Ready to unlock the exhilarating world of online trading? For ambitious individuals in Brazil, the digital landscape presents a powerful new frontier for financial exploration. This comprehensive guide serves as your trusted companion, designed to illuminate every facet of trading with IQ Option Brazil – a leading platform embraced by millions worldwide.

We understand that diving into the forex market or other financial instruments can seem daunting. That’s why we’ve crafted this resource to simplify the journey, empowering you with the insights needed to make informed decisions. From understanding various asset classes to grasping crucial regulatory frameworks, we cover it all. Our guide will help you:

- Understand the fundamentals of online trading.

- Explore the diverse financial instruments available on the platform.

- Navigate the specific features of IQ Option Brazil.

- Grasp the importance of regulation for a secure trading experience.

“The best investment you can make is in knowledge itself.” As a trader, this truth resonates deeply. We aim to equip you with that very knowledge.

Brazilian traders are increasingly looking for reliable and user-friendly platforms to engage with global markets. Our focus here is to show you how IQ Option Brazil stands out, offering a robust environment for your trading aspirations. Get ready to explore possibilities, understand the platform’s features, and learn about the important regulations that ensure a secure and transparent online trading journey.

- Is IQ Option Legal and Regulated in Brazil?

- Understanding CVM’s Stance on Online Trading

- Platform Security and User Protection Measures

- How to Register Your IQ Option Brazil Account

- Step-by-Step Account Creation Process

- Choose Your Account Type

- Complete the Registration Form

- Undergo Account Verification

- Fund Your Account

- Start Trading Forex!

- Verification Requirements for Brazilian Users

- Essential Documents for Brazilian Traders

- Tips for a Speedy Verification Process

- Funding Your Account: Deposit and Withdrawal Methods in Brazil

- Making Deposits: Getting Started in the Brazilian Market

- Withdrawing Your Earnings: Taking Profits Home

- Important Considerations for Funding Your Account

- Popular Brazilian Payment Options (Boleto, Pix, Bank Transfers)

- Boleto Bancário: The Traditional Staple

- Pix: Brazil’s Instant Payment Revolution

- Bank Transfers: Reliable and Secure

- Navigating Withdrawal Procedures and Times

- Understanding Withdrawal Methods and Their Impact on Processing Times

- Speeding Up Your Withdrawal Process

- Trading Instruments and Features on IQ Option Brazil

- Diverse Trading Instruments at Your Fingertips

- Unrivaled Features for an Enhanced Trading Experience

- Key Features Highlight:

- Forex, Stocks, Cryptocurrencies, and Commodities

- Exploring Digital and Binary Options in Brazil

- Why Brazil?

- What to Consider Before Diving In:

- The Mobile Trading Experience with IQ Option Brazil App

- What Makes the IQ Option Brazil App Stand Out?

- Customer Support Tailored for Brazilian Traders

- Advantages and Disadvantages of Using IQ Option in Brazil

- The Upsides: Why Brazilian Traders Choose IQ Option

- The Downsides: What Brazilian Traders Should Consider

- Essential Tips for Successful Trading with IQ Option Brazil

- Taxation on Trading Profits in Brazil: A Comprehensive Guide

- Why Brazilian Tax Rules Matter for Traders

- Key Principles of Taxation for Trading Income

- Differentiating Day Trading and Swing Trading Taxation

- Tax Rates for Trading Profits

- Forex Trading Tax in Brazil

- Crucial Reporting and Payment Details

- Seek Professional Guidance

- IQ Option Brazil Reviews and User Experiences

- What Brazilian Traders Often Praise:

- Common Points for Improvement from User Feedback:

- How IQ Option Compares to Other Brokers in Brazil

- IQ Option: Strengths and Considerations in the Brazilian Market

- The Future Landscape for IQ Option in Brazil

- Key Drivers Shaping IQ Option’s Future in Brazil:

- Frequently Asked Questions

Is IQ Option Legal and Regulated in Brazil?

Many aspiring traders in Brazil ask a crucial question: is IQ Option a legitimate platform, and does it operate under local regulatory oversight? Understanding this is key before you start your trading journey.

The situation in Brazil for binary options brokers like IQ Option is nuanced. Brazil’s primary financial regulator, the CVM (Comissão de Valores Mobiliários), supervises the securities market. However, binary options are not currently regulated as financial instruments by the CVM in the same way traditional stocks or bonds are. This means that while IQ Option itself is an international broker, headquartered and regulated in other jurisdictions, it does not hold a specific Brazilian CVM license for offering binary options to residents.

What does this mean for you?

- Accessibility: Brazilians can still access and use the IQ Option platform. The platform does not block users from Brazil.

- International Regulation: IQ Option is regulated by international bodies in other regions where it operates, offering a level of oversight for its global user base.

- Risk Awareness: Trading binary options inherently carries significant risk. Without direct CVM regulation over binary options, local investor protections specifically for this instrument are limited. Always exercise caution and trade responsibly.

Before you deposit funds, consider the following:

| Aspect | Details for Brazil |

|---|---|

| CVM Stance | Does not regulate binary options as traditional securities. |

| IQ Option Status | Operates internationally, accessible in Brazil. |

| Account Creation | Brazilian residents can open accounts. |

| Fund Safety | Relies on IQ Option’s international regulatory compliance. |

While IQ Option is widely used by Brazilian traders, it’s vital to be fully informed about the regulatory landscape. Your trading decisions should always stem from a complete understanding of both the market and the platform’s legal standing in your region.

Understanding CVM’s Stance on Online Trading

Navigating the dynamic world of online trading means you absolutely must understand the regulatory landscape. For traders in Brazil, the Comissão de Valores Mobiliários (CVM) is the central authority. Think of them as the primary guardian of the Brazilian securities market. Their mission is crystal clear: to ensure market integrity, protect investors, and foster a healthy financial environment. This broad oversight naturally extends to all forms of online trading activities.

When we talk about online trading, especially in areas like forex and Contracts for Difference (CFDs), the CVM adopts a protective and often cautious stance. They are deeply committed to ensuring that every financial service provider operating within their jurisdiction adheres to stringent guidelines. This means brokers must possess proper authorization and maintain complete transparency about their offerings, associated risks, and fee structures.

So, what does this commitment mean for you as an aspiring or active online trader? It means the CVM is actively working to shield you from fraudulent schemes and unregulated entities. They frequently issue public warnings against platforms that operate without proper authorization, highlighting the significant and often catastrophic risks involved in dealing with such providers. Their message is consistent and vital: always conduct thorough due diligence. Verifying a broker’s regulatory status is not just a suggestion; it’s a fundamental step to protect your capital.

Here are the core pillars of CVM’s stance on online trading:

- Investor Safeguards: Their paramount focus is to protect investors from unfair practices, potential market manipulation, and the dangers of unauthorized services.

- Robust Regulatory Oversight: The CVM demands that all financial service providers, particularly those offering complex instruments, meet and maintain rigorous regulatory standards.

- Promoting Risk Awareness: They actively encourage traders to develop a clear and comprehensive understanding of the inherent risks associated with online trading, especially for highly leveraged products.

- Mandating Transparency: The CVM pushes relentlessly for full disclosure from brokers regarding their operational procedures, terms of service, and any potential conflicts of interest.

Ultimately, the CVM’s stance serves as a crucial guide for responsible trading. It powerfully emphasizes the importance of choosing a regulated environment, thoroughly understanding the financial products you trade, and diligently protecting your hard-earned capital. Partnering with a reputable, CVM-compliant broker provides an indispensable layer of security, allowing you to focus on developing and executing your trading strategies with greater confidence and peace of mind.

