Are you an aspiring trader in India looking to navigate the exciting world of financial markets? Perhaps you’re searching for a reliable platform to kickstart your journey toward online trading success. Look no further! This comprehensive guide introduces you to IQ Option India, a dynamic and user-friendly trading platform that empowers millions to explore diverse investment opportunities.

IQ Option offers a robust environment for engaging in various forms of online trading, from forex trading and stock trading to commodities and even crypto trading. It’s designed with both beginners and experienced investors in mind, providing tools and resources to help you make informed decisions.

This ultimate guide is your roadmap. We understand that stepping into the trading arena can feel daunting, but with the right knowledge and a powerful platform like IQ Option, you can build confidence and develop effective trading strategies. We will delve into everything you need to know, from setting up your account to understanding market analysis and implementing sound risk management principles.

Here’s a sneak peek at what awaits you:

- Discovering the IQ Option platform and its key features.

- Mastering essential trading concepts for profitable decisions.

- Exploring various assets, including digital options, for diversified portfolios.

- Learning how to utilize powerful analytical tools and indicators.

- Strategies for managing your capital and minimizing potential losses.

- Tips for continuous learning and adapting to market changes.

Join us as we unlock the full potential of IQ Option India, guiding you every step of the way toward building your path to trading success. Your journey to becoming a confident and skilled trader starts right here!

- Is IQ Option Legal and Safe for Indian Traders?

- Understanding the Regulatory Landscape for Indian Traders

- Assessing the Safety of IQ Option

- Advantages and Disadvantages for Indian Traders

- Advantages for Indian Traders

- Disadvantages for Indian Traders

- Understanding IQ Option: What It Is and How It Works

- Getting Started with IQ Option India: Account Registration Steps

- Your First Steps: Account Creation

- Email Verification: A Quick Check

- What Happens Next?

- Deposits and Withdrawals: Funding Your IQ Option India Account

- Making a Deposit: Fueling Your Trading Ambition

- Withdrawing Your Profits: Enjoying Your Trading Success

- Key Considerations for Indian Traders

- Popular Deposit Methods for Indian Traders (UPI, Net Banking, E-Wallets)

- Instant Funding with UPI Payments

- Reliable Net Banking Deposits

- Flexible E-Wallet Transactions

- Fast Withdrawal Options and Processing Times for IQ Option India

- Popular Withdrawal Methods for IQ Option India Traders

- Understanding Withdrawal Processing Times

- Trading Instruments Available on IQ Option India

- Unlocking Diverse Market Opportunities

- Why Instrument Variety Matters

- Exploring Forex Trading in India with IQ Option

- Why Indian Traders Choose IQ Option:

- Options Trading Explained: Opportunities for Indian Users

- Cryptocurrencies and CFDs: Diversifying Your Portfolio

- Why Diversify with Crypto and CFDs?

- Crafting a Robust Trading Strategy

- IQ Option Platform Features and Trading Tools

- A Universe of Trading Opportunities

- Empowering Tools for Sharper Decisions

- Seamless User Experience and Accessibility

- Mobile Trading: The IQ Option India App Experience

- Key Advantages of the IQ Option India Mobile App:

- Practice Risk-Free: Utilizing the IQ Option Demo Account

- Key Benefits of the IQ Option Practice Account:

- Security Measures and Data Protection on IQ Option India

- How IQ Option India Protects You:

- Our Commitment to Data Protection:

- Pros and Cons of Using IQ Option in India

- The Bright Side: Advantages of Using IQ Option in India

- The Flip Side: Disadvantages and Key Considerations

- Comparing IQ Option with Other Online Brokers in India

- Risk Management Strategies for Indian Traders on IQ Option

- Why Risk Management Matters More Than Ever

- Key Strategies for Capital Preservation

- The Psychological Edge

- Risk Management in Action on IQ Option

- Customer Support and Assistance for IQ Option India Users

- How to Connect with IQ Option Support:

- What You Can Expect from IQ Option’s Support Team:

- Frequently Asked Questions about IQ Option India

- How do I start trading with IQ Option in India?

- What trading instruments are available on IQ Option for Indian users?

- What are the minimum deposit and withdrawal amounts?

- Is my money safe with IQ Option?

- Conclusion: Is IQ Option India the Right Choice for Your Trading Journey?

- Frequently Asked Questions

Is IQ Option Legal and Safe for Indian Traders?

Many aspiring traders in India look for accessible platforms to dive into the exciting world of financial markets. IQ Option often pops up as a popular choice due to its user-friendly interface and diverse range of assets. However, a crucial question always arises: Is IQ Option legal and safe for Indian traders? Let’s peel back the layers and explore this in detail, giving you a clear picture.

Understanding the Regulatory Landscape for Indian Traders

India’s financial markets are primarily regulated by the Securities and Exchange Board of India (SEBI). SEBI oversees stock exchanges, brokers, and other financial intermediaries within the country. When it comes to platforms like IQ Option, which are based offshore, the situation becomes a bit nuanced. Here’s what you need to know:

- No Direct SEBI Regulation: IQ Option is not directly regulated by SEBI. It operates under international licenses, typically from regulatory bodies in other jurisdictions (for example, CySEC for its EU operations). This means that while IQ Option itself is regulated internationally, it doesn’t fall under Indian financial law.

- Access is Not Illegal: While not regulated by SEBI, it’s generally not illegal for Indian residents to access and trade on offshore platforms. There’s no specific law prohibiting individuals from engaging in online trading with international brokers. However, users must ensure compliance with India’s foreign exchange laws, particularly regarding currency conversions and tax obligations.

- Forex Trading Status: The Reserve Bank of India (RBI) has issued advisories discouraging unauthorized forex trading. However, these advisories primarily target platforms that are explicitly *illegal* or operate without any credible regulation. IQ Option, with its international licensing, stands in a slightly different category, though traders should always be aware of the RBI’s stance on unapproved entities.

So, while IQ Option isn’t an Indian-regulated entity, accessing it from India isn’t explicitly against the law. It operates in a regulatory grey area, placing a greater emphasis on individual trader diligence.

Assessing the Safety of IQ Option

Beyond legality, safety is paramount. When you entrust your funds to an online trading platform, you need assurance. Let’s look at IQ Option’s safety features:

| Safety Aspect | IQ Option’s Approach |

|---|---|

| International Regulation | IQ Option holds licenses from reputable international regulatory bodies. These regulations ensure a certain level of investor protection, transparency, and operational standards. This includes financial reporting and client fund segregation. |

| Client Fund Segregation | A key safety measure is keeping client funds separate from the company’s operational funds. This means that even if the company faces financial difficulties, your trading capital remains protected and can be returned to you. |

| Data Security | The platform employs advanced encryption technologies (like SSL) to protect your personal and financial data. This safeguards your information from unauthorized access during transactions and logins. |

| Negative Balance Protection | For certain account types and jurisdictions, IQ Option may offer negative balance protection. This feature ensures that you cannot lose more money than you have deposited, protecting you from falling into debt with the broker due to market volatility. |

| Risk Management Tools | The platform provides tools like stop-loss and take-profit orders. These help traders manage their exposure and define their risk tolerance for each trade, which is crucial for responsible trading. |

From a technical and operational standpoint, IQ Option implements many standard safety measures found across reputable online brokers. Its long-standing presence in the global market and millions of users also speak to its operational reliability.

Advantages and Disadvantages for Indian Traders

Making an informed decision means weighing the pros and cons specifically from an Indian trader’s perspective:

Advantages for Indian Traders

- Accessibility: Easy signup process and low minimum deposit make it accessible for beginners.

- Diverse Instruments: Offers a wide range of financial instruments including forex pairs, cryptocurrencies, stocks, and commodities through CFDs.

- User-Friendly Platform: Known for its intuitive and powerful trading platform, available on web, desktop, and mobile.

- Demo Account: Provides a free demo account with virtual funds, allowing you to practice strategies without real financial risk.

