Are you ready to elevate your trading game and test your mettle against a global community of traders? IQ Option tournaments offer an exhilarating platform to do just that. Imagine a high-stakes competition where your trading skills, sharp decision-making, and understanding of the financial markets determine your success. These aren’t just mere trading sessions; they are competitive trading arenas designed to challenge and reward participants.

- How IQ Option Tournaments Work: The Mechanics

- Why Join the Competitive Trading Arena?

- Defining Tournament Basics: Virtual Funds & Real Rewards

- Understanding the Tournament Leaderboard Mechanism

- Why You Should Participate in IQ Option Tournaments

- Skill Development and Competitive Trading Environment

- Opportunities for Real Prize Money and Bonuses

- Exploring Different Types of IQ Option Tournaments

- Free Tournaments: Your Risk-Free Training Ground

- Paid Tournaments: The Path to Bigger Rewards

- Diverse Formats and Features

- Tournament Types at a Glance

- Free Tournaments: The Perfect Starting Point

- Why Free Forex Tournaments Are a Must-Try:

- Paid Entry Tournaments: Greater Rewards for Strategic Players

- Why Serious Traders Prefer Paid Entry:

- How to Join and Get Started in an IQ Option Tournament

- Your Path to Joining an IQ Option Tournament

- Preparing for Your IQ Option Tournament Challenge

- What to Expect During Your Tournament

- Key Rules and Regulations for Tournament Participation

- Eligibility and Account Setup

- The Trading Arena: What You Need to Know

- Performance Tracking and Winning Criteria

- Effective Strategies for Winning IQ Option Tournaments

- Mastering Tournament Capital Management

- Adapting Your Trading Strategy for Competition

- The Psychology of a Champion: Emotional Discipline

- Mastering Risk Management in High-Stakes Environments

- Core Pillars of Effective Risk Management

- Advantages of a Disciplined Approach

- Analyzing Market Conditions for Optimal Entries

- Key Elements for Pinpointing Your Entries:

- The Psychological Edge: Discipline and Focus

- Mastering Discipline in Forex

- Sharpening Your Focus Amidst Market Noise

- Optimizing Your Tournament Balance Management

- Key Pillars of Tournament Balance Management

- Strategies for Intelligent Capital Allocation

- Risk Management in a Tournament Setting

- Advantages and Disadvantages of Aggressive Tournament Trading

- Advantages

- Disadvantages

- Decoding the Leaderboard and Prize Payout Structure

- Common Pitfalls and How to Avoid Them in Tournaments

- Recognizing the Traps:

- Strategies for Evasion and Success:

- Advanced Tips to Maximize Your Tournament Performance

- Strategic Pillars for Competitive Trading

- The Balance of Aggression and Prudence

- Mastering Your Mental Game

- Post-Tournament Review and Growth

- IQ Option Tournaments vs. Standard Trading: A Comparative Look

- The Thrill of IQ Option Tournaments

- Key Characteristics of Tournaments:

- Standard Trading: The Conventional Approach

- Fundamentals of Standard Trading:

- Comparing the Two: Where Do They Stand?

- Which Path is Right for You?

- Is Participating in IQ Option Tournaments Worth Your Time?

- Unleash Your Trading Skills in a Competitive Arena

- The Tangible Rewards: Prize Pools and More

- Is it Right for You?

- Frequently Asked Questions

How IQ Option Tournaments Work: The Mechanics

Participating in an IQ Option tournament is straightforward, yet it demands strategic thinking and robust risk management. Here’s a breakdown of the typical process:

- Registration: You sign up for a specific tournament. Some tournaments are free, while others require a small entry fee.

- Starting Balance: Every participant begins with the same virtual balance in a dedicated tournament account. This levels the playing field, ensuring everyone starts on equal footing.

- Trading Period: The tournament runs for a predetermined duration, which could be a few hours, a day, or even a week. During this time, you trade various assets available on the IQ Option platform, including forex trading pairs, stocks, commodities, and cryptocurrencies.

- Objective: Your primary goal is to increase your account balance as much as possible through successful trades. The more profitable your trades, the higher your balance climbs.

- Leaderboard: A real-time leaderboard tracks the progress of all participants. You can see your current rank and how you stack up against others.

- Prize Pool: At the end of the tournament, the traders with the highest balances on the leaderboard share a predefined prize pool. This pool often consists of real money and can be quite substantial, especially in larger tournaments.

It’s an excellent way to apply your knowledge, refine your strategy, and even discover new trading skills without risking your main trading capital directly. Many use these events as an advanced form of a practice account, but with the added thrill of winning actual rewards.

Why Join the Competitive Trading Arena?

Beyond the excitement, there are tangible benefits to diving into IQ Option tournaments:

- Test Your Skills: It’s a fantastic way to benchmark your abilities against other traders in a controlled, competitive environment.

- Win Real Prizes: The chance to win a share of a significant prize pool is a major draw. For a minimal entry fee, or even for free, you could walk away with a substantial reward.

- Learn and Grow: Observing how others perform and adapting your own methods can accelerate your learning curve. You practice making quick decisions under pressure.

- Low Risk, High Reward: Since you start with a virtual balance, your personal capital isn’t directly at risk during the competition, yet the potential for real money prizes is there.

- Community Engagement: Connect with a broader community of traders and experience the camaraderie and rivalry that comes with competitive trading.

For those looking to push their boundaries in the dynamic world of financial markets, IQ Option tournaments offer a unique blend of challenge, learning, and the exciting prospect of victory.

Defining Tournament Basics: Virtual Funds & Real Rewards

Imagine diving into the thrilling world of forex trading, making bold decisions, and executing precision trades without ever touching your real money. That’s the essence of forex tournaments! These exciting competitions offer a unique opportunity to test your trading strategies and market instincts in a simulated environment.

The core principle revolves around **virtual funds**. When you join a tournament, you receive a designated amount of fictional capital. This allows you to open and close positions, manage risk, and explore various trading techniques just as you would in a live market, but with zero financial risk to your personal bankroll. It’s the ultimate training ground for both novice traders looking to gain experience and seasoned pros wanting to experiment with new systems or simply enjoy the competitive spirit.

But here’s the kicker – while your trading capital is virtual, the **rewards are absolutely real**. Top performers don’t just win bragging rights; they secure tangible prizes that can significantly boost their trading journey. The types of real rewards often include: Cash Prizes, Trading Credits, Exclusive Access, Partnerships & Mentorship.

- Cash Prizes: Direct payouts to the highest-ranking traders.

- Trading Credits: Funds added to a live trading account, giving winners real capital to trade with.

- Exclusive Access: Entry to premium tools, advanced analytics, or educational courses.

- Partnerships & Mentorship: Opportunities to connect with industry experts.

This fantastic blend of risk-free practice and genuine incentives makes forex tournaments incredibly popular. You get all the excitement of market competition and the chance to prove your trading prowess, leading to valuable rewards that can kickstart or accelerate your success in the actual forex market. It’s a win-win scenario where learning, competing, and earning all come together.

Understanding the Tournament Leaderboard Mechanism

Ever wondered how we track the best of the best in our thrilling forex tournaments? It all comes down to the ingenious leaderboard mechanism, the heart of our competition. This system is designed for complete transparency, showing you exactly where you stand against your fellow traders. It’s not just about who trades the most; it’s about who trades the smartest and most effectively.

Our ranking system is straightforward, focusing on measurable trading performance to ensure fairness and excitement. Here’s a quick look at how your position on the leader board is determined:

- Profit Percentage: This is often the primary metric. It measures the percentage gain on your initial capital, ensuring that traders with smaller starting balances have an equal chance to compete with those holding larger accounts. It truly levels the playing field!

- Equity Growth: Sometimes, we also factor in the total equity growth, which considers both realized and unrealized profits. This gives a comprehensive view of a trader’s account health and overall performance throughout the tournament.