Platform Security and User Protection Measures

When you choose a forex trading platform, your peace of mind is our top priority. We understand that trust is paramount. That’s why we invest significantly in ensuring top-tier platform security and robust user protection measures. We want you to focus purely on your trading strategies, free from concerns about the safety of your assets and personal data.

Here’s how we build a fortress around your trading experience:

- Advanced Data Encryption: Your personal and financial information deserves the strongest defense. We employ cutting-edge data encryption protocols, similar to those trusted by global financial institutions. This shields all your sensitive data, from your personal details to your transaction history. Every connection you make to our platform is secure, giving you confidence in your digital interactions.

- Two-Factor Authentication (2FA): We offer and strongly recommend two-factor authentication for all accounts. This adds an essential extra layer of defense. Even if someone somehow gains access to your password, they cannot enter your account without a second verification step, usually from your mobile device. This significantly enhances your account’s security.

- Strict Regulatory Adherence: Our commitment to regulatory compliance means we strictly adhere to the highest financial standards set by reputable authorities. This oversight ensures transparency, fairness, and accountability in all our operations, providing a strong foundation for your user protection.

- Segregated Funds: A cornerstone of our financial safeguards is the use of segregated accounts. This critical measure ensures your trading capital is kept entirely separate from our company’s operational funds. Your money remains secure, distinct, and readily accessible, always.

- Powerful Risk Management: We empower you with various risk management tools directly within the platform. These features allow you to set limits, manage your exposure, and make informed decisions, providing an extra layer of user protection as you navigate the dynamic forex market.

Our goal is to create a consistently secure trading environment where you can execute your strategies with absolute confidence. We never compromise on safety. Our ongoing dedication to enhancing platform security means we constantly update our systems and practices, staying ahead of potential threats. Join us and experience trading with the assurance that your interests are always protected.

How to Register Your IQ Option Brazil Account

Ready to dive into the exciting world of online trading? Opening your IQ Option Brazil account is a straightforward process, designed to get you started quickly and efficiently. We understand you’re eager to explore the markets, and we’ve made sure that your journey from potential trader to active participant is as smooth as possible. Forget about complicated forms and endless waiting; signing up for IQ Option is about simplicity and speed.

Here’s a simple guide to get your IQ Option Brazil account up and running:

- Visit the Official IQ Option Website: Your first step is to navigate to the official IQ Option platform. Look for the “Sign Up” or “Register” button prominently displayed on the homepage.

- Enter Your Details: You’ll need to provide some basic information. This typically includes your email address, which will serve as your primary login ID, and a strong password to secure your account. Make sure to choose a password that is unique and memorable for you.

- Agree to the Terms: Before proceeding, you’ll be asked to read and accept the Terms and Conditions and Privacy Policy. It’s always a good idea to quickly review these documents to understand the platform’s rules and your rights.

- Click “Open an Account”: Once you’ve filled in your details and agreed to the terms, simply click the “Open an Account” button. Congratulations! Your basic IQ Option Brazil account is now created.

- Verify Your Email: You’ll usually receive an email to the address you provided. Open this email and click the verification link to confirm your account. This step is crucial for security and full account activation.

That’s it! In just a few minutes, you can open your IQ Option Brazil account and gain access to the platform. You’ll then have the option to explore the free demo account, practice your strategies, and familiarize yourself with the interface before you decide to fund your live trading account. We make sure that getting started with your IQ Option Brazil registration is the easiest part of your trading adventure.

The IQ Option Brazil account registration was surprisingly fast. I was expecting a lot more hassle, but it was just a few clicks!

So, why wait? Join our growing community of traders in Brazil today. The financial markets are constantly moving, and your opportunity to engage starts with a simple IQ Option Brazil sign up.

Step-by-Step Account Creation Process

Embarking on your forex trading journey is an exciting prospect, and we’ve made the first step – creating your account – incredibly simple and secure. Our streamlined process ensures you can quickly set up your forex trading account and begin exploring the markets. Forget complicated forms or lengthy waits; we focus on getting you trading with confidence.

Here’s a clear breakdown of how you can open your account and start your journey with our advanced online trading platform:

Choose Your Account Type

Your first decision is to select the type of account that fits your aspirations. Whether you’re a complete novice looking for a beginner forex account or an experienced trader seeking advanced features, we have options for everyone. You might start with a demo account to hone your skills risk-free, or jump straight into a live account to experience real-time market action. Consider your experience level, trading goals, and the capital you plan to commit.

Complete the Registration Form

Next, you’ll fill out our concise online registration form. We’ll ask for some basic personal details, such as your name, email address, phone number, and country of residence. This information helps us create your unique profile and ensures we comply with regulatory standards. Rest assured, your data is protected with the highest security protocols.

Undergo Account Verification

To ensure a safe and regulated trading environment for all our clients, we require a quick account verification process. This typically involves submitting a copy of your identification (like a passport or driver’s license) and a proof of residence (such as a utility bill). This crucial step helps prevent fraud and keeps your funds secure. Our dedicated team processes these documents swiftly, so you won’t be waiting long.

Fund Your Account

Once your account is verified, it’s time to deposit funds. We offer a wide range of convenient and secure deposit methods, including bank transfers, credit/debit cards, and popular e-wallets. Choose the option that works best for you. Our platform clearly outlines minimum deposit requirements, ensuring transparency from the outset.

Start Trading Forex!

Congratulations! With your account funded, you’re now ready to officially start trading forex. Log into your personal client portal, access our powerful online trading platform, and begin exploring the vast opportunities the global currency markets present. Remember to utilize the educational resources available to make informed trading decisions. We’re here to support your exciting live trading experience every step of the way.

Verification Requirements for Brazilian Users

Embarking on your forex trading journey in Brazil is an exciting step! To ensure a secure and compliant trading environment for all our Brazilian users, we follow standard international regulations. This means a straightforward verification process, commonly known as KYC (Know Your Customer), is essential. It’s designed to protect your account and maintain the integrity of our trading platform.

The goal is to confirm your identity and residency, making sure you can trade with confidence and peace of mind. Here’s what you typically need to prepare:

Essential Documents for Brazilian Traders

- Proof of Identity: This verifies who you are. We usually accept one of the following official documents:

- Brazilian National ID (RG – Registro Geral)

- Valid Passport

- Driver’s License (CNH – Carteira Nacional de Habilitação)

Make sure the document is current, clearly shows your full name, date of birth, photo, and issue/expiry dates.

- Proof of Address: This confirms where you reside. You can provide a document that displays your name and current Brazilian residential address, issued within the last three to six months. Common examples include:

- Utility Bill (e.g., electricity, water, gas, internet/landline phone bill)

- Bank Statement

- Credit Card Statement

- Tax Statement

Ensure the document is not older than 3-6 months and clearly shows your name and address. Mobile phone bills are typically not accepted.

- CPF (Cadastro de Pessoas Físicas): Your individual taxpayer registration number is a critical identifier in Brazil. We will require this number for compliance purposes.

We understand that navigating these requirements can seem like a lot, but our aim is to make the process as smooth and quick as possible for every Brazilian user. Our dedicated support team is always ready to assist you if you have any questions or need clarification on specific documents.

Tips for a Speedy Verification Process

To help you get verified quickly and start trading forex in Brazil without delay, here are a few pointers:

- High-Quality Scans/Photos: Ensure all images are clear, well-lit, and show all four corners of the document. Blurry or cropped images might lead to delays.

- Matching Information: Double-check that the name and address on your proof of identity and proof of address match the information provided during your account registration.

- Timely Submission: Submit all requested documents at once. This prevents back-and-forth communication and speeds up the review.