- Payment Options: Supports various convenient payment methods that are popular in India for deposits and withdrawals.

Disadvantages for Indian Traders

- Regulatory Grey Area: The lack of direct SEBI regulation means limited recourse under Indian law if disputes arise.

- Tax Compliance: Traders are solely responsible for understanding and complying with Indian income tax laws on their trading profits, which can be complex.

- Forex Exchange Risk: Dealing with an international broker means currency conversion when depositing or withdrawing, which can incur fees and exchange rate fluctuations.

- High Risk of CFDs: Trading Contracts for Difference (CFDs) and options carries a high level of risk, and you can lose your entire investment quickly, especially with leverage.

In conclusion, IQ Option presents a viable platform for Indian traders seeking to participate in global markets. While it operates in a regulatory grey area within India, the platform itself implements robust safety measures and holds international licenses. Your priority as an Indian trader should be thorough due diligence, understanding the inherent risks of trading, and ensuring compliance with all local tax and foreign exchange regulations. Trade smart, stay informed, and always prioritize responsible risk management.

Understanding IQ Option: What It Is and How It Works

Are you curious about the exciting world of online trading and wondering how platforms like IQ Option can fit into your financial journey? You’ve come to the right place! As an experienced forex professional, I see countless individuals eager to explore market opportunities. IQ Option stands out as a popular choice, known for its user-friendly interface and diverse range of trading instruments.

So, what exactly is IQ Option? At its core, it’s an innovative online trading platform that gives you access to various financial markets. Think of it as your digital gateway to potentially profit from price movements in assets like currency pairs, stocks, commodities, and even cryptocurrencies. It’s designed to simplify complex market activities, making them understandable and accessible even for beginners. You can engage with real-time market dynamics, making predictions about whether an asset’s price will go up or down.

Now, let’s dive into how it works for you, the trader. The process is remarkably straightforward, focusing on predicting market direction within set timeframes. Here’s a simple breakdown of the typical trading flow:

- Account Setup & Funding: First, you open an account. IQ Option offers a fantastic free demo account loaded with virtual money, which is perfect for practicing your strategies without any risk. When you’re ready to trade with real capital, you can deposit funds using various convenient payment methods.

- Asset Selection: Next, you choose an asset you want to trade. This could be a major currency pair like EUR/USD, a popular company stock, a commodity such as gold, or a cryptocurrency. The platform provides a wide and liquid selection to explore.

- Prediction & Investment: This is where the excitement builds! You predict the direction the price of your chosen asset will move within a specific expiration period. Will it rise, or will it fall? Based on your analysis and market insights, you invest a certain amount in that prediction.

- Trade Execution & Outcome: The platform instantly executes your trade. If your prediction is correct by the time the expiration period ends, you earn a profit, often a high percentage of your initial investment. If your prediction is incorrect, you lose the amount you invested in that particular trade. It’s a dynamic environment where sharp market analysis and quick decisions are key.

IQ Option also offers various trading types, including popular options and Contracts for Difference (CFDs), each with unique characteristics and risk profiles. Their intuitive interface, coupled with readily available educational resources, helps you navigate these choices effectively. It’s all about empowering you to take control of your trading journey with a platform designed for both simplicity and powerful market engagement.

Getting Started with IQ Option India: Account Registration Steps

Ready to dive into the exciting world of online trading? IQ Option India offers a fantastic platform for both beginners and experienced traders to explore various financial instruments. Whether you are interested in forex, options, or other assets, getting started is straightforward. We’ll walk you through the simple account registration steps, so you can begin your trading journey with confidence.

Your First Steps: Account Creation

Opening an account with IQ Option India is designed to be quick and user-friendly. Here’s a breakdown of what you need to do:

- Visit the Official Website: Navigate to the IQ Option India official website. Always ensure you are on the correct domain to protect your information.

- Click “Sign Up”: You’ll usually find this button prominently displayed, often in the top right corner of the page.

- Provide Basic Information:

- Enter your active email address.

- Create a strong, unique password.

- Select your country of residence (India, in this case).

- Agree to Terms: Read and accept the Terms and Conditions and Privacy Policy. It’s always a good practice to understand the rules of the platform you’re joining.

- Complete Registration: Click the “Sign Up” or “Create Account” button to finalize this initial stage.

Email Verification: A Quick Check

After registering, IQ Option India sends a verification email to the address you provided. This is a crucial step to activate your account and ensure its security. Open the email and click on the verification link. This confirms your email address and unlocks full access to your new trading account.

What Happens Next?

Once your account is verified, you can immediately access the platform. You’ll find options to explore the interface, try out a demo account with virtual funds to practice your strategies, or proceed to make your first deposit and start real trading. The platform offers a seamless experience, guiding you through its features and tools.

Embarking on your trading adventure with IQ Option India begins with these easy steps. Take the leap and discover the opportunities that await you in the financial markets!

Deposits and Withdrawals: Funding Your IQ Option India Account

Embarking on your online trading journey with IQ Option India begins with a crucial step: effectively managing your funds. Seamless deposits and efficient withdrawals are not just conveniences; they are cornerstones of a stress-free and productive trading experience. Understanding the various methods available and how they work ensures you can focus on market analysis and strategy, rather than worrying about your money’s accessibility.

Making a Deposit: Fueling Your Trading Ambition

Funding your IQ Option India account is designed to be straightforward, allowing you to quickly get started with live online trading. The platform offers a variety of payment methods tailored to the preferences of Indian traders, ensuring secure transactions and instant processing in most cases. You want to be able to jump into the market when opportunities arise, and a quick deposit makes that possible.

Here are some common ways Indian users can fund their accounts:

- Debit/Credit Cards: Visa and MasterCard are widely accepted, offering a familiar and fast way to deposit funds. Most transactions are processed instantly, allowing you to start trading without delay.

- E-Wallets: Digital wallets like Skrill, Neteller, and Perfect Money provide a modern and often preferred method for online transactions. They are known for their speed and enhanced security features, making them excellent choices for your IQ Option India account.

- Bank Transfer: While generally slower, direct bank transfers are available for those who prefer traditional banking methods. Keep in mind that processing times can vary, sometimes taking a few business days.

Remember, the minimum deposit amount is typically low, making IQ Option accessible for beginners. Always check the latest requirements on the platform for the most up-to-date information.

Withdrawing Your Profits: Enjoying Your Trading Success

The true satisfaction of forex trading comes when you successfully withdraw your earned profits. IQ Option India prioritizes a secure and efficient withdrawal process to ensure you can access your funds when you need them. While deposits are often instant, withdrawals involve a few more steps to safeguard your money and comply with financial regulations.

The general withdrawal process involves:

- Request Submission: Navigate to the withdrawal section in your trading account and specify the amount you wish to withdraw.

- Method Selection: You will typically need to withdraw funds using the same method you used for depositing, especially for debit/credit cards, to prevent money laundering. If you used multiple methods, the system usually prioritizes specific channels.

- Verification: For your first withdrawal, or for larger sums, you might be asked to complete a verification process. This often involves submitting identity documents. This is a standard security measure to protect your funds and is common across regulated online trading platforms.

- Processing Time: IQ Option aims to process withdrawal requests quickly, often within 1-3 business days. However, the total time it takes for funds to appear in your account can depend on your chosen payment provider (e.g., bank, e-wallet).

It’s important to plan your withdrawals, especially if you need the funds by a specific date. Fast withdrawals are a priority, but external factors can influence the final timeline.

Key Considerations for Indian Traders

As you manage your funds on IQ Option India, keep these practical points in mind:

- Currency Conversion: While you might deposit in INR, your trading account will often operate in USD. Be mindful of potential currency conversion fees during deposits and withdrawals.

- Documentation: Have your identification and proof of address documents ready for verification. This ensures a smooth and quick process when you make your first withdrawal.

- Platform Support: If you encounter any issues during the funding process, IQ Option’s customer support team is available to assist you, ensuring your experience is as seamless as possible.