- Risk Management: While not always a direct ranking factor, strong risk management often leads to consistent profits, which naturally helps you climb the ranks. Tournaments reward smart, sustainable growth.

We pride ourselves on providing real-time tracking, so you’ll see leader board updates almost instantly after your trades are executed. This dynamic display keeps the competitive spirit alive, allowing you to monitor your competition standings and strategize your next moves. Every win, every profitable trade, pushes you closer to the top. Keep an eye on the leader board; your name could be next to claim a spot among the top traders and secure a share of the impressive prize pool!

Why You Should Participate in IQ Option Tournaments

Are you looking for an exciting way to test your trading skills, win real money, and push your limits without risking your entire capital? IQ Option tournaments offer an incredible opportunity that seasoned traders and beginners alike should not miss. Imagine stepping into an arena where your strategic prowess and quick thinking are your greatest assets, competing against a global community of traders. This isn’t just about making trades; it’s about mastering your craft in a dynamic, competitive environment.

Participating in these events brings a unique blend of learning and potential financial gain. Unlike standard trading, where every decision directly impacts your personal balance, tournaments provide a controlled setting. You start with a virtual balance, and your goal is to grow it more than anyone else. This setup dramatically reduces the pressure of personal capital loss, allowing you to experiment with new strategies and refine your approach to the markets. It’s an ideal playground to practice advanced binary options and digital options techniques.

Here are compelling reasons to jump into the action:

- Develop Your Trading Edge: Tournaments force you to make rapid, decisive actions. You’ll learn to manage risk under pressure, analyze market trends quickly, and execute trades with precision. This intense practice hones your skills faster than routine trading.

- Access Significant Prize Pools: Many tournaments boast impressive cash prizes, sometimes reaching thousands of dollars. A small entry fee, or even no fee at all for some events, could lead to a substantial boost in your trading capital.

- Low-Risk Skill Enhancement: With a set tournament balance, your personal trading account remains untouched. This means you can be aggressive, try new indicators, and explore different timeframes without fear of financial setbacks.

- Experience the Thrill of Competition: There’s an undeniable adrenaline rush that comes from competing against hundreds, or even thousands, of other traders. Watching your rank climb the leaderboard is incredibly motivating and rewarding.

- Gain Recognition and Confidence: Performing well in a tournament not only brings monetary rewards but also builds immense confidence in your abilities. It validates your trading strategies and provides bragging rights within the trading community.

Let’s consider the clear advantages of tournament participation:

| Aspect | Benefit of Tournaments | Benefit of Regular Trading |

|---|---|---|

| Risk Exposure | Limited to tournament entry fee (often low or free). | Directly impacts personal capital. |

| Skill Development | Accelerated under competitive pressure. | Gradual, self-paced learning. |

| Potential Reward | Large prize pools for top performers. | Proportional to investment and risk. |

| Strategy Testing | Freedom to experiment without personal loss. | Requires careful management of capital. |

| Motivation | High due to competition and leaderboard. | Internal discipline is key. |

A well-known trading maxim states, “Practice makes perfect.” IQ Option tournaments are your perfect practice ground. They provide a structured yet exhilarating environment to refine your trading strategies, manage your emotions under pressure, and potentially walk away with a significant cash prize. Don’t just trade; compete, learn, and win!

Skill Development and Competitive Trading Environment

Embarking on the forex journey means committing to continuous skill development. This isn’t just about learning the basics; it’s about mastering a dynamic craft. To truly thrive, you must view every market interaction as a chance to sharpen your abilities, much like an athlete constantly refines their technique.

The beauty of forex lies in its competitive trading environment. While it might seem challenging, this very competitiveness acts as a powerful catalyst for growth. It pushes you to innovate, adapt, and consistently elevate your game. Each trading day presents a unique learning opportunity, demanding that you bring your A-game and refine your approach.

Here are key areas where you will develop crucial forex trading skills:

- Market Analysis Mastery: Learn to interpret both technical indicators and fundamental economic data. Understanding how global events impact currency pairs is vital for making informed decisions.

- Robust Trading Strategies: Develop and rigorously backtest your own trading strategies. This includes defining clear entry and exit points, understanding position sizing, and knowing when to adjust your plan.

- Impeccable Risk Management: Protecting your capital is paramount. You will master setting stop-loss orders, calculating risk-reward ratios, and understanding how much you can comfortably risk on any single trade.

- Unwavering Trading Psychology: Control your emotions. Discipline, patience, and resilience are non-negotiable traits for long-term success. Overcoming fear and greed becomes a continuous, self-improving process.

- Continuous Learning and Adaptation: The forex market constantly evolves. Staying updated with new tools, global news, and market insights ensures your skills remain sharp and relevant.

The competitive nature of forex trading is not a barrier; it’s an accelerator for trader development. It forces you to critically evaluate your performance, learn quickly from both wins and losses, and constantly seek an edge.

“The forex market’s intense competition doesn’t just filter out the unprepared; it actively forges resilient, strategic, and disciplined traders from those committed to constant improvement.”

Embracing this environment means embracing a journey of perpetual learning and refinement. You will find yourself growing not just as a trader, but as a critical thinker, an adaptable strategist, and a highly disciplined individual.

Opportunities for Real Prize Money and Bonuses

Get ready to transform your passion for the markets into tangible wealth! We believe in rewarding skill and dedication. That’s why our community offers exciting avenues to earn real money prizes and benefit from generous trading bonuses. Imagine the satisfaction of seeing your strategic decisions not only lead to successful trades but also translate into actual financial incentives.

Our platform frequently hosts engaging live trading contests. These events are not just for bragging rights; they are your direct pathway to significant cash prizes. Pit your analytical prowess against fellow traders in a dynamic, competitive trading environment. Top performers consistently walk away with substantial winnings, proving that smart forex trading can be incredibly lucrative beyond your daily profits. These are genuine opportunities to grow your capital.

Beyond the thrill of competition, we also provide a range of valuable trading bonuses designed to give you an extra edge. Whether it’s a welcome bonus to kickstart your journey, a deposit bonus to amplify your trading power, or performance-based rewards for consistent excellence, these financial incentives boost your account. They offer additional capital, allowing you to explore more opportunities or manage your risk more effectively.

Here’s what these opportunities mean for you:

- Increased Capital: Use bonuses to expand your trading volume or diversify your portfolio without dipping further into your initial investment.

- Motivation to Excel: The prospect of real money prizes pushes you to refine your strategies and improve your market analysis.

- Skill Validation: Winning contests or achieving performance rewards confirms your trading acumen and builds confidence.

- Risk Mitigation: With bonus funds, you can sometimes experiment with new strategies with less direct risk to your primary capital.

Don’t just watch the market move; become an active participant and claim your share of the rewards. Your journey in forex trading can be incredibly rewarding, both in knowledge and in lucrative financial returns.