Completing these verification requirements is not just a formality; it’s a vital step in creating a secure, transparent, and trustworthy environment for your forex trading activities. It ensures we comply with local and international financial regulations, protecting both you and the platform. Join our growing community of satisfied Brazilian traders and experience a world of trading opportunities!

Funding Your Account: Deposit and Withdrawal Methods in Brazil

Ready to jump into the exciting world of forex trading? One of the first steps, and often a crucial one for many new traders, is understanding how to manage your funds. You need seamless ways to deposit money into your trading account and, just as importantly, easy methods to withdraw your hard-earned profits. For our friends in Brazil, the good news is that many reliable and convenient options are available, making your trading journey smooth from start to finish.

Making Deposits: Getting Started in the Brazilian Market

Depositing funds into your forex trading account should be straightforward, and for traders in Brazil, it certainly is. We understand the need for speed and security when funding your trading endeavors. Here’s a look at common deposit methods popular among Brazilian traders:

- Pix: This revolutionary instant payment system has transformed financial transactions in Brazil. Many leading forex brokers now offer Pix as a primary deposit method, allowing you to fund your account in seconds, 24/7. It’s fast, secure, and incredibly convenient.

- Bank Transfers (TED/DOC): Traditional bank transfers remain a solid option. You can send funds directly from your Brazilian bank account to your broker. While not as instant as Pix, they are reliable and widely accepted.

- Credit/Debit Cards: Visa and Mastercard are globally recognized and frequently used for deposits. You can fund your account instantly, making it a popular choice for quick access to the markets.

- E-wallets: Solutions like Skrill and Neteller offer another layer of convenience. They act as intermediaries, allowing you to deposit quickly once your e-wallet is funded. These are often favored for their speed and enhanced privacy.

Remember, always check for any minimum deposit requirements set by your broker. We believe in providing you with flexible choices to ensure you can start trading with ease.

Withdrawing Your Earnings: Taking Profits Home

What’s better than making a successful trade? Withdrawing your profits, of course! We make sure the process of taking money out of your trading account is just as hassle-free as putting it in. Brazilian traders have several secure ways to access their funds:

- Pix: Just as with deposits, Pix is rapidly becoming a preferred method for withdrawals. You can receive your profits directly into your Brazilian bank account, often within minutes, thanks to its instant processing.

- Bank Transfers: Direct bank transfers are a robust option for withdrawals. Your funds will be sent straight to your registered Brazilian bank account. While it might take a few business days, it’s a secure and reliable way to receive larger amounts.

- E-wallets: If you deposited via an e-wallet, withdrawing to the same e-wallet is often the most efficient route. From there, you can typically transfer funds to your bank or use them for other online services.

Important Considerations for Funding Your Account

To ensure a smooth experience, keep these points in mind when managing your funds:

| Factor | Description for Brazilian Traders |

|---|---|

| Processing Times | Pix offers instant deposits and withdrawals. Other methods like bank transfers or card withdrawals may take 1-5 business days. |

| Fees | Many brokers offer fee-free deposits. However, some withdrawal methods or specific banking transfers might incur minor charges from the bank or payment processor. Always check your broker’s policy. |

| Verification | To comply with regulations and ensure your security, you’ll need to complete a Know Your Customer (KYC) verification. This often involves providing proof of identity and address, which helps protect your funds. |

| Currency Conversion | While many brokers support BRL, your trading account might be denominated in USD. Be aware of potential currency conversion fees if you deposit/withdraw in BRL to a USD account. |

Our priority is to provide you with a secure, efficient, and transparent funding experience. We believe that managing your money should never be a barrier to your trading success. With a range of options tailored for the Brazilian market, you can focus on what truly matters: making informed trading decisions and growing your portfolio.

Popular Brazilian Payment Options (Boleto, Pix, Bank Transfers)

Navigating the vibrant landscape of Brazilian finance is key for anyone looking to engage in online forex trading Brazil. Understanding the local Brazilian payment methods is not just about convenience; it’s about seamless access to the markets. Brazil offers a unique blend of traditional and cutting-edge options, each with its own advantages for funding your trading account.

Boleto Bancário: The Traditional Staple

When we talk about traditional Brazilian payment methods, Boleto Bancário often comes to mind. It’s a widely accepted payment slip that allows you to pay for goods and services offline, usually at banks, lottery houses, or even online through your banking app. For many, it’s a familiar and trusted way to handle transactions.

- How it works: You generate a Boleto, which acts like a bill. You then pay this bill using cash or your bank account.

- Pros for traders: Accessible to a broad population, including those without traditional bank accounts or credit cards. It offers a sense of security as you don’t share bank details directly.

- Cons for traders: The main drawback is processing time. Funds often take 1-3 business days to clear, which can be slow when market opportunities arise.

Pix: Brazil’s Instant Payment Revolution

Enter Pix, the game-changer! The Pix payment system has revolutionized how Brazilians transfer money. Launched by the Central Bank of Brazil, Pix offers instant payments and transfers 24/7, including weekends and holidays. This innovation has had a profound impact on all financial sectors, including how forex brokers Brazil operate.

The speed and availability of Pix make it incredibly attractive for funding your trading account. Forget waiting days; your funds appear almost immediately, allowing you to react quickly to market movements.

“Pix isn’t just a payment method; it’s an economic accelerator. Its instant nature has transformed transactions for businesses and individuals across Brazil, making it a critical tool for speedy financial operations, including depositing funds for trading.”

For traders, the benefits are clear:

- Instant Deposits: Fund your account in seconds, any time of day.

- 24/7 Availability: Trade on your schedule, not your bank’s.

- Ease of Use: Simple to set up and execute payments through your banking app.

- Low Costs: Often free for individuals, reducing transaction expenses.

Bank Transfers: Reliable and Secure

While Pix has taken center stage, traditional bank transfers Brazil remain a reliable and secure option. These transfers involve moving funds directly from your bank account to your broker’s account. They are well-established and trusted, especially for larger transactions or for those who prefer conventional banking methods.

Traditional bank transfers, such as TED (Transferência Eletrônica Disponível) and DOC (Documento de Ordem de Crédito), offer different speeds and limits. TEDs are generally faster, clearing within the same business day if initiated early, while DOCs can take longer.

| Payment Method | Speed | Convenience | Market Impact for Traders |

|---|---|---|---|

| Boleto Bancário | 1-3 business days | High accessibility | Delayed funding, less agile |

| Pix | Instant (24/7) | Extremely high, digital | Immediate market access, highly agile |

| Bank Transfers | Same-day (TED), up to 1 business day (DOC) | Standard banking channels | Reliable, but not instant like Pix |

Choosing the right payment option depends on your priorities: instant access with Pix, broad accessibility with Boleto Bancário, or the traditional security of bank transfers Brazil. Many reputable forex brokers Brazil now offer a combination of these options to cater to diverse client needs, ensuring you have flexible ways to manage your trading capital.

Navigating Withdrawal Procedures and Times

You’ve made successful trades and now it’s time to enjoy the fruits of your labor! Getting your money out of your trading account should be as straightforward as putting it in. We understand that accessing your funds quickly and securely is a top priority, and we’ve designed our forex withdrawal process to be efficient and transparent.

Here’s a simple breakdown of what to expect when you’re ready to make a withdrawal:

- Initiating Your Request: Log in to your secure client portal. Navigate to the “Withdrawal” section, clearly visible and easy to find.

- Selecting Your Method: Choose your preferred payment method. We offer a variety of popular options to suit your needs.

- Entering the Amount: Specify the amount you wish to withdraw. Always double-check your figures!

- Submitting for Review: Hit the submit button. Our team immediately receives your request for processing.