Effective management of your deposits and withdrawals is key to a positive online trading journey. By understanding the available methods and the processes involved, you empower yourself to trade with confidence and easily access your earnings.

Popular Deposit Methods for Indian Traders (UPI, Net Banking, E-Wallets)

Navigating the financial landscape of forex trading in India requires understanding convenient and secure ways to fund your trading account. For Indian traders, a few key deposit methods stand out for their reliability and ease of use. These methods ensure that you can quickly top up your balance and focus on seizing market opportunities.

Instant Funding with UPI Payments

The Unified Payments Interface (UPI) has revolutionized digital payments in India, and its popularity extends seamlessly to online trading. UPI offers an incredibly fast and straightforward way to deposit funds. Most brokers supporting forex trading India now readily accept UPI, allowing for instant deposits directly from your bank account using your UPI ID. It’s highly secure, convenient, and incredibly efficient for smaller, frequent top-ups, making it a favorite for many active traders.

Reliable Net Banking Deposits

Net Banking remains a steadfast and trusted method for funding trading accounts. This option allows you to transfer funds directly from your bank account to your broker using your bank’s online portal. While perhaps not as instantaneous as UPI, net banking deposits are known for their high security protocols and are ideal for larger transactions. Many traders appreciate the familiarity and robust nature of direct bank transfers, knowing their funds are moved through established banking channels. It’s a method that offers peace of mind and broad acceptance across various trading platforms.

Flexible E-Wallet Transactions

E-wallets have become an indispensable part of daily financial life for many Indians, and their utility extends to funding forex accounts. These digital wallets offer a flexible and often quick way to deposit funds, acting as an intermediary between your bank and your trading platform. The process for e-wallet transactions is generally smooth and user-friendly, providing an extra layer of privacy as your bank details are not directly shared with the broker. They are excellent for managing your trading budget separately and for making quick deposits on the go, leveraging the convenience of mobile applications.

Choosing the right deposit method often comes down to personal preference and the specific features offered by your broker. However, UPI, Net Banking, and E-Wallets collectively provide a comprehensive suite of options that cater to the diverse needs of Indian forex traders.

Fast Withdrawal Options and Processing Times for IQ Option India

One of the most crucial aspects traders consider when choosing a platform is the ease and speed of getting their funds out. At IQ Option India, we understand this completely. You work hard to make profitable trades, and you deserve to access your earnings quickly and without hassle. We’ve optimized our system to provide some of the most efficient fast withdrawal options available, ensuring your funds reach you promptly.

Our commitment is to make your trading experience as smooth as possible, from depositing funds to securing your quick payouts. We offer a variety of popular and reliable methods specifically tailored for our Indian users, focusing on both speed and security.

Popular Withdrawal Methods for IQ Option India Traders

We support several convenient avenues for you to withdraw your profits. Each method is chosen for its efficiency and widespread use in India:

- E-wallets: Solutions like Skrill, Neteller, and Perfect Money are incredibly popular for their speed. After IQ Option processes your request, funds often appear in your e-wallet account within hours, sometimes even minutes. These are generally the fastest options.

- Bank Transfers: While slightly slower than e-wallets, direct bank transfers are a reliable and secure way to receive larger sums directly into your Indian bank account.

- Debit Cards: Withdrawals to your Visa or MasterCard debit cards are also an option. Keep in mind that for security reasons, you can only withdraw up to the amount you initially deposited using that card. Any profits beyond that would typically need to go via another method, like an e-wallet or bank transfer.

Understanding Withdrawal Processing Times

When you initiate a withdrawal, there are generally two stages involved in the processing times:

- IQ Option Internal Processing: Our finance department reviews and approves your withdrawal request. This usually takes up to 3 business days. During this stage, we verify your account and ensure all security protocols are met.

- Payment Provider Processing: Once approved by IQ Option, the funds are sent to your chosen payment system. The time it takes for the money to appear in your account depends entirely on the provider:

Here’s a quick overview of typical post-approval times:

| Withdrawal Method | Estimated Time (After IQ Option Approval) | Best For |

|---|---|---|

| E-wallets (Skrill, Neteller, Perfect Money) | Instant – 24 hours | Speed, frequent smaller withdrawals |

| Bank Transfers | 1 – 5 business days | Larger sums, direct to bank |

| Debit Cards (Visa/MasterCard) | 1 – 5 business days | Initial deposit amount withdrawals |

To ensure the quickest possible experience, always make sure your account is fully verified before requesting a withdrawal. A completed verification process avoids potential delays. Providing accurate and up-to-date documentation helps our team process your request without a hitch. We prioritize your financial security with every transaction, making sure your funds are handled with care from start to finish.

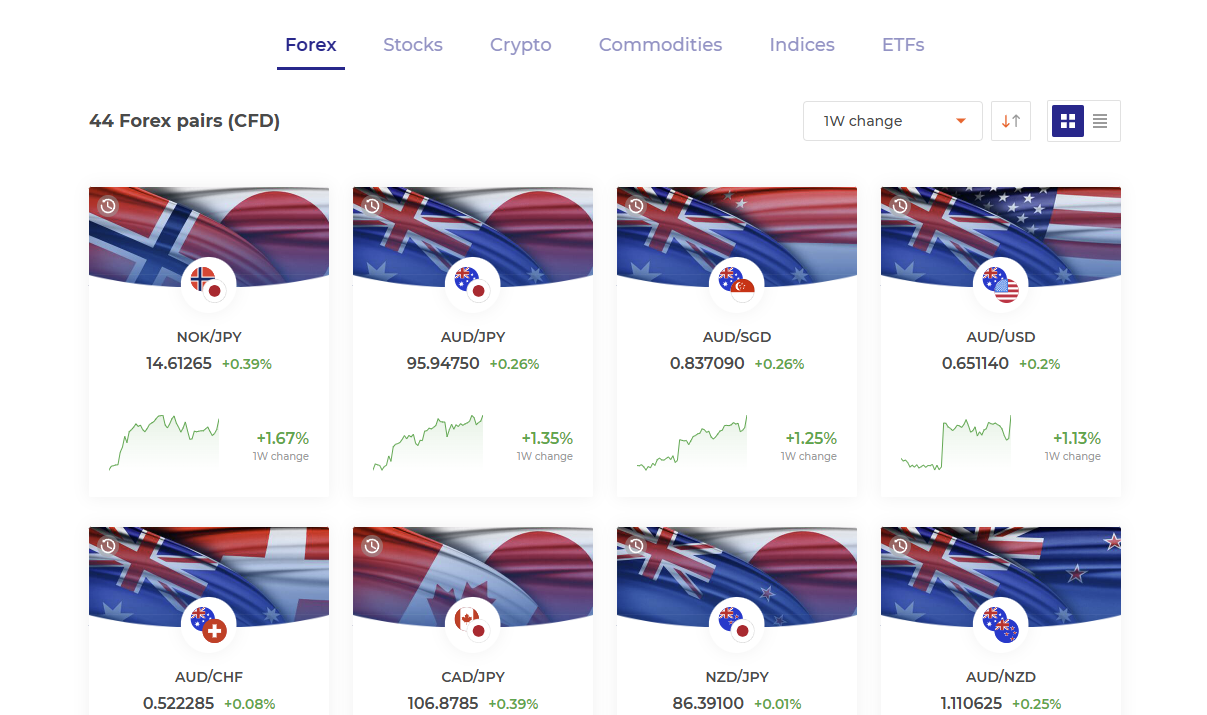

Trading Instruments Available on IQ Option India

Diving into the world of online trading means exploring a diverse universe of assets. On IQ Option India, traders gain access to a broad selection of instruments, each offering unique opportunities and challenges. Whether you’re a seasoned pro or just starting your journey, the platform provides a rich environment to diversify your portfolio and explore different market dynamics. Let’s unwrap the exciting range of trading instruments waiting for you.