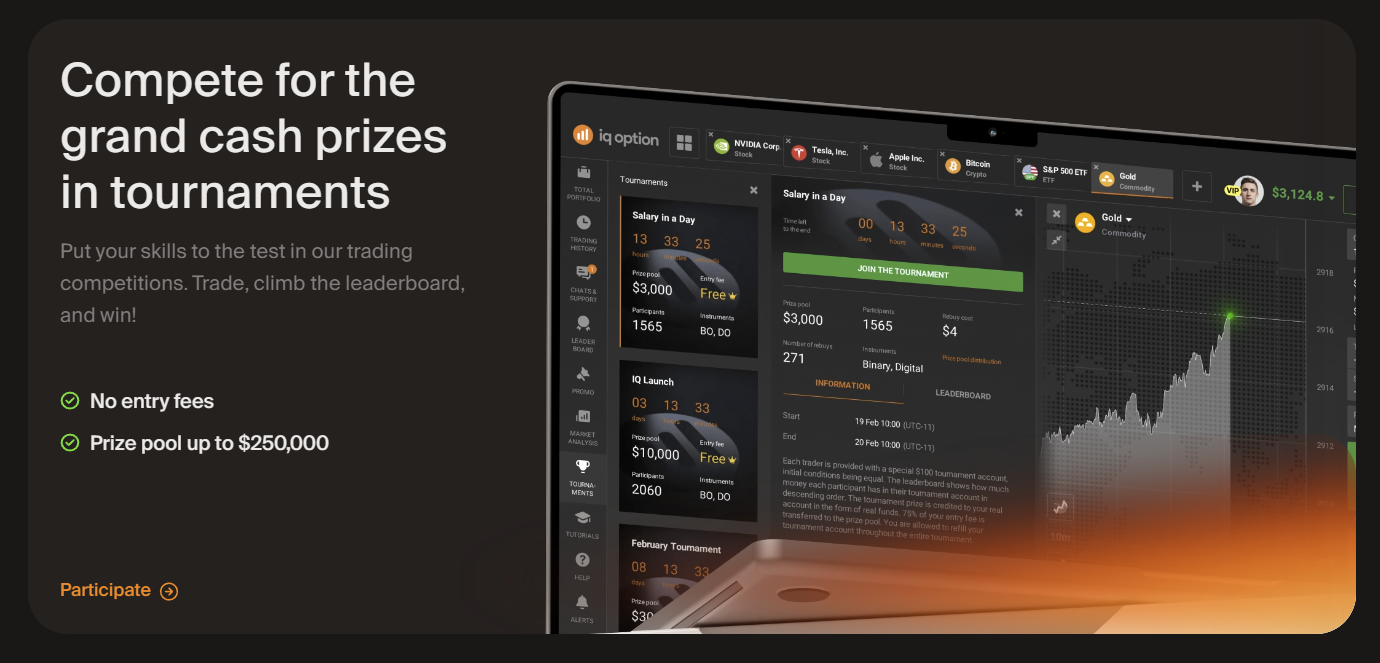

Exploring Different Types of IQ Option Tournaments

Step into the exhilarating arena of IQ Option tournaments! These aren’t just ordinary trading sessions; they are thrilling competitive events where your analytical prowess and sharp decision-making can lead to substantial rewards. For traders eager to test their mettle, fine-tune their strategies, and potentially secure impressive prizes, IQ Option offers a dynamic and diverse range of competitions.

What makes these tournaments so captivating? They transform solo trading into a vibrant, competitive sport. Imagine pitting your financial insights against hundreds, or even thousands, of other traders worldwide. It’s an unparalleled opportunity to gauge your performance against a diverse field, push your limits under pressure, and refine your approach to the markets.

Free Tournaments: Your Risk-Free Training Ground

Many traders kick off their tournament journey with the incredibly popular free entry tournaments. These are fantastic for both beginners and seasoned pros who want to practice without any financial risk. Typically, these exciting contests use virtual funds on a demo account. You receive a set amount of virtual currency and a specific timeframe to grow your portfolio as much as possible. It’s a perfect environment to:

- Test new forex trading strategies without any real money exposure.

- Familiarize yourself with the tournament interface and specific rules.

- Build confidence and improve your trading skills before moving to higher stakes.

- Experience the thrill of competition for a chance to win real money prizes, as some free tournaments surprisingly offer actual cash rewards!

These demo account tournaments serve as invaluable training grounds, helping aspiring champions hone their craft and prepare for more intense challenges. They are a great way to get a feel for the competitive atmosphere and understand how you stack up against other participants on the leaderboard.

Paid Tournaments: The Path to Bigger Rewards

For those ready to elevate their game and embrace higher stakes, IQ Option hosts numerous paid entry tournaments. These real money tournaments typically involve a modest entry fee, which directly contributes to a larger, more attractive prize pool. The competition in these contests is often more intense and demanding, as participants are investing their own capital for a shot at significant winnings. Think of them as the premier leagues of binary options contests or advanced forex trading contests.

“Success in a trading tournament isn’t just about making money; it’s about mastering your emotions and executing a flawless strategy under pressure.”

Succeeding in these higher-stakes contests demands sharp analytical skills, robust risk management, and the ability to execute trades decisively. While the financial risk is certainly present, the potential rewards can be substantial, making them highly appealing to experienced traders looking for a serious challenge and a greater payout.

Diverse Formats and Features

Beyond the fundamental free versus paid distinction, IQ Option diversifies its tournament offerings with several other exciting variations:

- Duration: Some trading competitions are quick, intense sprints lasting a day or two, perfect for a rapid challenge and immediate results. Others are longer marathons, spanning weeks, which allow for more strategic play, recovery from minor setbacks, and sustained performance.

- Rebuy Options: Certain tournaments offer “rebuy” options. This means if your balance drops below a specific level, you can pay an additional fee to replenish your virtual tournament balance. This can give you a crucial second chance to climb back up the leaderboard and stay in the race.

- Asset Focus: While many tournaments are open to trading various assets, you might occasionally find specialized contests. These could be tailored to specific markets, such as certain currency pairs in a dedicated forex trading contest, or particular stocks or commodities, adding another layer of strategic depth.

Tournament Types at a Glance

To help you choose the best fit for your trading style and goals, here’s a quick comparison of the main IQ Option tournament types:

| Feature | Free Tournaments (Demo Account) | Paid Tournaments (Real Money) |

|---|---|---|

| Entry Fee | None required | Required (contributes to the prize pool) |

| Trading Funds | Virtual money for trading | Virtual money (funded by real money buy-in) |

| Financial Risk Level | Zero financial risk to you | Involves financial risk (entry fee and potential rebuys) |

| Prize Pool | Often smaller, sometimes includes real money | Significantly larger, always real money payouts |

| Primary Benefit | Practice, learning, skill development, risk-free fun | High potential rewards, intense competition, professional challenge |

Free Tournaments: The Perfect Starting Point

Are you curious about the dynamic world of forex trading but hesitant to dive in with real capital? Free tournaments offer an unparalleled opportunity to explore online trading without any financial risk. Imagine a competitive environment where you can test your skills, learn the ropes, and even win real prizes, all while using virtual funds. It’s the ultimate playground for aspiring traders to gain confidence and practical experience.

Think of these tournaments as your personal training ground. You get to interact with real-time market data, execute trades, and manage a portfolio, just as you would in a live trading account. This hands-on experience is invaluable for developing a keen understanding of market movements and price action. It’s an excellent way to bridge the gap between theoretical knowledge and practical application, allowing you to build foundational trading skills in a supportive, zero-pressure setting.

Why Free Forex Tournaments Are a Must-Try:

- Risk-Free Learning: Experience the thrill of forex trading without putting your own money on the line. All trading is done with virtual funds, eliminating financial stress.

- Strategy Development: Experiment with different trading strategies and see what works best for you in a competitive environment. This is crucial for honing your approach before engaging in live online trading.

- Skill Enhancement: Practice trade execution, order management, and risk assessment under realistic market conditions. Improve your decision-making abilities and emotional discipline.

- Community Engagement: Connect with other traders, share insights, and learn from their approaches. Many broker platforms offer vibrant communities around their tournament offerings.

- Prize Potential: While the primary goal is learning, many free tournaments offer exciting real cash or valuable prizes for top performers. Imagine winning money just for practicing!

Embarking on your forex trading journey through free tournaments is a smart move. It allows you to build a solid foundation, refine your approach, and even taste success, all before you commit any real capital. It’s truly the perfect starting point for anyone looking to master the art of currency exchange.