Understanding Withdrawal Methods and Their Impact on Processing Times

We provide several reliable options for you to withdraw your earnings. Each method comes with its own typical processing times and minimum/maximum limits, all designed with your convenience and security in mind.

Here’s a quick look at common choices:

| Method | Typical Processing Time (Once Approved) | Key Features |

|---|---|---|

| Bank Wire Transfer | 3-5 Business Days | Ideal for larger amounts, highly secure, global reach. |

| Credit/Debit Cards | 2-5 Business Days | Convenient, widely used, quick for smaller amounts. |

| E-Wallets (e.g., Skrill, Neteller) | 1-2 Business Days | Fastest option, popular for frequent transactions. |

Speeding Up Your Withdrawal Process

While we strive for promptness, a few things can influence the overall speed of your withdrawal process. The most crucial factor is your account’s verification status. To comply with strict financial regulations and ensure secure transactions, we require all accounts to be fully verified. This typically involves submitting identification and proof of address documents.

Here are some proactive steps you can take to ensure your funds reach you without unnecessary delays:

- Complete Verification Early: Finish all account verification steps right after you open your account. This prevents any hold-ups when you request a withdrawal later.

- Use Consistent Methods: Often, withdrawals must go back to the same source from which you deposited. This is an anti-money laundering measure that keeps your funds safe.

- Check for Pending Issues: Make sure you have no open bonuses with specific withdrawal conditions or other pending actions on your account.

- Keep Your Information Current: Ensure your personal and banking details are up-to-date in your client portal. Outdated information can cause significant delays.

Our dedicated customer support team is always ready to assist you if you have any questions about the withdrawal process or encounter any issues. We make getting your money as smooth and worry-free as possible, letting you focus on what matters most: your trading success.

Trading Instruments and Features on IQ Option Brazil

Are you ready to explore the dynamic world of online trading right from Brazil? IQ Option offers an incredible gateway, packed with a diverse range of trading instruments and cutting-edge features designed to empower both new and experienced traders. This platform has carved a niche for itself by providing an accessible and robust environment for financial market participation. Let’s dive into what makes IQ Option Brazil a top choice for those looking to engage with global markets.

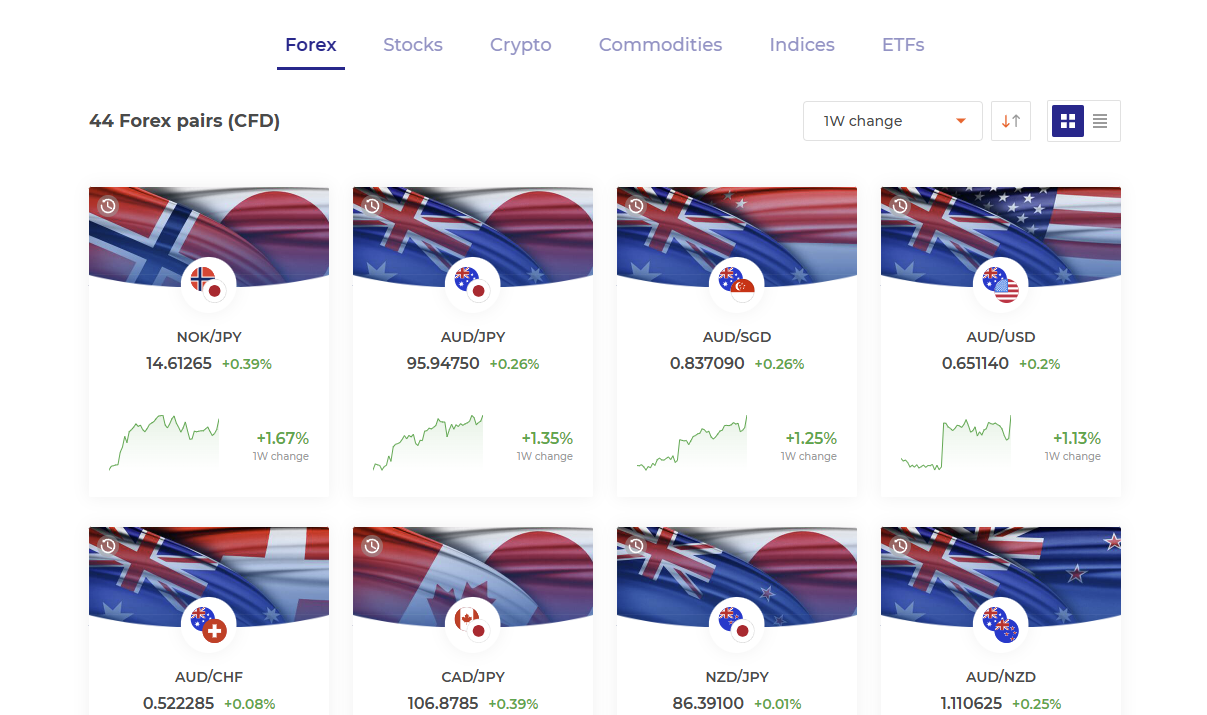

Diverse Trading Instruments at Your Fingertips

One of the primary attractions of IQ Option is its wide selection of financial instruments. This diversity allows traders in Brazil to diversify their portfolios and capitalize on various market opportunities. Whether you are interested in short-term speculation or longer-term strategies, you will find an instrument that suits your style.

- Forex (Foreign Exchange): Trade major, minor, and exotic currency pairs. Engage with the world’s largest financial market, speculating on currency fluctuations like EUR/USD or GBP/JPY. The platform provides competitive spreads, making forex trading a popular choice.

- Binary Options: A simplified way to trade where you predict whether an asset’s price will go up or down within a specific timeframe. If your prediction is correct, you earn a fixed payout. This can be a high-reward, high-risk instrument.

- Digital Options: Similar to binary options but with higher potential payouts and more flexibility. You predict not just the direction but also how far the price will move from the strike price.

- Stocks: Invest in the shares of leading companies from various industries across global markets. Access to a selection of popular stocks gives you the chance to benefit from corporate growth.

- Commodities: Trade precious metals like gold and silver, or energy commodities such as crude oil. These instruments often serve as a hedge against inflation or market volatility.

- Cryptocurrencies: Participate in the booming crypto market by trading popular digital assets like Bitcoin, Ethereum, and Ripple. IQ Option makes it easy to engage with the volatility of the crypto world.

- ETFs (Exchange Traded Funds): Diversify instantly by trading ETFs, which are baskets of assets that track specific indices, sectors, or commodities.

Unrivaled Features for an Enhanced Trading Experience

Beyond the impressive array of instruments, IQ Option Brazil boasts a suite of features designed to provide a comprehensive and user-friendly trading environment. These tools and functionalities are crucial for making informed decisions and managing your trades effectively.

Key Features Highlight:

| Feature | Benefit for Traders |

|---|---|

| Intuitive Platform Interface | Easy navigation, even for beginners. Clear charts and accessible tools. |

| Advanced Charting Tools | Access to various chart types (candlestick, bar, line) and a wide range of technical indicators for in-depth market analysis. |

| Economic Calendar | Stay informed about major economic events and news releases that can impact market prices. Plan your trades around key announcements. |

| Mobile Trading App | Trade on the go with a fully functional mobile application available for iOS and Android. Never miss a market opportunity. |

| Risk Management Tools | Utilize features like stop-loss and take-profit orders to manage potential losses and secure gains, providing peace of mind. |

| Educational Resources | Access tutorials, video lessons, and articles to improve your trading knowledge and skills. Continuous learning is key to success. |

| Multiple Deposit/Withdrawal Methods | Convenient and secure local payment options for Brazilian users, ensuring smooth transactions. |

| Demo Account | Practice trading with virtual funds without any risk. Hone your strategies and get familiar with the platform before committing real capital. |

The commitment of IQ Option to providing a superior trading platform is evident in these robust features. The platform is not just about placing trades; it’s about empowering you with the tools and knowledge to navigate the markets confidently. Whether you are looking to trade forex, engage with options, or explore cryptocurrencies, IQ Option Brazil offers a compelling package for every aspiring trader.