Unlocking Diverse Market Opportunities

IQ Option understands the need for variety. They strive to offer instruments that cater to different trading styles and risk appetites. Here’s a breakdown of what you can expect to trade:

- Forex (Foreign Exchange): This is the largest financial market globally, and on IQ Option, you can trade popular currency pairs. Think USD/INR, EUR/USD, GBP/USD, and many more. Engage with currency movements and leverage global economic events to your advantage.

- Stocks CFDs (Contracts for Difference): Ever wanted to trade shares of companies like Apple, Google, or Amazon? Through CFDs, you can speculate on the price movements of major international companies without owning the underlying asset. This gives you flexibility and opportunities in both rising and falling markets.

- Commodities CFDs: Gold, crude oil, silver – these essential resources significantly influence global economies. IQ Option allows you to trade CFDs on these and other commodities, providing a way to participate in their price fluctuations driven by supply, demand, and geopolitical events.

- Cryptocurrency CFDs: The digital currency revolution is here to stay. Trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and many others. This lets you capitalize on the often volatile but potentially rewarding crypto market without needing a crypto wallet.

- ETFs (Exchange Traded Funds) CFDs: ETFs offer a convenient way to invest in a basket of assets. With IQ Option, you can trade CFDs on various ETFs, gaining exposure to entire sectors or market indices with a single trade. It’s an excellent way to diversify and spread risk.

Why Instrument Variety Matters

A wide selection of trading instruments offers several key benefits for traders:

| Benefit | Description |

|---|---|

| Diversification | Spreading your capital across different asset classes helps reduce overall portfolio risk. When one market struggles, another might thrive. |

| More Opportunities | Different instruments become active at various times and under different market conditions. More options mean more chances to find profitable trades. |

| Strategy Flexibility | Certain strategies work better with specific instruments. A broad choice allows you to adapt your approach to current market trends. |

| Learning Experience | Exploring various markets expands your knowledge and understanding of global finance. You become a more well-rounded trader. |

Engaging with these different trading instruments on IQ Option India opens up a world of possibilities. Each asset class responds to unique market drivers, providing multiple avenues for strategic trading. Take your time to understand each one, practice on a demo account, and build a trading strategy that aligns with your financial goals.

Exploring Forex Trading in India with IQ Option

The world of forex trading offers exciting opportunities, and for many in India, IQ Option stands out as a platform worth considering. As more individuals look to engage with global financial markets, understanding how to navigate these waters effectively becomes crucial. India’s burgeoning interest in online trading has paved the way for platforms like IQ Option to offer their services, providing a gateway to the dynamic foreign exchange market.

Engaging in forex trading in India requires a reliable and user-friendly platform. IQ Option has gained traction for its intuitive interface, making it accessible even for those new to the scene. You can easily access a wide array of currency pairs, allowing you to diversify your trading strategies. The platform emphasizes simplicity without compromising on advanced tools and features that seasoned traders appreciate.

Why Indian Traders Choose IQ Option:

- Accessibility: Offers a user-friendly experience, perfect for beginners and experienced traders alike.

- Diverse Instruments: Beyond forex, access other financial instruments for a broader trading scope.

- Educational Resources: Provides tutorials and guides to help you understand market dynamics.

- Mobile Trading: The dedicated mobile trading app allows you to trade on the go, anytime, anywhere.

- Demo Account: Practice your strategies with a free demo account before committing real capital.

When you start with IQ Option India, you’ll find the process of setting up an account straightforward. They offer various deposit methods tailored for Indian users, ensuring a smooth entry into the market. It’s essential to approach online forex trading with a clear strategy and an understanding of market risks. IQ Option empowers you with the tools to analyze market trends and make informed decisions, whether you are interested in major currency pairs or exploring more exotic options.

Many traders appreciate the platform’s commitment to continuous improvement, regularly updating features to enhance the trading experience. This focus on technology and user experience helps create a positive environment for those looking to participate in the global foreign exchange market from India. Always remember to trade responsibly and manage your capital wisely.

Options Trading Explained: Opportunities for Indian Users

Options trading can seem complex at first glance, but it’s a powerful financial instrument that opens up a world of strategic possibilities for investors. Simply put, an option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset—like stocks, indices, or commodities—at a predetermined price on or before a specific date. The beauty of options lies in their versatility, allowing you to profit from various market movements, not just when prices go up.

For Indian users, the growth of the financial markets has brought a surge in opportunities for engaging with derivative products. The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) offer robust platforms for trading stock options and index options, providing ample liquidity and diverse choices. This accessibility means individual investors can participate in sophisticated strategies that were once only available to institutional players.

Here are some compelling reasons why options trading presents significant opportunities for investors in India:

- Leverage: Options allow you to control a large block of shares with a relatively small amount of capital. This means a small price movement in the underlying asset can result in a significant percentage gain on your options investment. However, it’s crucial to understand that leverage also amplifies losses.

- Hedging: Options serve as an excellent tool to protect your existing portfolio. If you own shares of a company and are concerned about a short-term price drop, you can buy put options to safeguard your gains or limit potential losses, much like an insurance policy.

- Income Generation: Strategies like covered calls can generate regular income from your existing stock holdings. By selling call options against shares you own, you collect premium, enhancing your overall returns.

- Diversified Strategies: Whether the market is bullish, bearish, or even moving sideways, there’s an options strategy that can potentially profit. You can execute strategies like straddles or strangles to benefit from volatility, or spreads to limit risk.

The Indian market provides a dynamic environment for options traders. With easily accessible online brokerage platforms and increasing financial literacy, more individuals are exploring how to incorporate options into their investment portfolios. It’s a journey that demands continuous learning and a disciplined approach, but the potential for enhancing returns and managing risk makes it a truly exciting frontier.

Cryptocurrencies and CFDs: Diversifying Your Portfolio

Building a resilient and dynamic investment portfolio in today’s fast-paced financial world demands more than just traditional assets. Savvy traders constantly seek innovative ways to expand their horizons and manage risk. This is where the powerful combination of cryptocurrency trading and CFD trading comes into play, offering unique avenues for true portfolio diversification.

Why Diversify with Crypto and CFDs?

The goal of diversification is simple: spread your risk and capture opportunities across different market segments. Cryptocurrencies and Contracts for Difference (CFDs) each bring distinct advantages to this strategy.

Cryptocurrencies: The New Frontier of Digital Assets

Digital assets like Bitcoin, Ethereum, and countless altcoins represent a revolutionary asset class. They often operate independently from traditional financial markets, making them excellent candidates for diversification. Here’s what they offer:

- Uncorrelated Movements: Cryptocurrencies can move differently from stocks or commodities, providing a hedge against downturns in conventional markets.

- High Growth Potential: While characterized by significant market volatility, cryptocurrencies have shown explosive growth potential over time, attracting traders looking for high returns.

- Technological Innovation: Investing in crypto is also an investment in cutting-edge blockchain technology, tapping into a sector with immense future prospects.

CFDs: Flexible Market Access Across Multiple Asset Classes

CFD trading allows you to speculate on the price movements of a wide range of underlying assets without actually owning them. This includes stocks, indices, commodities, currencies (the forex market), and even cryptocurrencies themselves. The versatility of CFDs makes them a prime tool for diversification:

| Feature | Benefit for Diversification |

|---|---|

| Leveraged Trading | Magnify your market exposure with a smaller initial capital, potentially amplifying returns across diverse assets (but also risks). |

| Go Long or Short | Profit from both rising and falling markets, adding flexibility to your trading strategies regardless of market direction. |

| Broad Market Access | Trade various global markets from a single platform, easily diversifying across sectors and geographies. |

Crafting a Robust Trading Strategy

Combining cryptocurrencies and CFDs provides a powerful approach to build a well-rounded portfolio. You can use crypto for long-term growth speculation and as a unique, non-traditional asset class. Simultaneously, employ CFDs for more agile, short-to-medium term risk management and tactical market plays across a broad spectrum of instruments.

Imagine using CFDs to trade gold or oil to balance your portfolio while holding a position in a promising cryptocurrency. Or, use crypto CFDs to speculate on the price of digital assets without the complexities of owning the underlying coins directly. This integrated approach allows you to respond dynamically to market conditions and uncover opportunities you might otherwise miss.