Paid Entry Tournaments: Greater Rewards for Strategic Players

Step into the arena where true trading prowess shines. Paid entry tournaments offer an exhilarating challenge for those ready to put their skills to the ultimate test. Unlike their free counterparts, these competitions attract a more dedicated and strategic caliber of trader. When you invest a small entry fee, you’re not just buying a ticket; you’re signaling your commitment and belief in your analytical abilities.

The stakes are higher, and so are the rewards. This creates a competitive environment where only the sharpest minds rise to the top. It’s an opportunity to measure your trading strategies against serious competitors and claim substantial prizes that truly make your efforts worthwhile.

Why Serious Traders Prefer Paid Entry:

- Elevated Prize Pools: A significant portion of the entry fees often contributes directly to a much larger prize fund. This means the potential winnings are considerably more attractive.

- Higher Caliber Competition: The entry fee acts as a filter, attracting traders who are serious about their craft and confident in their strategies. This ensures a more challenging and rewarding experience.

- Motivation and Focus: Having a stake in the game can sharpen your focus and encourage more disciplined decision-making throughout the tournament.

- Skill-Based Recognition: These tournaments are less about luck and more about skillful market analysis, risk management, and execution. They provide a clear platform to showcase and validate your trading expertise.

Imagine the thrill of outmaneuvering top-tier traders, making astute market calls, and seeing your trading account grow not just from your performance, but from a hefty tournament prize. This isn’t just about winning money; it’s about earning recognition in a challenging environment. It’s a testament to your disciplined approach and your mastery of the financial markets.

Consider the difference between casual practice and a high-stakes championship. Paid entry tournaments are your championship. They demand your best, but they also offer the most significant returns for your dedication and strategic insight. Are you ready to elevate your trading game and compete for rewards that truly reflect your potential?

How to Join and Get Started in an IQ Option Tournament

Are you ready to elevate your trading game and compete for exciting prizes? IQ Option tournaments offer a thrilling arena where traders from around the globe test their skills. It’s more than just trading; it’s a dynamic forex trading competition that sharpens your instincts and offers a chance to win from impressive prize pools. Getting started is easier than you might think, and we’re here to guide you through every step. Let’s dive in and see how you can become a part of this exhilarating experience!

Your Path to Joining an IQ Option Tournament

Joining an IQ Option contest is a straightforward process designed to get you into the action quickly. Here’s a simple breakdown:

- Access Your Account: First things first, log into your IQ Option trading platform. Make sure your account is verified and ready for action.

- Find the Tournament Section: Look for the “Tournaments” tab or icon on your platform’s interface. It’s usually prominently displayed, inviting you to explore the active competitions.

- Browse Available Tournaments: Once in the tournament section, you’ll see a list of ongoing and upcoming competitions. Each entry displays vital information like the entry fee (if any), the duration, and the potential prize pool. You’ll find options ranging from free entry tournaments, perfect for getting started, to more competitive real money tournament options.

- Review the Rules: Before you commit, always read the specific tournament rules. Understanding how points are scored, the starting balance, and any limitations is crucial for developing your strategy.

- Register and Start: Found the perfect competition? Simply click the “Register” or “Join” button. You’ll typically be allocated a special tournament account with a set amount of virtual money to trade with. Now, you’re officially in the game!

Preparing for Your IQ Option Tournament Challenge

Once you’ve completed the “getting started IQ Option” steps and joined a tournament, preparation becomes key. Success isn’t just about luck; it’s about strategy and discipline.

- Practice on a Demo Account: Even if you’re an experienced trader, utilizing your demo account practice before a real tournament can refine your approach. It allows you to test new ideas without risk.

- Develop a Trading Strategy: Don’t enter blindly. Have a clear plan. Will you focus on short-term scalping, or are you looking for longer trends? Your chosen trading strategy should align with the tournament’s duration and your risk tolerance.

- Master Risk Management: While tournament accounts often use virtual money, treating it as if it were real money instills good habits. Understand how much you’re willing to risk per trade to protect your capital and stay in the game longer.

- Stay Informed: Keep an eye on market news and economic calendars. Unexpected events can drastically impact asset prices, presenting both opportunities and risks during a competition.

What to Expect During Your Tournament

When you participate in an IQ Option tournament, you’ll be given a separate tournament balance, usually a fixed amount of virtual funds. Your goal is to increase this balance as much as possible before the tournament concludes. The trader with the highest balance at the end wins or secures a top position in the prize pool. This structure means you’re competing directly against others, which adds an exciting layer of strategy and urgency.

Whether you’re aiming for the top spot or simply looking to gain valuable experience, participating in an IQ Option tournament is an incredible way to hone your trading skills. It’s a low-risk, high-reward environment where you can learn, adapt, and potentially walk away with a fantastic prize. So, why wait? Take the leap and discover the thrill of competitive trading today!

Key Rules and Regulations for Tournament Participation

Ready to put your trading skills to the ultimate test? Joining our forex trading tournament is an exhilarating journey, but like any competitive arena, it comes with a clear set of rules designed to ensure fairness, transparency, and an even playing field for everyone. Understanding these regulations is your first step towards potential victory and a crucial part of becoming a formidable competitor.

We’ve meticulously crafted these guidelines to make sure every participant has the best experience, focusing on genuine trading prowess and strategic thinking. No surprises, just pure skill and smart decisions!

Eligibility and Account Setup

- Who Can Play? To participate, you must be at least 18 years old. We welcome both seasoned traders and enthusiastic newcomers looking to prove their mettle in a competitive environment.

- Your Tournament Account: Each participant will be provided with a dedicated, virtual trading account. This account will have a standardized initial balance, ensuring everyone starts on equal footing. This setup allows you to take calculated risks and explore various trading strategies without impacting your personal capital.

- One Account Per Trader: Fair play is paramount. Each individual is permitted to register and trade with only one tournament account. Any attempts to register multiple accounts will result in immediate disqualification.

The Trading Arena: What You Need to Know

Once you’re in, you’ll find the trading environment familiar yet thrilling. Here’s a breakdown of the operational aspects:

| Rule Category | Details for Participants |

|---|---|

| Available Instruments | You’ll primarily trade major and minor currency pairs. We might also include select commodities like gold and silver to diversify your strategic options. Keep an eye on the official announcement for the full list! |

| Leverage Limits | A specific leverage ratio will be applied to all tournament accounts. This ensures responsible trading practices and prevents excessive risk-taking that could skew results unfairly. |

| Trading Hours | The tournament follows standard market hours for the available instruments. Be aware of rollover times and market closures, as these can impact your open positions. |

| No Expert Advisors (EAs) or Bots | To emphasize manual trading skill and strategy, the use of Expert Advisors (EAs) or automated trading bots is strictly prohibited. We want to see your personal decision-making shine! |

Performance Tracking and Winning Criteria

How do we crown a champion? It’s all about your trading performance, measured precisely and transparently:

- Profit Percentage is Key: Winners are determined based on the highest percentage gain achieved on their initial tournament balance by the competition’s end. This levels the playing field, making sure every trade counts regardless of the starting capital’s absolute value.

- Maximum Drawdown: We encourage smart risk management. A maximum drawdown limit will be in place. Exceeding this limit might lead to disqualification, as it indicates excessively risky trading behavior. It’s about sustainable growth, not just one lucky trade!

- Transparency in Ranking: Your current ranking will be updated regularly on our leaderboards, allowing you to track your progress against fellow competitors in real-time. This adds an exciting dynamic to the tournament, fueling your competitive spirit.

Joining this tournament offers more than just the chance to win prizes; it’s an incredible opportunity to hone your forex trading skills, test new strategies, and engage with a vibrant community of fellow enthusiasts. Adhering to these rules ensures a fair and exciting competition for everyone involved. So, study up, trade smart, and get ready to dominate the market!