Forex, Stocks, Cryptocurrencies, and Commodities

Stepping into the world of financial markets opens up a universe of opportunities. You don’t have to pick just one; understanding the diverse landscape allows you to build a robust and exciting trading strategy. Let’s explore some of the most dynamic arenas where smart money plays.

Forex, or foreign exchange, is the largest financial market globally. Imagine trading currencies – buying one while simultaneously selling another. It’s a 24-hour, five-day-a-week market, famous for its incredible liquidity. This means you can enter and exit trades with ease. Major currency pairs like EUR/USD or GBP/JPY offer constant action, driven by global economic news and geopolitical events. The sheer volume makes it an electrifying space for traders looking for constant movement.

Then we have Stocks. When you trade stocks, you’re buying a piece of a company. Think about owning a share in your favorite tech giant or a promising startup. Stock markets offer potential for capital appreciation as companies grow, plus some stocks pay dividends, giving you a share of the company’s profits. The excitement comes from following company news, industry trends, and understanding the core value behind a business. It’s about betting on innovation and leadership.

The new frontier is Cryptocurrencies. These digital assets, powered by blockchain technology, have revolutionized how we think about money and finance. Bitcoin, Ethereum, and countless altcoins offer incredible volatility and potential for significant gains, though they come with higher risks. Cryptocurrencies operate outside traditional banking systems, representing a decentralized future. They attract those who are fascinated by cutting-edge technology and disruptive innovation.

Finally, there are Commodities. These are the raw materials that fuel our world – gold, oil, natural gas, agricultural products like wheat and corn. Trading commodities means betting on the fundamentals of supply and demand for essential goods. They often act as a hedge against inflation or economic uncertainty. For instance, gold is traditionally seen as a safe haven, while oil prices reflect global economic activity. Commodities offer a tangible connection to the real-world economy.

Each market offers unique characteristics, risks, and rewards. Here’s a quick glance at what makes them distinct:

| Market Type | Key Characteristic | Primary Drivers |

|---|---|---|

| Forex | Highest liquidity, 24/5 trading | Interest rates, economic data, geopolitics |

| Stocks | Company ownership, growth potential | Company earnings, industry trends, market sentiment |

| Cryptocurrencies | Decentralized, high volatility | Technological adoption, regulatory news, network effects |

| Commodities | Raw materials, tangible assets | Supply & demand, weather events, economic growth |

Exploring these diverse markets empowers you to tailor your trading approach. Whether you’re drawn to the fast pace of forex, the growth stories in stocks, the innovation of cryptocurrencies, or the fundamental value of commodities, a world of opportunity awaits.

Exploring Digital and Binary Options in Brazil

Are you ready to explore an exciting trading landscape? Brazil’s financial market offers a unique and dynamic environment for digital and binary options, drawing attention from traders eager for fast-paced opportunities. These instruments provide a compelling way to speculate on price movements across various assets, making them incredibly popular for those seeking clear, high-reward, and short-term trading ventures.

Digital and binary options allow you to predict whether an asset’s price will rise or fall within a specified timeframe. It’s a straightforward “yes” or “no” proposition. If your prediction is correct, you receive a predetermined payout. If it’s incorrect, you lose your initial investment. This simplicity is a major part of their appeal, especially for new traders entering the market.

Why Brazil?

Brazil, with its growing economy and increasing digital adoption, presents fertile ground for these types of trading activities. Local traders are always on the lookout for innovative ways to engage with the global markets, and digital options fit this bill perfectly. The vibrant financial sector and the increasing availability of platforms catering to Portuguese speakers make it an accessible entry point.

Understanding the basics is key. Here’s what sets them apart:

- Digital Options: Often provide more flexibility. You can close positions early, and payouts might vary based on how “in the money” your option finishes. They sometimes offer a higher degree of customization.

- Binary Options: Generally simpler. It’s an all-or-nothing outcome. You know your potential profit or loss upfront. The expiration is fixed, and there’s no early exit.

Regardless of the specific type, both share the core characteristic of a fixed risk and a fixed potential reward, known before you even place a trade. This transparency helps traders manage their expectations and capital effectively.

What to Consider Before Diving In:

Trading digital and binary options can be incredibly engaging, but it’s crucial to approach them with a clear strategy and an understanding of the inherent risks. Here are some key points to keep in mind:

| Aspect | Description |

|---|---|

| Simplicity | Easy to understand: predict up or down. |

| Fixed Payouts | Know your potential profit before trading. |

| Short Timeframes | Trades can last from minutes to hours, offering quick results. |

| High Risk | You can lose your entire investment quickly. |

| Market Volatility | Asset prices can change rapidly, impacting outcomes. |

The allure of quick returns is powerful, and many traders find the fast pace thrilling. However, responsible trading means educating yourself thoroughly, starting with small amounts, and never risking more than you can comfortably afford to lose. Brazil’s market is ripe with possibilities, but smart choices define long-term success.

The Mobile Trading Experience with IQ Option Brazil App

The IQ Option Brazil mobile trading app offers an unparalleled journey into the world of online trading, right from the palm of your hand. Gone are the days when you needed a dedicated workstation to monitor your investments or execute trades. Now, the power of global markets, including dynamic forex trading opportunities, is always within reach, offering you incredible flexibility and unparalleled convenient access.

This isn’t just any trading application; it’s a meticulously designed platform built for both beginners and seasoned traders. The user-friendly interface ensures that navigating complex financial instruments feels intuitive and straightforward. You can check live quotes, analyze market trends, and make informed decisions with remarkable ease, whether you are commuting, traveling, or simply relaxing at home. Imagine having the pulse of the market at your fingertips, letting you seize opportunities as they arise.

What Makes the IQ Option Brazil App Stand Out?

The IQ Option Brazil app is packed with features designed to enhance your trading on the go experience:

- Real-Time Data: Stay updated with instant market prices and charts, ensuring you always have the most current information.

- Instant Notifications: Receive critical push notifications about market movements, price alerts, and account updates directly on your device, so you never miss a beat.

- Comprehensive Tools: Access a suite of professional technical analysis tools and indicators to help you spot trends and strategize effectively.

- Diverse Assets: Trade a wide range of assets, from major currency pairs in forex trading to stocks, commodities, and indices.

- Quick Transactions: Enjoy seamless and quick deposits and withdrawals, making funding your account and accessing your profits incredibly simple.

- Practice Mode: Utilize a free demo account to hone your skills and test strategies without risking real capital. It’s an excellent way to learn and grow.

Your security is paramount. The secure platform employs advanced encryption to protect your personal and financial information, giving you peace of mind while you focus on your trading goals. With IQ Option Brazil, you’re not just getting a mobile app; you’re gaining a powerful ally in your financial journey, providing the tools and confidence you need to excel in the exciting world of online trading.

Customer Support Tailored for Brazilian Traders

Navigating the dynamic world of forex trading requires more than just sharp strategies; it demands reliable, accessible support that truly understands your needs. For our valued Brazilian traders, we recognize that one-size-fits-all customer service simply won’t do. That’s why we’ve meticulously crafted a support system specifically designed to resonate with you, ensuring every question is answered and every concern addressed with local insight and a friendly touch.