Embrace the future of trading by intelligently integrating cryptocurrencies and CFDs into your investment framework. It’s a smart move for anyone serious about elevating their trading game and achieving superior portfolio diversification.

IQ Option Platform Features and Trading Tools

Embarking on your trading journey requires a robust and intuitive platform, and the **IQ Option trading platform** stands out as a top contender. Designed with both novice and experienced traders in mind, it offers a rich suite of features and tools to navigate the dynamic world of financial markets. From the moment you log in, you’ll experience a seamless environment crafted for efficient trading and in-depth market analysis. We understand that success in **forex trading**, as well as other asset classes, often hinges on the quality of your tools, and IQ Option delivers.

A Universe of Trading Opportunities

One of the most compelling aspects of IQ Option is the sheer diversity of instruments available for trading. This platform doesn’t limit you; it opens doors to various global markets, allowing you to diversify your portfolio and seize opportunities wherever they arise. Here’s a glimpse of what you can trade:

- Forex Pairs: Access major, minor, and exotic currency pairs, capitalizing on global economic movements.

- Digital Options: Experience a unique trading style with predictable risk and potential returns.

- CFDs on Stocks: Trade shares of leading companies without owning the underlying asset, benefiting from price fluctuations.

- Cryptocurrency Trading: Engage with popular digital currencies like Bitcoin, Ethereum, and many others, leveraging their volatility.

- Commodities Trading: Participate in markets for gold, silver, crude oil, and other valuable resources.

This extensive selection ensures that you can always find an asset that aligns with your trading strategy and risk appetite, making the **IQ Option trading platform** incredibly versatile.

Empowering Tools for Sharper Decisions

Successful trading is rarely a matter of luck; it’s about informed decisions. IQ Option equips you with an impressive array of **technical analysis tools** and features designed to help you analyze market trends and identify potential entry and exit points. Forget about complicated external software; everything you need is right there, integrated into the platform.

Consider these essential features:

| Tool Category | Description & Benefit |

|---|---|

| Charting Tools | Multiple chart types (candlesticks, bars, lines) and customizable timeframes to visualize price movements clearly. |

| Technical Indicators | A vast library including Moving Averages, RSI, MACD, Bollinger Bands, and more to uncover patterns and predict future price action. |

| Graphical Tools | Draw trend lines, support/resistance levels, and Fibonacci retracements directly on your charts for precise analysis. |

| Market News & Analysis | Stay informed with real-time market updates and economic calendars that could impact your trades. |

As a seasoned trader, I always stress the importance of understanding and utilizing these tools. They are your eyes and ears in the market, providing critical insights for your **forex trading** and other investments.

Seamless User Experience and Accessibility

A great platform isn’t just about features; it’s about how easily you can access and use them. IQ Option boasts a highly **user-friendly interface** that prioritizes clarity and efficiency. The intuitive design means less time figuring out the platform and more time focusing on your trades.

Here’s what makes the experience smooth:

- Clean Layout: Everything is where you expect it, making navigation simple even for beginners.

- Customizable Workspace: Arrange your charts and tools to suit your personal trading style.

- Lightning-Fast Execution: Place trades quickly and accurately, which is crucial in fast-moving markets.

- Mobile Trading App: Never miss an opportunity with the robust IQ Option mobile app, available for both iOS and Android. Trade, monitor, and analyze on the go.

Furthermore, if you’re new to trading or want to test new strategies without financial risk, the **demo account** is an invaluable resource. It mirrors live market conditions with virtual funds, allowing you to practice and gain confidence before committing real capital. This feature alone is a testament to IQ Option’s commitment to trader education and **risk management**.

In conclusion, the IQ Option platform is more than just a place to trade; it’s a comprehensive ecosystem built to empower traders. Its rich features, diverse instruments, and user-centric design make it an excellent choice for anyone looking to engage with the financial markets effectively.

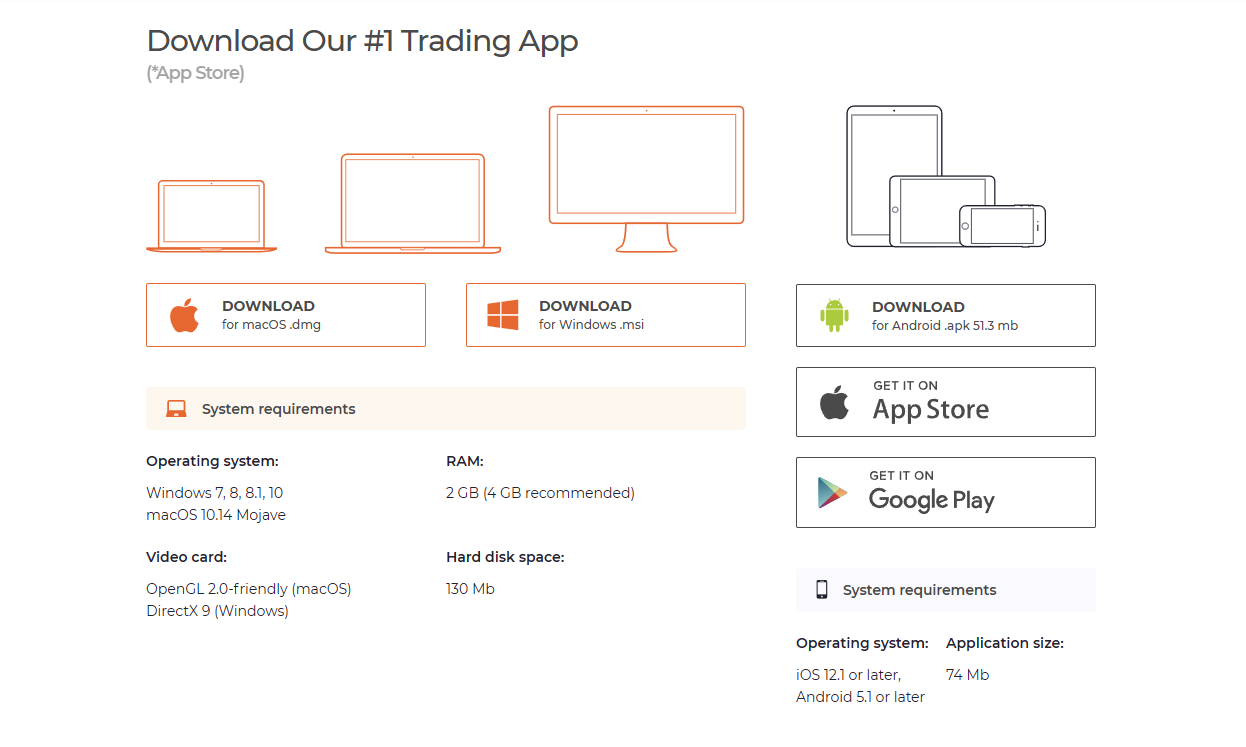

Mobile Trading: The IQ Option India App Experience

In today’s fast-paced financial world, the ability to trade on the go isn’t just a luxury—it’s a necessity. The evolution of

The

Key Advantages of the IQ Option India Mobile App:

- Unmatched Accessibility: Trade

anytime, anywhere – all you need is your smartphone and an internet connection. - Intuitive Design: Enjoy a clean, responsive interface that simplifies complex trading operations.

- Live Market Data: Get instant access to up-to-the-minute price movements and market trends.

- Customizable Alerts: Set up

push notifications for specific price levels or market events, so you never miss an opportunity. - Practice Account: Hone your strategies with a free demo account, switching to live trading with ease when ready.

- Robust Security: Benefit from advanced encryption and protocols, ensuring

secure transactions and protecting your funds and data.