Effective Strategies for Winning IQ Option Tournaments

Ever dreamt of seeing your name at the top of a leaderboard, claiming a substantial prize pool? IQ Option tournaments offer an exhilarating arena where your trading prowess meets head-on competition. These contests aren’t just about making profitable trades; they’re about strategic thinking, rapid adaptation, and consistent execution under pressure. Whether you’re a seasoned trader or just starting your journey into the dynamic world of binary options and forex trading, mastering the tournament game can unlock new levels of success and excitement. It’s a chance to test your mettle, refine your trading strategies, and potentially walk away with significant rewards.

Mastering Tournament Capital Management

One of the most crucial elements in IQ Option tournaments is effective capital management. Unlike regular trading where you might focus on long-term growth, tournaments often require a more aggressive, yet calculated, approach to your initial capital. The goal is to climb the leaderboard quickly without blowing up your account. This delicate balance demands smart decisions on trade size and frequency.

- Start Strong but Sensibly: Begin with moderately sized trades to build an initial buffer. Don’t go all-in on your first few trades; preserve your capital.

- Increase Trade Size Strategically: Once you have a comfortable profit margin, you can incrementally increase your trade size. This allows you to leverage your gains to make bigger jumps on the leaderboard.

- Implement a Stop-Loss Mentality: Even though there isn’t a traditional stop-loss in binary options, mentally set limits. If a series of trades goes against you, reduce your trade size or take a short break to reassess the market.

- Reinvest Wisely: The profits you make are your ammunition. Reinvest a significant portion to accelerate your growth, but always keep enough to stay in the game if a trade doesn’t pan out.

Adapting Your Trading Strategy for Competition

The fast-paced nature of IQ Option tournaments often requires a different mindset compared to your everyday forex trading or long-term investments. You need strategies that deliver quick, consistent results. Technical analysis becomes your best friend, helping you spot short-term trends and reversal patterns.

Consider these points for adapting your approach:

“In the heat of a tournament, successful traders don’t just rely on a single perfect strategy. They master several and know exactly when to deploy each one based on market conditions. It’s about being agile, not rigid.” – Veteran Tournament Player

Focus on short-term expiration times, as these can generate rapid turnover of your capital. Look for clear entry and exit points using indicators like moving averages, RSI, and Bollinger Bands. Market analysis that highlights strong momentum or clear consolidation breaks can give you the edge you need to move up the ranks.

The Psychology of a Champion: Emotional Discipline

Winning IQ Option tournaments isn’t just about charts and indicators; it’s heavily influenced by your psychological state. Emotional discipline is paramount. Fear of losing, or greed when winning, can lead to impulsive and poor decisions that quickly derail your progress.

| Challenge | Solution for Tournament Success |

|---|---|

| Fear of Losing | Stick to your pre-defined trading rules. Accept small losses as part of the game. Remember, you can always recover. |

| Greed (Overtrading) | Set daily or hourly profit targets. Once reached, take a break. Don’t chase every single market movement. |

| Frustration (After Loss) | Step away from the screen for a few minutes. Clear your head. Avoid revenge trading, which almost always ends badly. |

| Lack of Focus | Ensure a distraction-free trading environment. Stay hydrated and well-rested. Treat it like a serious competition. |

Practice with a demo account is incredibly valuable for building this mental fortitude. It allows you to experiment with various trading strategies and experience the highs and lows without any real money risk, preparing you for the intense environment of real money tournaments.

Mastering Risk Management in High-Stakes Environments

Ever felt the adrenaline rush of a fast-moving market? That excitement is part of what draws us to the dynamic world of forex trading, but it also highlights the critical need for mastering risk management. In these high-stakes environments, protecting your capital isn’t just smart; it’s the bedrock of sustained success. Without a robust strategy, even the most promising trading opportunities can quickly turn into costly lessons. Think of risk management as your ultimate shield, allowing you to navigate volatility and stay in the game for the long run.

Successful traders don’t just focus on winning trades; they obsess over managing their potential losses. This mindset shift is what separates the consistently profitable from those who quickly burn out. It’s about making calculated decisions, not gambling. Every trade carries a degree of uncertainty, and embracing this reality is the first step toward building resilience in your trading journey.

Core Pillars of Effective Risk Management

Implementing strong risk management involves several key components that work together to safeguard your trading capital:

- Capital Protection: Always prioritize preserving your trading account. Never risk more than a small, defined percentage of your total capital on a single trade. A common rule is to risk no more than 1-2% per trade.

- Position Sizing: This is arguably the most crucial aspect. Determine the appropriate size of your trade based on your risk tolerance and the distance to your stop-loss orders. Incorrect position sizing can quickly lead to outsized losses.

- Stop-Loss Orders: Always use them! A stop-loss order is an instruction to close a trade if the price moves against you to a certain level. It’s your predetermined exit point for a losing trade, preventing small losses from becoming catastrophic.

- Risk-Reward Ratio: Before entering a trade, evaluate the potential profit against the potential loss. Aim for trades where the potential reward significantly outweighs the risk (e.g., 1:2 or 1:3). This means you stand to gain at least twice or thrice what you are willing to lose.

- Emotional Discipline: This isn’t just a technical skill; it’s a psychological one. Sticking to your plan, even when emotions run high, is paramount. Avoid revenge trading or widening your stop-loss in the hope of a turnaround.

As the legendary trader Paul Tudor Jones once famously said,

“I’m always thinking about losing money as opposed to making money. Don’t focus on making money, focus on protecting what you have.”

This powerful quote encapsulates the essence of effective risk management in high-pressure trading scenarios.

Advantages of a Disciplined Approach

Embracing a robust risk management framework brings significant advantages to your trading strategies:

| Benefit | Description |

|---|---|

| Longevity in Markets | You stay in the game longer, giving yourself more opportunities to learn and profit. |

| Reduced Stress | Knowing your maximum loss on any trade brings immense peace of mind. |

| Consistent Performance | Protects your account during inevitable losing streaks, allowing for recovery. |

| Better Decision-Making | Frees up mental energy to focus on strategy and analysis rather than fear. |

Ultimately, mastering risk management cultivates the discipline and resilience needed for long-term success in forex trading. It’s not about avoiding losses entirely – that’s impossible – but about controlling them, ensuring they are small and manageable, and allowing your winning trades to build your account steadily. Embrace these principles, and you’ll be well-equipped to thrive in even the most volatile high-stakes environments.

Analyzing Market Conditions for Optimal Entries

Unlocking profitable trades in the dynamic forex market starts with mastering the art of analyzing market conditions for optimal entry points. It’s not just about jumping in; it’s about making a calculated decision when the odds are stacked in your favor. Think of yourself as a detective, piecing together clues from various sources to uncover the best trading opportunities.

Successful traders don’t just guess; they use a robust framework to identify when to enter the market. This involves a deep dive into both technical and fundamental analysis, looking for confluence – multiple signals pointing in the same direction. Your goal is to enter a trade when the market is most likely to move in your anticipated direction, minimizing your exposure to unnecessary risk.

Key Elements for Pinpointing Your Entries:

- Price Action & Structure: Observe how buyers and sellers interact. Are there clear trends, consolidation patterns, or signs of reversal? Look for support and resistance levels that define price boundaries.

- Technical Indicators: Utilize tools like moving averages, RSI, or MACD to confirm momentum, overbought/oversold conditions, or potential divergences that signal a shift.

- Fundamental Analysis & Economic Data: Stay informed about major economic releases, central bank decisions, and geopolitical events. These can be powerful catalysts that drive significant market movements. Understanding the underlying strength or weakness of currency pairs is crucial.

- Market Sentiment: Gauge the overall mood of the market. Is there fear, greed, or uncertainty? Sentiment can push prices beyond what technicals or fundamentals alone suggest.

Combining these elements helps you build a high-probability trading setup. For instance, you might wait for a currency pair to retest a key support level after a strong economic report, then look for a bullish candlestick pattern as confirmation for your entry. Always remember that an optimal entry point also considers your stop-loss placement and profit targets, ensuring a favorable risk-to-reward ratio.