Imagine communicating with a support team that not only speaks your language fluently but also grasps the unique nuances of the Brazilian market. Our dedicated professionals are proficient in Portuguese, eliminating language barriers and making your interactions smooth and stress-free. This means you can articulate your questions about trading platforms, account management, or market movements with complete clarity, receiving responses that are just as clear and precise. We believe this personalized approach fosters trust and empowers you to trade with greater confidence.

What makes our tailored support truly stand out?

- Portuguese-Speaking Experts: Our team includes native or highly fluent Portuguese speakers, ready to assist you. This ensures no detail is lost in translation.

- Understanding Local Time Zones: We align our support hours to effectively serve Brazilian traders, providing assistance when you need it most, even during the busiest trading sessions.

- Knowledge of Local Regulations: Our support staff is well-versed in the local regulatory environment, offering guidance that is relevant and compliant for the Brazilian forex market.

- Multiple Contact Channels: Reach out via live chat, email, or phone. We provide diverse options so you can choose the method most convenient for you, anytime, anywhere.

- Proactive Communication: We don’t just wait for you to come to us. We strive to provide timely updates and helpful resources, keeping you informed and ahead of the curve.

We are committed to providing an exceptional trading experience where excellent customer support is a cornerstone. When you join our community, you gain a partner dedicated to your success, with a support team ready to assist you every step of the way. Focus on your trading strategies; we’ll handle the rest, ensuring your journey in the forex market is as seamless and profitable as possible.

Advantages and Disadvantages of Using IQ Option in Brazil

Exploring the world of online trading can feel like navigating a vibrant, bustling market, especially when you consider platforms like IQ Option. For many ambitious investors in Brazil, IQ Option presents a tempting gateway to various financial instruments. But, like any investment tool, it comes with its own set of unique benefits and drawbacks tailored to the Brazilian market. Understanding these can be the difference between a confident trade and a missed opportunity.

The Upsides: Why Brazilian Traders Choose IQ Option

IQ Option has certainly made a name for itself, captivating a significant portion of the global trading community, including many enthusiastic Brazilian traders. Here are some compelling reasons why:

- Accessibility and User-Friendly Interface: One of IQ Option’s biggest draws is its incredibly intuitive design. Even if you’re new to the world of trading, navigating the platform is straightforward. The interface is clean, making it easy to find assets, execute trades, and manage your account. This simplicity is a major plus for those just starting their journey in online trading.

- Low Minimum Deposit and Trade Size: Getting started doesn’t require a hefty investment. IQ Option often allows you to begin with a very low minimum deposit, making it accessible to a wider range of people in Brazil who want to try their hand at forex trading or other instruments without significant initial capital. You can even place trades with minimal amounts, which is great for practicing risk management.

- Diverse Asset Selection: While perhaps best known for binary options and digital options, IQ Option also offers a robust selection of other assets. You can delve into forex pairs, cryptocurrencies, commodities, and stocks. This variety provides ample investment opportunities, allowing traders to diversify their portfolios and explore different markets.

- Excellent Demo Account: Before risking any real money, you can sharpen your skills with a free, fully functional demo account. This account comes pre-loaded with virtual funds, allowing you to practice strategies, understand market movements, and get comfortable with the platform’s features without any financial pressure. It’s an invaluable tool for both beginners and experienced traders looking to test new approaches.

- Robust Mobile Trading App: For traders on the go, IQ Option offers a powerful and responsive mobile trading app. Available on both iOS and Android, it provides a seamless trading experience, allowing you to monitor markets, place trades, and manage your account from anywhere, anytime.

The Downsides: What Brazilian Traders Should Consider

While IQ Option offers many attractive features, it’s crucial to approach it with a clear understanding of its potential drawbacks, especially within the specific context of Brazil’s financial landscape.

| Disadvantage Aspect | Detailed Consideration for Brazil |

|---|---|

| Regulatory Environment Challenges | The regulatory environment for platforms offering binary and digital options in Brazil can be complex and, at times, ambiguous. While IQ Option is regulated internationally, its specific operations within Brazil often operate in a grey area concerning local financial authorities. This lack of direct local regulation can present certain risks and a less protected environment for local investors compared to domestically regulated brokers. |

| High-Risk Instruments | Products like binary options and digital options are inherently high-risk. They offer the potential for high returns but also carry a significant risk of losing your entire investment in a very short period. For new Brazilian traders, understanding and managing this high level of risk is paramount, as emotional trading can quickly lead to substantial losses. |

| Withdrawal Processing | Some users occasionally report delays or complexities with withdrawal processes. While IQ Option aims for efficiency, the international nature of the platform combined with local banking systems in Brazil can sometimes lead to longer processing times or additional verification steps. It’s important to be aware of the withdrawal policies and potential fees. |

| Limited Advanced Tools | For highly experienced traders looking for advanced charting capabilities, complex order types, or sophisticated analytical tools, IQ Option might feel somewhat basic. While it covers the essentials well, it might not cater to every need of a professional investor seeking a full suite of institutional-grade features. |

In conclusion, IQ Option offers a compelling and accessible platform for online trading, particularly for those in Brazil looking to explore diverse investment opportunities with a low entry barrier. However, it’s crucial to weigh these advantages against the specific risks, especially concerning the regulatory landscape and the high-risk nature of certain trading instruments. Always approach trading with caution, thorough research, and a clear understanding of your personal risk tolerance.

Essential Tips for Successful Trading with IQ Option Brazil

Are you ready to unlock the potential of the financial markets with IQ Option Brazil? Successful trading requires more than just luck; it demands knowledge, discipline, and a well-thought-out approach. As an experienced trader and content creator, I’m here to guide you through some fundamental tips that will enhance your journey on this dynamic trading platform. Let’s dive into making your online trading experience both profitable and sustainable.

Many aspiring Brazilian traders find themselves overwhelmed by the vast options available, from the exciting forex market to the rapid pace of binary options. However, by focusing on a few core principles, you can significantly improve your chances of achieving consistent results. Here are some essential tips to master your craft and maximize your profit potential:

- Master the Platform: Before you even consider live trading, spend ample time navigating the IQ Option Brazil interface. Understand where everything is, from charting tools to different financial instruments. Familiarize yourself with how to execute trades, set stop-losses, and take-profits effectively. Knowing your way around the trading platform is your first step to confidence.

- Utilize Your Demo Account: IQ Option provides an excellent demo account, and it’s your best friend. Treat it like a real account. Practice your trading strategies without risking real money. This is your risk-free sandbox to test ideas, understand market analysis, and build confidence before transitioning to real capital. Many successful traders attribute their initial growth to extensive demo practice.

- Develop a Robust Trading Strategy: Never trade impulsively. A clear trading strategy is your roadmap. Decide which assets you will trade, your entry and exit points, and your risk tolerance. Whether you focus on the forex market, cryptocurrencies, or commodities, having a defined plan helps you stay disciplined and focused on your goals.

- Implement Strict Risk Management: This is non-negotiable for successful trading. Never risk more than a small percentage of your total capital on a single trade. Understand the concept of capital preservation – your primary goal is to protect your trading account. Learning to cut losses quickly and letting profits run is a cornerstone of long-term profit potential.

- Stay Informed with Market Analysis: The financial world constantly changes. Keep up with global news, economic indicators, and company reports that can impact the financial instruments you trade. Both technical and fundamental analysis are vital tools for making informed decisions. Continuous learning about market analysis gives you an edge.

- Manage Your Emotions: Fear and greed are common pitfalls for any trader. Maintain emotional discipline. Stick to your strategy even when the market is volatile. Avoid overtrading or chasing losses, which often lead to poor decisions. Patience and composure are powerful assets in online trading.

- Start Small and Scale Up: When you move to live trading, begin with smaller trade sizes. As you gain experience and confidence, and prove your trading strategies are effective, you can gradually increase your investment. This approach helps you adapt to the psychological pressures of using real capital on the IQ Option platform.