For those interested in currency exchange, the

Practice Risk-Free: Utilizing the IQ Option Demo Account

Stepping into the dynamic world of online trading can feel daunting, especially for newcomers. The fear of losing capital often holds potential traders back. But what if you could learn the ropes, test strategies, and gain confidence without risking a single penny of your hard-earned money? That’s precisely where the IQ Option demo account becomes your invaluable partner. It’s a powerful tool, replicating real market conditions, yet operating entirely with virtual funds.

Think of it as your personal training ground, a sandbox where mistakes are lessons, not losses. This forex demo account isn’t just for beginners; seasoned traders also leverage its capabilities to fine-tune advanced strategies or explore new assets like cryptocurrencies or stocks without financial exposure. You get access to a full range of trading instruments and features that mirror the live trading environment.

Key Benefits of the IQ Option Practice Account:

- Zero Financial Risk: Trade with virtual money, protecting your actual capital while you learn. This allows you to explore different markets and order types without stress.

- Master the Platform: Familiarize yourself with the intuitive IQ Option interface, charting tools, indicators, and order execution processes. You’ll navigate the platform like a pro in no time.

- Develop and Test Strategies: Experiment with various trading strategies and see how they perform under different market scenarios. This is crucial for understanding what works for you before committing real funds.

- Understand Market Dynamics: Get a feel for how prices move, react to news, and identify potential trading opportunities. It’s an excellent way to grasp the practical aspects of market analysis.

- Build Confidence: Each successful virtual trade builds your self-assurance. You develop a robust trading mindset, which is vital for long-term success in live trading.

- Access to Real-Time Data: The demo account provides real-time market data, ensuring your practice is as authentic as possible. You’re not trading on stale information.

The beauty of the IQ Option demo account lies in its accessibility and realism. You don’t need to register a credit card or make an initial deposit to start. A simple registration grants you instant access to a substantial amount of virtual funds, typically $10,000, which you can replenish anytime. This allows for extensive and continuous practice trading, turning theoretical knowledge into practical skills.

Whether your interest lies in binary options practice or delving into CFDs on currency pairs, commodities, or indices, the demo account provides a comprehensive environment. It’s not just a simulation; it’s a bridge to actual trading, equipping you with the experience and mental fortitude required to navigate the financial markets effectively. Embrace this opportunity to refine your skills and pave your way to becoming a confident and informed trader.

Security Measures and Data Protection on IQ Option India

Embarking on your trading journey requires confidence, especially when it comes to the safety of your funds and personal information. On IQ Option India, we understand that security is not just a feature; it’s the bedrock of a successful trading experience. We implement robust security measures and strict data protection protocols to ensure you can focus on making informed trading decisions without unnecessary worry.

Your peace of mind is our priority. We employ advanced technology and adhere to international best practices to safeguard your digital assets and sensitive data. From the moment you create an account to every single transaction you make, we are committed to providing a secure trading environment.

How IQ Option India Protects You:

- State-of-the-Art Encryption: All communications between your device and our servers, including your personal details and financial transactions, are secured with powerful SSL/TLS encryption. This means your data remains private and protected from unauthorized access.

- Secure Payment Gateways: We partner with reputable payment service providers, ensuring that all deposits and withdrawals are processed through secure, industry-standard channels. Your financial transactions are handled with the utmost care, using protocols designed to prevent fraud and protect your banking information.

- Two-Factor Authentication (2FA): Enhance your account protection with 2FA. This optional but highly recommended feature adds an extra layer of security, requiring a unique code from your mobile device in addition to your password to log in. It’s a simple step that significantly boosts your account safety.

- Segregated Accounts: To further protect your funds, client money is held in segregated accounts separate from the company’s operational funds. This ensures that your investments are always accessible and not used for the company’s liabilities.

- Regular Security Audits: Our systems undergo regular, independent security audits. These assessments help us identify and address potential vulnerabilities, ensuring our defenses are always up-to-date against evolving cyber threats.

Our Commitment to Data Protection:

Your personal data is treated with the highest level of confidentiality and respect. IQ Option India adheres to a comprehensive privacy policy that outlines how we collect, use, and protect your information. We never share your data with third parties without your explicit consent, and only authorized personnel have access to sensitive information, strictly for the purposes of providing you with our services.

We leverage cutting-edge security infrastructure designed to prevent data breaches and unauthorized access. This continuous vigilance helps maintain the integrity and privacy of your account details and trading history. Our team is always on alert, monitoring for suspicious activities and employing proactive measures to maintain a secure ecosystem for all our traders.

Choosing IQ Option India means choosing a platform where your security is paramount. Join our community and experience the confidence that comes from trading in a safe, protected, and regulated environment.

Pros and Cons of Using IQ Option in India

Are you considering IQ Option for your online trading ventures in India? Many traders are drawn to the platform’s global reach and accessible features. As a leading name in the industry, IQ Option offers various financial instruments that can appeal to different trading styles. However, like any significant decision, understanding both the advantages and disadvantages is crucial before you commit. We will explore what makes IQ Option an attractive choice for many Indian traders, along with the important considerations and potential challenges you might face.

The Bright Side: Advantages of Using IQ Option in India

IQ Option has successfully carved out a niche in the Indian market, largely due to its approachability and the diverse opportunities it presents. Here’s why many traders in India find it a compelling platform:

- Accessible Entry Point: One of IQ Option’s biggest draws is its low minimum deposit requirement. This feature makes online trading more accessible for Indian beginners who want to dip their toes into the financial markets without committing a large sum upfront.

- Intuitive Trading Platform: The platform boasts a user-friendly interface that is easy to navigate, even for those new to trading. It combines simplicity with powerful charting tools and technical indicators, allowing for effective analysis across various financial instruments.

- Free Demo Account: Learning to trade involves practice, and IQ Option provides an excellent, risk-free environment with its free demo account. Loaded with virtual funds, it allows you to test trading strategies and become familiar with the platform and market dynamics without any financial risk.

- Robust Mobile App: For traders who prefer managing their portfolios on the move, the IQ Option mobile app is highly functional. Available for both Android and iOS devices, it offers full trading capabilities, real-time market updates, and instant trade execution, ensuring you can seize opportunities anytime, anywhere in India.

- Variety of Financial Instruments: The platform offers a diverse range of assets. You can engage in forex trading with major currency pairs, explore CFDs on popular stocks, trade commodities like oil and gold, and venture into the exciting world of cryptocurrencies. This variety helps in portfolio diversification.

- Quick Withdrawal Processes: IQ Option strives for efficiency in its withdrawal process, offering various methods for Indian traders to access their earnings. While processing times can vary based on the chosen method, the platform generally aims for timely transactions.

The Flip Side: Disadvantages and Key Considerations

While the advantages are clear, it is equally important to be aware of the potential drawbacks and risks involved with using IQ Option, particularly from an Indian perspective. Informed decision-making starts with a full understanding of these challenges:

- Regulatory Environment in India: A primary concern for Indian traders is IQ Option’s regulatory status within India. While regulated by CySEC in Europe, it does not hold specific regulation from SEBI (Securities and Exchange Board of India). This can mean less local investor protection compared to platforms regulated domestically.

- High Trading Risk: It’s crucial to understand that trading financial instruments, especially CFDs and binary options, involves significant risk. You can lose a considerable amount of capital, potentially even more than your initial investment, particularly when using leverage in forex trading. These products are not suitable for all investors.

- Potential for Over-Trading: The platform’s accessibility and ease of use, combined with the fast-paced nature of certain instruments, can sometimes encourage new traders to over-trade or make impulsive decisions without sufficient analysis, leading to increased risk exposure.

- Customer Support Experiences: While customer support is available, some users have reported varying experiences, including occasional delays in responses or generic answers to complex queries. Timely and effective support is vital, especially when facing technical or account-related issues.

- Limited Advanced Educational Content: While basic tutorials exist, the depth of educational resources for advanced strategies and comprehensive risk management might require traders to seek additional learning materials from external sources. Fully mastering the markets often demands more than platform-provided guides.

