption, or even prominent figures’ opinions can sway prices dramatically. Combine your technical analysis with an awareness of the fundamental landscape to gain a holistic view.

Practice Smart Diversification Crypto Strategies

While some traders prefer to focus on a few assets, strategic diversification crypto can help mitigate risk. Instead of putting all your capital into one coin, spread it across a few different cryptocurrencies with varying characteristics. For example, balance some stable, large-cap coins with a small allocation to promising, higher-risk altcoins. This approach helps cushion your portfolio against unexpected downturns in a single asset.

Keep a Detailed Trading Journal

A trading journal is your personal growth tool. Document every trade: entry price, exit price, reasons for opening/closing, profit/loss, and your emotional state. Regularly reviewing your journal helps you identify recurring mistakes, recognize successful patterns, and refine your strategies. It turns every trade, win or loss, into a valuable learning experience.

Utilize Demo Account Practice Extensively

Before risking real capital, maximize your demo account practice. IQ Option provides an excellent platform for this. Experiment with different strategies, test new indicators, and get comfortable with the platform’s interface without any financial pressure. Treat your demo account seriously; it’s your training ground for the live market. This builds confidence and sharpens your skills.

Stay Updated with Crypto News and Trends

The crypto market evolves rapidly. Make it a habit to stay updated crypto news from reputable sources. Follow key analysts, read industry reports, and understand emerging technologies. Being aware of current trends allows you to anticipate shifts and position yourself advantageously, rather than reacting belatedly.

Cultivate Emotional Discipline

Greed and fear are powerful emotions that can derail even the most well-planned trades. Emotional discipline is crucial. Stick to your trading plan, even when fear urges you to sell early or greed tempts you to hold onto a losing trade. Avoid impulsive decisions driven by market hype or panic. Maintain a calm, logical approach at all times.

By integrating these tips into your IQ Option crypto trading routine, you significantly boost your potential for long-term success. It’s a journey of continuous learning and refinement, but with dedication, the crypto market offers exciting rewards.

Frequently Asked Questions

What is IQ Option, and why is it suitable for crypto trading?

IQ Option is a user-friendly online trading platform offering access to diverse assets, including cryptocurrencies via CFDs. It’s suitable for crypto trading due to its intuitive interface, powerful analytical tools, and integrated environment, simplifying access to digital asset markets for both beginners and experienced traders.

How do I open an account and start trading cryptocurrencies on IQ Option?

To start, visit the IQ Option website, sign up with your email, and complete the verification (KYC) process by providing ID and proof of address. Once verified, deposit funds using various methods like bank cards or e-wallets. You can then select your crypto asset and place your trade, using a free demo account for practice beforehand.

What types of cryptocurrencies and other assets can I trade on IQ Option?