Embracing these essential tips will significantly enhance your journey towards successful trading with IQ Option Brazil. Remember, consistency, continuous learning, and discipline are your best allies in the dynamic world of online trading. Start applying these principles today and watch your trading skills flourish!

Taxation on Trading Profits in Brazil: A Comprehensive Guide

Navigating the world of online trading offers incredible opportunities, but understanding the local tax landscape is crucial for long-term success. For traders in Brazil, this means grappling with specific regulations set by the Receita Federal. Ignoring these rules can lead to unwelcome surprises, so let’s dive into what you need to know about taxation on your trading profits.

Why Brazilian Tax Rules Matter for Traders

Whether you engage in forex, stocks, or other financial instruments, the Brazilian government views your earnings as taxable income. Properly managing your tax obligations ensures compliance and helps you maximize your net profits. Many aspiring traders get excited about the potential gains but overlook the equally important aspect of tax planning.

Key Principles of Taxation for Trading Income

In Brazil, capital gains derived from trading operations are generally subject to income tax. The specific rates and reporting requirements often depend on the type of asset traded, the volume of your operations, and whether you are classified as a day trader or a swing trader. Understanding these distinctions is your first step towards clarity.

Here are some fundamental aspects:

- Capital Gains Tax (Imposto de Renda sobre Ganhos de Capital): This is the primary tax applied to profits from selling assets for more than you bought them.

- Monthly Reporting (Carnê-Leão or DARF): You typically need to calculate and pay your taxes monthly for most trading profits, especially if your operations exceed certain thresholds.

- Annual Declaration (Declaração de Ajuste Anual): All your trading activities and paid taxes must be summarized and reported in your annual income tax declaration.

- CPF Requirement: As a Brazilian resident or non-resident trading in Brazil, having a valid CPF (Cadastro de Pessoas Físicas) is mandatory for tax purposes.

Differentiating Day Trading and Swing Trading Taxation

The Receita Federal makes a clear distinction between short-term operations, particularly day trading, and longer-term swing trading or position trading. This impacts both the tax rate and the method of calculation.

Day Trading Tax in Brazil:

Day trading involves opening and closing a position on the same day. Profits from these operations face a specific tax rate and a mandatory withholding tax (IRRF).

- Tax Rate: Day trading profits are subject to a 20% capital gains tax.

- Withholding Tax (IRRF – Imposto de Renda Retido na Fonte): A small percentage (typically 1%) of the gross profit from day trading is withheld directly by the brokerage or exchange. This is known as “dedo-duro” (informer’s finger) and serves as an advance payment that you deduct from your final monthly tax calculation.

Swing Trading Tax and Other Short-Term Operations:

Operations that are not closed on the same day are generally considered short-term or swing trading. The taxation here often depends on the monthly sales volume for stocks.

- Stock Market Exemption: For individuals, if your total sales of stocks on the Brazilian stock exchange (B3) do not exceed R$20,000 in a calendar month, profits from non-day trade operations are exempt from income tax. This exemption does NOT apply to forex trading profits or sales in other markets.

- Tax Rate (above exemption): Profits from non-day trade stock operations exceeding the R$20,000 monthly sales limit, or profits from other instruments like forex, are typically taxed at 15%.

Tax Rates for Trading Profits

Here’s a general overview of the progressive tax rates that might apply to your capital gains, depending on the total profit accumulated during the year. Remember, these are for the capital gains themselves, not necessarily the specific operations mentioned above.

| Accumulated Capital Gains (R$) | Tax Rate |

|---|---|

| Up to R$5,000,000 | 15% |

| From R$5,000,000.01 to R$10,000,000 | 17.5% |

| From R$10,000,000.01 to R$30,000,000 | 20% |

| Above R$30,000,000 | 22.5% |

Note: These progressive rates apply to the final capital gains calculation, often at the time of your annual declaration, after considering your monthly payments (DARF) and any withholding tax (IRRF).

Forex Trading Tax in Brazil

For individuals engaging in forex trading, the rules are generally straightforward. There is no specific R$20,000 exemption for forex. All profits are typically subject to capital gains tax.

- Tax Rate: Profits from forex operations are generally taxed at 15%. This rate can go up according to the progressive table above if your accumulated capital gains from various sources are very high.

- Monthly Payment: You are responsible for calculating your monthly profits and losses, consolidating them, and paying the tax via a DARF by the last business day of the subsequent month.

- Loss Carry Forward: You can typically offset losses against future gains of the same nature (e.g., forex losses against forex gains). This is a crucial benefit for traders.

Crucial Reporting and Payment Details

Paying your taxes on time is paramount. Use the Sicalc program or the Receita Federal’s online services to generate your DARF (Documento de Arrecadação de Receitas Federais). Your monthly calculation involves summing all profits, deducting commissions, fees, and any prior losses carried forward. Remember to also account for the IRRF already withheld on day trading profits.

“Accurate record-keeping is not just good practice; it’s your best defense in a tax audit. Keep detailed logs of every trade, including buy and sell prices, dates, and associated costs.”

Seek Professional Guidance

While this guide provides a solid overview, tax laws can be complex and subject to change. The best strategy for any serious trader in Brazil is to consult with a qualified accountant or tax specialist who has experience with financial market operations. They can provide personalized advice, help you optimize your tax strategy, and ensure you remain fully compliant with all Brazilian tax regulations.

Don’t let tax concerns deter you from the exciting world of trading. With the right knowledge and professional support, you can confidently manage your finances and focus on achieving your trading goals.

IQ Option Brazil Reviews and User Experiences

Stepping into the world of online trading in Brazil often brings IQ Option into the spotlight. This platform has garnered a significant following, and naturally, a wealth of user reviews and experiences accompany its popularity. Brazilian traders, from novices to seasoned pros, frequently share their insights, painting a comprehensive picture of what it’s like to use IQ Option.

When we dive into the feedback, several themes consistently emerge. Many users appreciate the platform’s accessibility and ease of use. The intuitive interface and the availability of a robust demo account are often cited as major advantages, especially for those just starting their trading journey. This allows new traders to practice strategies without financial risk, building confidence before committing real capital.

What Brazilian Traders Often Praise:

- User-Friendly Interface: A clean, modern design that is easy to navigate, even for beginners. This simplifies the trading process.

- Low Minimum Deposit: Making it accessible for a wider range of individuals to start trading with a smaller initial investment.

- Diverse Asset Selection: A wide variety of options, from currency pairs to commodities and cryptocurrencies, caters to different trading preferences.

- Educational Resources: Many users find the tutorials and learning materials helpful for understanding market dynamics and platform features.

- Mobile Trading: The mobile app receives high marks for its functionality and ability to trade on the go, a crucial feature in today’s fast-paced world.

However, like any widely used platform, IQ Option Brazil also faces constructive criticism. Some user experiences highlight areas where the platform could enhance its services. Concerns occasionally revolve around withdrawal times, with some users wishing for faster processing. Customer support, while generally responsive, can sometimes have varied response times depending on the complexity of the query or peak hours.

Common Points for Improvement from User Feedback:

| Area | User Sentiment |

|---|---|

| Withdrawal Process | Generally reliable, but occasional reports of slower processing compared to deposit times. |

| Customer Support | Often effective, but some users desire quicker responses during high-demand periods or for complex issues. |

| Trading Limits | Specific trading conditions or occasional limitations on certain assets can sometimes be a point of discussion for advanced traders. |

Overall, the sentiment among Brazilian traders regarding IQ Option is largely positive, acknowledging its role in democratizing access to online trading. The platform offers a robust environment for many to explore financial markets. As with any trading endeavor, individual experiences can vary, influenced by personal trading style, risk tolerance, and market conditions. Diligent research and understanding the platform’s terms are always key to a successful experience.