Comparing IQ Option with Other Online Brokers in India

Navigating the vibrant landscape of online trading can feel like a complex journey, especially for those in India looking to engage in forex trading. With numerous brokers vying for your attention, understanding where IQ Option stands among its peers is crucial for making an informed decision. Indian traders have a plethora of choices, each offering a unique blend of features, tools, and services. Our goal here is to shed light on how IQ Option stacks up when placed alongside other prominent online trading platforms available in the region.

When you’re evaluating an online trading platform, several key factors come into play. These aspects directly influence your trading experience, potential profitability, and overall peace of mind. Let’s look at the essential criteria for a comprehensive broker comparison:

- Regulatory Compliance: This is paramount. Does the broker adhere to local and international financial regulations, offering a secure environment for Indian traders?

- Trading Instruments: What range of asset classes do they offer? This includes forex pairs, commodities, stocks, indices, and potentially cryptocurrencies.

- Platform Usability and Features: Is the trading interface intuitive? Does it offer advanced charting tools, technical indicators, and mobile trading capabilities?

- Trading Fees and Spreads: How competitive are their spreads, commissions, and overnight fees? Transparency here is vital.

- Minimum Deposit and Account Types: What is the initial capital required? Are there different account tiers catering to various trading styles and capital levels?

- Deposit and Withdrawal Options: Are the methods convenient and efficient for users in India? What are the associated processing times and fees?

- Customer Support: How responsive and helpful is their support team? Are they available through multiple channels and in local languages?

- Educational Resources and Demo Account: Do they provide learning materials for new traders? Is a free demo account available for practice?

IQ Option has certainly carved out a significant presence globally, known for its user-friendly interface and relatively low minimum deposit. This often makes it an attractive starting point for many individuals looking to delve into online trading. Their platform is generally praised for its simplicity, making it accessible even for those new to the financial markets. It’s a key reason why many choose to explore forex trading India through their services.

However, when we put it side-by-side with other established brokers, the differences become clearer. Some competitors might offer a broader range of exotic forex pairs, while others might specialize in lower spreads for specific asset classes. The depth of analytical tools or the availability of certain order types can also vary significantly. For instance, a comparison might look something like this for an average trader’s perspective:

| Feature Category | IQ Option’s Position | Common Peer Offerings |

|---|---|---|

| Minimum Deposit | Very Low (e.g., $10 equivalent) | Varies (e.g., $50 – $1000+) |

| Platform Usability | Highly Intuitive & Modern | MT4/MT5, cTrader, Proprietary (can be complex) |

| Trading Instruments | Forex, Stocks, Crypto, Commodities, Indices | Broader range of niche assets or more currency pairs |

| Spreads & Commission | Generally competitive, especially on popular assets | Can be tighter on high-volume accounts or specific ECN brokers |

| Regulatory Oversight | Regulated by CySEC (EU-focused), but not directly by Indian bodies for India operations | Often regulated by multiple top-tier global authorities (FCA, ASIC, etc.) |

It is important to remember that while IQ Option offers an accessible online trading platform, especially for quick entry into markets, other brokers might cater more to advanced strategies requiring features like Expert Advisors (EAs) or more extensive API access. For those prioritizing deep market analysis and a vast array of niche trading instruments, some alternative brokers might present a more comprehensive solution.

Ultimately, the best online broker for you in India depends on your individual trading style, experience level, capital, and what you prioritize in a trading partner. Do you value simplicity and low entry barriers, or are advanced tools and a wider selection of assets more critical? By carefully weighing these factors against what each platform offers, you empower yourself to choose a broker that aligns perfectly with your financial aspirations and trading journey.

Risk Management Strategies for Indian Traders on IQ Option

Embarking on the exciting journey of online trading, especially with platforms like IQ Option, opens up a world of potential. For Indian traders, understanding and implementing robust risk management strategies is not just an option, it is an absolute necessity for long-term success. The market is dynamic, and while profits are the goal, protecting your capital should always be your top priority. Let’s explore how you can navigate the financial seas with confidence and smart decisions.

Why Risk Management Matters More Than Ever

Think of risk management as your financial shield. It protects your trading account from unexpected market movements and emotional decisions. Without it, even a few bad trades can wipe out your capital, ending your trading journey prematurely. Successful forex trading and options trading are not about avoiding losses entirely – that’s impossible. Instead, they are about controlling the size of your losses and letting your winners run. This disciplined approach keeps you in the game, ready for the next opportunity.

Key Strategies for Capital Preservation

Here are some essential strategies every Indian trader should adopt on IQ Option:

- Implement Stop-Loss Orders: This is your most basic safety net. A stop-loss order automatically closes your trade when the price reaches a certain predetermined level, limiting your potential loss. It removes emotion from the exit decision and is crucial for managing your exposure to market volatility.

- Define Take-Profit Levels: Just as important as knowing when to exit a losing trade is knowing when to secure your gains. A take-profit order closes your trade automatically when the price hits your desired profit target. This prevents you from getting greedy and watching your profits evaporate.

- Practice Smart Position Sizing: Never risk more than a small percentage of your total trading capital on a single trade. A common rule is to risk no more than 1-2% of your account balance per trade. This strategy ensures that a string of losses won’t devastate your account. For example, if you have ₹10,000 in your account, risking ₹100-₹200 per trade is a sound approach.

- Diversify Your Portfolio: While IQ Option offers various assets, avoid putting all your eggs in one basket. Explore different currency pairs, commodities, or even crypto assets available. Diversification spreads your risk across various markets, reducing the impact of a poor performance in any single asset.

- Understand Leverage: IQ Option offers leverage, which can amplify both profits and losses. While it allows you to control a larger position with less capital, it significantly increases your risk. Use leverage cautiously and only with a clear understanding of its implications.

The Psychological Edge

Your mindset plays a massive role in effective money management. Emotional trading – chasing losses, over-trading, or letting fear dictate your decisions – is a direct threat to your capital. Cultivate a disciplined approach:

“Successful trading isn’t about being right all the time; it’s about losing less when you’re wrong and winning more when you’re right. Emotional control is your greatest asset.”

Stick to your trading plan. If your strategy indicates a trade, execute it. If it says stay out, then stay out. Avoid impulsive actions based on market noise or social media hype. Regular self-assessment and journal keeping can highlight patterns in your emotional responses and help you develop stronger discipline.

Risk Management in Action on IQ Option

IQ Option provides tools that help you implement these strategies effectively. You can easily set stop-loss and take-profit levels directly from the trading interface. Their user-friendly platform makes it simple to manage your positions and monitor your risk exposure in real-time. By actively utilizing these features, Indian traders can maintain better control over their trading outcomes.

Adopting robust risk management practices is the cornerstone of sustainable success in online trading. It protects your capital, reduces stress, and empowers you to trade with greater confidence. Begin your journey with IQ Option today and apply these essential strategies to build a resilient and profitable trading future!

Customer Support and Assistance for IQ Option India Users

When you navigate the dynamic world of online trading, having robust and reliable customer support is not just a luxury—it’s a necessity. For IQ Option India users, a dedicated support system ensures that your trading journey is smooth, your questions are answered promptly, and any technical hiccups get resolved without delay. Imagine needing help with a deposit or understanding a new feature; quick, efficient assistance makes all the difference.

IQ Option understands the unique needs of its diverse user base, especially in a vibrant market like India. They have built a comprehensive support infrastructure designed to keep you trading with confidence and peace of mind.

How to Connect with IQ Option Support:

Reaching out for help is straightforward, thanks to multiple convenient channels:

- Live Chat: This is often the fastest way to get real-time assistance. You can simply type your question and receive an instant response from a support agent. It’s perfect for urgent queries or quick clarifications.

- Email Support: For more detailed questions, account-specific issues, or when you need to provide attachments, email support offers a comprehensive solution. Expect thorough responses tailored to your inquiry.

- Dedicated Help Center/FAQ: Before even contacting an agent, you might find your answer in their extensive help center. It’s packed with articles, guides, and frequently asked questions covering everything from platform navigation to withdrawal processes. This self-service option empowers you to find solutions at your own pace.