“The best entry isn’t just where you get in, but where you have the clearest path to profit with minimal risk.”

By diligently analyzing the interplay of these factors, you enhance your ability to spot powerful surges and quiet consolidations alike, setting yourself up for success. It’s about patience, precision, and understanding that every trade begins with an informed decision at the optimal moment.

The Psychological Edge: Discipline and Focus

Forex trading is not just about charts and numbers; it’s a profound test of your mental game. While strategy and analysis are crucial, your success often boils down to how well you manage your inner world. Cultivating a strong psychological edge, anchored by unwavering discipline and razor-sharp focus, transforms ordinary traders into consistent performers. It’s the silent force that helps you navigate market volatility and sidestep common pitfalls.

Mastering Discipline in Forex

Discipline in trading means sticking to your plan, no matter what. It’s about executing your strategy with precision and avoiding impulsive decisions driven by fear or greed. Imagine having a clear set of rules for entering and exiting trades; discipline is the commitment to follow those rules even when the market whispers temptations or screams panic. This commitment builds a strong foundation for managing risk effectively and achieving long-term growth.

- Develop a Robust Trading Plan: Outline your entry points, exit points, stop-loss levels, and profit targets before you open a trade.

- Stick to Your Risk Management Rules: Never overleverage or risk more capital than you can comfortably lose on any single trade.

- Avoid Emotional Trading: Do not chase losses or get carried away by winning streaks. Let your plan guide you, not your feelings.

- Review Your Trades Consistently: Learn from both your successes and failures without self-judgment.

Sharpening Your Focus Amidst Market Noise

Focus is your ability to concentrate on the relevant information and ignore distractions. In the fast-paced forex market, staying focused means understanding your chosen currency pairs, monitoring key economic indicators, and not getting sidetracked by sensational headlines or social media chatter. A focused trader processes information calmly, makes clear decisions, and executes them without hesitation.

Consider the difference between a focused and an unfocused approach:

| Aspect | Focused Trader | Unfocused Trader |

|---|---|---|

| Decision Making | Strategic, calm, plan-driven | Impulsive, reactive, emotional |

| Market Analysis | Analyzes relevant data, sees the bigger picture | Jumps between strategies, gets lost in noise |

| Risk Management | Strict adherence to predefined limits | Often ignores limits, chases losses |

| Emotional State | Composed, patient, resilient | Anxious, frustrated, prone to panic/euphoria |

Developing this psychological edge—the blend of discipline and focus—is an ongoing journey. It requires self-awareness, constant practice, and a commitment to personal growth. Embrace it, and you’ll unlock a significant advantage in the dynamic world of forex trading.

Optimizing Your Tournament Balance Management

Crushing it in a forex trading tournament isn’t just about spotting the perfect entry or nailing a high-profit trade. It’s fundamentally about smart balance management. Think of your tournament capital as your strategic reserve. How you protect it, grow it, and deploy it dictates your longevity and ultimately, your ranking. Many traders, even skilled ones, stumble because they neglect this critical aspect. But fear not! Mastering your tournament balance management is an achievable skill that will dramatically boost your chances of walking away with the prize.

Effective balance management in a competitive trading environment requires a blend of discipline, foresight, and adaptability. It’s not a one-size-fits-all approach; rather, it’s about tailoring your strategy to the specific tournament rules, duration, and your personal risk tolerance. The goal is simple: maximize your potential gains while minimizing the risk of an early knockout.

Key Pillars of Tournament Balance Management

To really get ahead, focus on these essential areas:

- Capital Preservation: Your first priority is always to protect your initial capital. Without it, you can’t trade.

- Calculated Risk-Taking: Tournaments often demand higher risk than standard trading, but it must be controlled.

- Adaptive Strategy: Be ready to pivot your approach as the tournament progresses and your standing changes.

- Psychological Fortitude: Keep emotions in check, especially when facing losses or intense pressure.

Strategies for Intelligent Capital Allocation

Let’s dive into some concrete strategies you can implement right away. These aren’t just theoretical ideas; they are tried-and-true methods that top traders utilize.

Initial Phase: The Conservative Start

During the early stages of a tournament, don’t go all-in. It’s tempting to chase high returns immediately, but a disciplined start builds a solid foundation.

“The primary objective is not to win, but to avoid losing. The secondary objective is to not forget the primary objective.” – Warren Buffett (paraphrased for trading context)

Start with smaller position sizes relative to your overall balance. This allows you to test the waters, understand market conditions, and gather momentum without taking catastrophic hits. Focus on high-probability setups with tight stop losses.

Mid-Phase: Strategic Aggression

As the tournament progresses and you have a clearer picture of your standing and the performance of your competitors, you can consider becoming more aggressive. However, this aggression must be strategic, not reckless. It’s about increasing your leverage or position sizes on your highest conviction trades, those backed by strong analysis and confirming signals.

Late Phase: The Decisive Push

In the final stretch, your balance management becomes even more critical. If you’re trailing, you might need to take larger, calculated risks to catch up. If you’re leading, your focus shifts to defending your position while still seeking opportunities for incremental growth. This phase often requires quick decisions and precise execution.

Risk Management in a Tournament Setting

Risk management takes on a slightly different flavor in a tournament. While the core principles remain, the context changes the application.

Here’s a comparative look at standard vs. tournament risk management:

| Aspect | Standard Trading | Tournament Trading |

|---|---|---|

| Overall Goal | Long-term capital growth | Outperform competitors, win prize |

| Risk Per Trade | Typically 1-2% of capital | Can be higher (e.g., 3-5% or more) depending on stage and rank |

| Focus | Consistency, low drawdown | Aggressive growth, managing leaderboard position |

| Stop Loss | Strictly adhered to | May be wider or adjusted for high-conviction plays, but still present |

| Psychology | Calm, measured | Intense, competitive, high pressure |

Never trade without a stop loss, even in a tournament. The market can always surprise you, and an uncontrolled loss can instantly wipe out your tournament aspirations. Understand your maximum acceptable drawdown. If the tournament rules specify a maximum drawdown before disqualification, make that your absolute hard limit.

Advantages and Disadvantages of Aggressive Tournament Trading

Advantages

- Higher Potential Returns: Increased risk can lead to rapid capital growth, propelling you up the leaderboard.

- Catching Up: If you’re behind, a few well-executed aggressive trades can quickly close the gap.

- Psychological Edge: Successfully taking controlled risks can build confidence and momentum.

Disadvantages

- Increased Risk of Knockout: One bad trade with too much leverage can lead to early elimination.

- Stress and Burnout: The pressure of aggressive trading can be mentally exhausting.

- Inconsistent Performance: High-risk strategies are often less consistent, leading to volatile equity curves.

Ultimately, optimizing your tournament balance management means being smart with your money, disciplined with your trades, and adaptable to the ever-changing competitive landscape. It’s about finding that sweet spot between playing it safe and taking calculated leaps, always keeping your eyes on the prize without letting greed or fear dictate your actions.

Decoding the Leaderboard and Prize Payout Structure

Ever wondered how elite traders rise to the top and claim incredible rewards? It all starts with a clear understanding of the leaderboard and its associated prize payout structure. This isn’t just about showing off; it’s a dynamic, real-time snapshot of performance, an engine for ambition, and a roadmap to lucrative opportunities in the exciting world of forex trading. The leaderboard is where your skill, discipline, and quick thinking translate into tangible success, showcasing your journey among a community of sharp minds.

Our comprehensive leaderboard isn’t just a list of names. It’s a transparent ranking system designed to highlight consistent performance and strategic brilliance. We meticulously track various key metrics to ensure fairness and accuracy, allowing everyone to compete on an even playing field. This gives you a true measure of your progress and provides valuable insights into what drives success in a competitive trading environment.