How IQ Option Compares to Other Brokers in Brazil

Navigating the vibrant landscape of online trading in Brazil requires a clear understanding of your options. IQ Option has established a significant presence, becoming a popular choice for many, but how does it truly stack up against the myriad of other forex brokers in Brazil? This comparison will help you see where IQ Option shines and where other trading platforms might offer different advantages, ensuring you pick the best fit for your trading journey.

When you evaluate online trading platforms, several key factors come into play. These include the variety of tradable assets, the user-friendliness of the trading platform, the fee structure, and the overall quality of customer support. For many in Brazil, a low minimum deposit and a straightforward withdrawal process are also top considerations.

Let’s look at the core aspects Brazilian traders often prioritize:

- Asset Diversity: What range of instruments do they offer? This can include currency pairs, commodities, stocks, cryptocurrencies, or specialized digital options.

- Platform Experience: Is the trading platform intuitive, fast, and equipped with useful trading tools for analysis?

- Costs & Spreads: How competitive are the spreads and commissions? Transparency in pricing is crucial.

- Minimum Investment: How accessible is it for new traders starting with smaller capital?

- Customer Service: Is local support available in Portuguese, and how responsive are they to inquiries?

- Withdrawal Efficiency: Is the withdrawal process smooth, fast, and reliable?

- Educational Resources: Does the broker provide materials to help you learn and improve your trading skills?

IQ Option has particularly resonated with a segment of the Brazilian market largely due to its focus on accessibility and a highly intuitive trading platform. For those interested in digital options and a streamlined trading experience, it frequently emerges as a strong contender. Its low minimum deposit often makes it an attractive starting point for many who are new to online trading Brazil.

IQ Option: Strengths and Considerations in the Brazilian Market

| Aspect | IQ Option’s Standing | How It Compares to Other Brokers |

|---|---|---|

| Platform Usability | Offers a highly user-friendly, modern interface, excellent for beginners and mobile traders. | Often simpler and more direct than the more complex, professional-grade platforms like MetaTrader 4/5 offered by many traditional forex brokers in Brazil. |

| Asset Focus | Strong emphasis on digital options, alongside traditional forex, stocks, crypto, and commodities. | While diverse, some other brokers might offer a much wider range of traditional forex pairs or more in-depth stock market access with specific regional listings. |

| Minimum Deposit | Generally boasts one of the lowest entry points in the market. | Significantly lower than many conventional forex brokers, making it exceptionally accessible for new participants in online trading Brazil. |

| Educational Tools | Provides a good selection of video tutorials and a robust, free demo account. | Competes well, but some larger, global brokers might have more extensive, multi-language trading academies and advanced analytical webinars. |

| Customer Support | Available in Portuguese, often responsive through various channels. | Comparable to good regional brokers, though some international giants provide 24/7 global support networks that might cover more time zones. |

| Regulatory Oversight | Regulated by CySEC (for its EU operations), which provides a layer of credibility. For foreign brokers, local Brazilian regulation remains an ongoing consideration. | Other brokers may hold different international licenses (e.g., FCA, ASIC), appealing to varied trader preferences for oversight and investor protection schemes. |

For many in Brazil keen on exploring the world of trading without a massive initial investment, IQ Option provides a compelling entry point. Its simplified approach to digital options trading and the ease of navigating its platform are significant draws. However, if your strategy demands a very specific set of advanced analytical tools, or if you exclusively trade a vast array of niche forex pairs, you might find that other forex brokers in Brazil offer specialized platforms that better suit those particular needs.

“Choosing a trading platform is like finding the right tool for a job. The ‘best’ one isn’t universal; it’s the one that perfectly fits your individual trading style, experience level, and financial goals.”

Ultimately, the decision among online trading platforms in Brazil boils down to individual priorities. IQ Option clearly distinguishes itself with a strong focus on a user-friendly experience and broad accessibility, particularly for those looking to engage with digital options and a variety of other assets from a low minimum deposit. By carefully weighing these aspects against what other brokers offer, you can make an informed decision that robustly supports your journey in the dynamic Brazilian trading environment.

The Future Landscape for IQ Option in Brazil

Brazil, a vibrant economic powerhouse in Latin America, presents a dynamic and ever-evolving market for online trading platforms like IQ Option. As the financial sector within the country continues its digital transformation, the opportunities for growth and innovation are immense. We are looking at a future where accessibility to global markets becomes even more seamless for Brazilian traders.

The journey ahead for IQ Option in Brazil is shaped by several key factors. Understanding these elements helps us paint a clear picture of what’s to come for this prominent online trading platform.

Key Drivers Shaping IQ Option’s Future in Brazil:

- Evolving Regulatory Environment: Brazil’s financial watchdog, CVM (Comissão de Valores Mobiliários), is continuously refining its regulations for investment products and online brokers. IQ Option’s ability to adapt swiftly and maintain compliance will be paramount. This ensures a secure and trustworthy environment for traders.

- Growing Financial Literacy: More Brazilians are seeking control over their financial futures. Educational initiatives and accessible trading tools contribute to a more informed user base, driving demand for platforms that offer clear guidance and a user-friendly interface. The desire to explore forex trading Brazil is definitely on the rise.

- Technological Adoption: Brazil boasts a high rate of smartphone penetration and digital connectivity. The prevalence of mobile trading app usage means platforms must prioritize intuitive mobile experiences, fast execution, and robust security features on the go.

- Economic Landscape and Diversification: As Brazilians increasingly look to diversify their investments beyond traditional savings, online trading platforms provide avenues to explore various assets. This creates a fertile ground for engagement with a broad range of financial instruments.

- Localized User Experience: Success hinges on deep understanding of local preferences. This includes offering Portuguese language support, localized payment methods, and customer service attuned to Brazilian cultural nuances.

The potential for IQ Option Brazil is significant, driven by a young, tech-savvy population eager to participate in the global financial markets. The platform’s commitment to continuous improvement, adherence to local regulations, and dedication to user education will define its trajectory. Expect to see further innovations in trading tools, educational resources, and community building, all designed to empower Brazilian traders on their financial journey.

Frequently Asked Questions

Is IQ Option legal and regulated in Brazil?

IQ Option operates internationally, accessible in Brazil. While it holds international regulations, binary options are not currently regulated by Brazil’s CVM (Comissão de Valores Mobiliários) as traditional financial instruments. Traders should be aware of this nuanced regulatory landscape.

How do I register an IQ Option Brazil account?

Registering an IQ Option Brazil account is straightforward. Visit the official website, provide your email and password, agree to terms, and verify your email. The process is quick and grants access to a demo account for practice.

What payment methods are available for deposits and withdrawals in Brazil?

IQ Option Brazil supports various local payment methods, including Pix (for instant transactions), traditional Bank Transfers (TED/DOC), and Credit/Debit Cards (Visa/Mastercard). E-wallets like Skrill and Neteller are also common.

What trading instruments can I find on IQ Option Brazil?

IQ Option Brazil offers a diverse range of trading instruments, including Forex (currency pairs), Binary Options, Digital Options, Stocks, Commodities (like gold, oil), Cryptocurrencies (Bitcoin, Ethereum), and ETFs, allowing for varied trading strategies.

Are trading profits taxed in Brazil, and how does it work?

Yes, trading profits in Brazil are subject to capital gains tax by Receita Federal. Day trading profits are taxed at 20%, while swing trading profits (and forex) are generally taxed at 15%, with specific rules and exemptions depending on the asset and monthly sales volume. Monthly reporting via DARF is usually required.