- Phone Support: While not always the primary channel for all regions, specific circumstances might allow for direct phone communication, offering a personal touch.

What You Can Expect from IQ Option’s Support Team:

The support team at IQ Option is trained to handle a wide array of inquiries, ensuring you always feel supported.

| Aspect of Support | Benefit for India Users |

|---|---|

| Multi-Lingual Assistance | Access support in various languages, potentially including regional Indian languages, making communication clear and effective. |

| 24/7 Availability | Get help any time, day or night. This is crucial for traders operating across different time zones or those trading outside standard business hours. |

| Knowledgeable Agents | Connect with trained professionals who understand the platform inside out and can provide accurate, helpful solutions. |

| Privacy and Security | Discuss sensitive account details with confidence, knowing your information remains protected and confidential. |

A responsive and understanding support team minimizes frustration and allows you to focus on what matters most: your trading strategies. When you choose a platform like IQ Option, you are not just selecting a trading tool; you are also choosing a partner dedicated to your success, supported by a team ready to assist you every step of the way.

Frequently Asked Questions about IQ Option India

Embarking on your trading journey with a platform like IQ Option in India can bring up many questions. It’s natural to seek clarity before you dive into the exciting world of financial markets. Here, we address some of the most common inquiries, providing you with straightforward answers to help you navigate your experience with confidence.

Many prospective traders wonder about the legitimacy and operational framework of IQ Option in the Indian context. Is IQ Option a reliable platform for Indian traders? Absolutely. While the regulatory landscape for binary options and CFDs can be complex, IQ Option operates under international regulations and adheres to strict compliance standards. This commitment ensures a fair and transparent trading environment for its global user base, including those in India. They focus on providing a secure and accessible platform for everyone interested in online trading.

How do I start trading with IQ Option in India?

Getting started is a breeze! The process is designed to be user-friendly and quick. First, you’ll need to visit the official IQ Option website or download their mobile application. Look for the “Sign Up” or “Register” button. You’ll typically be asked to provide an email address and create a password. After that, you’ll need to verify your email. The next step involves completing a simple registration form with some personal details, followed by identity verification as per regulatory requirements. Once your account is set up and verified, you can make your first deposit and begin exploring the trading platform. It’s a straightforward path from curiosity to active trading.

What trading instruments are available on IQ Option for Indian users?

IQ Option offers a diverse range of trading instruments, giving Indian traders ample opportunities to diversify their portfolios. You can access various financial markets all from one robust platform. Here’s a snapshot of what’s typically available:

- Forex (Foreign Exchange): Trade major, minor, and exotic currency pairs. Predict the movements between currencies like USD/INR, EUR/USD, and GBP/JPY.

- Cryptocurrencies: Engage with popular digital assets suchs as Bitcoin, Ethereum, Litecoin, and Ripple.

- Commodities: Trade on the price movements of gold, silver, crude oil, and other valuable resources.

- Stocks: Access Contracts for Difference (CFDs) on shares of leading global companies.

- ETFs (Exchange Traded Funds): Diversify your investment by trading ETFs, which track various indices or sectors.

This wide selection allows you to choose instruments that align with your trading strategy and risk tolerance.

What are the minimum deposit and withdrawal amounts?

IQ Option is known for its accessibility, and this extends to its deposit and withdrawal policies. The minimum deposit amount is often quite low, making it easy for new traders to start without a huge initial investment. Typically, you can begin with as little as 10 USD (or its equivalent in INR), which opens the door for many aspiring traders. For withdrawals, the minimum amount is also designed to be convenient, often starting from just 2 USD. This flexibility allows you to manage your funds effectively, whether you are just putting in a small sum to test the waters or taking out profits.

Is my money safe with IQ Option?

Trader safety is a top priority for any reputable brokerage, and IQ Option takes this seriously. They employ advanced security measures to protect your funds and personal information. These include:

| Security Feature | Description |

|---|---|

| SSL Encryption | All data transferred between your device and the platform is encrypted, protecting sensitive information. |

| Segregated Accounts | Client funds are kept in separate accounts from the company’s operational funds, enhancing security. |

| Identity Verification | Rigorous KYC (Know Your Customer) procedures prevent fraud and ensure legitimate transactions. |

| Two-Factor Authentication (2FA) | An optional but highly recommended security layer for account login. |

These measures ensure that your trading experience is not only engaging but also secure. Always remember to use strong, unique passwords and enable 2FA for added protection.

We hope these answers provide clarity and help you feel more confident as you explore the opportunities IQ Option presents to traders in India. Happy trading!

Conclusion: Is IQ Option India the Right Choice for Your Trading Journey?

As we wrap up our detailed look at IQ Option India, it becomes clear why this platform has become a prominent name among traders. It combines an accessible entry point with sophisticated tools and educational resources, making it an attractive option for both newcomers and seasoned market participants. If you’re pondering your next move in the world of online trading, IQ Option offers a compelling set of features designed to support your ambitions.

For those ready to embark on or continue their trading journey in India, IQ Option provides a remarkably user-friendly interface that demystifies the complexities of the financial markets. The platform’s low minimum deposit significantly lowers the barrier to entry, making real-money trading more accessible than ever. Furthermore, the availability of a free demo account is a huge advantage, allowing you to practice strategies and build confidence without any financial risk. This commitment to fostering trader development and ease of access makes IQ Option a strong candidate for anyone starting their personal trading expedition.

However, selecting the perfect platform is a highly individual decision. Your choice should always align with your personal trading style, your comfort level with risk, and your long-term financial objectives. Consider the following key aspects as you weigh your options:

- Your Primary Trading Focus: Do you lean towards short-term opportunities in forex and CFDs, or are you exploring longer-term investment horizons? IQ Option particularly excels in instruments suitable for active trading.

- Personal Risk Management: While the platform offers various tools, the ultimate responsibility for effective risk management rests with you. Fully understand the inherent risks involved in online trading before you commit your capital.

- Time Commitment Required: Successful trading demands dedication to learning, continuous market analysis, and disciplined execution. Are you prepared to invest the necessary time and effort?

Ultimately, IQ Option India stands out as a robust choice for many aspiring and active traders. It delivers a comprehensive trading experience, significantly enhanced by its powerful mobile trading application, which ensures you can manage your positions and stay connected to the markets no matter where you are. If your priorities include an intuitive platform, an accessible entry point, and abundant opportunities for learning and growth, then IQ Option could very well be the ideal launchpad for your exciting trading journey. Remember, continuous learning and disciplined practice are your most valuable assets in the dynamic trading landscape. Take the initiative to explore its features, leverage the demo account, and make an informed decision that perfectly fits your aspirations.

Frequently Asked Questions

Is IQ Option legal and safe for Indian traders?

While IQ Option is not directly regulated by SEBI (Securities and Exchange Board of India), it operates under international licenses, making it generally accessible for Indian residents. The platform employs robust safety features like client fund segregation, data encryption, and risk management tools to ensure security. However, traders must comply with India’s foreign exchange and tax laws.

How can I register an account with IQ Option India?

To register, visit the official IQ Option India website or app, click “Sign Up,” provide your email and create a password, select India as your country, and agree to the terms. After email verification, you can access your account, start with a demo, or proceed to real trading.

What deposit methods are available for Indian traders on IQ Option?

IQ Option India supports several convenient deposit methods, including debit/credit cards (Visa, MasterCard), popular e-wallets (Skrill, Neteller, Perfect Money), UPI payments for instant deposits, and direct bank transfers.

What trading instruments can I trade on IQ Option India?

IQ Option offers a diverse range of instruments, including Forex pairs, CFDs on stocks of major companies, commodities (like gold, oil), cryptocurrencies (Bitcoin, Ethereum), and ETFs, allowing for broad portfolio diversification.

Can I practice trading without real money on IQ Option India?

Yes, IQ Option provides a free demo account loaded with virtual funds (typically $10,000) that mirrors real market conditions. This allows you to practice strategies, familiarize yourself with the platform, and build confidence without any financial risk.