Here’s how we typically determine who truly stands out:

- Profit Percentage: This is often the ultimate indicator, reflecting your ability to generate returns regardless of initial capital. A higher profit percentage shows superior market analysis and execution.

- Risk Management: While not always a direct ranking factor, strong risk management often leads to sustained performance and prevents dramatic drops, keeping you high on the board.

- Consistency: Traders who maintain steady gains over time often climb higher than those with erratic, high-risk, high-reward streaks.

- Trading Volume: Sometimes, activity level plays a role, especially in certain types of challenges. This measures how actively you engage with the market.

Now, let’s talk about the exciting part: the prize payout structure. This is where your hard work genuinely pays off. Our system is designed to reward a broad range of top performers, ensuring that dedication and skill are celebrated across multiple tiers. We believe in providing significant incentives that not only recognize the absolute best but also encourage new talent to strive for excellence.

Imagine your name climbing higher, knowing that each position brings you closer to fantastic rewards. Here’s a typical example of how prizes might be distributed, showcasing the escalating value as you ascend the ranks:

| Rank Position | Reward Tier | Example Prize |

|---|---|---|

| 1st Place | Elite Champion | Substantial Cash Prize + Exclusive Trading Account Funding |

| 2nd Place | Master Trader | Significant Cash Prize + Advanced Trading Tools |

| 3rd Place | Pro Trader | Generous Cash Prize + Premium Market Analysis Subscription |

| 4th-10th Places | Top Performers | Valuable Cash Bonus + Trading Software Licenses |

| 11th-25th Places | Rising Stars | Cash Bonus + Educational Course Vouchers |

This tiered approach means that even if you don’t snatch the very top spot, there are still incredible opportunities awaiting. It motivates you to refine your trading strategy, push your limits, and consistently improve. Every decision you make, every trade you execute, contributes to your standing and your potential earnings. So, dive in, understand the dynamics, and position yourself for remarkable success on the leaderboard!

Common Pitfalls and How to Avoid Them in Tournaments

Diving into a trading tournament is an exhilarating experience, a true test of skill, strategy, and nerve. However, even the most seasoned traders can stumble if they’re not aware of the common pitfalls that lurk in these high-stakes environments. Our goal isn’t just to participate; it’s to excel and emerge victorious. Let’s shine a light on these traps and equip you with the knowledge to navigate around them, ensuring your journey towards consistent profitability is smoother and more strategic.

Recognizing the Traps:

- Ignoring a Solid Trading Strategy: Many participants get caught up in the thrill, abandoning their carefully planned approach for impulsive decisions. Without a defined trading strategy, you’re essentially gambling, not trading.

- Poor Risk Management: In an effort to rapidly climb the leaderboards, traders often take on excessive risk, allocating too much capital to single trades. This can lead to devastating losses and an early exit from the competition.

- Emotional Trading: Fear of missing out (FOMO) and the desire to recoup losses quickly are powerful emotions that can derail even the best intentions. Allowing emotions to dictate trade execution is a surefire way to make costly mistakes.

- Overtrading: The pressure to constantly be in the market and make more trades can lead to overtrading, where you execute too many low-probability setups, racking up commissions and small losses that quickly add up.

- Inadequate Preparation: Jumping into a tournament without thoroughly understanding its rules, prize structure, and the specific market conditions it covers is a recipe for disaster.

Strategies for Evasion and Success:

Avoiding these common traps requires discipline, foresight, and a commitment to your principles. Here’s how you can proactively mitigate risks and enhance your performance:

- Stick to Your Plan: Before the tournament begins, solidify your forex trading strategy. Define your entry and exit points, position sizing, and the currency pairs you’ll focus on. During the tournament, refer back to it constantly. Treat your strategy as your roadmap to success.

- Prioritize Smart Risk Management: Implement strict risk-reward ratios. Never risk more than a small percentage of your tournament capital on any single trade. Use stop-loss orders diligently. Remember, the primary goal is capital preservation; growing it comes next.

- Master Your Mindset: Practice mindfulness and take short breaks. If you feel emotions taking over, step away from the screen. A calm and logical mind is your greatest asset. Use backtesting to build confidence in your strategy, which helps reduce emotional responses during live trading.

- Quality Over Quantity: Focus on high-probability setups that align with your trading strategy. There’s no prize for the most trades; only for the most profitable. This prevents overtrading and keeps your decision-making sharp.

- Leverage Your Learning Curve: If you’re new to tournaments, consider practicing on a demo account with tournament-like conditions first. This offers valuable experience without financial risk and helps refine your approach to market volatility. Use every trade as a learning opportunity.

Tournament success isn’t just about making big wins; it’s about making smart, calculated moves and meticulously managing your capital. By recognizing and actively avoiding these common pitfalls, you position yourself not just to compete, but to truly shine and achieve consistent profitability.

Advanced Tips to Maximize Your Tournament Performance

You’ve entered the arena, the competitive spirit is high, and you’re ready to prove your trading prowess. While basic strategies get you started, achieving top-tier results in a forex trading tournament demands a more sophisticated approach. This isn’t just about making trades; it’s about executing a refined game plan, adapting swiftly, and maintaining a laser focus under pressure. Let’s dive into advanced techniques that can truly elevate your standing.

Strategic Pillars for Competitive Trading

Success in a tournament hinges on more than just market prediction. It requires a robust framework for decision-making and execution. Consider these crucial elements:

- Adaptive Risk Management: Your usual risk management might need adjustments. Tournaments often involve higher stakes and shorter timeframes. Instead of fixed percentages, consider dynamic risk allocation based on your current standing and remaining time.

- Aggressive Early-Stage Capitalization: Many top performers try to build a significant lead early on. This doesn’t mean reckless trading, but rather identifying high-probability, higher-leverage opportunities to create a cushion.

- Targeted Profit Taking: Set clear, ambitious profit targets for individual trades and for your overall tournament progression. Don’t let winning trades turn into losing ones by holding on too long out of greed.

- Drawdown Control: Define your absolute maximum drawdown tolerance and stick to it religiously. A major setback can quickly eliminate you from contention. Protect your capital at all costs.

The Balance of Aggression and Prudence

Navigating a competitive trading environment requires a delicate balance. Too much aggression leads to burnout; too much caution means missed opportunities. Here’s how different approaches stack up:

| Approach | Advantages | Disadvantages |

|---|---|---|

| Aggressive Trading (Early Stage) | Rapid capital growth; Establishes early lead; High reward potential. | High risk of significant drawdown; Increased stress; Requires swift decision-making. |

| Prudent Trading (Late Stage) | Capital preservation; Reduced risk of elimination; Consistent, steady growth. | Slower growth; May not catch up if far behind; Missed breakout opportunities. |

Mastering Your Mental Game

No amount of technical expertise can compensate for a faltering mindset. Trading psychology plays an immense role in your tournament success. The pressure is real, and emotions can easily derail your strategy. Practice mindfulness and objective analysis.

“The successful trader is always learning, always adapting, and always maintaining a detached, objective view of the market, regardless of the emotional rollercoaster.”

Focus on process over outcome. Celebrate good decisions, not just profitable trades. Learn from every mistake without dwelling on it. This continuous cycle of learning and adaptation is key to sustained performance optimization in the heat of competitive trading.

Post-Tournament Review and Growth

Even after the tournament concludes, your journey isn’t over. A thorough review of your performance is vital for future improvement. Analyze your winning and losing trades, identify patterns in your decision-making, and evaluate how well you adhered to your strategic plan. Did your tournament strategy hold up? Where were your weaknesses? This reflective practice turns every competition into a valuable learning experience, honing your skills for the next challenge.

IQ Option Tournaments vs. Standard Trading: A Comparative Look

Diving into the world of online trading offers various paths to financial growth. Two popular avenues available to traders are IQ Option tournaments and the more traditional standard trading approach. While both involve making informed decisions in financial markets, they differ significantly in their structure, risk profile, and potential rewards. Understanding these differences is crucial for any trader looking to optimize their experience and align it with their personal goals and trading style.

The Thrill of IQ Option Tournaments

IQ Option tournaments inject a competitive, game-like element into the trading experience. Here, traders don’t just compete against the market; they compete against each other. Participants start with an equal amount of virtual money in a specific tournament account. The goal is simple: end up with the highest balance by the tournament’s conclusion. It’s an exciting way to test trading strategies under pressure.

Key Characteristics of Tournaments:

- Fixed Duration: Tournaments run for a set period, from a few hours to several weeks.

- Entry Fee: Most tournaments require a small entry fee, which contributes to the prize pool.

- Virtual Funds: Trading occurs with virtual money, but real prizes are at stake.

- Rebuys: Some tournaments allow “rebuys” if your balance drops too low, letting you rejoin the competition.

- Leaderboard: A live leaderboard displays participants’ rankings, fueling the competitive spirit.

Many traders find these competitive events a fantastic way to develop quick decision-making skills and learn risk management within a controlled, high-stakes environment. It’s a unique take on binary options and other short-term instruments.

Standard Trading: The Conventional Approach

Standard trading, whether it’s forex trading, stock trading, or commodities, is what most people envision when they think of financial markets. This approach involves opening a real account, depositing actual capital, and trading directly in the live market. Your profits and losses are directly tied to your individual trading performance and market analysis.

Fundamentals of Standard Trading:

“Standard trading provides direct exposure to market dynamics, offering flexibility and control over your capital and strategies, without the pressure of a leaderboard.”

With standard trading, you have complete control over your capital, the instruments you trade, and the duration of your positions. There’s no fixed end time or competition against other traders in the same way as a tournament. It’s about personal profit potential and long-term strategy implementation.

Comparing the Two: Where Do They Stand?

Let’s break down the core differences between these two engaging ways to trade.

| Feature | IQ Option Tournaments | Standard Trading |

|---|---|---|

| Objective | Outperform other traders to win a prize. | Generate personal profit from market movements. |

| Capital Risk | Limited to entry fee (and rebuys). Trading with virtual funds. | Directly risk your deposited capital. Trading with real funds. |

| Learning Curve | Excellent for practicing trading strategies under pressure. | Requires thorough market analysis, risk management, and discipline. |

| Pressure | High, due to competitive nature and time limits. | Self-imposed, based on individual financial goals. |

| Profit Potential | Fixed prize pool distribution among top performers. | Unlimited, directly proportional to capital and skill. |

| Focus | Short-term, aggressive trading for ranking. | Long-term strategy, capital preservation, consistent growth. |

Which Path is Right for You?

Your choice between IQ Option tournaments and standard trading largely depends on your personality, financial goals, and experience level. If you enjoy competition, thrive under pressure, and want to test your mettle without risking a large sum of real money, tournaments offer an engaging and low-risk entry point. They can be a fantastic playground for refining your trading strategies and getting accustomed to the platform.

On the other hand, if your goal is steady, sustainable financial growth, and you prefer a more controlled, less competitive environment, standard trading is likely your best bet. It requires discipline, continuous market analysis, and a solid understanding of risk management, but it offers the greatest flexibility and ultimate control over your financial destiny. Many start with a demo account in standard trading before committing real funds, mirroring the low-risk practice tournaments provide. Consider what drives you: the thrill of the chase or the steady climb of growth.

Is Participating in IQ Option Tournaments Worth Your Time?

Ever wondered if those high-stakes, action-packed IQ Option tournaments are more than just a fleeting diversion? As a seasoned trader, I can tell you they offer a unique blend of excitement, challenge, and genuine opportunity. While the allure of a substantial prize pool is undeniably strong, the real value extends far beyond the monetary rewards. Let’s dive into why these competitions might just be the perfect arena for you to sharpen your edge and even boost your income.

Unleash Your Trading Skills in a Competitive Arena

IQ Option tournaments are not just about luck; they are a fantastic proving ground for your trading skills. Imagine pitting your strategies against hundreds, sometimes thousands, of other traders from around the globe. This intense environment pushes you to make quicker, more calculated decisions. You get to test new approaches for forex trading, commodities, or even binary options without the fear of significant personal capital loss, especially in those tournaments with low entry fees or even free participation.

Here’s why many traders find them incredibly beneficial:

- Risk-Free Practice: Many tournaments start with a virtual balance, allowing you to experiment with aggressive or conservative trading strategies without risking your own money. It’s like a high-octane demo account with a real prize on the line!

- Skill Development: The pressure of a leaderboard forces you to analyze market conditions rapidly, manage risk effectively, and execute trades with precision. This accelerates your learning curve in ways that solo trading often cannot.

- Discover New Strategies: Observing the winning trading strategies of others (through public leaderboards or post-tournament analysis) can spark new ideas and refine your own approach.

- Boost Confidence: Performing well, even if you don’t win the top prize, builds immense confidence in your abilities, which is crucial for sustained success in real money trading.

The Tangible Rewards: Prize Pools and More

Of course, we can’t ignore the impressive prize pools often associated with IQ Option tournaments. These can range from smaller sums for daily challenges to substantial amounts for major events. Imagine turning a small entry fee into a significant payout – that’s a very real possibility. Beyond the cash, there’s also the immense satisfaction of achieving a high rank, proving your mettle against a global field.

Consider these compelling advantages:

| Advantage | Description |

|---|---|

| Financial Gain | Opportunity to win real money from a collective prize pool, often much larger than your initial buy-in. |

| Low Barrier to Entry | Many tournaments have minimal entry fees, making them accessible to traders of all budget levels. Some are even completely free. |

| Competitive Edge | Testing your wits against others sharpens your competitive edge, a vital trait in the fast-paced world of trading. |

| Networking (Indirect) | While not direct, participating in these global events can make you feel part of a larger trading community, fostering a sense of belonging and shared ambition. |

As one experienced trader famously stated, “The markets are a relentless teacher, but tournaments are where you get to graduate with honors, often with a cash prize to boot!”

Is it Right for You?

Participating in IQ Option tournaments is certainly worth your time if you’re looking for an exciting way to develop your trading skills, test new trading strategies, and potentially earn significant income. It’s a dynamic environment that rewards discipline, quick thinking, and a solid understanding of market movements. If you’re eager to take your trading journey to the next level and embrace a thrilling challenge, then sign up for an upcoming tournament. You might just surprise yourself with how much you can achieve.

Frequently Asked Questions

What are IQ Option Tournaments?

IQ Option Tournaments are competitive trading events where participants use virtual funds in a dedicated tournament account to compete against other traders. The goal is to grow the account balance as much as possible within a set timeframe, with top performers sharing real money prizes.

How do IQ Option tournaments work?

Participants register for a tournament (some free, some with an entry fee), receive a virtual balance, and trade various assets. A real-time leaderboard tracks progress, and at the end, traders with the highest balances share a predefined prize pool.

What kind of prizes can be won in IQ Option tournaments?

Prizes typically include cash payouts, trading credits for live accounts, exclusive access to premium tools, advanced analytics, or educational courses, and sometimes opportunities for partnerships or mentorship.

Are there free IQ Option tournaments available?

Yes, IQ Option frequently offers free entry tournaments that use virtual funds on a demo account. These are excellent for practicing strategies and gaining experience without financial risk, with some even offering real cash rewards.

How do IQ Option tournaments help improve trading skills?

Tournaments accelerate skill development by forcing traders to make rapid, decisive actions under pressure. They provide a low-risk environment to test new strategies, refine market analysis, manage risk effectively, and build emotional discipline and confidence.